Receipt documents necessary for employee reimbursement requests include original, itemized receipts that clearly show the date, vendor, and details of the purchased goods or services. These receipts must match the expenses claimed and comply with company policies to ensure accurate processing. Proper documentation helps prevent disputes and facilitates timely reimbursement.

What Receipt Documents Are Necessary for Employee Reimbursement Requests?

| Number | Name | Description |

|---|---|---|

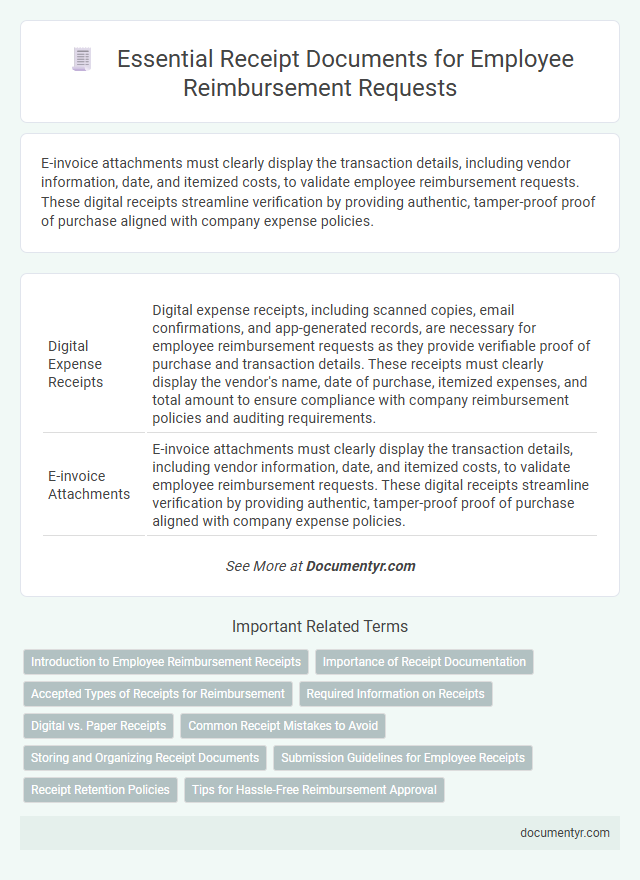

| 1 | Digital Expense Receipts | Digital expense receipts, including scanned copies, email confirmations, and app-generated records, are necessary for employee reimbursement requests as they provide verifiable proof of purchase and transaction details. These receipts must clearly display the vendor's name, date of purchase, itemized expenses, and total amount to ensure compliance with company reimbursement policies and auditing requirements. |

| 2 | E-invoice Attachments | E-invoice attachments must clearly display the transaction details, including vendor information, date, and itemized costs, to validate employee reimbursement requests. These digital receipts streamline verification by providing authentic, tamper-proof proof of purchase aligned with company expense policies. |

| 3 | Blockchain-verified Receipts | Employee reimbursement requests require receipt documents that clearly detail transaction dates, amounts, vendor information, and itemized expenses, with blockchain-verified receipts offering enhanced security by providing immutable proof of authenticity and tamper-proof records. These blockchain-verified receipts streamline audit processes and ensure accurate validation of claims through decentralized ledger technology. |

| 4 | QR Code Receipt Validation | Employee reimbursement requests require receipt documents that clearly display transaction details, with QR code receipt validation ensuring authenticity and preventing fraud by linking directly to the vendor's database. Validated QR code receipts streamline approval processes by instantly verifying payment dates, amounts, and merchant information, enhancing compliance with company expense policies. |

| 5 | Split Payment Receipts | Split payment receipts are essential for employee reimbursement requests as they clearly itemize individual expenses paid through multiple payment methods, ensuring accurate accounting and verification. These receipts provide detailed information on the transaction breakdown, including amounts charged to each payment source, enabling precise expense tracking and compliance with company reimbursement policies. |

| 6 | Mobile Wallet Transaction Proof | Mobile wallet transaction proof, such as digital receipts or transaction confirmations, is essential for employee reimbursement requests to verify expenses accurately and ensure compliance with company policies. These digital documents must include transaction details like date, amount, merchant name, and payment method to facilitate efficient expense tracking and approval. |

| 7 | Cloud-stored Transaction Records | Cloud-stored transaction records are essential for employee reimbursement requests as they provide secure, accessible, and time-stamped proof of payment tied to specific expenses. These digital receipts streamline the verification process, reduce paper clutter, and ensure compliance with company policies and auditing standards. |

| 8 | Real-time Expense Snapshot | Receipts that provide a clear itemization of expenses including date, vendor, and amount are essential for employee reimbursement requests, ensuring accuracy and compliance. Real-time expense snapshots captured via mobile apps expedite the submission process by documenting purchases instantly, reducing errors and facilitating timely approvals. |

| 9 | AI-generated Receipt Summaries | AI-generated receipt summaries enhance employee reimbursement requests by accurately extracting critical data such as vendor details, transaction amounts, and dates from digital or scanned receipts. These summaries streamline verification processes and ensure compliance with company policies by providing consistent, easily accessible documentation. |

| 10 | Cross-border VAT-compliant Receipts | Cross-border VAT-compliant receipts required for employee reimbursement must include vendor details, VAT identification numbers, transaction dates, itemized purchases, and VAT amounts explicitly stated. Ensuring receipts meet both the home country's tax regulations and the foreign VAT requirements facilitates accurate cross-border tax reclamation and compliance. |

Introduction to Employee Reimbursement Receipts

Receipts play a crucial role in the employee reimbursement process by providing proof of business-related expenses. Understanding the types of documents required ensures your reimbursement requests are processed smoothly.

- Original Receipts - Official proof of purchase must include date, vendor name, and amount spent to validate expenses.

- Itemized Receipts - Detailed receipts show individual items or services purchased, clarifying what was expensed.

- Digital or Paper Formats - Both scanned electronic receipts and physical paper copies are acceptable when submitting reimbursement requests.

Importance of Receipt Documentation

Receipts serve as essential proof for employee reimbursement requests, confirming that expenses were incurred legitimately. Proper receipt documentation helps ensure compliance with company policies and financial regulations.

Your reimbursement request must include clear, itemized receipts showing the date, vendor, and amount paid. These documents protect both the employee and the employer by preventing disputes and enabling accurate record-keeping. Receipts missing critical details may result in denied or delayed reimbursements.

Accepted Types of Receipts for Reimbursement

Receipts are essential for employee reimbursement requests as they verify the authenticity of expenses incurred. Accepted receipt documents typically include itemized invoices, credit card statements, and digital payment confirmations.

Employees should ensure receipts clearly display the vendor's name, date, and amount spent for successful reimbursement. Receipts lacking these details may be rejected, delaying the reimbursement process.

Required Information on Receipts

Receipts serve as crucial proof for employee reimbursement requests, ensuring transparency and accuracy in expense reporting. Proper receipt documentation helps prevent disputes and facilitates smooth financial processing.

- Date of Purchase - The receipt must clearly show the transaction date to verify the timing of the expense.

- Vendor Information - The receipt should include the name and contact details of the merchant or service provider.

- Itemized List and Amount - Detailed descriptions of purchased items or services along with the exact cost should be visible on the receipt.

Digital vs. Paper Receipts

Receipt documents necessary for employee reimbursement requests include clear proof of purchase, itemized details, and the date of the transaction. Digital receipts provide easy access, storage, and verification through email or apps, while paper receipts offer tangible proof but can be prone to loss or damage. Employers often accept either format, but digital receipts streamline the reimbursement process and reduce administrative workload.

Common Receipt Mistakes to Avoid

Employee reimbursement requests require accurate and complete receipt documents to ensure smooth processing. Understanding common receipt mistakes helps prevent delays and rejections.

- Missing Essential Details - Receipts lacking date, vendor name, or itemized purchases often get rejected by finance departments.

- Illegible or Faded Copies - Poor quality images or photocopies of receipts can be considered invalid for reimbursement claims.

- Non-Original Receipts - Using handwritten or altered receipts instead of original printed documents can lead to denial of reimbursement.

Submitting clear, original, and detailed receipts improves the chances of prompt reimbursement approval.

Storing and Organizing Receipt Documents

| Receipt Document Type | Purpose | Storage and Organization Tips |

|---|---|---|

| Original Receipts | Proof of purchase for expense reimbursement | Store in a dedicated folder or envelope labeled by date or project; scan for digital backup |

| Credit Card Statements | Supplementary evidence linking purchases to your account | Organize statements monthly, keeping relevant pages with corresponding receipts |

| Expense Reports | Summary of reimbursable expenses, often required for approval | Maintain in a centralized digital folder with proper naming conventions for easy retrieval |

| Invoices | Verification of services or products purchased | Keep invoices grouped by vendor and date for quick reference |

| Digital Copies of Receipts | Backup copies to prevent loss of physical receipts | Utilize cloud storage solutions and organize by expense category or month |

| Approval Emails or Notes | Authorization records for expenses exceeding policy limits | Archive in an email folder or link to corresponding expense files |

Efficient storage and organization of these receipt documents ensure smooth processing of employee reimbursement requests. It is important that you keep receipts easily accessible and systematically arranged to support expense verification and approval.

Submission Guidelines for Employee Receipts

What receipt documents are necessary for employee reimbursement requests? Receipts must clearly display the date, vendor name, items purchased, and total amount paid. Your submission should include original or digital copies that are legible and unaltered.

Receipt Retention Policies

Receipts are essential documents for employee reimbursement requests, providing proof of business-related expenses. Accurate and detailed receipts ensure compliance with company policies and facilitate timely reimbursements.

Receipt retention policies require employees to submit and retain original receipts for a specified period, often three to seven years. Maintaining organized records helps prevent disputes and supports audit processes effectively.

What Receipt Documents Are Necessary for Employee Reimbursement Requests? Infographic