To claim medical expense receipts, submit official documents such as detailed invoices from veterinary clinics, showing the pet's name, date of treatment, and itemized services or medications. Include proof of payment like receipts or bank statements to verify the transaction. Any additional supporting documents, such as prescriptions or referral letters, may also be required to ensure accurate processing of claims.

What Documents Should Be Submitted for Medical Expense Receipts?

| Number | Name | Description |

|---|---|---|

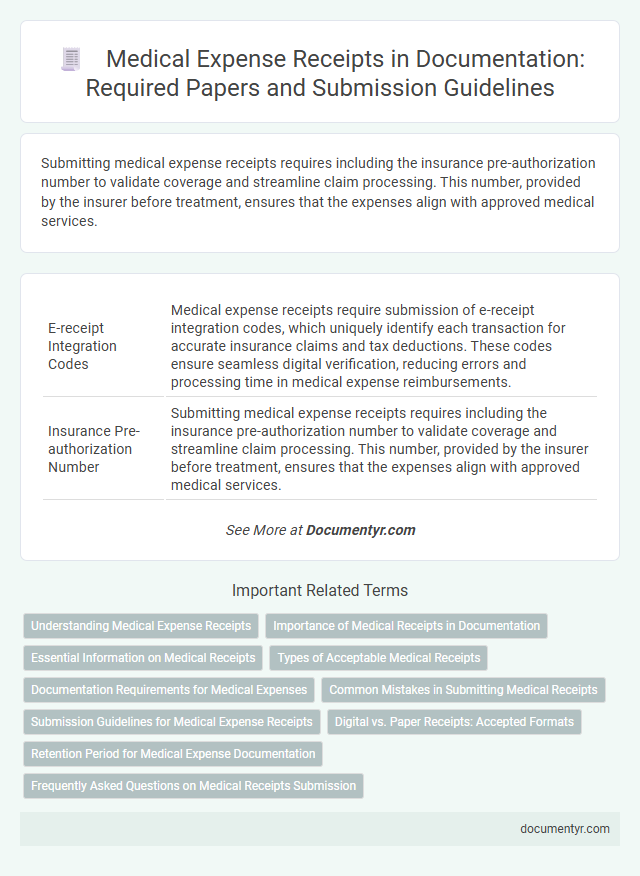

| 1 | E-receipt Integration Codes | Medical expense receipts require submission of e-receipt integration codes, which uniquely identify each transaction for accurate insurance claims and tax deductions. These codes ensure seamless digital verification, reducing errors and processing time in medical expense reimbursements. |

| 2 | Insurance Pre-authorization Number | Submitting medical expense receipts requires including the insurance pre-authorization number to validate coverage and streamline claim processing. This number, provided by the insurer before treatment, ensures that the expenses align with approved medical services. |

| 3 | Telemedicine Consultation Records | Telemedicine consultation records must include detailed documentation of the date, healthcare provider's name, services rendered, and patient information to qualify for medical expense receipts. Submitting these records ensures accurate verification and compliance with insurance or tax requirements. |

| 4 | Blockchain-Stamped Medical Invoices | Blockchain-stamped medical invoices ensure authentic and tamper-proof records for submission of medical expense receipts, requiring the original invoice alongside a verified blockchain certificate as proof of legitimacy. These documents streamline claim processes by providing transparent, immutable transaction records that comply with health insurance and tax authorities' standards. |

| 5 | EHR (Electronic Health Record) Extracts | Medical expense receipts require submission of EHR extracts that detail patient treatment dates, procedures performed, and associated costs to ensure precise insurance claims and tax deductions. These digital documents provide verifiable, itemized medical service records necessary for validating medical expenses. |

| 6 | QR-Code-Verified Doctor’s Prescription | Submit a QR-code-verified doctor's prescription along with the medical expense receipt to ensure authenticity and eligibility for insurance claims or tax deductions. This digital verification streamlines processing by confirming the legitimacy of prescribed treatments directly from healthcare providers. |

| 7 | Decentralized Identity (DID) Credentials | Medical expense receipts should be submitted with Decentralized Identity (DID) credentials that securely verify the patient's identity and the authenticity of the medical service provider, ensuring privacy and tamper-proof validation. These credentials enhance trust by enabling seamless and verifiable exchange of medical billing information without relying on centralized authorities. |

| 8 | AI-Generated Treatment summary | To validate medical expense receipts, submitting an AI-generated treatment summary detailing dates, procedures, and healthcare provider information is essential; this document enhances accuracy and streamlines insurance claims processing. Including the original prescription, diagnostic reports, and payment receipts alongside the AI-generated summary ensures comprehensive proof of medical services rendered. |

| 9 | FHIR-Compliant Billing Statement | Submit a FHIR-compliant billing statement, which includes standardized patient information, itemized services, dates of service, and detailed cost breakdowns to ensure accurate medical expense receipt processing. This structured format facilitates interoperability and verification by health insurance providers and regulatory bodies. |

| 10 | Remote Patient Monitoring (RPM) Data Receipts | Submit detailed Remote Patient Monitoring (RPM) data reports that include timestamped biometric readings, device logs, and patient adherence records to validate medical expense claims. Ensure all documentation is physician-certified and aligns with the billing period specified for RPM services to facilitate accurate reimbursement. |

Understanding Medical Expense Receipts

Understanding medical expense receipts is essential for accurate record-keeping and tax deductions. These receipts provide proof of medical payments made, ensuring transparency and validity in expense claims.

- Detailed Medical Expense Receipt - This document includes the patient's name, date of service, type of treatment, and total amount paid, serving as primary proof for claims.

- Doctor's Prescription or Referral - Necessary to validate prescribed treatments or medications associated with the receipt.

- Payment Proof - Bank statements, credit card slips, or cash payment confirmations complement receipts to verify transactions.

Importance of Medical Receipts in Documentation

| Document Type | Description |

|---|---|

| Medical Expense Receipts | Official proof of payment for medical services, treatments, and medications. Essential for tax deductions and insurance claims. |

| Doctor's Prescriptions | Written orders from physicians for prescribed medicines or treatments, validating medical expenses. |

| Hospital Bills | Detailed statements from healthcare providers outlining the costs incurred during hospital stays or procedures. |

| Pharmacy Receipts | Records of purchased medications, supporting claims for medical reimbursements and tax benefits. |

| Importance of Medical Receipts |

|---|

| Medical receipts serve as reliable evidence for incurred healthcare expenses. Precise documentation ensures eligibility for tax deductions, insurance reimbursements, and compliance with legal requirements. Organized and accurate medical receipts reduce disputes with insurance companies and streamline financial record-keeping. Providing full documentation supports transparency and validates the legitimacy of medical claims. Proper records assist in budgeting healthcare costs and planning future medical expenses. |

Essential Information on Medical Receipts

When submitting medical expense receipts, it is crucial to provide documents containing all necessary details to ensure reimbursement or tax deductions. Proper documentation helps verify the authenticity and eligibility of the claimed expenses.

- Patient Information - The receipt must include the patient's full name to confirm who received the medical service.

- Date of Service - The exact date when the medical treatment or consultation occurred is required to validate the timing of the expense.

- Provider Details - The name, address, and registration number of the medical provider should be clearly stated to prove the legitimacy of the service.

These key elements guarantee that medical expense receipts meet the necessary standards for official processing.

Types of Acceptable Medical Receipts

Medical expense receipts must clearly itemize services, treatments, or medications received to be eligible for submission. Acceptable documents include official receipts from hospitals, clinics, pharmacies, and licensed healthcare providers that detail patient information, date of service, and costs incurred. Receipts lacking these details or handwritten notes usually do not qualify for reimbursement or tax deduction purposes.

Documentation Requirements for Medical Expenses

Medical expense receipts require specific documentation to ensure proper verification and reimbursement. Accurate records help in claiming tax deductions or insurance settlements efficiently.

Receipts should include the date of service, the provider's name, and a detailed description of the medical treatment or supplies. Official invoices or bills must be itemized and show payment proof such as a credit card slip or bank statement. Prescription copies may also be necessary for certain medications to validate expenses accurately.

Common Mistakes in Submitting Medical Receipts

Submitting medical expense receipts requires careful attention to detail to ensure proper reimbursement. Common mistakes include missing itemized receipts, incomplete documentation, and receipts without the provider's information. To avoid delays, verify that all submitted documents clearly show the date, service description, and payment proof.

Submission Guidelines for Medical Expense Receipts

What documents should be submitted for medical expense receipts? Submit the original medical expense receipts along with a detailed prescription or doctor's note specifying the treatment. Ensure that all documents clearly state the patient's name, date of service, and the amount paid for accurate processing.

Digital vs. Paper Receipts: Accepted Formats

Medical expense receipts must be submitted in accepted formats to ensure proper reimbursement and record-keeping. Understanding the differences between digital and paper receipts is essential for compliance.

- Paper Receipts - Physical receipts from medical providers are widely accepted for expense claims and must be clear and legible.

- Digital Receipts - Electronic receipts, such as PDFs or email confirmations, are valid when they include all necessary details like date, service, and cost.

- Format Requirements - Both digital and paper receipts should contain provider information, patient name, treatment details, and payment confirmation to be accepted.

Retention Period for Medical Expense Documentation

Medical expense receipts require submission of detailed invoices, prescription records, and payment proofs to ensure valid claims. These documents must clearly show the treatment details, healthcare provider information, and payment dates.

Retain medical expense receipts and related documents for at least five years from the end of the tax year in which the expenses were claimed. This retention period aligns with tax authority regulations and supports audit readiness.

What Documents Should Be Submitted for Medical Expense Receipts? Infographic