Freelancers need to keep detailed records of invoices, receipts, and expense reports to ensure accurate tax deduction claims. Essential documents include proof of income, purchase receipts for business-related expenses, and bank statements showing transactions. Maintaining organized records facilitates smooth tax filing and compliance with tax authorities.

What Documents Does a Freelancer Need for Tax Deduction Receipt Records?

| Number | Name | Description |

|---|---|---|

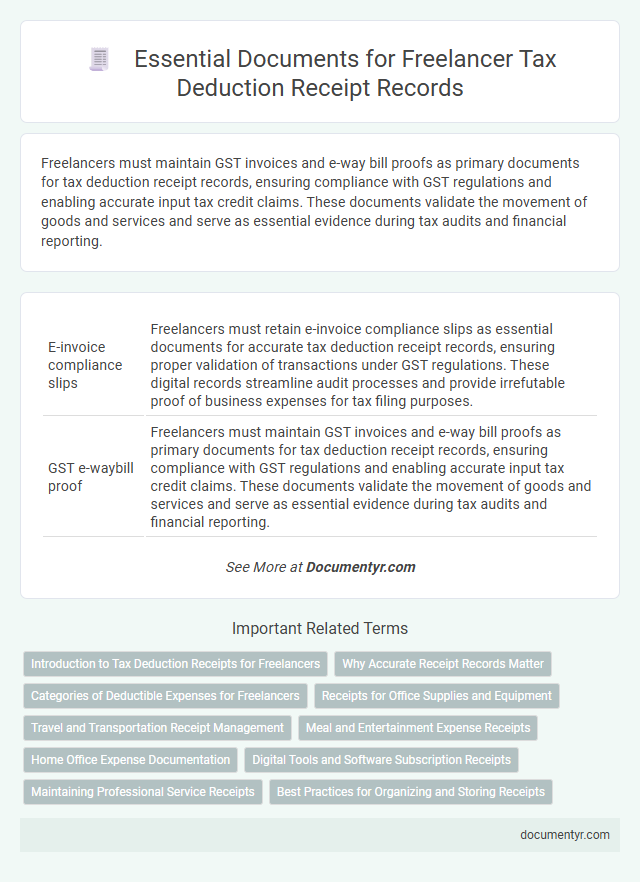

| 1 | E-invoice compliance slips | Freelancers must retain e-invoice compliance slips as essential documents for accurate tax deduction receipt records, ensuring proper validation of transactions under GST regulations. These digital records streamline audit processes and provide irrefutable proof of business expenses for tax filing purposes. |

| 2 | GST e-waybill proof | Freelancers must maintain GST invoices and e-way bill proofs as primary documents for tax deduction receipt records, ensuring compliance with GST regulations and enabling accurate input tax credit claims. These documents validate the movement of goods and services and serve as essential evidence during tax audits and financial reporting. |

| 3 | Digital payment acknowledgment | Freelancers need digital payment acknowledgments such as transaction receipts, payment confirmation emails, and digital invoices to maintain accurate records for tax deduction purposes. These documents serve as proof of income and support claims for deductible expenses during tax filing. |

| 4 | Cloud-based expense logs | Freelancers need cloud-based expense logs, including detailed digital receipts and invoices, to ensure accurate tax deduction records and streamline expense tracking. These secure, timestamped documents facilitate compliance with tax regulations and improve audit readiness by providing organized, accessible proof of business expenses. |

| 5 | Blockchain transaction receipts | Freelancers must keep blockchain transaction receipts, including digital wallets' transaction IDs, timestamps, and encrypted proofs of payment, to accurately document income and expenses for tax deductions. These blockchain-based receipts ensure verifiable, tamper-proof records, allowing seamless auditing and compliance with tax authorities. |

| 6 | Automated mileage tracker reports | Freelancers must keep automated mileage tracker reports as essential documents for tax deduction receipt records, ensuring accurate tracking of business-related travel expenses. These digital records provide detailed logs of dates, distances, and destinations, maximizing deductible mileage claims while complying with tax regulations. |

| 7 | E-signature contract confirmation | Freelancers require a digitally signed contract confirmation as a crucial document for tax deduction receipt records, ensuring legal compliance and verification of service agreements. E-signature contracts provide authenticated proof of transactions, enhancing record accuracy and facilitating audit processes. |

| 8 | Real-time tax withholding statements | Freelancers must maintain real-time tax withholding statements as essential documents for accurate tax deduction receipt records, ensuring compliance with tax authorities and facilitating precise income tax calculations. These statements provide detailed records of taxes withheld at the source, enabling freelancers to verify deductions and optimize their tax filings efficiently. |

| 9 | Split-payment record (for gig economy jobs) | Freelancers engaged in gig economy jobs must maintain accurate split-payment records, including detailed receipts that document each transaction portion paid separately to comply with tax deduction requirements. These records should clearly show payment dates, amounts received via different methods, and corresponding client information to ensure proper tax reporting and deductions. |

| 10 | AI-generated expense categorization summaries | Freelancers should maintain detailed tax deduction receipt records including invoices, bank statements, and AI-generated expense categorization summaries that organize expenditures by type and date for accurate tax reporting. AI-driven summaries enhance accuracy by automatically classifying expenses such as office supplies, travel, and software subscriptions, ensuring compliance with tax regulations and simplifying audit preparation. |

Introduction to Tax Deduction Receipts for Freelancers

Tax deduction receipts are essential documents for freelancers to accurately report income and claim eligible expenses. These receipts serve as proof of transactions and help in maintaining transparent financial records.

You must keep detailed records of all receipts to maximize your tax deductions and avoid potential issues with tax authorities. Proper documentation ensures compliance and supports your claims during tax audits.

Why Accurate Receipt Records Matter

Maintaining accurate receipt records is essential for freelancers to claim tax deductions correctly. Receipts serve as proof of expenses and help avoid disputes during tax audits.

- Proof of Expense - Receipts verify the legitimacy of your deductible business costs.

- Audit Protection - Detailed records provide evidence to support your claims if questioned by tax authorities.

- Financial Management - Organized receipts help track spending patterns and improve budget planning.

Accurate receipt documentation ensures compliance and maximizes your available tax deductions effectively.

Categories of Deductible Expenses for Freelancers

Freelancers must organize specific documents to support tax deduction receipt records effectively. Proper categorization of deductible expenses helps ensure accurate and compliant tax reporting.

- Business Expenses - Receipts for office supplies, software subscriptions, and equipment purchases validate business-related costs.

- Travel and Transportation - Documentation for mileage, airfare, hotel stays, and meals during business trips substantiates deductible travel expenses.

- Professional Services - Invoices and payment records for legal, accounting, or consulting services support claims for service-related deductions.

Receipts for Office Supplies and Equipment

Receipts for office supplies and equipment are essential documents for freelancers to support tax deduction claims. Proper record-keeping ensures compliance and maximizes deductions related to business expenses.

- Itemized receipts - These detail each purchase and serve as proof of expenditures on office supplies and equipment.

- Purchase date and vendor information - Receipts must clearly show the date and seller to validate the timing and source of the expense.

- Payment method documentation - Records of how you paid (credit card, cash, or bank transfer) help verify the authenticity of the transaction.

Travel and Transportation Receipt Management

Freelancers must retain detailed travel and transportation receipts to validate deductible expenses for tax purposes. Essential documents include mileage logs, public transit tickets, fuel receipts, and taxi or ride-share invoices. Proper organization of these records supports accurate tax deductions and compliance with tax authority requirements.

Meal and Entertainment Expense Receipts

```htmlWhat documents does a freelancer need to keep for meal and entertainment expense receipts? Receipts must clearly show the date, location, and amount spent to qualify for tax deductions. Detailed records help ensure accurate reporting and compliance with tax regulations.

```Home Office Expense Documentation

Freelancers must keep detailed home office expense documentation to support tax deduction claims related to their workspace. Essential documents include utility bills, rent receipts, and mortgage statements that show the cost of maintaining the home office.

Receipts for office supplies and equipment purchases specifically used in the home office also play a crucial role in accurate tax records. Properly organized documents ensure compliance with tax regulations and maximize deductible amounts for freelancers.

Digital Tools and Software Subscription Receipts

Freelancers must keep digital tools and software subscription receipts to claim tax deductions accurately. These receipts serve as proof of business expenses incurred for essential services like design programs, cloud storage, and project management apps. Maintaining organized digital copies simplifies expense tracking and ensures compliance with tax regulations.

Maintaining Professional Service Receipts

Freelancers must maintain professional service receipts to ensure accurate tax deduction records. These documents serve as proof of expenses that qualify for tax benefits.

Essential receipts include invoices from clients, payment confirmations, and detailed service contracts. Maintaining organized digital or physical copies facilitates efficient tax filing and audit readiness. Proper record-keeping helps maximize deductible expenses and supports compliance with tax regulations.

What Documents Does a Freelancer Need for Tax Deduction Receipt Records? Infographic