Essential documents for tax deduction receipts include the original receipt showing payment details, the name of the organization or individual receiving the donation, and the date of the transaction. Proof of payment methods such as bank statements or credit card slips can further substantiate the claim. Maintaining these records ensures compliance with tax regulations and supports accurate deduction claims.

What Documents Are Essential for Tax Deduction Receipts?

| Number | Name | Description |

|---|---|---|

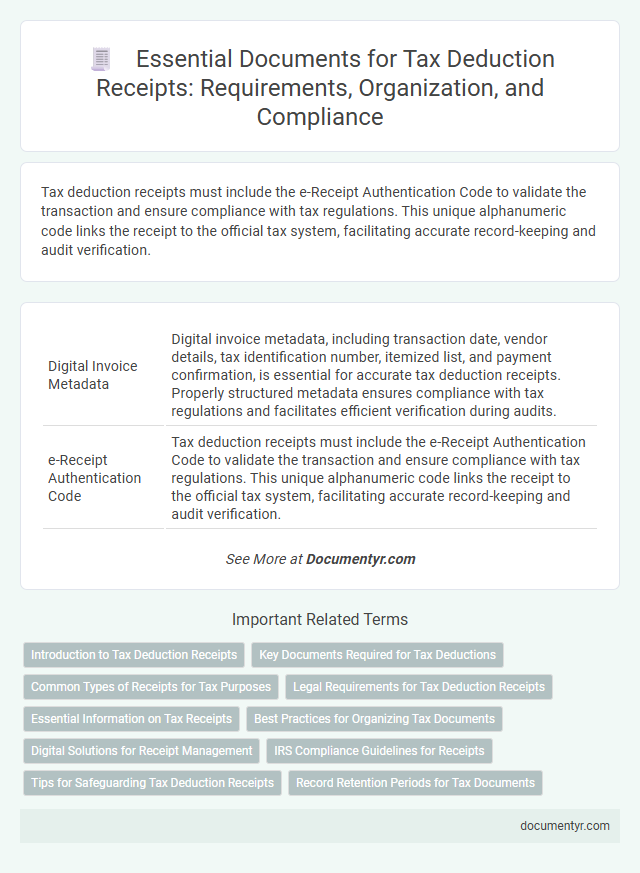

| 1 | Digital Invoice Metadata | Digital invoice metadata, including transaction date, vendor details, tax identification number, itemized list, and payment confirmation, is essential for accurate tax deduction receipts. Properly structured metadata ensures compliance with tax regulations and facilitates efficient verification during audits. |

| 2 | e-Receipt Authentication Code | Tax deduction receipts must include the e-Receipt Authentication Code to validate the transaction and ensure compliance with tax regulations. This unique alphanumeric code links the receipt to the official tax system, facilitating accurate record-keeping and audit verification. |

| 3 | Blockchain-Stamped Receipts | Blockchain-stamped receipts provide immutable proof of transaction authenticity, essential for tax deduction documentation as they enhance verification accuracy and reduce fraud risk. Key documents include the blockchain receipt itself, proof of payment, and detailed transaction metadata to ensure compliance with tax authorities. |

| 4 | E-signature Validation Report | Tax deduction receipts must include an E-signature Validation Report to authenticate the digital signature's legitimacy, ensuring compliance with tax authorities' electronic filing standards. This report verifies the integrity and origin of the receipt, enabling taxpayers to claim deductions confidently. |

| 5 | QR-Coded Donation Slips | QR-coded donation slips are essential for tax deduction receipts as they provide verifiable proof of charitable contributions, linking directly to the donor's details and transaction records stored in official databases. These slips ensure accuracy and compliance with tax authorities by enabling quick validation of donation amounts and recipient information. |

| 6 | Machine-Readable Expense Statement | Machine-readable expense statements are essential for tax deduction receipts as they enable automated extraction and accurate verification of transaction details, including date, amount, and vendor information. These digital documents facilitate seamless integration with tax software, ensuring compliance and simplifying record-keeping for audits. |

| 7 | Cloud-Synced Transaction Proof | Cloud-synced transaction proof serves as a critical document for tax deduction receipts by providing real-time, tamper-proof records of purchases and payments stored securely on cloud servers. These digital receipts enhance accuracy and compliance by ensuring seamless access and verification during tax filings. |

| 8 | AI-Extracted Deduction Category Tag | Essential documents for tax deduction receipts include AI-extracted deduction category tags that accurately classify expenses such as medical bills, charitable donations, and business costs, enabling precise categorization for tax reporting. These tags enhance the organization of receipts by automatically identifying relevant deduction categories, streamlining tax preparation and maximizing eligible deductions. |

| 9 | Encrypted Vendor Acknowledgement | Encrypted vendor acknowledgements are crucial for tax deduction receipts as they validate the authenticity of the transaction and protect sensitive information from unauthorized access. These documents must include encrypted digital signatures, vendor details, transaction IDs, and timestamps to ensure compliance with tax regulations and secure record-keeping. |

| 10 | API-Integrated Receipt Archive | API-integrated receipt archives streamline the storage and retrieval of essential documents such as tax deduction receipts, invoices, and donation proofs, ensuring compliance and accurate record-keeping. These systems automatically categorize and validate receipts against tax requirements, enhancing audit readiness and minimizing manual errors. |

Introduction to Tax Deduction Receipts

Tax deduction receipts serve as crucial proof for claiming tax benefits on eligible expenses. These documents validate payments and help taxpayers reduce taxable income legally.

Accurate and complete receipts ensure compliance with tax regulations and simplify the filing process. Understanding which documents qualify as tax deduction receipts is essential for effective tax planning.

Key Documents Required for Tax Deductions

Tax deduction receipts must include specific key documents to ensure validity and compliance with tax regulations. These documents serve as proof of eligible expenses that qualify for tax benefits.

Essential documents for tax deduction receipts typically include official invoices, payment proofs such as bank statements or transaction receipts, and detailed descriptions of the goods or services purchased. It is important that these documents clearly show the date, amount paid, and the parties involved. Proper documentation helps in accurate tax filing and reduces the risk of audit issues.

Common Types of Receipts for Tax Purposes

Tax deduction receipts play a crucial role in substantiating claims during tax filing. Common types of receipts for tax purposes include medical expense receipts, charitable donation receipts, and business expense invoices. Retaining these documents ensures compliance with tax regulations and maximizes eligible deductions.

Legal Requirements for Tax Deduction Receipts

Tax deduction receipts must include specific legal details to ensure compliance with tax authorities. Essential documents often require the donor's name, date of donation, amount contributed, and the issuing organization's tax-exempt status.

Receipts must also contain a clear statement confirming that no goods or services were received in exchange for the donation. You should keep these documents safely as proof for tax deduction claims during audit inspections.

Essential Information on Tax Receipts

Tax deduction receipts serve as proof of eligible expenses for tax benefits. Accurate documentation on these receipts is crucial for successful tax filing and audit purposes.

- Donor's Name and Address - The receipt must include the full name and address of the individual or organization making the donation.

- Date of Donation - The exact date on which the contribution was made should be clearly stated on the receipt.

- Amount and Description of Donation - The receipt needs to specify the monetary value or a detailed description of non-monetary contributions.

Ensuring these details are present helps maximize tax deduction claims and complies with tax authority regulations.

Best Practices for Organizing Tax Documents

Organizing your tax deduction receipts is crucial for accurate and efficient tax filing. Maintaining a systematic approach to your tax documents helps ensure you maximize your eligible deductions.

- Collect All Relevant Receipts - Gather receipts related to charitable donations, medical expenses, and business costs to support your deductions.

- Label and Categorize Documents - Sort receipts by type and date to facilitate quick retrieval during tax preparation or audits.

- Use Digital Tools for Storage - Scan and store receipts electronically to reduce clutter and create searchable files.

Digital Solutions for Receipt Management

Tax deduction receipts require specific documents to validate your expenses accurately. Digital solutions streamline the management and storage of these essential papers.

- Proof of Purchase - Receipts must display detailed information such as date, vendor, and amount to qualify for tax deductions.

- Digital Storage Platforms - Using cloud-based applications ensures receipts are organized, easily accessible, and securely backed up.

- Automated Categorization - Software that automatically labels and sorts receipts expedites tax filing and reduces errors.

IRS Compliance Guidelines for Receipts

What documents are essential for tax deduction receipts according to IRS compliance guidelines?

IRS compliance guidelines require that tax deduction receipts include the donor's name, the date of the contribution, and the amount or description of the donation. Receipts must also specify whether any goods or services were provided in exchange to ensure proper documentation for tax purposes.

Tips for Safeguarding Tax Deduction Receipts

Tax deduction receipts must include essential documents such as proof of payment, detailed transaction information, and official receipt headers. Safeguard these receipts by organizing them in labeled folders, both physical and digital. Regularly back up digital copies to secure cloud storage to prevent loss during tax filing.

What Documents Are Essential for Tax Deduction Receipts? Infographic