Receipts for travel expense audits should include transportation tickets such as plane, train, or bus fares, hotel invoices showing dates and room charges, and itemized meal receipts detailing food and beverage costs. Expense reports must also capture car rental agreements and fuel receipts to verify mileage claims. Collecting these documents ensures compliance with company policies and facilitates accurate reimbursement processing.

What Receipts Should Be Collected for Travel Expense Audits?

| Number | Name | Description |

|---|---|---|

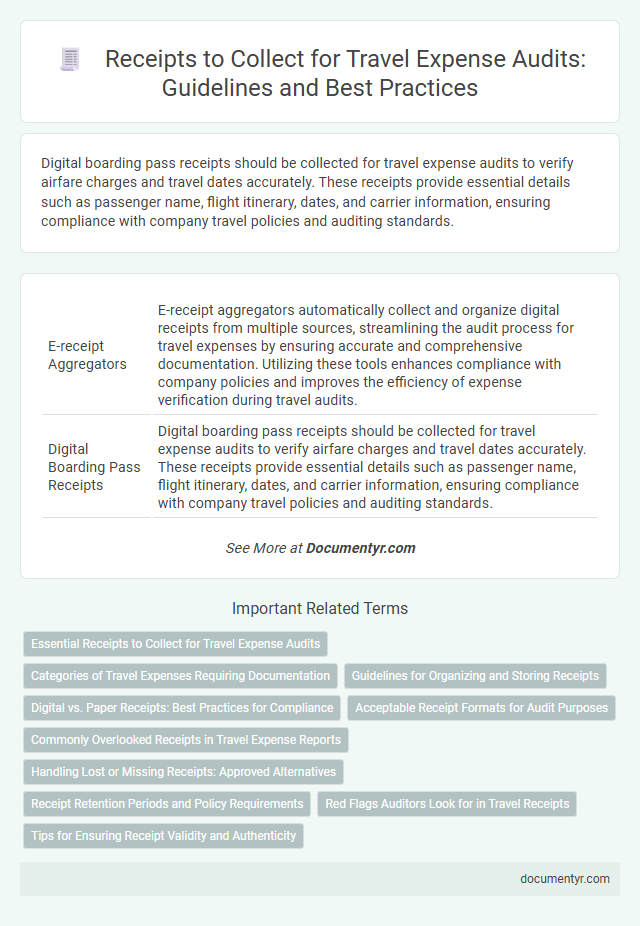

| 1 | E-receipt Aggregators | E-receipt aggregators automatically collect and organize digital receipts from multiple sources, streamlining the audit process for travel expenses by ensuring accurate and comprehensive documentation. Utilizing these tools enhances compliance with company policies and improves the efficiency of expense verification during travel audits. |

| 2 | Digital Boarding Pass Receipts | Digital boarding pass receipts should be collected for travel expense audits to verify airfare charges and travel dates accurately. These receipts provide essential details such as passenger name, flight itinerary, dates, and carrier information, ensuring compliance with company travel policies and auditing standards. |

| 3 | Virtual Card Transaction Proofs | Receipts for travel expense audits must include virtual card transaction proofs that clearly detail the date, merchant name, amount, and itemized purchases to ensure compliance and accurate verification. Digital receipts and transaction logs from the virtual card provider serve as critical documentation to validate expenses and support audit trails. |

| 4 | Ride-share Micro-receipts | Ride-share micro-receipts should include detailed information such as the date, time, pickup and drop-off locations, fare amount, and payment method to ensure accurate verification in travel expense audits. Collecting itemized digital receipts from ride-share apps is crucial for substantiating expense claims and maintaining compliance with corporate travel policies. |

| 5 | Contactless Payment Logs | Contactless payment logs serve as essential receipts for travel expense audits, capturing transaction details such as vendor information, date, time, and amount without needing physical paper copies. These digital records streamline verification processes by providing accurate, tamper-proof evidence of expenses, enhancing audit efficiency and compliance. |

| 6 | App-based Meal Splits | Receipts for travel expense audits should include detailed app-based meal split records showing individual meal costs, tax, and tip broken down per participant to ensure accurate reimbursement and compliance. Digital receipts from meal-splitting apps provide clear itemization and timestamps, essential for verifying expense legitimacy and preventing duplicate claims. |

| 7 | Currency Exchange Fee Slips | Currency exchange fee slips must be collected as part of travel expense audits to verify the exact costs incurred during currency conversion. These receipts provide critical evidence of transaction dates, exchange rates, and fee amounts, ensuring accurate reimbursement and compliance with company travel policies. |

| 8 | CO2 Emissions Offset Receipts | Receipts for CO2 emissions offset purchases should be collected to verify compliance with corporate sustainability policies during travel expense audits, ensuring that travelers have legitimately offset their carbon footprint. These receipts must clearly detail the amount of CO2 offset, provider information, and the transaction date to support accurate environmental impact reporting. |

| 9 | Subscription-based Wifi Receipts | Receipts for subscription-based WiFi services used during travel must clearly display the service provider, subscription dates, and payment amount to validate expense claims. Ensuring these receipts detail the connection period aligns with travel dates supports accurate and audit-compliant expense reporting. |

| 10 | Automated Mileage Tracker Exports | Receipts collected for travel expense audits should include automated mileage tracker exports detailing trip dates, distances traveled, and GPS routes to ensure accurate validation of mileage claims. These digital records complement traditional paper receipts by providing precise, tamper-proof evidence required for comprehensive audit compliance. |

Essential Receipts to Collect for Travel Expense Audits

Essential receipts for travel expense audits include transportation tickets, such as airline boarding passes and train tickets, to verify travel dates and costs. Hotel invoices are necessary to confirm accommodation expenses and ensure compliance with company policies. Meal receipts and related expenses must also be collected to validate daily allowances and spending limits during your trip.

Categories of Travel Expenses Requiring Documentation

Receipts must be collected for all travel expenses to ensure accurate auditing and compliance with company policies. Proper documentation helps verify the legitimacy and purpose of each expenditure.

Categories of travel expenses requiring receipts include transportation costs such as airfare, taxi fares, and car rentals. Lodging expenses, meal purchases, and conference or registration fees also demand thorough documentation.

Guidelines for Organizing and Storing Receipts

What receipts should be collected for travel expense audits? Receipts for transportation, lodging, meals, and incidental expenses must be retained. Ensure all receipts clearly display dates, amounts, and vendor details.

How should receipts be organized for travel expense audits? Group receipts by date and category to streamline the auditing process. Label and timestamp digital or physical copies consistently to maintain order.

Where should receipts be stored to facilitate a smooth audit? Store receipts in a secure, accessible location such as a dedicated folder or expense management software. Regular backups and encryption protect receipts from loss or unauthorized access.

Digital vs. Paper Receipts: Best Practices for Compliance

Receipts are essential for verifying travel expenses during audits, with both digital and paper formats accepted by most organizations. Digital receipts offer ease of storage and quick access, while paper receipts remain valid proof of purchase, especially for merchants not providing electronic records.

For compliance, it is crucial to ensure digital receipts are clear, complete, and stored securely in approved systems. Paper receipts should be scanned promptly to create digital copies, minimizing the risk of loss or damage during travel expense audits.

Acceptable Receipt Formats for Audit Purposes

Receipts play a crucial role in verifying travel expenses during audits. Collecting the correct types and formats of receipts ensures compliance and smooth processing.

- Paper Receipts - Physical copies printed at the point of sale, containing detailed transaction information, are widely accepted.

- Digital Receipts - Electronic receipts sent via email or mobile apps must clearly show the vendor details, date, and amount to be valid.

- Credit Card Statements - Supplementary documents that support travel expenses need to align with corresponding receipts for audit purposes.

You must retain receipts in their original format or a high-quality scanned copy to meet audit requirements.

Commonly Overlooked Receipts in Travel Expense Reports

Receipts are critical for verifying travel expenses during audits. Accurate documentation ensures compliance with company policies and prevents reimbursement disputes.

Commonly overlooked receipts include taxi and rideshare fares, parking fees, and meal expenses. Employees often forget to collect receipts for incidental costs like tips and in-flight purchases. Keeping a detailed record of these minor expenses strengthens the audit trail and supports comprehensive expense reporting.

Handling Lost or Missing Receipts: Approved Alternatives

| Receipt Type | Description | Approved Alternatives for Lost or Missing Receipts |

|---|---|---|

| Transportation | Receipts for flights, taxis, ride-shares, rental cars, and parking fees | Credit card statements showing the transaction, e-ticket confirmations, or official fare summaries |

| Accommodation | Hotel invoices and booking confirmations | Credit card statements reflecting payment, email confirmation from the booking platform, or hotel folios |

| Meals | Receipts for food and beverage purchases during travel | Itemized credit card statements, bank statements, or a detailed personal expense log with dates and amounts |

| Miscellaneous Expenses | Receipts for conference fees, supplies, or other travel-related costs | Invoice copies, payment confirmation emails, or documented approval of expenses from a supervisor |

If a receipt is lost or missing, you must provide one of these approved alternatives to ensure your travel expenses are fully auditable and compliant with company policy.

Receipt Retention Periods and Policy Requirements

Proper collection and retention of receipts are critical for accurate travel expense audits. Compliance with receipt retention periods and organizational policies ensures transparency and accountability.

- Receipt Retention Periods - Receipts must be retained for a minimum of 7 years to comply with IRS guidelines and corporate audit requirements.

- Policy Requirements - Organizations typically require original receipts for all travel-related expenses over a specified amount, often $25 or more.

- Types of Receipts - Receipts should include transportation, lodging, meals, and incidentals with clear dates, vendor details, and itemized charges.

Red Flags Auditors Look for in Travel Receipts

Travel expense audits require collecting receipts that clearly show the date, merchant name, and itemized charges to verify the authenticity of expenses. Auditors look for red flags such as altered dates, missing itemized details, or receipts that appear to be duplicated. Receipts without a clear business purpose or those that lack signatures often trigger further scrutiny during the audit process.

What Receipts Should Be Collected for Travel Expense Audits? Infographic