To obtain HSA/FSA reimbursements, Receipt pet owners must provide detailed receipts showing the service date, provider information, and specific treatment or product purchased. The document should clearly outline the pet-related expense eligible under healthcare flexible spending accounts. Properly formatted receipts ensure smooth processing and faster reimbursement approval for owner's healthcare cost claims.

What Receipt Documents Are Necessary for HSA/FSA Reimbursements?

| Number | Name | Description |

|---|---|---|

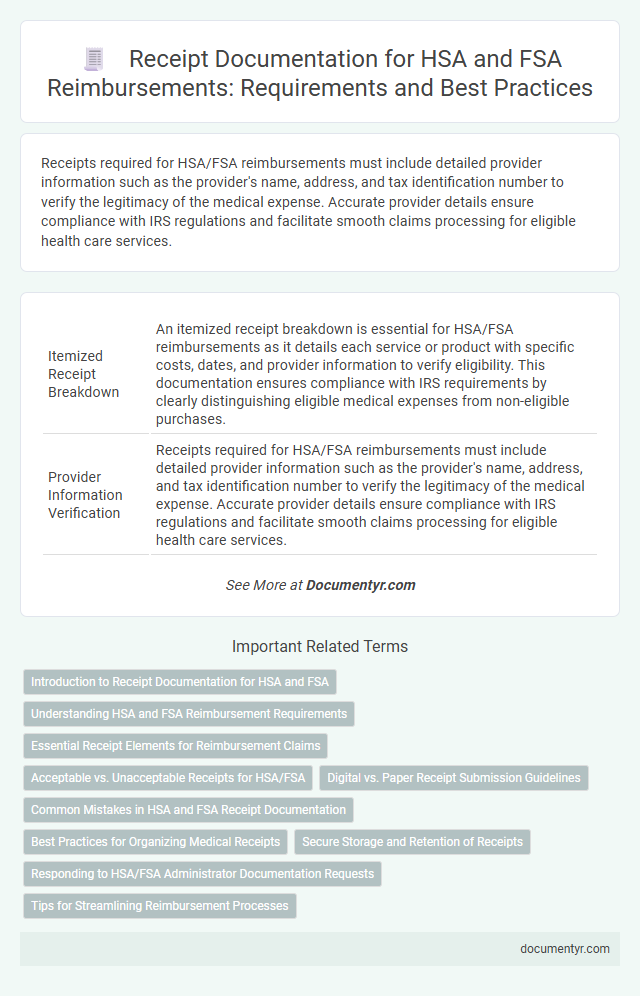

| 1 | Itemized Receipt Breakdown | An itemized receipt breakdown is essential for HSA/FSA reimbursements as it details each service or product with specific costs, dates, and provider information to verify eligibility. This documentation ensures compliance with IRS requirements by clearly distinguishing eligible medical expenses from non-eligible purchases. |

| 2 | Provider Information Verification | Receipts required for HSA/FSA reimbursements must include detailed provider information such as the provider's name, address, and tax identification number to verify the legitimacy of the medical expense. Accurate provider details ensure compliance with IRS regulations and facilitate smooth claims processing for eligible health care services. |

| 3 | Over-the-Counter (OTC) Eligibility Notation | Receipts for HSA/FSA reimbursements must include detailed information such as the date of purchase, vendor name, item description, and amount paid, with over-the-counter (OTC) items requiring a clear eligibility notation confirming they qualify as medical expenses. The OTC eligibility notation is critical for substantiating claims under IRS guidelines, ensuring medications and medical supplies meet qualified expense criteria without a prescription. |

| 4 | Prescription-Linked Receipt Tagging | Prescription-linked receipt tagging is essential for Health Savings Account (HSA) and Flexible Spending Account (FSA) reimbursements because it clearly identifies eligible medical expenses by associating receipts with specific prescriptions. Accurate tagging ensures that receipts include key details such as patient name, medication name, date of purchase, and provider information, complying with IRS requirements for reimbursement documentation. |

| 5 | Date-of-Service Audit Trail | Receipts for HSA/FSA reimbursements must include the date of service to serve as a clear audit trail demonstrating when the eligible expense was incurred. Accurate date-of-service documentation ensures compliance with IRS regulations and facilitates timely, precise reimbursement processing. |

| 6 | CPT/HCPCS Code Documentation | Receipt documents necessary for HSA/FSA reimbursements must include detailed CPT (Current Procedural Terminology) or HCPCS (Healthcare Common Procedure Coding System) codes to verify eligible medical expenses. These codes ensure accurate and compliant processing by clearly identifying the specific medical services or products received. |

| 7 | Patient Responsibility Statement | Patient Responsibility Statements are essential receipt documents for HSA/FSA reimbursements as they itemize the patient's out-of-pocket expenses, including co-pays, deductibles, and coinsurance. These statements provide the required proof of eligible medical expenses, ensuring compliance with IRS guidelines for health account reimbursements. |

| 8 | EOB (Explanation of Benefits) Attachment | Receipt documents necessary for HSA/FSA reimbursements include detailed EOB (Explanation of Benefits) attachments, which verify the services provided, dates of service, and amounts paid or owed. These EOB attachments ensure compliance with IRS guidelines by clearly outlining covered expenses and patient responsibilities for accurate reimbursement submissions. |

| 9 | HSA/FSA Compliant Digital Receipt | HSA/FSA compliant digital receipts must clearly include the provider's name, date of service, type of service or product, and the amount paid to ensure eligibility for reimbursements. These receipts are essential for validating expenses and maintaining compliance with IRS guidelines for Health Savings Accounts and Flexible Spending Accounts. |

| 10 | Denied-Claim Receipt Annotation | Receipts for HSA/FSA reimbursements must clearly itemize the date of service, provider name, description of services or products, and amount paid to avoid claim denials. Denied-claim receipt annotations often indicate missing or illegible details, requiring resubmission with complete documentation to ensure reimbursement. |

Introduction to Receipt Documentation for HSA and FSA

| Introduction to Receipt Documentation for HSA and FSA | |

|---|---|

| Receipt Documents | Necessary for Health Savings Account (HSA) and Flexible Spending Account (FSA) reimbursements |

| Purpose | Verify qualified medical expenses and comply with IRS requirements |

| Receipt Contents | Date of service, provider name, description of service or item, amount paid |

| Accepted Receipt Formats | Printed receipts, electronic receipts, Explanation of Benefits (EOB) statements |

| Importance | You must keep accurate receipt documentation to ensure smooth HSA/FSA reimbursement |

| Common Mistakes | Missing essential details such as provider information or item description, illegible receipts |

Understanding HSA and FSA Reimbursement Requirements

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA) reimbursements require specific receipt documents for verification. These receipts must clearly show the date of service, provider name, and the expense amount.

Eligible expenses include medical, dental, and vision services or products that meet IRS guidelines. Your receipt should also include a description of the service or item to ensure it qualifies for reimbursement.

Essential Receipt Elements for Reimbursement Claims

Receipts are crucial for substantiating HSA/FSA reimbursement claims. Ensuring your receipt includes specific information helps prevent claim denials.

- Provider Information - The receipt must clearly show the name and contact details of the healthcare provider or pharmacy.

- Date of Service - It is essential that the receipt displays the exact date when the medical service or purchase was made.

- Itemized Description - Each reimbursable service or product should be individually listed with corresponding costs.

Proper receipt documentation streamlines the reimbursement process and safeguards your HSA/FSA funds.

Acceptable vs. Unacceptable Receipts for HSA/FSA

For HSA/FSA reimbursements, receipts must clearly show the date of service, provider's name, and itemized description of eligible medical expenses. Acceptable receipts include detailed pharmacy printouts, physician invoices, and explanation of benefits (EOB) statements. Receipts lacking detailed service information, handwritten notes without official documentation, or proof of payment alone are generally unacceptable for reimbursement.

Digital vs. Paper Receipt Submission Guidelines

Receipt documents are essential for Health Savings Account (HSA) and Flexible Spending Account (FSA) reimbursements to verify eligible medical expenses. Understanding the guidelines for digital versus paper receipt submission ensures a smooth reimbursement process.

- Digital Receipt Submission - Digital receipts must be clear, legible, and include essential details such as date, provider, service, and amount.

- Paper Receipt Submission - Paper receipts require physical submission or scanning with all necessary information visible to validate your claim.

- Compliance Requirements - Both digital and paper receipts must meet IRS standards to qualify for reimbursement under HSA/FSA rules.

Common Mistakes in HSA and FSA Receipt Documentation

Receipt documents necessary for HSA/FSA reimbursements must clearly show the date of service, provider name, and itemized description of the medical expense. Common mistakes include submitting incomplete receipts, missing detailed service descriptions, or using credit card statements instead of official receipts. Ensuring these key details are present prevents claim denials and speeds up the reimbursement process.

Best Practices for Organizing Medical Receipts

Receipts are essential for HSA and FSA reimbursements to verify medical expenses and ensure compliance with IRS regulations. Organizing medical receipts efficiently streamlines the reimbursement process and prevents claim denials.

- Keep original receipts - Retain detailed, itemized receipts that clearly show the service date, provider, and amount paid.

- Sort by category - Group receipts by type of expense, such as prescriptions, doctor visits, or medical supplies, for easier reference.

- Use digital tools - Scan and store receipts electronically to reduce paper clutter and enable quick access when submitting reimbursement claims.

Secure Storage and Retention of Receipts

Receipt documents are essential for HSA and FSA reimbursements to verify eligible medical expenses and ensure compliance with IRS regulations. Accurate and detailed receipts must include the date of service, provider name, and description of the service or product.

Secure storage and retention of receipts protect your financial records and facilitate hassle-free reimbursements. Organize receipts digitally or physically in a dedicated folder to prevent loss or damage. Retain all relevant documents for at least three years, as the IRS may request proof during audits or reviews.

Responding to HSA/FSA Administrator Documentation Requests

Receipt documents are essential for processing HSA/FSA reimbursements and must clearly show the date, provider's name, service or item purchased, and the amount paid. These details help verify that expenses comply with IRS regulations for eligible medical costs.

Responding promptly to HSA/FSA administrator documentation requests ensures your reimbursement claims are approved without delay. Submitting itemized receipts that match the expense claimed is critical to avoid claim denials or audits.

What Receipt Documents Are Necessary for HSA/FSA Reimbursements? Infographic