To ensure digital receipt storage compliance, businesses must retain original transaction records, including purchase receipts, invoices, and payment confirmations in a secure electronic format. It is essential to maintain clear audit trails and metadata that verify the authenticity and integrity of the digital receipts. Compliance also requires adherence to local tax regulations, data protection laws, and retention periods specified by governing authorities.

What Documents Are Required for Digital Receipt Storage Compliance?

| Number | Name | Description |

|---|---|---|

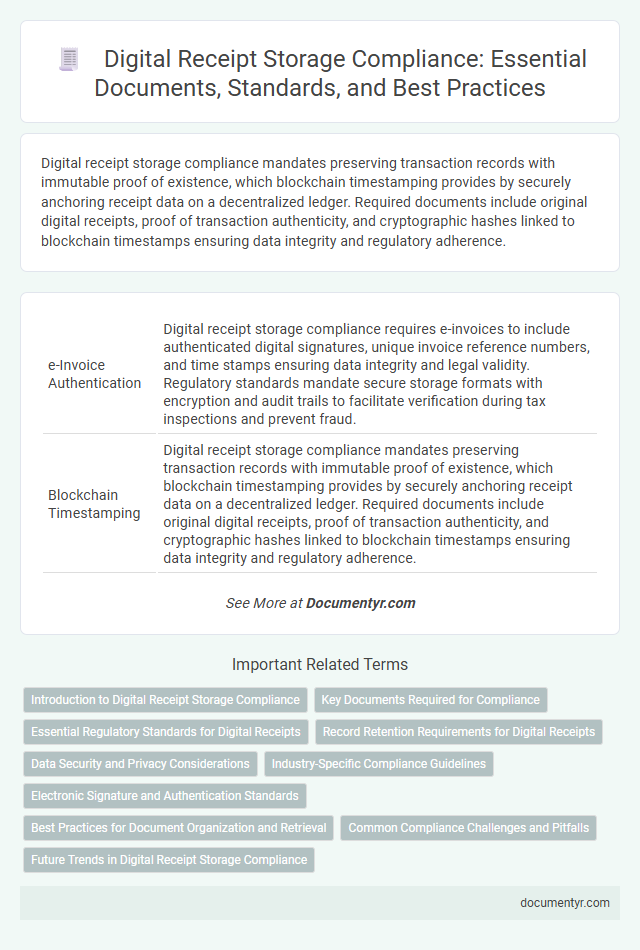

| 1 | e-Invoice Authentication | Digital receipt storage compliance requires e-invoices to include authenticated digital signatures, unique invoice reference numbers, and time stamps ensuring data integrity and legal validity. Regulatory standards mandate secure storage formats with encryption and audit trails to facilitate verification during tax inspections and prevent fraud. |

| 2 | Blockchain Timestamping | Digital receipt storage compliance mandates preserving transaction records with immutable proof of existence, which blockchain timestamping provides by securely anchoring receipt data on a decentralized ledger. Required documents include original digital receipts, proof of transaction authenticity, and cryptographic hashes linked to blockchain timestamps ensuring data integrity and regulatory adherence. |

| 3 | eIDAS Certification | Digital receipt storage compliance requires documents that verify data authenticity and integrity, prominently supported by eIDAS certification to ensure qualified electronic signatures meet EU regulatory standards. Maintaining eIDAS-certified receipts guarantees legal validity and long-term preservation of digital documents under stringent security protocols. |

| 4 | PDF/A Compliance | PDF/A compliance is essential for digital receipt storage as it ensures documents are preserved in a standardized, long-term archival format that supports reliable retrieval and readability. Required documents must be converted to PDF/A format with embedded fonts, metadata, and no encryption to meet regulatory standards for digital receipt retention. |

| 5 | Zero-Knowledge Proof Receipts | Zero-Knowledge Proof Receipts require digital signatures, cryptographic proofs, and timestamp metadata to ensure authenticity and compliance without revealing sensitive information. Storing these documents securely involves encrypted logs and immutable audit trails that meet regulatory standards for data privacy and integrity. |

| 6 | Hash-based Document Verification | Digital receipt storage compliance mandates the use of hash-based document verification to ensure data integrity and authenticity, requiring original receipts to be converted into cryptographic hashes stored securely on a blockchain or distributed ledger. These hashed documents enable tamper-proof audit trails, meeting legal standards for digital storage while facilitating quick verification without exposing sensitive receipt information. |

| 7 | Secure Audit Trail Logs | Secure audit trail logs are essential for digital receipt storage compliance, ensuring that every transaction and modification is accurately recorded and time-stamped for accountability. These logs must be immutable, encrypted, and accessible for verification during audits to meet regulatory standards such as GDPR or PCI DSS. |

| 8 | Digital Signature Validation | Digital receipt storage compliance mandates the inclusion of a validated digital signature using cryptographic methods such as RSA or ECDSA to ensure authenticity and integrity. Documents must contain metadata detailing the signature algorithm, timestamp, and certificate authority information to meet regulatory standards for secure digital record-keeping. |

| 9 | Machine-Readable Receipt Schema | Digital receipt storage compliance requires documents adhering to a machine-readable receipt schema, such as standardized XML or JSON formats containing key transaction data like vendor details, purchase date, itemized lists, and total amounts. Implementing schemas like the Universal Business Language (UBL) or PEPPOL ensures interoperability, data integrity, and legally recognized electronic record-keeping. |

| 10 | Digital Tax Ledger Integration | Digital tax ledger integration requires storing receipts in formats that include metadata such as transaction date, vendor details, tax identification numbers, and digital signatures to ensure authenticity and traceability. Compliance mandates interoperable electronic documents compatible with government tax systems for seamless auditing and reporting. |

Introduction to Digital Receipt Storage Compliance

Digital receipt storage compliance ensures that electronic records meet legal and regulatory standards for accuracy, security, and accessibility. Proper documentation is essential for businesses to maintain trust and avoid penalties during audits.

- Legal Identification Documents - Valid government-issued IDs verify the identity of the receipt issuer or recipient.

- Transaction Records - Detailed sales or service receipts must include date, time, amount, and payment method to satisfy compliance rules.

- Tax Information - Documentation must contain accurate tax codes and amounts to align with fiscal regulations.

Maintaining these documents in digital formats following compliance guidelines safeguards business operations and financial transparency.

Key Documents Required for Compliance

| Document Name | Description | Compliance Importance |

|---|---|---|

| Original Receipt | Physical or scanned copy of the transaction receipt. | Serves as the primary proof of purchase and legal evidence in audits. |

| Invoice | Detailed bill issued by the seller listing goods or services with prices. | Required for tax reporting and validation of transactions. |

| Proof of Payment | Bank statements, credit card slips, or payment confirmation documents. | Verifies that the transaction amount has been settled. |

| Audit Trail Logs | Records showing the history of receipt access, modifications, and storage. | Ensures data integrity and accountability in the digital storage system. |

| Data Retention Policy | Document outlining how long digital receipts must be kept and managed. | Supports compliance with legal requirements for document preservation. |

| Access Control Records | Logs of users authorized to view or edit digital receipts. | Protects sensitive information and maintains regulatory security standards. |

| Digital Signature or Timestamp | Electronic proof ensuring receipt authenticity and date verification. | Confirms non-repudiation and compliance with electronic record laws. |

Essential Regulatory Standards for Digital Receipts

Digital receipt storage compliance mandates adherence to specific regulatory standards to ensure authenticity and data integrity. Essential documents include proof of transaction, authorization records, and audit trails aligned with legal frameworks.

Regulations such as GDPR, HIPAA, and SOX establish requirements for secure digital recordkeeping and data privacy. Businesses must retain electronic receipts in tamper-proof formats while ensuring accessibility for audits. Compliance also involves maintaining metadata that verifies the origin, time, and content of each digital receipt.

Record Retention Requirements for Digital Receipts

Digital receipt storage compliance mandates adherence to specific record retention requirements to ensure legal and financial accountability. Businesses must retain digital receipts for a minimum period, often ranging from 3 to 7 years, depending on jurisdiction and industry regulations. Proper encryption, secure backup, and easy retrieval protocols are essential components of compliant digital receipt storage systems.

Data Security and Privacy Considerations

Digital receipt storage compliance requires specific documents such as transaction records, customer consent forms, and data encryption certificates. These documents ensure the authenticity and integrity of stored receipts in a digital environment.

Data security measures must include encryption protocols, secure access controls, and regular audit logs to protect sensitive information. Privacy considerations demand adherence to local regulations and transparent policies about how your data is collected, stored, and used.

Industry-Specific Compliance Guidelines

What documents are required for digital receipt storage compliance in different industries? Industries such as healthcare, finance, and retail have unique regulations governing digital receipt retention. Compliance often involves adhering to standards like HIPAA for healthcare, SOX for finance, and PCI DSS for retail transactions.

Electronic Signature and Authentication Standards

Complying with digital receipt storage requires adherence to electronic signature and authentication standards to ensure document integrity and legal validity. Proper documentation and secure authentication methods are critical for regulatory compliance and audit readiness.

- Electronic Signature Records - Store signatures that meet standards such as eIDAS or ESIGN to validate the authenticity of digital receipts.

- Authentication Logs - Maintain logs detailing user identity verification processes to ensure that access and approvals are secure and traceable.

- Compliance Certifications - Retain certifications that demonstrate adherence to digital signature and identity verification standards required by law.

Best Practices for Document Organization and Retrieval

To ensure compliance with digital receipt storage regulations, retain original receipt images in high-resolution formats such as PDF or JPEG. Include metadata details like date, vendor name, transaction amount, and payment method to enhance searchability.

Organize digital receipts using a consistent folder structure categorized by date or vendor for efficient retrieval. Implement indexing and tagging systems to enable quick and accurate document searches during audits or financial reviews.

Common Compliance Challenges and Pitfalls

Digital receipt storage compliance requires maintaining original receipts, transaction records, and audit trails to meet legal and regulatory standards. Common compliance challenges include ensuring data integrity, preventing unauthorized access, and maintaining accurate time-stamped records. Your system must address these pitfalls to avoid penalties and ensure reliable record-keeping.

What Documents Are Required for Digital Receipt Storage Compliance? Infographic