When disputing a purchase receipt with a credit card, essential documents include the original purchase receipt, proof of the transaction such as credit card statements, and any communication with the merchant regarding the dispute. Providing detailed transaction records and evidence of returned items or services not rendered strengthens the claim. Keeping these documents organized and accessible ensures a smoother resolution process with the credit card issuer.

What Documents Are Essential for Purchase Receipt Disputes with Credit Cards?

| Number | Name | Description |

|---|---|---|

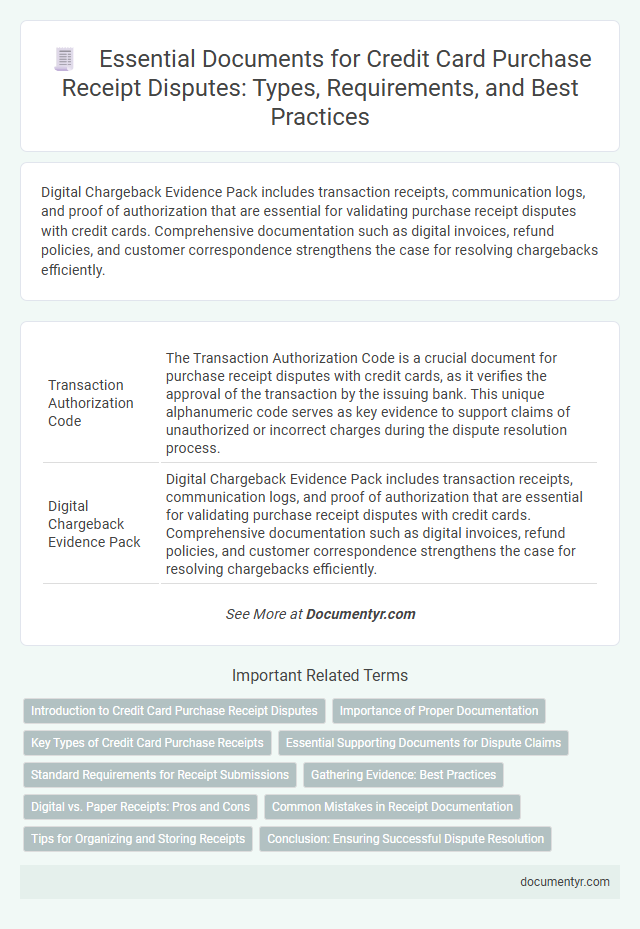

| 1 | Transaction Authorization Code | The Transaction Authorization Code is a crucial document for purchase receipt disputes with credit cards, as it verifies the approval of the transaction by the issuing bank. This unique alphanumeric code serves as key evidence to support claims of unauthorized or incorrect charges during the dispute resolution process. |

| 2 | Digital Chargeback Evidence Pack | Digital Chargeback Evidence Pack includes transaction receipts, communication logs, and proof of authorization that are essential for validating purchase receipt disputes with credit cards. Comprehensive documentation such as digital invoices, refund policies, and customer correspondence strengthens the case for resolving chargebacks efficiently. |

| 3 | e-Receipt Blockchain Hash | Essential documents for purchase receipt disputes with credit cards include the original purchase receipt, credit card statement, and any correspondence with the merchant. Leveraging an e-Receipt blockchain hash provides irrefutable proof of transaction authenticity and timestamp, enhancing dispute resolution accuracy. |

| 4 | Dynamic Refund Trace ID | Purchase receipt disputes with credit cards require essential documents such as the original purchase receipt, credit card statement showing the transaction, and the Dynamic Refund Trace ID, which acts as a unique identifier for tracking refund processes. Including the Dynamic Refund Trace ID enables efficient verification and resolution by linking the dispute directly to the refund transaction in the payment system. |

| 5 | Virtual Terminal Log | The Virtual Terminal Log is essential for purchase receipt disputes with credit cards as it provides detailed transaction records, including date, time, amount, and authorization codes. Retaining this log alongside the original receipt and cardholder communication strengthens the evidence needed to resolve chargeback claims effectively. |

| 6 | Bank-Issued Dispute Reference Number | A bank-issued dispute reference number is essential for tracking and resolving credit card purchase receipt disputes effectively. This unique identifier links all correspondence, transaction details, and investigation outcomes, ensuring accurate and timely dispute resolution. |

| 7 | Payment Gateway Digital Signature | Payment gateway digital signatures are crucial in purchase receipt disputes with credit cards, providing verifiable authentication of transaction details and ensuring data integrity. Essential documents include the digital receipt containing the encrypted digital signature, transaction logs from the payment gateway, and the credit card statement highlighting the contested charges. |

| 8 | Smart Reconciliation Report | For purchase receipt disputes with credit cards, a Smart Reconciliation Report is essential as it provides detailed transaction data, timestamps, and merchant information that validate the purchase. This report enhances accuracy in identifying discrepancies and serves as a critical piece of evidence during the dispute resolution process. |

| 9 | Contactless Payment Itemization | Essential documents for purchase receipt disputes with credit cards include detailed contactless payment itemization that clearly outlines transaction date, time, merchant name, and individual item costs. These records enable accurate verification and support dispute claims by providing granular financial data directly tied to the contactless transaction. |

| 10 | EMV Chip Data Extract | EMV chip data extract is crucial for purchase receipt disputes with credit cards as it provides detailed transaction authentication records, including cryptographic information and terminal verification results. These data elements help verify the legitimacy of the transaction and support dispute resolution by confirming the card's presence and interaction during the purchase. |

Introduction to Credit Card Purchase Receipt Disputes

Disputing a credit card purchase often requires specific documentation to support your claim. Proper paperwork helps streamline the resolution process and protects your financial interests.

You must gather key documents such as the original purchase receipt, credit card statements, and any communication with the merchant. These records serve as crucial evidence during the dispute investigation.

Importance of Proper Documentation

What documents are essential for resolving purchase receipt disputes with credit cards? Proper documentation, including the original purchase receipt and credit card statement, plays a crucial role in supporting your claim. These documents provide clear evidence of the transaction details, helping to verify charges and expedite dispute resolution.

Key Types of Credit Card Purchase Receipts

Key types of credit card purchase receipts include itemized receipts, transaction confirmation slips, and digital receipts from online purchases. Itemized receipts provide detailed information about each product or service purchased, which is crucial for verifying charges during disputes. Confirming the transaction with your credit card statement helps support your claim in case of discrepancies.

Essential Supporting Documents for Dispute Claims

Essential supporting documents for purchase receipt disputes with credit cards include the original purchase receipt, proof of payment, and any correspondence with the merchant. These documents help verify the transaction details and establish the legitimacy of your dispute claim.

Additionally, providing your credit card statement highlighting the disputed charge and any contract or agreement related to the purchase strengthens the case. Organized and clear documentation speeds up the resolution process with the credit card issuer.

Standard Requirements for Receipt Submissions

Essential documents for purchase receipt disputes with credit cards include the original sales receipt, proof of transaction such as credit card statements, and any related correspondence with the merchant. These documents verify the purchase and support the dispute claim.

Standard requirements for receipt submissions typically involve a clear, legible copy of the purchase receipt showing the date, merchant name, and amount charged. Credit card statements should highlight the disputed transaction for easy reference. Providing any communication records with the merchant strengthens the case for resolving the dispute efficiently.

Gathering Evidence: Best Practices

Gathering accurate evidence is crucial when disputing purchase receipts with credit cards. Proper documentation strengthens Your case and expedites resolution.

- Receipts and Invoices - Collect original transaction receipts and detailed invoices to verify purchase details and amounts.

- Credit Card Statements - Obtain statements highlighting the disputed charge to confirm the transaction date and merchant information.

- Communication Records - Preserve emails, chat logs, or call records with the merchant as proof of attempted resolution or inquiries.

Organizing these documents systematically improves the clarity and effectiveness of your dispute submission.

Digital vs. Paper Receipts: Pros and Cons

Digital receipts offer easy storage and quick access, making it simpler to track purchases and resolve credit card disputes. Paper receipts provide a physical proof of transaction but are prone to damage or loss over time. Both formats have advantages and drawbacks; having copies of either can strengthen your case during purchase receipt disputes.

Common Mistakes in Receipt Documentation

| Essential Documents for Purchase Receipt Disputes with Credit Cards |

|---|

| Credit Card Statement showing the disputed transaction |

| Original Purchase Receipt detailing items, prices, and date |

| Proof of Return or Refund if applicable, including return receipts or email confirmation |

| Correspondence with the Merchant related to the dispute |

| Common Mistakes in Receipt Documentation |

|---|

| Missing or illegible receipts create difficulty in verifying purchases or returns |

| Using receipts that lack detailed pricing, item descriptions, or date information |

| Failing to keep copies of all correspondence and documentation relevant to the transaction |

| Ignoring the importance of matching the receipt information exactly to the disputed credit card transaction |

| Submitting handwritten or altered receipts without valid proof of authenticity |

Ensuring your purchase receipt documentation is accurate and complete strengthens your position in credit card dispute resolutions.

Tips for Organizing and Storing Receipts

Keeping well-organized and easily accessible receipts is crucial when disputing credit card purchase charges. Proper storage methods ensure you have all necessary documentation to support your claim effectively.

- Use a Dedicated Receipt Folder - Store physical receipts in a labeled folder to prevent loss and make retrieval straightforward.

- Digitize Receipts - Scan or photograph receipts immediately after purchase to create electronic backups that are easier to manage and share.

- Organize by Date and Merchant - Categorize receipts chronologically and by retailer to quickly locate documents relevant to specific transactions.

What Documents Are Essential for Purchase Receipt Disputes with Credit Cards? Infographic