Freelancers need to provide detailed receipt documents that clearly outline the services rendered, payment amounts, and transaction dates to establish credible income proof. Essential receipts should include the freelancer's name, client information, and a unique invoice number to ensure authenticity and traceability. Maintaining organized, professional receipts helps simplify tax reporting and supports financial transparency.

What Receipt Documents Does a Freelancer Need for Income Proof?

| Number | Name | Description |

|---|---|---|

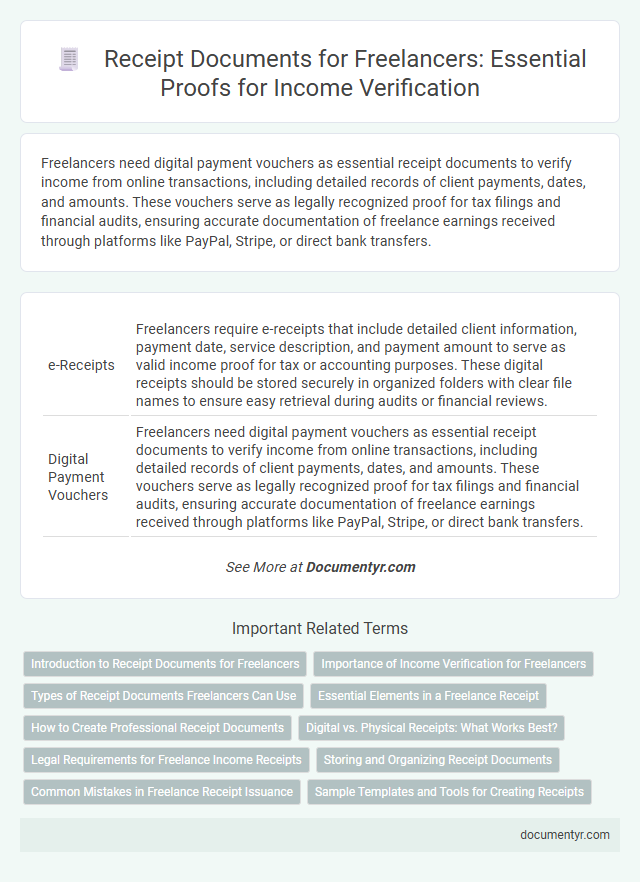

| 1 | e-Receipts | Freelancers require e-receipts that include detailed client information, payment date, service description, and payment amount to serve as valid income proof for tax or accounting purposes. These digital receipts should be stored securely in organized folders with clear file names to ensure easy retrieval during audits or financial reviews. |

| 2 | Digital Payment Vouchers | Freelancers need digital payment vouchers as essential receipt documents to verify income from online transactions, including detailed records of client payments, dates, and amounts. These vouchers serve as legally recognized proof for tax filings and financial audits, ensuring accurate documentation of freelance earnings received through platforms like PayPal, Stripe, or direct bank transfers. |

| 3 | e-Invoice PDFs | Freelancers require e-Invoice PDFs as essential receipt documents to provide verifiable proof of income, incorporating detailed transaction data, client information, and tax compliance elements. These digital invoices ensure accuracy, secure storage, and easy retrieval for accounting, tax filing, and financial auditing purposes. |

| 4 | Cloud-Based Income Statements | Freelancers require cloud-based income statements as essential receipt documents for accurate income proof, as these digital records provide real-time transaction summaries and are easily accessible for tax reporting and audits. Platforms such as QuickBooks, FreshBooks, and Wave offer secure, organized income reports that consolidate invoices, payments, and expenses, streamlining financial management and compliance. |

| 5 | Blockchain Transaction Logs | Freelancers can use blockchain transaction logs as verifiable receipt documents for income proof because these logs provide immutable, time-stamped evidence of payments received, ensuring transparency and authenticity. Utilizing blockchain technology enhances the credibility of financial records and simplifies auditing processes for freelancers. |

| 6 | Payment Gateway Receipts | Freelancers need payment gateway receipts as essential income proof, which include transaction IDs, payment amounts, dates, and payer details to verify earnings. These digital receipts provide traceable, secure records required for tax filings and financial audits. |

| 7 | Freelance Platform Earnings Reports | Freelancers require detailed earnings reports from freelance platforms as essential receipt documents to verify income, showing transaction dates, client details, and payment amounts. These reports serve as official proof for tax filings, loan applications, and financial audits by consolidating all platform-generated payments into a comprehensive statement. |

| 8 | Mobile Payment Confirmations | Freelancers must retain mobile payment confirmations, such as screenshots or digital receipts from platforms like PayPal, Venmo, and Square, as they serve as essential income proof for tax filing and client disputes. These documents should include transaction details like date, amount, payer information, and payment method to ensure accuracy and validity in financial records. |

| 9 | Peer-to-Peer Transfer Screenshots | Freelancers must retain peer-to-peer transfer screenshots as crucial receipt documents for income verification, showcasing transaction details such as sender identity, date, and amount received. These digital proofs provide clear evidence of payment, supporting accurate income reporting and tax compliance. |

| 10 | NFT Service Receipts | Freelancers providing NFT services need detailed receipt documents that include the buyer's information, transaction date, NFT description, and payment amount to accurately verify income. These receipts also serve as critical proof for tax reporting and financial audits, ensuring compliance with local regulations. |

Introduction to Receipt Documents for Freelancers

| Introduction to Receipt Documents for Freelancers | |

|---|---|

| Definition | Receipt documents are official records provided to confirm payment transactions between freelancers and clients. |

| Purpose | Receipts serve as proof of income, essential for tax reporting, financial management, and client accountability. |

| Types of Receipt Documents | Includes digital invoices, itemized receipts, payment confirmations, and service agreements with payment clauses. |

| Key Components | Freelancer name, client details, service description, payment amount, date of transaction, and payment method. |

| Legal Importance | Receipts are critical for tax audits, income verification, and establishing contractual transparency with clients. |

| Storage Recommendations | Maintain organized digital and physical copies for a minimum of 5 years in compliance with tax regulations. |

Importance of Income Verification for Freelancers

Freelancers must maintain accurate receipt documents to verify their income for tax and legal purposes. Essential receipts include payment confirmations, invoices issued to clients, and bank statements showing deposits. Proper income verification ensures financial credibility and smooth business operations for freelancers.

Types of Receipt Documents Freelancers Can Use

Freelancers require specific receipt documents to validate their income for tax and accounting purposes. Proper documentation helps maintain transparency and ease financial verification.

- Invoice Receipts - Detailed invoices issued to clients serve as proof of services rendered and corresponding payments received.

- Payment Confirmation Receipts - Digital or bank transaction receipts confirm the actual receipt of funds from clients.

- Contractual Agreements with Payment Terms - Contracts specifying payment schedules and amounts support income claims by outlining agreed compensation.

Essential Elements in a Freelance Receipt

Freelancers require specific receipt documents to validate their income effectively for tax and accounting purposes. These receipts serve as proof of payment received from clients and must contain essential elements to be considered legitimate.

A comprehensive freelance receipt should include the freelancer's name, contact information, and a unique receipt number for reference. It must also detail the services provided, payment date, amount received, and the client's information to ensure clarity and authenticity.

How to Create Professional Receipt Documents

Receipts are essential for freelancers to provide clear proof of income. Properly created receipt documents help maintain professional records and support tax filings.

- Invoice Receipt - This document details services rendered, payment amounts, and payment dates, serving as a straightforward proof of income.

- Official Receipt Template - Use a standardized template including your name, contact, client information, service description, and payment method to ensure clarity.

- Digital Receipts - Creating and sending digital receipts via email or specialized software adds professionalism and easy record-keeping to your workflow.

Digital vs. Physical Receipts: What Works Best?

What types of receipt documents does a freelancer need for income proof? Freelancers require clear and accurate records of payments received to validate their income. These documents often include invoices, payment confirmations, and receipts from clients.

Do digital receipts work better than physical receipts for freelancers? Digital receipts offer easier organization, faster access, and enhanced security through cloud storage compared to physical receipts. Many tax authorities accept digital proof of income, making digital receipts a practical and reliable option.

How should freelancers manage digital and physical receipts for income proof? Freelancers should maintain both digital backups and physical copies when possible to ensure comprehensive record-keeping. Using accounting software or apps can automate digital receipt management and facilitate tax reporting.

Legal Requirements for Freelance Income Receipts

Freelancers must provide income receipts that comply with local tax laws and legal standards. These receipts serve as proof of earnings and must include specific details such as the freelancer's name, business registration number, date, description of services, and payment amount.

Legal requirements often mandate that income receipts be clear, accurate, and issued promptly after payment. Keeping properly formatted receipts helps you maintain transparent records for tax reporting and financial auditing purposes.

Storing and Organizing Receipt Documents

Freelancers need to collect and maintain receipt documents such as invoice copies, payment confirmations, and expense receipts for accurate income proof. Proper handling of these documents ensures compliance with tax authorities and simplifies financial tracking.

Storing receipt documents digitally in organized folders labeled by date or project enhances accessibility and prevents loss. Using cloud storage solutions offers secure backup and easy sharing during audits. Keeping physical copies in a dedicated filing system helps maintain order and quick retrieval when needed.

Common Mistakes in Freelance Receipt Issuance

Freelancers need clear and detailed receipts to prove their income, including client information, service description, date, and payment amount. Common mistakes in freelance receipt issuance include missing essential details, inaccurate dates, and lack of official formatting or signatures. Ensuring proper receipt documentation helps freelancers maintain transparent records for tax purposes and client verification.

What Receipt Documents Does a Freelancer Need for Income Proof? Infographic