Small business expense receipts require essential documents such as the original receipt or invoice, a detailed description of the expense, and proof of payment, including credit card statements or canceled checks. It is important to include the date of the transaction, vendor information, and the business purpose to ensure proper accounting and tax compliance. Maintaining organized and complete records supports accurate expense tracking and eases the process of financial audits.

What Documents Are Needed for Small Business Expense Receipts?

| Number | Name | Description |

|---|---|---|

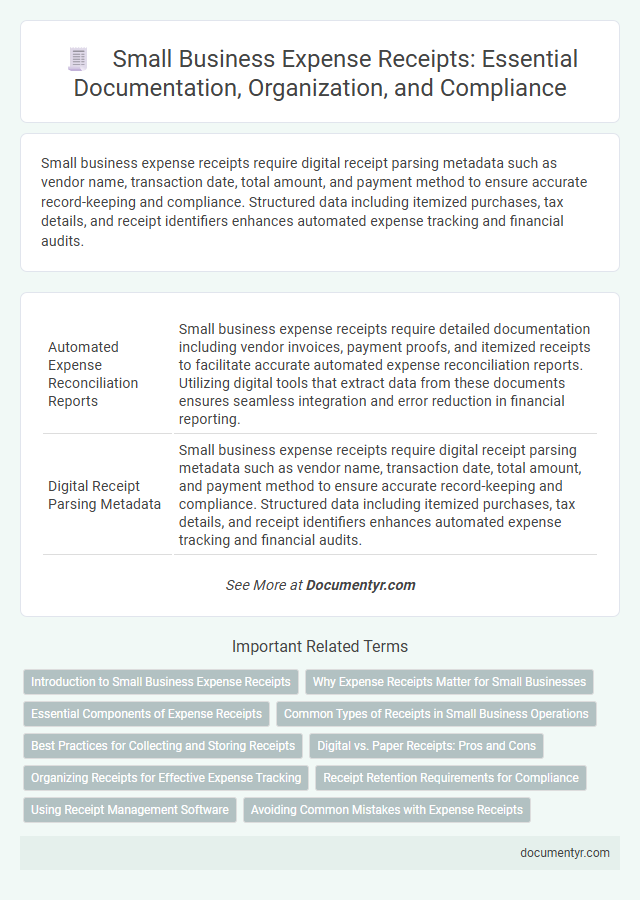

| 1 | Automated Expense Reconciliation Reports | Small business expense receipts require detailed documentation including vendor invoices, payment proofs, and itemized receipts to facilitate accurate automated expense reconciliation reports. Utilizing digital tools that extract data from these documents ensures seamless integration and error reduction in financial reporting. |

| 2 | Digital Receipt Parsing Metadata | Small business expense receipts require digital receipt parsing metadata such as vendor name, transaction date, total amount, and payment method to ensure accurate record-keeping and compliance. Structured data including itemized purchases, tax details, and receipt identifiers enhances automated expense tracking and financial audits. |

| 3 | Blockchain-Verified Transaction Slips | Small business expense receipts require authentic documentation such as blockchain-verified transaction slips that provide tamper-proof proof of purchase and transaction details. These digital receipts enhance transparency, reduce fraud risks, and streamline accounting processes by ensuring each expense is securely recorded on a decentralized ledger. |

| 4 | AI-Generated Expense Categorization Tags | Small business expense receipts require clear documentation such as invoices, payment proofs, and vendor details to ensure accurate record-keeping and tax compliance. AI-generated expense categorization tags enhance this process by automatically classifying receipts into categories like travel, office supplies, or meals, improving expense tracking efficiency and reducing manual errors. |

| 5 | e-Document Chain of Custody Logs | Small business expense receipts require documentation including the original invoice, payment proof, and the e-Document Chain of Custody Logs to verify the integrity and traceability of digital records. Maintaining detailed e-Document Chain of Custody Logs ensures secure tracking of receipt modifications, authorization timestamps, and audit trails essential for compliance. |

| 6 | Embedded QR Code Receipts | Small business expense receipts with embedded QR codes must include detailed transaction data, such as vendor information, date, itemized purchases, and total amount, enabling efficient digital verification and record-keeping. These QR codes link directly to encrypted digital copies or cloud-stored documents, ensuring compliance with tax regulations and simplifying audit processes. |

| 7 | e-Invoice UBL Attachments | Small business expense receipts require e-Invoice UBL attachments that include detailed transaction data such as supplier information, itemized costs, tax amounts, and payment terms to ensure compliance and facilitate accurate accounting. These digital documents streamline expense tracking by providing standardized, machine-readable formats that improve verification and audit processes. |

| 8 | Instant Verification Micro-Receipts | Small business expense receipts require documents including itemized invoices, purchase orders, and proof of payment for instant verification micro-receipts, ensuring accurate and efficient expense tracking. Micro-receipts generated through digital payment systems provide real-time data with transaction timestamps, merchant details, and payment method, enabling seamless audit trails and compliance. |

| 9 | Crypto Payment Expense Proofs | Small business expense receipts for crypto payments require detailed transaction records from digital wallets or exchange platforms, including transaction IDs, amounts, dates, and recipient addresses to ensure accurate proof of purchase. Supplementing these with blockchain confirmations and corresponding invoices or purchase orders enhances validity for accounting and tax reporting purposes. |

| 10 | OCR-Enhanced Multi-Lingual Receipts | OCR-enhanced multi-lingual receipts require clear capture of vendor name, date, itemized expenses, and total amount to ensure accurate expense tracking and compliance. Essential documents include original receipts, proof of payment, and any supplementary invoices or contracts that verify the transaction details. |

Introduction to Small Business Expense Receipts

Small business expense receipts are essential records that verify your purchases and business expenditures. They serve as proof for tax deductions and financial tracking.

Understanding what documents are needed for small business expense receipts helps ensure accurate bookkeeping. Receipts, invoices, and purchase orders are commonly required to validate expenses. Keeping these documents organized protects your business from discrepancies and audit issues.

Why Expense Receipts Matter for Small Businesses

| Document Type | Description | Importance |

|---|---|---|

| Itemized Receipts | Detailed receipts showing date, vendor, items purchased, and cost. | Provides clear evidence of the expense, essential for accurate record-keeping and tax deductions. |

| Invoices | Billing statements from suppliers or service providers. | Serves as proof of a business-related transaction and supports expense claims. |

| Proof of Payment | Bank statements, credit card statements, or canceled checks showing payment. | Validates that the expense was paid, reinforcing the legitimacy of the transaction. |

| Mileage Logs | Records of business-related travel distances with dates and purposes. | Necessary for deducting vehicle expenses and complying with tax regulations. |

| Expense Reports | Summaries compiled from individual receipts for business reimbursement or accounting. | Helps organize multiple expenses and simplifies financial tracking. |

| Why Expense Receipts Matter | Expense receipts ensure the accuracy of your financial records, support tax deductions, and protect your business during audits. Maintaining organized and complete documentation reduces errors and substantiates credible expense claims, which is critical for financial health and regulatory compliance. | |

Essential Components of Expense Receipts

Expense receipts for small businesses must include essential components to ensure accurate record-keeping and compliance. Key details include the date of the transaction, the vendor's name, and a clear description of the goods or services purchased.

The total amount paid, including taxes, and the payment method should also be visible on the receipt. You need to keep these documents organized to support expense claims and tax deductions effectively.

Common Types of Receipts in Small Business Operations

Small business expense receipts are essential for accurate financial tracking and tax reporting. You need specific documents to validate your business expenses effectively.

- Sales Receipts - Proof of purchase for goods or services used in business operations.

- Invoice Receipts - Detailed bills from suppliers or contractors showing amounts owed and paid.

- Credit Card Receipts - Records of business-related transactions made via credit cards.

Best Practices for Collecting and Storing Receipts

What documents are needed for small business expense receipts? Receipts should include detailed information such as the date of purchase, vendor name, item description, and total amount paid. Maintaining accurate receipts ensures proper record-keeping and eases tax preparation.

What are the best practices for collecting receipts? Collect receipts promptly after every business expense to avoid lost or missing documents. Use a consistent system to organize receipts by date, category, or project for easy retrieval.

How should small businesses store their expense receipts? Store receipts digitally using scanned copies or receipt management software to minimize physical clutter. Back up digital files regularly to secure documents against loss or damage.

Digital vs. Paper Receipts: Pros and Cons

Small businesses must maintain accurate documentation for expense receipts to ensure proper accounting and tax compliance. Understanding the advantages and disadvantages of digital versus paper receipts helps you streamline record-keeping effectively.

- Digital Receipts - Easy to store and organize electronically, reducing physical clutter.

- Paper Receipts - Widely accepted for all transactions but prone to damage and loss over time.

- Expense Verification - Both digital and paper receipts must include merchant details, date, amount, and description for valid expense claims.

Careful selection between digital and paper receipts supports efficient expense tracking and audit readiness.

Organizing Receipts for Effective Expense Tracking

Small business expense receipts require essential documents such as the original receipt, proof of payment, and a detailed description of the expense. Organizing these receipts by date, category, and vendor streamlines the tracking process and enhances financial accuracy. Maintaining a consistent filing system, either digitally or physically, supports efficient expense management and simplifies tax preparation.

Receipt Retention Requirements for Compliance

Small businesses must retain expense receipts to comply with tax regulations and support financial reporting. Essential documents include original receipts, invoices, and proof of payment, which validate business expenditures. Retaining these records for at least three to seven years ensures preparedness for tax audits and maintains accurate accounting.

Using Receipt Management Software

Using receipt management software streamlines the process of handling small business expense receipts. You can easily organize and verify required documents for accurate record-keeping.

- Receipts from Purchases - Digital or scanned copies of expense receipts provide proof of transactions for your business expenses.

- Invoices and Bills - Supporting documents like invoices help validate the purpose and amount of each expense.

- Payment Confirmation - Bank statements or payment confirmations confirm that expenses were paid, ensuring accuracy in your records.

What Documents Are Needed for Small Business Expense Receipts? Infographic