To verify an insurance claim receipt for your pet, you need to provide the original veterinary bill, detailed treatment reports, and proof of payment such as a bank statement or receipt. These documents must clearly outline the services rendered, dates of treatment, and costs incurred to ensure proper validation by the insurance provider. Keeping copies of all related communications with the vet clinic can also support a smooth claims process.

What Documents Are Necessary for Insurance Claim Receipt Verification?

| Number | Name | Description |

|---|---|---|

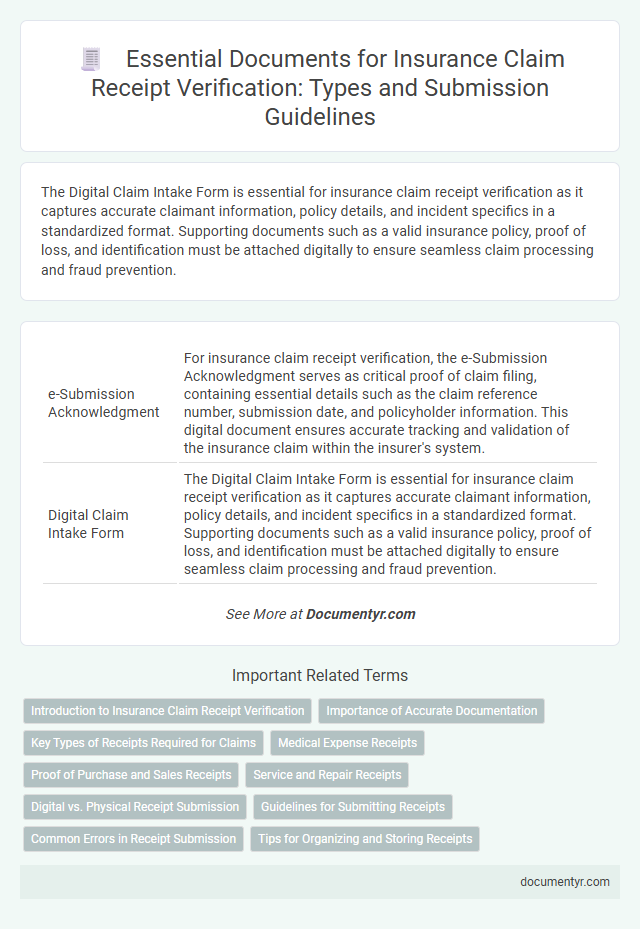

| 1 | e-Submission Acknowledgment | For insurance claim receipt verification, the e-Submission Acknowledgment serves as critical proof of claim filing, containing essential details such as the claim reference number, submission date, and policyholder information. This digital document ensures accurate tracking and validation of the insurance claim within the insurer's system. |

| 2 | Digital Claim Intake Form | The Digital Claim Intake Form is essential for insurance claim receipt verification as it captures accurate claimant information, policy details, and incident specifics in a standardized format. Supporting documents such as a valid insurance policy, proof of loss, and identification must be attached digitally to ensure seamless claim processing and fraud prevention. |

| 3 | Blockchain Timestamp Certificate | Insurance claim receipt verification requires submission of a Blockchain Timestamp Certificate, which provides an immutable and tamper-proof record of the transaction time and details. This certificate ensures authenticity and prevents disputes by securely linking the claim receipt data to a decentralized ledger. |

| 4 | AI-Validated Damage Proof | Essential documents for insurance claim receipt verification include the AI-validated damage proof report, detailed photographs of the damage, the original purchase receipt, and the completed claim form. AI-validated damage proof enhances accuracy by using machine learning algorithms to assess and authenticate the extent of damage, ensuring faster and more reliable claim processing. |

| 5 | Geo-Tagged Incident Photo | Geo-tagged incident photos provide critical timestamp and location verification, essential for insurance claim receipt validation. These images ensure authenticity by linking the documented damage directly to the insured event's precise geographic coordinates and timing. |

| 6 | Electronic Loss Notification | Electronic loss notification requires submission of original insurance policy documents and a detailed electronic loss report to verify the claim receipt accurately. Essential digital files include scanned receipts, proof of ownership, and confirmation of loss date to ensure seamless processing. |

| 7 | Smart Contract Authorization Slip | Smart Contract Authorization Slips serve as critical documents for insurance claim receipt verification, ensuring transparent and tamper-proof authorization of the claim process. These slips include encrypted digital signatures and timestamped approval records, which streamline validation and reduce fraud risk during claim settlements. |

| 8 | QR-Coded Original Invoice | The QR-coded original invoice is essential for insurance claim receipt verification as it provides a secure, tamper-proof digital record that links directly to the transaction details stored in the issuer's database. This document ensures authenticity and accelerates claim processing by enabling quick validation of purchase information through scanning the QR code. |

| 9 | Biometric Identity Affidavit | A Biometric Identity Affidavit is essential for insurance claim receipt verification as it confirms the claimant's identity through biometric data such as fingerprints or facial recognition, reducing the risk of fraud. This affidavit, alongside the original receipt, reinforces the authenticity of the claim and expedites the verification process. |

| 10 | Dynamic Policyholder Consent Form | A Dynamic Policyholder Consent Form is essential for insurance claim receipt verification as it authorizes the insurer to access and process personal data related to the claim. This form ensures compliance with data protection regulations while streamlining the validation of claim documents such as receipts, invoices, and proof of purchase. |

Introduction to Insurance Claim Receipt Verification

Insurance claim receipt verification is a crucial process that confirms the authenticity of your submitted documents. It ensures that the claim corresponds accurately to the insurance policy and covered events.

Verification requires specific documents like the original claim receipt, policy number, and proof of identity. These elements help the insurance company validate the claim details and prevent fraud. Understanding the necessary paperwork streamlines the verification process and speeds up claim approval.

Importance of Accurate Documentation

Accurate documentation is essential for verifying insurance claim receipts. Insurance companies require specific documents to ensure the legitimacy of your claim and process it efficiently.

Necessary documents typically include the original receipt, policy number, proof of payment, and identification. Properly maintaining these documents helps prevent delays and reduces the risk of claim denial.

Key Types of Receipts Required for Claims

| Key Types of Receipts Required for Claims |

|---|

| Proof of Purchase Receipt A detailed sales receipt or invoice that verifies the purchase of the insured item. This must include the date of purchase, item description, and the seller's information. It helps confirm ownership and value. |

| Repair or Service Receipt Receipts from authorized service centers or repair shops showing the work done on the insured item. These documents should specify the nature of the repair, parts replaced, and cost incurred, essential for damage claims. |

| Payment Receipt for Deductibles Proof of payment for deductibles or co-pays related to the insurance claim. This confirms that you have met your financial responsibility part before insurance coverage applies. |

| Proof of Loss or Damage Documentation Receipts for any immediate repairs or emergency services following loss or damage. These support the claim by showing the initial response to the claim-triggering event. |

| Supporting Receipts for Related Expenses Items like temporary accommodations, transportation, or replacement purchases may require receipts. These demonstrate additional costs covered by the claim. |

Medical Expense Receipts

Medical expense receipts play a crucial role in insurance claim receipt verification as they provide proof of incurred healthcare costs. Accurate and complete documentation ensures faster processing and approval of insurance claims.

- Itemized Medical Receipts - Detailed bills specifying treatments, medications, and services received are essential for verifying claim validity.

- Proof of Payment - Receipts or bank statements confirming payment of medical expenses help establish the authenticity of the claimed amounts.

- Doctor's Prescription or Referral - Supporting documents from healthcare providers justify the necessity of the medical services listed on the receipts.

Proof of Purchase and Sales Receipts

Proof of purchase and sales receipts play a crucial role in insurance claim receipt verification. These documents confirm the legitimacy and value of the items claimed.

- Proof of Purchase - This document verifies the original transaction, showing where and when the item was bought.

- Sales Receipts - Sales receipts provide detailed information about the product, price, and payment method.

- Accuracy and Legitimacy - Both documents ensure that claims are accurate and prevent fraudulent submissions.

You must present clear and valid proof of purchase and sales receipts to streamline your insurance claim verification process.

Service and Repair Receipts

What documents are necessary for insurance claim receipt verification related to service and repair receipts? Service and repair receipts must clearly display the service provider's name, date of service, and detailed description of the work performed. These documents also need to include the total cost and any parts or labor charges for accurate verification.

Digital vs. Physical Receipt Submission

Insurance claim receipt verification requires submitting accurate documentation to ensure prompt processing. Both digital and physical receipts have specific criteria that must be met for validation purposes.

- Digital receipts require clear, unaltered images - High-resolution scans or photos with legible purchase details are essential for online submission.

- Physical receipts must be original or certified copies - Handwritten or printed receipts often need to be presented in their original form for authenticity.

- Supporting documentation enhances verification - Invoices, payment confirmations, and proof of purchase complement both digital and physical receipts for comprehensive claim validation.

Guidelines for Submitting Receipts

To ensure smooth insurance claim receipt verification, submit original receipts clearly displaying the vendor's name, date of purchase, and itemized details. Include proof of payment such as credit card statements or bank slips to complement the receipt. Follow insurer-specific guidelines to verify submitted documents are authentic and complete for prompt claim processing.

Common Errors in Receipt Submission

When submitting receipts for insurance claim verification, it is essential to include the original receipt, proof of payment, and a detailed explanation of the purchased items or services. Common errors in receipt submission include submitting photocopies instead of original receipts, missing transaction dates, and incomplete vendor information. Ensuring all required documents are accurate and complete helps avoid delays in claim processing and increases the likelihood of approval.

What Documents Are Necessary for Insurance Claim Receipt Verification? Infographic