Tax deduction receipts must include the donor's name, the recipient organization's name, donation date, and the exact amount contributed. Official receipts should also contain a unique serial number and the organization's tax registration or charity identification number. Clear descriptions of the donated items or services, if applicable, are essential for validating the deduction.

What Documents Must Be Included for Tax Deduction Receipts?

| Number | Name | Description |

|---|---|---|

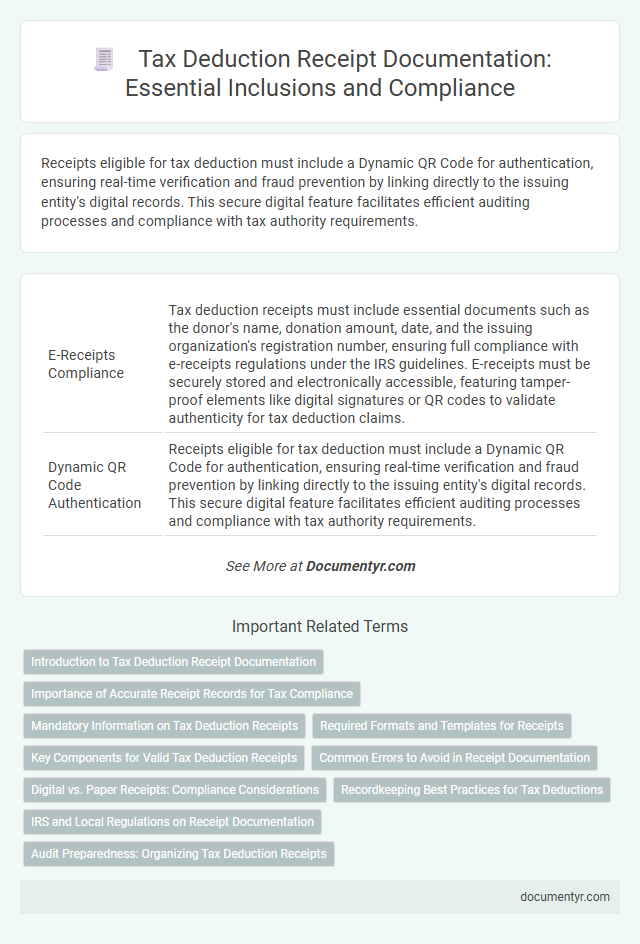

| 1 | E-Receipts Compliance | Tax deduction receipts must include essential documents such as the donor's name, donation amount, date, and the issuing organization's registration number, ensuring full compliance with e-receipts regulations under the IRS guidelines. E-receipts must be securely stored and electronically accessible, featuring tamper-proof elements like digital signatures or QR codes to validate authenticity for tax deduction claims. |

| 2 | Dynamic QR Code Authentication | Receipts eligible for tax deduction must include a Dynamic QR Code for authentication, ensuring real-time verification and fraud prevention by linking directly to the issuing entity's digital records. This secure digital feature facilitates efficient auditing processes and compliance with tax authority requirements. |

| 3 | Source-of-Funds Statement | Tax deduction receipts must include a clearly detailed Source-of-Funds Statement, specifying the origin, amount, and date of the transaction to validate the deduction claim. Accurate documentation linking the receipt to legitimate income sources ensures compliance with tax regulations and facilitates audit verification. |

| 4 | Donor-Advised Fund Letter | A Donor-Advised Fund Letter must include the fund's name, date of the donation, and the amount contributed to qualify for tax deductions. This letter serves as official documentation confirming the donor's charitable contribution for IRS compliance and record-keeping. |

| 5 | ESG-Linked Deduction Certificate | Tax deduction receipts must include the ESG-Linked Deduction Certificate, which documents investments in environmental, social, and governance initiatives qualifying for tax benefits. This certificate should detail the amount invested, project descriptions, and compliance with regulatory criteria to ensure eligibility for ESG-related tax deductions. |

| 6 | NFT Donation Provenance | Tax deduction receipts for NFT donations must include detailed provenance documentation, such as blockchain transaction records and the NFT's original minting data, to verify authenticity and ownership transfer. These documents ensure compliance with IRS guidelines by providing transparent proof of the NFT's value and donor legitimacy. |

| 7 | Digital Timestamp Attestation | Tax deduction receipts must include a digital timestamp attestation to verify the exact date and time the transaction occurred, ensuring compliance with tax authorities. This electronic proof enhances the authenticity and security of receipts, preventing fraud and enabling easier verification during audits. |

| 8 | Machine-Readable Expense Tags | Tax deduction receipts must include machine-readable expense tags that accurately categorize the type of expense, such as medical, education, or charitable donations, to ensure seamless integration with tax software and compliance with tax authority requirements. Embedding standardized machine-readable data like QR codes or data matrix codes facilitates automated expense tracking and verification during tax assessments. |

| 9 | eSAND (Electronic Source Allocation Narrative Document) | Tax deduction receipts must include essential documents such as the eSAND (Electronic Source Allocation Narrative Document), which provides a detailed electronic record of transaction sources and allocations to ensure accurate tax reporting. Including eSAND alongside invoices and payment proofs enhances compliance with tax authority requirements by electronically verifying the legitimacy of the deductible expense. |

| 10 | Blockchain-Verified Transaction Evidence | Receipts for tax deduction must include blockchain-verified transaction evidence to ensure authenticity and immutability of the payment details, such as transaction hashes and timestamped records. This secure documentation facilitates accurate audit trails and compliance with tax authorities by proving the validity of the claimed deduction. |

Introduction to Tax Deduction Receipt Documentation

| Introduction to Tax Deduction Receipt Documentation | |

|---|---|

| Purpose | Tax deduction receipts serve as proof of eligible expenses for reducing taxable income. Proper documentation ensures compliance with tax regulations and maximizes deductions. |

| Essential Documents |

|

| Legal Compliance | Receipts must meet local tax authority standards, including legible information and authorized formats. |

| Record Retention | Maintain documents for the required statutory period, usually between 3 to 7 years, to support audit processes. |

| Impact on Tax Filing | Accurate and complete documentation streamlines tax return preparation and substantiates deduction claims during tax audits. |

Importance of Accurate Receipt Records for Tax Compliance

What documents must be included for tax deduction receipts? Accurate receipts should contain the date of the transaction, the seller's name, and a detailed description of the purchased items or services. Maintaining precise receipt records ensures compliance with tax regulations and facilitates smooth auditing processes.

Mandatory Information on Tax Deduction Receipts

Tax deduction receipts must include specific mandatory information to be valid for tax purposes. Essential details such as the donor's name, the amount donated, and the date of the donation are required.

The receipt should also contain the issuing organization's name, registration number, and a clear statement that the donation is eligible for tax deduction. Including your signature or an authorized representative's signature ensures authenticity and compliance.

Required Formats and Templates for Receipts

Receipts for tax deductions must include specific details such as the payer's name, date of payment, amount paid, and a clear description of the goods or services. Required formats often include standardized templates that ensure all necessary information is presented clearly and legibly. Your receipt should follow these templates to meet tax authority guidelines and qualify for deductions.

Key Components for Valid Tax Deduction Receipts

Tax deduction receipts must include specific key components to be considered valid for tax purposes. These documents serve as proof of your charitable contributions or deductible expenses.

The receipt must clearly state the name of the organization issuing it, along with their tax identification number. It should also contain the date of the donation or transaction, the amount donated, and a detailed description of the goods or services received, if any. A valid receipt often requires an authorized signature to confirm authenticity and compliance with tax regulations.

Common Errors to Avoid in Receipt Documentation

Accurate receipt documentation is crucial for tax deduction purposes, ensuring all required documents are properly included. Common errors such as missing dates, incorrect amounts, or lack of official stamps can lead to rejection by tax authorities.

Receipts must clearly detail the vendor's name, transaction date, and itemized purchases for validity. Avoid vague descriptions, handwritten alterations, and incomplete contact information to maintain compliance and ease audit processes.

Digital vs. Paper Receipts: Compliance Considerations

Tax deduction receipts must include essential documents such as proof of payment, detailed descriptions of goods or services, and the date of the transaction. Digital receipts require compliance with electronic record-keeping standards to ensure authenticity and accessibility. Your choice between digital and paper receipts depends on meeting regulatory requirements and maintaining proper documentation for tax purposes.

Recordkeeping Best Practices for Tax Deductions

Proper documentation is essential for maximizing tax deductions and ensuring compliance with tax regulations. Maintaining organized receipts and records supports accurate reporting and audit readiness.

- Receipts with Detailed Information - Include the date, amount, vendor details, and description of the expense for each receipt to validate the deduction.

- Supplementary Documentation - Attach invoices, bank statements, or credit card statements that corroborate the receipt and transaction.

- Consistent Recordkeeping System - Use digital tools or physical filing systems to categorize and store receipts by type and date for easy retrieval.

Accurate and thorough recordkeeping strengthens the legitimacy of tax deduction claims and minimizes risks during audits.

IRS and Local Regulations on Receipt Documentation

Proper documentation is crucial to ensure your tax deduction receipts comply with IRS requirements and local regulations. Receipts must clearly demonstrate the nature and amount of the donation or expense to qualify for deductions.

- Receipt Detail Requirements - The IRS mandates receipts include the date, amount, and description of the donated goods or services for charitable contributions.

- Local Regulation Compliance - Some local tax authorities require additional information such as the donor's name and address on receipts for proper validation.

- Non-Cash Donation Documentation - Receipts for non-cash donations often need an appraisal or a detailed description to validate the deduction under IRS rules.

What Documents Must Be Included for Tax Deduction Receipts? Infographic