Receipts required for business expense reimbursement must include the date of purchase, the vendor's details, and a clear description of the items or services bought. A valid receipt should show the total amount paid and proof of payment method to verify the transaction. Proper documentation ensures compliance with company policies and facilitates accurate accounting and tax reporting.

What Receipt Documents are Needed for Business Expense Reimbursement?

| Number | Name | Description |

|---|---|---|

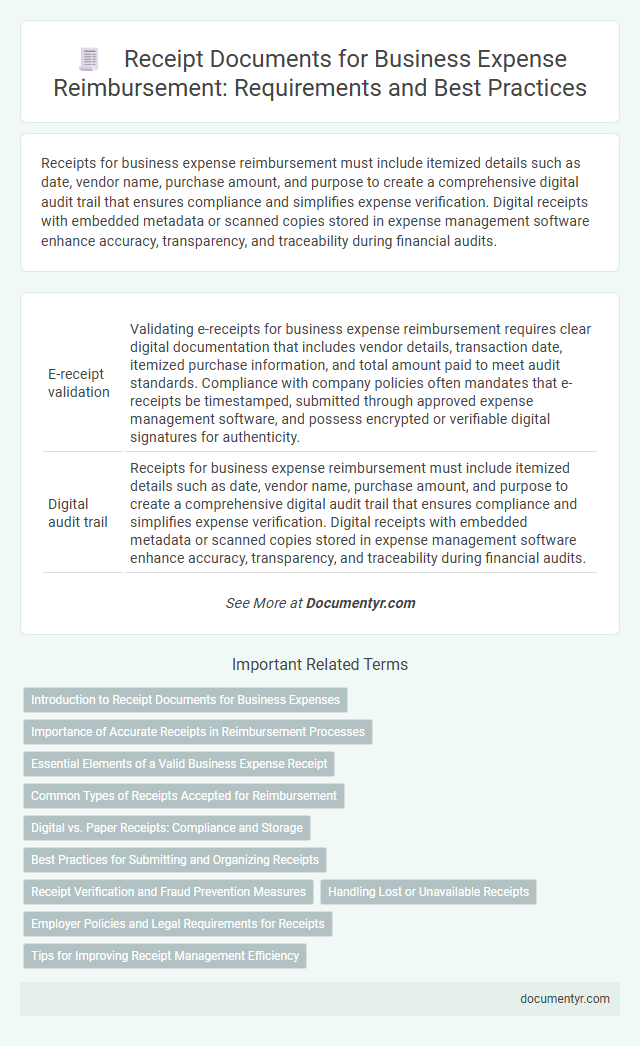

| 1 | E-receipt validation | Validating e-receipts for business expense reimbursement requires clear digital documentation that includes vendor details, transaction date, itemized purchase information, and total amount paid to meet audit standards. Compliance with company policies often mandates that e-receipts be timestamped, submitted through approved expense management software, and possess encrypted or verifiable digital signatures for authenticity. |

| 2 | Digital audit trail | Receipts for business expense reimbursement must include itemized details such as date, vendor name, purchase amount, and purpose to create a comprehensive digital audit trail that ensures compliance and simplifies expense verification. Digital receipts with embedded metadata or scanned copies stored in expense management software enhance accuracy, transparency, and traceability during financial audits. |

| 3 | Split payment invoice | A split payment invoice must clearly itemize each expense portion paid separately, showing the payment method, date, and amount for accurate business expense reimbursement. Detailed receipts with vendor information and transaction specifics ensure compliance with accounting policies and facilitate transparent expense tracking. |

| 4 | Blockchain-authenticated receipt | Business expense reimbursement requires receipt documents that include clear transaction details such as date, amount, vendor information, and purpose of the expense, with blockchain-authenticated receipts providing tamper-proof verification and enhanced security. These digital receipts leverage blockchain technology to ensure authenticity, reduce fraud, and streamline the approval process by offering a decentralized and immutable record. |

| 5 | Mobile wallet transaction slip | Mobile wallet transaction slips serve as crucial receipt documents for business expense reimbursement, providing detailed evidence of payment including date, amount, merchant information, and transaction ID. These digital receipts ensure accurate record-keeping and compliance with company reimbursement policies by verifying mobile payment legitimacy. |

| 6 | Third-party expense aggregator summary | Receipt documents required for business expense reimbursement must include detailed third-party expense aggregator summaries that consolidate individual transaction data, vendor information, and payment methods. These summaries streamline auditing processes by providing verified and itemized expense records compliant with company policies and tax regulations. |

| 7 | Automated receipt parsing | Automated receipt parsing requires clear, itemized receipt documents that include vendor details, transaction date, total amount, and payment method to ensure accurate business expense reimbursement. Digital formats such as scanned PDFs or image files with legible text enable seamless data extraction and reduce manual errors in processing. |

| 8 | OCR-verified expenditure proof | OCR-verified receipt documents for business expense reimbursement must clearly display vendor details, date of purchase, itemized costs, and total amount to ensure accurate verification and compliance. High-resolution digital copies processed through OCR software enhance fraud prevention and streamline approval workflows by extracting essential expenditure data automatically. |

| 9 | Real-time e-proof submission | Real-time e-proof submission for business expense reimbursement requires digital receipts that include transaction details such as date, vendor name, amount, and payment method, ensuring instant verification and approval. These electronic receipts streamline expense tracking, reduce processing time, and improve compliance with company policies by providing immediate proof of purchase. |

| 10 | AI-powered receipt matching | AI-powered receipt matching streamlines business expense reimbursement by accurately identifying and categorizing essential receipt documents such as itemized receipts, credit card statements, and digital invoices. This technology enhances compliance by ensuring that all submitted receipts meet company policy requirements, reducing human error and accelerating the approval process. |

Introduction to Receipt Documents for Business Expenses

Receipt documents serve as essential proof of business expenses incurred during work-related activities. They provide detailed information such as date, amount, vendor, and purpose, which are crucial for accurate reimbursement processing. Understanding the types of receipt documents required helps ensure your business expenses are properly recorded and reimbursed.

Importance of Accurate Receipts in Reimbursement Processes

Accurate receipt documents are essential for business expense reimbursement as they provide verifiable proof of purchases. These documents typically include detailed information such as date, vendor, amount, and itemized expenses, ensuring transparency and accountability.

Precise receipts help streamline the reimbursement process by minimizing disputes and delays, facilitating quick approval and payment. Maintaining accurate records supports compliance with company policies and tax regulations, reducing the risk of audit issues.

Essential Elements of a Valid Business Expense Receipt

Receipts for business expense reimbursement must contain specific details to ensure proper validation and approval. Understanding these essential elements helps you submit accurate documentation for timely reimbursement.

- Date of Purchase - Clearly indicates when the expense occurred to verify the timing of the business activity.

- Vendor Information - Shows the name and contact details of the seller or service provider for authenticity.

- Itemized Description - Lists purchased goods or services with individual costs to demonstrate the nature of the expense.

Common Types of Receipts Accepted for Reimbursement

What receipt documents are needed for business expense reimbursement? Common types of receipts accepted for reimbursement include itemized receipts, credit card statements, and electronic invoices. These documents must clearly show the date, amount, and description of the expense to qualify for reimbursement.

Digital vs. Paper Receipts: Compliance and Storage

Businesses require specific receipt documents to validate expense reimbursement claims. Understanding the differences between digital and paper receipts is crucial for compliance and effective storage management.

- Digital receipts offer easier storage - They can be organized electronically, reducing physical space and improving retrieval efficiency.

- Paper receipts are traditionally accepted - Many businesses and tax authorities still recognize them as valid proof of purchase.

- Compliance standards vary - Digital receipts must meet legal requirements such as authenticity and integrity to be accepted.

Choosing the appropriate receipt format depends on company policy, legal regulations, and practical storage considerations.

Best Practices for Submitting and Organizing Receipts

Business expense reimbursement requires specific receipt documents to ensure accurate and timely processing. Proper submission and organization of these receipts streamline approval and record-keeping.

- Detailed Receipts - Provide receipts that clearly list the vendor, date, items purchased, and total amount paid.

- Original Copies - Submit original or digital copies of receipts to maintain authenticity and prevent disputes.

- Organized Categories - Categorize receipts by expense type or project to facilitate efficient review and tracking.

Receipt Verification and Fraud Prevention Measures

Receipts required for business expense reimbursement must clearly show the vendor's name, date of purchase, items or services bought, and the total amount paid. Accurate receipt verification is essential to ensure that submitted expenses are legitimate and comply with company policies.

Implementing fraud prevention measures like cross-referencing receipts with purchase orders and monitoring for duplicate submissions helps protect your business from financial losses. Digital receipt management systems can further enhance verification accuracy and streamline the reimbursement process.

Handling Lost or Unavailable Receipts

Receipts are essential for business expense reimbursement as they provide proof of purchase and validate your claims. Common receipt documents include itemized receipts, credit card statements, and invoices.

If receipts are lost or unavailable, submitting a detailed affidavit explaining the expense can help. Photocopies, bank statements, or email confirmations might serve as alternative proof. Maintaining digital backups prevents future loss and supports accurate reimbursement.

Employer Policies and Legal Requirements for Receipts

| Receipt Document | Purpose | Employer Policy Requirements | Legal Requirements |

|---|---|---|---|

| Itemized Receipt | Provides detailed information on purchased items or services | Must include date, vendor, item descriptions, and amounts | Required by tax authorities to validate expense deductions |

| Proof of Payment | Verifies that transaction was completed via credit card, cash, or check | Some employers require credit card statements or canceled checks alongside receipts | Supports compliance with IRS audit standards |

| Travel Receipts | Documents expenses for transportation, lodging, and meals | Employer policies often specify acceptable expenses and necessary receipts | Must include date, location, and business purpose for lawful reimbursement |

| Electronic Receipts | Digital versions of purchase confirmations or invoices | Accepted if they contain all required information and are legible | IRS accepts electronic receipts as valid proof under proper records management |

| Expense Report | Summarizes all receipts and expense details for approval | Typically required to be submitted with original receipts attached | Ensures accurate documentation for tax reporting and reimbursement |

What Receipt Documents are Needed for Business Expense Reimbursement? Infographic