Corporate travel receipt submission requires key documents, including detailed receipts that clearly show the date, vendor, and amount spent. Expense reports summarizing the purpose and nature of each trip must accompany these receipts for proper reimbursement. Proof of payment, such as credit card statements or bank transaction records, is often necessary to validate the expenses incurred.

What Documents Are Necessary for Corporate Travel Receipt Submission?

| Number | Name | Description |

|---|---|---|

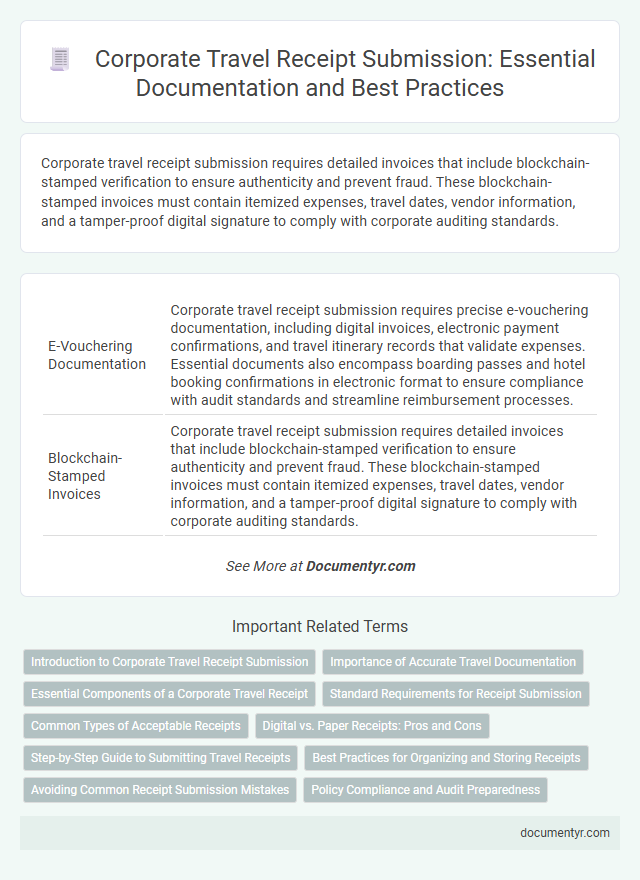

| 1 | E-Vouchering Documentation | Corporate travel receipt submission requires precise e-vouchering documentation, including digital invoices, electronic payment confirmations, and travel itinerary records that validate expenses. Essential documents also encompass boarding passes and hotel booking confirmations in electronic format to ensure compliance with audit standards and streamline reimbursement processes. |

| 2 | Blockchain-Stamped Invoices | Corporate travel receipt submission requires detailed invoices that include blockchain-stamped verification to ensure authenticity and prevent fraud. These blockchain-stamped invoices must contain itemized expenses, travel dates, vendor information, and a tamper-proof digital signature to comply with corporate auditing standards. |

| 3 | Dynamic QR Code Receipts | Dynamic QR code receipts streamline corporate travel expense processes by embedding essential data such as trip details, payment confirmation, and vendor information in a secure, machine-readable format. These documents ensure accurate, real-time verification and seamless integration with expense management systems, enhancing compliance and record-keeping efficiency. |

| 4 | Smart Expense Categorization Slips | Corporate travel receipt submission requires detailed expense documents such as itemized receipts, travel tickets, and accommodation invoices to ensure accurate reimbursement. Smart expense categorization slips enhance the process by automatically sorting and labeling expenses, improving compliance and simplifying audit trails. |

| 5 | Carbon Footprint Travel Certificates | Corporate travel receipt submission requires invoices detailing transportation, accommodation, and related expenses, along with Carbon Footprint Travel Certificates to verify environmental impact compliance. These certificates, often issued by recognized environmental agencies or travel providers, quantify carbon emissions and are essential for sustainable travel reporting and corporate social responsibility audits. |

| 6 | AI-Verified Booking Confirmations | AI-verified booking confirmations serve as essential documents for corporate travel receipt submissions, ensuring authenticity and accuracy of travel details such as dates, destinations, and payment information. These digitally authenticated confirmations streamline the reimbursement process by minimizing errors and reducing the need for manual verification steps. |

| 7 | Mobile Wallet Transaction Proofs | Mobile wallet transaction proofs for corporate travel receipt submission must include clear screenshots or digital receipts displaying the transaction date, amount, merchant details, and payment method. These documents ensure compliance with company expense policies and facilitate seamless reimbursement processing. |

| 8 | Zero-Touch Boarding Pass Records | Zero-touch boarding pass records are essential for corporate travel receipt submission as they provide automated, contactless verification of flight details, eliminating manual entry errors. These digital records ensure compliance and streamline expense reporting by accurately capturing travel dates, destinations, and passenger information directly from airline databases. |

| 9 | Real-Time Expense Tracking Logs | Real-time expense tracking logs are essential for corporate travel receipt submission as they provide accurate, timestamped records of all expenses incurred during business trips. These digital logs improve transparency and streamline reconciliation by automatically syncing with submitted receipts, ensuring compliance with company policies and facilitating efficient auditing. |

| 10 | ESG-Compliant Vendor Receipts | ESG-compliant vendor receipts for corporate travel submissions must include detailed supplier information such as company name, address, and tax identification number, alongside itemized expenses that align with sustainability criteria like eco-friendly transportation or accommodation. These documents ensure transparency and adherence to environmental, social, and governance standards required by corporate travel policies and regulatory frameworks. |

Introduction to Corporate Travel Receipt Submission

| Introduction to Corporate Travel Receipt Submission | |

|---|---|

| Purpose | Corporate travel receipt submission ensures accurate expense tracking, reimbursement processing, and compliance with company policies. |

| Key Documents Required | Receipts for transportation, accommodation, meals, and incidentals must be submitted to validate expenses. |

| Receipt Specifications | Receipts should include merchant details, date of transaction, itemized list, and total amount paid. |

| Supporting Documentation | Travel itinerary and approval forms may be required to corroborate expenses and confirm business purpose. |

| Submission Deadlines | Receipts typically must be submitted within 30 days of travel completion to avoid reimbursement delays. |

| Digital vs. Physical Receipts | Many companies accept scanned digital copies or app-generated e-receipts to streamline the process. |

Importance of Accurate Travel Documentation

Accurate travel documentation is crucial for seamless corporate travel receipt submission and compliance with company policies. Proper documents ensure transparent expense tracking and facilitate reimbursements without delays.

- Itemized Receipts - Detailed receipts verify the exact expenses incurred, supporting accurate accounting and expense validation.

- Travel Itinerary - The itinerary confirms travel dates and destinations, essential for matching expenses with business purposes.

- Approval Forms - Pre-approved travel authorizations demonstrate compliance with corporate travel policies and budgeting constraints.

Essential Components of a Corporate Travel Receipt

A corporate travel receipt must include essential components such as the date of travel, the name of the service provider, and the total amount paid. Detailed descriptions of services or items purchased, along with payment methods and currency, are crucial for accurate expense reporting. You should ensure that receipts are clear, itemized, and comply with company policy for seamless submission and reimbursement.

Standard Requirements for Receipt Submission

Corporate travel receipt submission requires specific documents to ensure proper reimbursement and record-keeping. Standard requirements include the original receipt, proof of payment, and a detailed itinerary reflecting the travel dates.

Receipts must clearly show the vendor's name, date of purchase, and total amount paid. Your submission should also include any expense reports or approval forms mandated by your organization's travel policy.

Common Types of Acceptable Receipts

Common types of acceptable receipts for corporate travel submission include itemized hotel bills, airline tickets, and detailed meal receipts. These documents must clearly show the date, vendor name, and amount paid to validate expenses accurately. Receipts lacking essential details or handwritten notes typically do not meet corporate reimbursement standards.

Digital vs. Paper Receipts: Pros and Cons

What documents are necessary for corporate travel receipt submission? Your submission should include either digital or paper receipts that clearly show the date, amount, and payment method. Both formats serve as proof of expense but have distinct advantages and drawbacks.

What are the pros and cons of digital receipts for corporate travel? Digital receipts are easy to store, search, and share electronically, reducing the risk of loss or damage. However, they depend on reliable technology and may require specific software for submission, which can complicate processing.

How do paper receipts compare to digital receipts in submission? Paper receipts provide a tangible proof of purchase and are widely accepted without the need for technology. They risk fading, tearing, or being misplaced, which could delay reimbursement or audit processes.

Step-by-Step Guide to Submitting Travel Receipts

Corporate travel receipt submission requires specific documents to ensure accurate expense reporting and reimbursement. Proper organization of these documents streamlines the approval process.

- Travel Itinerary - A detailed schedule of flights, accommodations, and meetings confirming the purpose of travel.

- Receipts for Expenses - Original or digital receipts for transportation, lodging, meals, and miscellaneous costs during the trip.

- Expense Report Form - A completed form detailing each expense with dates and explanations, following company policy.

Following these steps guarantees a smooth and efficient corporate travel expense submission.

Best Practices for Organizing and Storing Receipts

Corporate travel receipt submission requires essential documents such as itemized receipts, proof of payment, and detailed expense reports. Proper documentation ensures compliance with company policies and facilitates accurate reimbursement.

Best practices for organizing and storing receipts include categorizing expenses by date and type, using digital tools or apps for receipt capture, and maintaining backups in cloud storage. Consistent labeling and time-stamping receipts help streamline the approval process. Secure storage prevents loss and supports audit readiness for corporate travel expenses.

Avoiding Common Receipt Submission Mistakes

Corporate travel receipt submission requires accurate and complete documentation to ensure smooth reimbursement. Essential documents include the original receipt, a detailed expense report, and proof of payment.

Common mistakes such as missing itemized receipts or incomplete information can delay processing and result in claim denial. Verifying the receipt matches company travel policy and submitting all required documents helps avoid these errors.

What Documents Are Necessary for Corporate Travel Receipt Submission? Infographic