Receipts required for FSA or HSA reimbursements must clearly show the date of purchase, the provider or merchant's name, and a detailed description of the eligible medical expense. Receipts should include the amount paid and the type of service or product to verify compliance with IRS guidelines. Keeping accurate, itemized receipts ensures smooth reimbursement processing and supports audit compliance.

What Receipt Documents Are Needed for FSA or HSA Reimbursements?

| Number | Name | Description |

|---|---|---|

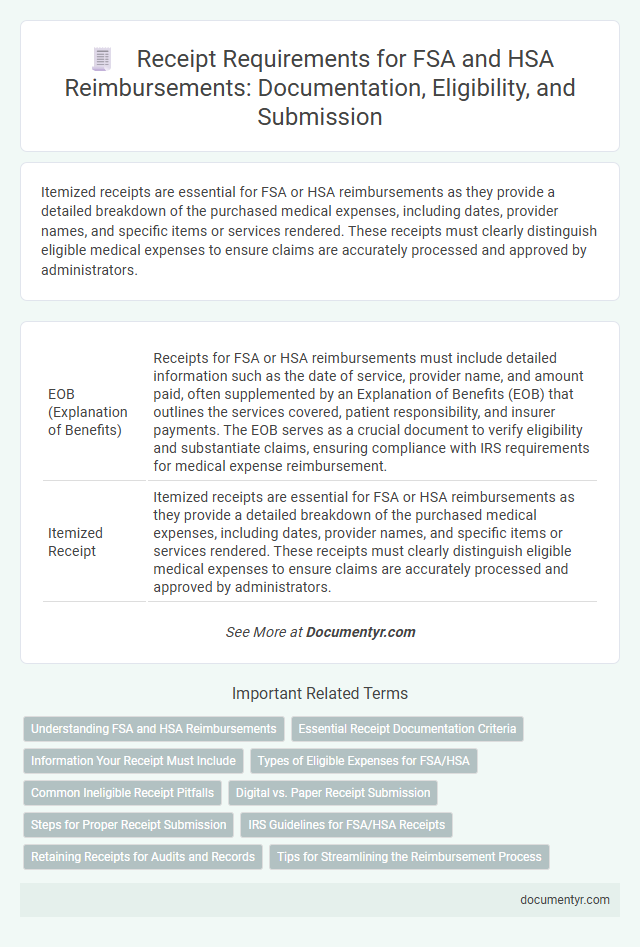

| 1 | EOB (Explanation of Benefits) | Receipts for FSA or HSA reimbursements must include detailed information such as the date of service, provider name, and amount paid, often supplemented by an Explanation of Benefits (EOB) that outlines the services covered, patient responsibility, and insurer payments. The EOB serves as a crucial document to verify eligibility and substantiate claims, ensuring compliance with IRS requirements for medical expense reimbursement. |

| 2 | Itemized Receipt | Itemized receipts are essential for FSA or HSA reimbursements as they provide a detailed breakdown of the purchased medical expenses, including dates, provider names, and specific items or services rendered. These receipts must clearly distinguish eligible medical expenses to ensure claims are accurately processed and approved by administrators. |

| 3 | Date-of-Service Timestamp | Receipts for FSA or HSA reimbursements must include a clear Date-of-Service timestamp to verify when the medical expense occurred, ensuring it matches the plan's coverage period. Accurate timestamps help prevent claim denials by confirming that the expense aligns with eligible service dates under IRS regulations. |

| 4 | Eligible Expense Documentation | Receipts for FSA or HSA reimbursements must clearly show the date, provider or merchant name, expense amount, and description of the eligible medical service or item purchased. Eligible expense documentation typically includes detailed invoices for prescription medications, doctor's visits, diagnostic tests, and other IRS-qualified medical expenses. |

| 5 | Provider NPI (National Provider Identifier) | Receipts submitted for FSA or HSA reimbursements must include the Provider NPI (National Provider Identifier) to verify the legitimacy of the medical service. This unique 10-digit identification number ensures compliance with IRS regulations and facilitates accurate processing of eligible healthcare expenses. |

| 6 | RX (Prescription) Receipt Validation | Receipt documents required for FSA or HSA reimbursements must include detailed RX information such as the prescription medication name, date of purchase, pharmacy name, and the amount paid. Valid RX receipts should clearly show proof of purchase and must be itemized to verify eligibility and facilitate accurate reimbursement processing. |

| 7 | Substantiation Request Letter | A Substantiation Request Letter for FSA or HSA reimbursements must include detailed receipt documents showing the date of service, provider or merchant name, description of the medical expense, and the amount paid. This letter verifies eligibility by confirming that the expense matches IRS-qualified medical expenses, ensuring compliance with FSA or HSA reimbursement policies. |

| 8 | IRS-Qualified Receipt | IRS-qualified receipts for FSA or HSA reimbursements must include the merchant's name, date of service or purchase, detailed description of the medical expense, and the amount paid to verify eligibility and comply with IRS regulations. These documents ensure accurate claims processing by validating that expenses are qualified medical costs under IRS guidelines. |

| 9 | Dependent Care Receipt | Dependent care receipts required for FSA or HSA reimbursements must include the provider's name, address, taxpayer identification number (TIN), dates of service, and the total amount paid. Detailed documentation ensures compliance with IRS regulations and substantiates eligibility for dependent care expense claims. |

| 10 | Telehealth Service Proof | Receipts needed for FSA or HSA reimbursements for telehealth services must include the provider's name, date of service, detailed description of the telehealth service, and the amount paid to confirm eligibility. A clear statement showing the service was delivered via telehealth or virtual consultation is essential for insurance and reimbursement compliance. |

Understanding FSA and HSA Reimbursements

Understanding FSA and HSA reimbursements requires proper documentation to ensure eligible medical expenses are covered. Receipt documents must clearly show the date, service description, and amount paid to qualify for reimbursement.

- Detailed Receipt - The receipt should include the provider's name, date of service, and a clear description of the medical service or product purchased.

- Proof of Payment - Documentation must verify that the expense was paid out of pocket or through an FSA/HSA account, such as a credit card statement or bank record.

- Eligible Expense Confirmation - Receipts need to demonstrate that the expense is approved under IRS rules for FSA or HSA withdrawals, such as prescription medications or doctor visits.

Essential Receipt Documentation Criteria

Accurate and detailed receipts are crucial for FSA or HSA reimbursements to ensure compliance with IRS regulations. Essential receipt documentation criteria focus on clarity, completeness, and legitimacy of the expense.

- Provider Information - Receipts must include the name and address of the healthcare provider or merchant.

- Date of Service - The receipt should clearly state the date when the medical service or purchase occurred.

- Description of Service or Product - A detailed description of the medical treatment, service, or item purchased is required to verify eligibility.

- Amount Paid - The exact amount charged for the service or product must be clearly listed on the receipt.

- Payment Method - Information regarding how the payment was made, such as credit card or cash, supports the validity of the claim.

Properly documented receipts reduce delays and ensure smooth reimbursement processing for FSA or HSA claims.

Information Your Receipt Must Include

Receipts for FSA or HSA reimbursements must clearly show the date of service, the provider's name, and a detailed description of the medical expense. The total amount paid and proof of payment are essential to verify the claim. Accurate documentation helps ensure quick approval of your healthcare reimbursement request.

Types of Eligible Expenses for FSA/HSA

Receipt documents are essential for verifying eligible expenses in Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) reimbursements. These receipts must clearly show the date, amount paid, and type of service or product purchased.

- Prescription Medications - Receipts must indicate the medication name, date of purchase, and amount to qualify for reimbursement.

- Medical Equipment and Supplies - Documentation should detail the item purchased, its medical purpose, and transaction date.

- Doctor Visits and Medical Procedures - Receipts need to list the healthcare provider, service date, and amount charged for eligibility.

Common Ineligible Receipt Pitfalls

Receipts for FSA or HSA reimbursements must clearly show the provider's name, date of service, description of the expense, and amount paid. Receipts missing these details often lead to claim denials or delays.

Common ineligible receipt pitfalls include generic or handwritten receipts that lack specific service descriptions or provider information. Receipts that do not specify the medical nature of the expense may be rejected. Keeping detailed and itemized receipts ensures smoother reimbursement processing and compliance with IRS regulations.

Digital vs. Paper Receipt Submission

Receipts for FSA or HSA reimbursements must clearly show the provider's name, date of service, description of the item or service, and the amount paid. Both digital and paper receipts are accepted as long as they contain all required information for verification.

Digital receipts can be submitted via online portals or mobile apps, offering convenience and quick access. Paper receipts require scanning or photocopying before submission, which may take more time but remain valid for reimbursement purposes.

Steps for Proper Receipt Submission

Receipt documents needed for FSA or HSA reimbursements include itemized proofs of purchase that clearly show the date, provider, and type of service or product. Steps for proper receipt submission involve verifying that the receipt details match the eligible expense, ensuring the document is legible and complete, and submitting it through the required platform or to the designated administrator. Keeping organized records and promptly sending receipts helps secure timely reimbursement for Your qualified medical expenses.

IRS Guidelines for FSA/HSA Receipts

Receipts for FSA or HSA reimbursements must include specific information to comply with IRS guidelines. These documents should clearly show the date of service, provider's name, description of the expense, and the amount paid.

You need to keep itemized receipts that detail eligible medical expenses for reimbursement purposes. Credit card statements or cancelled checks alone do not meet IRS requirements for FSA or HSA claims.

Retaining Receipts for Audits and Records

What receipt documents are needed for FSA or HSA reimbursements? Receipts must clearly show the date of service, the provider's name, a detailed description of the service or item, and the amount paid. Retaining these receipts is essential for audits and maintaining accurate financial records to ensure compliance with IRS regulations.

What Receipt Documents Are Needed for FSA or HSA Reimbursements? Infographic