Employees must submit original travel reimbursement receipts that include detailed information such as the date, vendor name, amount paid, and a clear description of the expense. Supporting documents like boarding passes, hotel invoices, and mileage logs should accompany the receipts to verify travel-related costs accurately. Submission of these comprehensive documents ensures timely and accurate processing of travel reimbursement claims.

What Documents Does an Employee Need to Submit for Travel Reimbursement Receipts?

| Number | Name | Description |

|---|---|---|

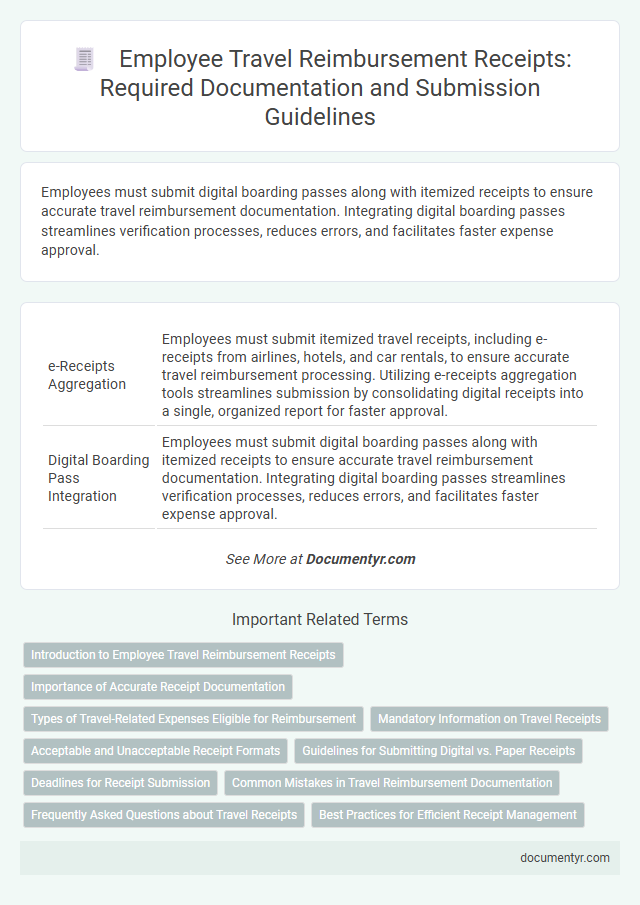

| 1 | e-Receipts Aggregation | Employees must submit itemized travel receipts, including e-receipts from airlines, hotels, and car rentals, to ensure accurate travel reimbursement processing. Utilizing e-receipts aggregation tools streamlines submission by consolidating digital receipts into a single, organized report for faster approval. |

| 2 | Digital Boarding Pass Integration | Employees must submit digital boarding passes along with itemized receipts to ensure accurate travel reimbursement documentation. Integrating digital boarding passes streamlines verification processes, reduces errors, and facilitates faster expense approval. |

| 3 | Expense Verification Code | Employees must submit original travel reimbursement receipts along with an Expense Verification Code to authenticate each expense claim accurately. The Expense Verification Code ensures that submitted receipts correspond to approved travel costs, streamlining the approval process and preventing fraudulent claims. |

| 4 | Automated Receipt Parsing | Automated receipt parsing requires employees to submit clear, itemized travel receipts in digital formats such as PDF or JPEG to ensure accurate extraction of essential details like date, merchant, and amount. This technology streamlines travel reimbursement by reducing manual entry errors and accelerating approval workflows through seamless integration with expense management systems. |

| 5 | Geo-tagged Travel Receipts | Employees must submit geo-tagged travel receipts that include location data and timestamps to verify trip authenticity and comply with company reimbursement policies. These receipts ensure accurate expense tracking by providing precise geographic proof of travel-related expenditures. |

| 6 | Blockchain Expense Documentation | Employees must submit detailed travel receipts verified through blockchain expense documentation to ensure authenticity and prevent tampering. Blockchain technology provides immutable records of expenditures, streamlining the reimbursement process and enhancing transparency for travel expense claims. |

| 7 | Dynamic QR Code Reimbursement | Employees must submit travel reimbursement receipts embedded with dynamic QR codes that verify transaction details and authenticity instantly. These QR codes streamline the approval process by linking directly to validated payment records within the company's financial system. |

| 8 | Mobile Capture Compliance | Employees must submit original travel reimbursement receipts that are clearly legible and include detailed information such as date, vendor, and amount; mobile capture submissions must comply with company policies ensuring captured images are high-resolution, unaltered, and timestamped for audit purposes. Compliance with mobile capture guidelines accelerates processing while maintaining document authenticity and adherence to expense verification standards. |

| 9 | AI-Powered Receipt Matching | Employees must submit itemized receipts that clearly detail travel expenses such as airfare, lodging, meals, and transportation for travel reimbursement. AI-powered receipt matching technology automatically verifies submitted receipts against travel itineraries and company policies, streamlining approval and ensuring accurate expense tracking. |

| 10 | Real-Time Document Validation | Employees must submit original, clearly legible receipts that include detailed transaction information such as date, vendor name, and amount for travel reimbursement. Real-time document validation systems verify receipt authenticity instantly, ensuring compliance and speeding up the reimbursement process. |

Introduction to Employee Travel Reimbursement Receipts

Employee travel reimbursement receipts are essential documents that verify expenses incurred during official business trips. These receipts serve as proof for companies to process and approve travel-related reimbursements accurately.

Submitting accurate and organized receipts is crucial for compliance with company policies and tax regulations. Employees must understand which documents are required to ensure a smooth reimbursement process.

Importance of Accurate Receipt Documentation

Accurate receipt documentation is crucial for travel reimbursement to ensure expenses are verified and approved promptly. You must submit original receipts that clearly show the date, vendor, and amount spent. Proper documentation helps avoid delays and supports compliance with company policies.

Types of Travel-Related Expenses Eligible for Reimbursement

| Type of Travel-Related Expense | Description | Required Documentation |

|---|---|---|

| Transportation | Costs for airfare, train tickets, rental cars, taxis, ride-shares, or mileage reimbursement for personal vehicle use during business travel. | Original boarding passes, train tickets, rental car agreements, taxi or ride-share receipts, mileage logs. |

| Lodging | Expenses for hotel stays or other accommodations during business trips. | Hotel invoices or receipts showing dates, guest name, and amount paid. |

| Meals | Meals consumed during business travel within company policy guidelines. | Receipts itemizing food and beverage purchases; credit card statements may be required if receipts are unavailable. |

| Conference and Registration Fees | Costs related to attending professional conferences, seminars, or training sessions. | Payment confirmations, registration receipts, or invoices. |

| Communication Expenses | Business-related phone calls, internet access fees, or fax charges incurred while traveling. | Receipts or itemized phone/internet bills indicating dates and charges. |

| Miscellaneous Expenses | Other work-related costs such as parking fees, tolls, or tips within company reimbursement policies. | Receipts or tickets showing date, amount, and description. |

Mandatory Information on Travel Receipts

Travel reimbursement receipts must include specific mandatory information to ensure proper processing. These details verify the authenticity and purpose of your expenses during the trip.

Mandatory information on travel receipts includes the date of the transaction, the vendor's name, and the total amount paid. Receipts should clearly describe the purchased goods or services related to travel. Without these key details, reimbursement requests may be delayed or denied.

Acceptable and Unacceptable Receipt Formats

What documents does an employee need to submit for travel reimbursement receipts? Employees must provide original, itemized receipts that clearly show the date, vendor, and amount paid. Photocopies, handwritten notes, or credit card statements without detailed purchase information are not accepted for reimbursement.

Guidelines for Submitting Digital vs. Paper Receipts

Employees must submit clear and accurate receipts to qualify for travel reimbursement. Different guidelines apply when submitting digital receipts compared to paper receipts to ensure proper processing.

- Digital Receipts Acceptance - Digital receipts must be legible, emailed, or uploaded through the designated company portal for verification.

- Paper Receipts Requirements - Paper receipts should be original, unaltered, and physically attached to the reimbursement form or scanned clearly.

- Documentation Completeness - All receipts must include date, vendor name, and amount paid to comply with company reimbursement policies.

Employees should verify the submission format aligns with their company's specific travel reimbursement procedures.

Deadlines for Receipt Submission

Employees must submit all travel reimbursement receipts within 30 days of completing their trip to ensure timely processing. Receipts should include proof of transportation, lodging, meals, and any other eligible expenses.

Failure to meet the submission deadline may result in delayed reimbursement or denial of claims. Employers often provide a clear timeline and submission instructions to help employees comply with these requirements.

Common Mistakes in Travel Reimbursement Documentation

Submitting the correct documents for travel reimbursement receipts is essential to ensure timely approval. Common mistakes in travel reimbursement documentation can delay or deny your reimbursement claim.

- Missing Original Receipts - Employers often require original, itemized receipts rather than photocopies or digital screenshots.

- Incomplete Expense Details - Receipts lacking date, vendor name, or amount lead to rejection of reimbursement claims.

- Incorrect or Unsupported Expenses - Submitting receipts for non-eligible expenses that do not comply with company travel policies causes claim denial.

Frequently Asked Questions about Travel Receipts

Employees must submit original travel reimbursement receipts to verify expenses such as transportation, lodging, and meals. Digital copies or scanned receipts are usually accepted if they are clear and legible. Your submission should include itemized details to ensure accurate reimbursement processing.

What Documents Does an Employee Need to Submit for Travel Reimbursement Receipts? Infographic