To submit receipts for Health Savings Accounts, you need detailed documentation including the itemized receipt that clearly shows the date of service, provider or merchant name, description of the service or product, and the amount paid. The receipt must also specify the eligible medical expense to ensure compliance with HSA guidelines. Retaining these documents is essential for auditing purposes and to validate your HSA claims with the IRS.

What Documents are Necessary for Submitting Receipts for Health Savings Accounts?

| Number | Name | Description |

|---|---|---|

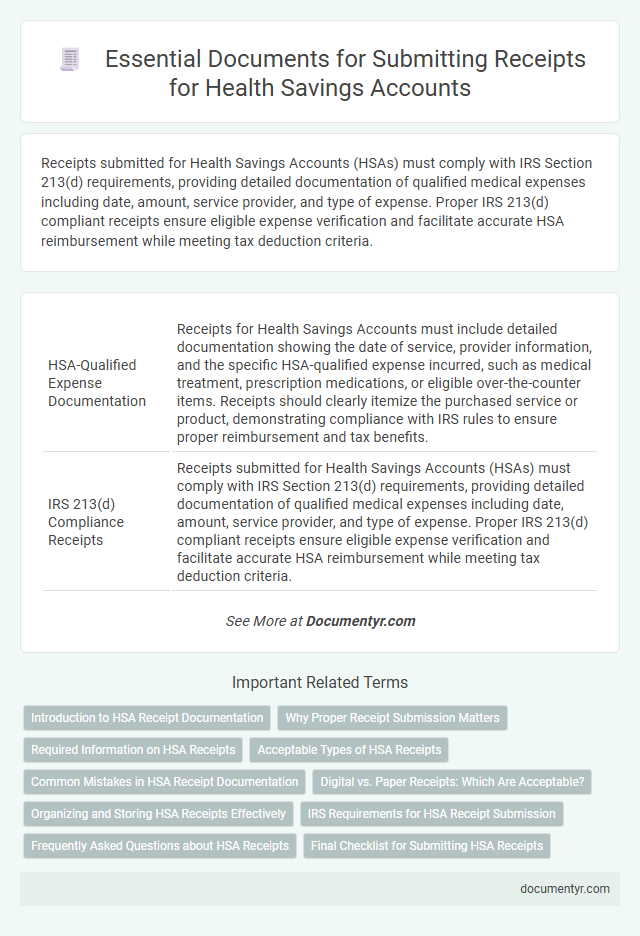

| 1 | HSA-Qualified Expense Documentation | Receipts for Health Savings Accounts must include detailed documentation showing the date of service, provider information, and the specific HSA-qualified expense incurred, such as medical treatment, prescription medications, or eligible over-the-counter items. Receipts should clearly itemize the purchased service or product, demonstrating compliance with IRS rules to ensure proper reimbursement and tax benefits. |

| 2 | IRS 213(d) Compliance Receipts | Receipts submitted for Health Savings Accounts (HSAs) must comply with IRS Section 213(d) requirements, providing detailed documentation of qualified medical expenses including date, amount, service provider, and type of expense. Proper IRS 213(d) compliant receipts ensure eligible expense verification and facilitate accurate HSA reimbursement while meeting tax deduction criteria. |

| 3 | Itemized Provider Statements | Itemized provider statements are essential documents for submitting receipts to Health Savings Accounts as they detail the date of service, description of each procedure or item, provider's name, and the amount charged. These statements ensure verification of eligible medical expenses, facilitating accurate claims processing and reimbursement. |

| 4 | Pharmacy National Drug Code (NDC) Receipt | Receipts submitted for Health Savings Accounts must include detailed information such as the Pharmacy National Drug Code (NDC), date of purchase, item description, and amount paid to verify eligibility of the expense. The NDC on the receipt uniquely identifies the medication purchased, ensuring compliance with IRS requirements for HSA claims. |

| 5 | Eligible Service Date Verification | Receipts for Health Savings Accounts require documentation verifying the eligible service date to confirm the expense qualifies under IRS guidelines. Proof such as dated invoices or statements from healthcare providers is essential to validate the treatment or service date for reimbursement purposes. |

| 6 | Explanation of Benefits (EOB) PDFs | Explanation of Benefits (EOB) PDFs are essential documents for submitting receipts to Health Savings Accounts (HSAs) as they provide detailed information on medical services rendered, amounts billed, insurance adjustments, and patient responsibilities. These PDFs verify eligibility and expenses, ensuring accurate reimbursement and compliance with IRS regulations for qualified medical expenses. |

| 7 | Electronic Health Record (EHR) Receipt Export | Submitting receipts for Health Savings Accounts requires electronic export of documents directly from Electronic Health Record (EHR) systems, ensuring accurate capture of medical service details such as date, provider, and treatment codes. This EHR-derived receipt export streamlines HSA claims by providing verifiable, itemized records that comply with IRS substantiation requirements. |

| 8 | Medical Expense Eligibility Letter | A Medical Expense Eligibility Letter is necessary for submitting receipts to Health Savings Accounts (HSAs) as it verifies the medical service or product qualifies under IRS guidelines for HSA reimbursement. This letter must detail the date, type of service, provider information, and cost to ensure compliance and facilitate accurate claims processing. |

| 9 | Digital FSA/HSA Mobile App Receipt Upload | Digital FSA/HSA mobile app receipt upload requires clear, legible images of itemized receipts showing the merchant name, date of purchase, and eligible medical expenses to verify claims effectively. Supporting documents such as Explanation of Benefits (EOB) statements and itemized invoices must accompany uploaded receipts to comply with IRS guidelines for Health Savings Accounts. |

| 10 | Telehealth Receipt Authentication | Receipts submitted for Health Savings Accounts (HSAs) must include detailed documentation such as the provider's name, date of service, description of medical services or telehealth consultations, and the amount paid. Telehealth receipt authentication requires proof of a legitimate virtual medical appointment, often verified through provider identification and service codes recognized by HSA administrators. |

Introduction to HSA Receipt Documentation

Health Savings Accounts (HSAs) require proper documentation to verify eligible medical expenses. Receipts play a crucial role in substantiating these claims for tax and reimbursement purposes.

When submitting receipts for an HSA, it is important to include detailed proof of the expense, such as the date, provider's name, and description of the service or product. Your receipt must clearly show the amount paid and confirm it relates to a qualified medical expense. Accurate documentation ensures compliance with IRS regulations and smooth processing of your claims.

Why Proper Receipt Submission Matters

Submitting accurate receipts is crucial for Health Savings Accounts (HSAs) to ensure expenses qualify for tax-free withdrawals. Necessary documents include itemized receipts showing the date, provider, and type of service or product. Proper receipt submission helps prevent IRS audits and guarantees compliance with HSA regulations.

Required Information on HSA Receipts

Submitting receipts for Health Savings Accounts requires specific documentation to ensure claims are processed correctly. Accurate and detailed receipts help verify eligible medical expenses.

- Date of Service - The receipt must include the exact date when the medical service or purchase was made.

- Provider Information - The name and contact details of the healthcare provider or merchant should be clearly stated on the receipt.

- Itemized Description - Each medical expense must be itemized with a clear description and the amount charged.

Your receipt should contain all required information to avoid delays or denial of HSA reimbursements.

Acceptable Types of HSA Receipts

Receipts submitted for Health Savings Accounts (HSA) must clearly show the date of service, the provider's name, and a detailed description of the medical expense. Acceptable types include itemized bills from healthcare providers, pharmacy receipts for prescription medications, and invoices for eligible medical supplies. You should ensure the receipt also indicates the amount paid to validate the expense for HSA reimbursement purposes.

Common Mistakes in HSA Receipt Documentation

Submitting receipts for Health Savings Accounts requires precise documentation to ensure compliance and reimbursement. Common mistakes in HSA receipt documentation often lead to claim denials or delays.

- Incomplete Receipts - Receipts missing dates, provider information, or itemized services may be rejected by HSA administrators.

- Non-Eligible Expenses - Including receipts for items that do not qualify as HSA-eligible expenses causes confusion and possible audits.

- Lack of Proof of Payment - Submitting receipts without proof that the expense was paid reduces the likelihood of successful reimbursement.

Digital vs. Paper Receipts: Which Are Acceptable?

Submitting receipts for Health Savings Accounts (HSAs) requires proper documentation to verify eligible medical expenses. Both digital and paper receipts are accepted as valid proof when submitting claims to HSA providers.

Digital receipts must clearly show the date, provider's name, expense description, and amount paid to be acceptable. Paper receipts need to include the same key details and should be legible to avoid claim rejection.

Organizing and Storing HSA Receipts Effectively

Organizing and storing Health Savings Account (HSA) receipts properly ensures smooth reimbursement and tax compliance. Maintaining clear documentation helps prevent disputes and simplifies record retrieval.

- Itemized Receipts - Essential for verifying eligible medical expenses with detailed service descriptions and dates.

- Digital Storage Solutions - Using apps or cloud storage allows easy access and reduces the risk of losing physical receipts.

- Consistent Filing System - Categorizing receipts by date or expense type improves efficiency during audits or account reviews.

IRS Requirements for HSA Receipt Submission

What documents are necessary for submitting receipts for Health Savings Accounts (HSAs) according to IRS requirements? The IRS mandates that receipts include detailed information such as the date of service, description of the medical expense, and the amount paid. Maintaining these documents ensures proper substantiation of HSA distributions during tax filing.

Frequently Asked Questions about HSA Receipts

Submitting receipts for Health Savings Accounts (HSA) requires specific documentation to ensure eligible expenses are reimbursed. Essential documents include itemized receipts or invoices that clearly detail the medical service or product, date of service, and amount paid.

Receipts must show the name of the provider or pharmacy, the type of medical expense, and proof of payment. Keeping receipts organized and legible simplifies the HSA reimbursement process and supports compliance with IRS regulations.

What Documents are Necessary for Submitting Receipts for Health Savings Accounts? Infographic