Receipts required for charitable donation deductions must include the donor's name, the charity's name, the date of the donation, and a detailed description of the donated items or amount. For cash donations, a bank record or written communication from the charity is necessary to substantiate the contribution. Non-cash donations exceeding a certain value often require a qualified appraisal or a detailed receipt from the organization to support tax deduction claims.

What Receipt Documents Are Needed for Charitable Donation Deductions?

| Number | Name | Description |

|---|---|---|

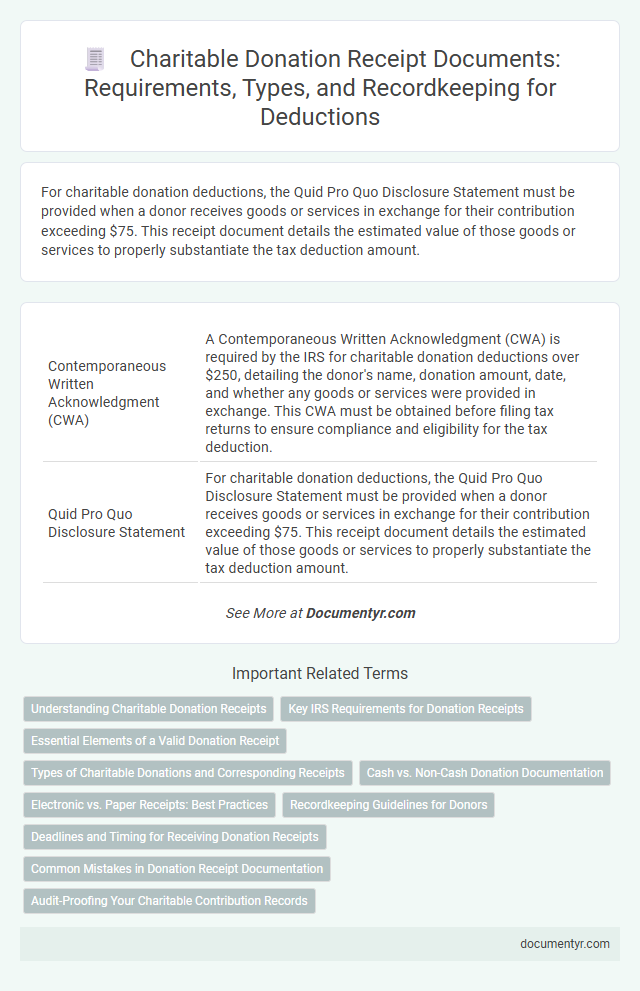

| 1 | Contemporaneous Written Acknowledgment (CWA) | A Contemporaneous Written Acknowledgment (CWA) is required by the IRS for charitable donation deductions over $250, detailing the donor's name, donation amount, date, and whether any goods or services were provided in exchange. This CWA must be obtained before filing tax returns to ensure compliance and eligibility for the tax deduction. |

| 2 | Quid Pro Quo Disclosure Statement | For charitable donation deductions, the Quid Pro Quo Disclosure Statement must be provided when a donor receives goods or services in exchange for their contribution exceeding $75. This receipt document details the estimated value of those goods or services to properly substantiate the tax deduction amount. |

| 3 | Donor-Advised Fund Contribution Receipt | A donor-advised fund contribution receipt must include the fund's name, contribution date, and a description or fair market value of the donated assets to qualify for charitable donation deductions. This receipt serves as official documentation required by the IRS to substantiate the deduction on the donor's tax return. |

| 4 | Fair Market Value (FMV) Assignment Certificate | A Fair Market Value (FMV) Assignment Certificate is essential for accurately documenting the value of donated items when claiming charitable donation deductions, ensuring compliance with IRS regulations. This certificate must include a detailed description of the donated property, its condition, and the methodology used to determine its FMV to support the deduction amount. |

| 5 | Noncash Contribution Statement Forms | Noncash charitable donations require a completed IRS Form 8283 Noncash Charitable Contributions, especially for items valued over $500, to substantiate deduction claims. Donors must obtain a written acknowledgment from the charity detailing the description, date of contribution, and whether any goods or services were received in return for proper tax documentation. |

| 6 | Qualified Appraisal Summary Attachment | The Qualified Appraisal Summary Attachment must include a detailed description of the donated property, its condition, and the methods used to determine its fair market value, serving as essential documentation for claiming charitable donation deductions. This attachment supports the IRS requirements by providing sufficient evidence of the item's appraisal, ensuring compliance and maximizing eligible tax deductions. |

| 7 | Donor Transaction Tracking Number (DTTN) | A Donor Transaction Tracking Number (DTTN) is essential for accurately documenting charitable donation receipts, ensuring compliance with IRS requirements for tax deduction claims. This unique identifier enables donors and organizations to efficiently track and verify each transaction, supporting transparent record-keeping and audit readiness. |

| 8 | Electronic Receipt with IRS-Compliant Metadata | Electronic receipts for charitable donation deductions must include IRS-compliant metadata such as the donor's name, date of donation, donation amount, and the charity's tax-exempt status. Ensuring these details are embedded in the digital receipt format is essential for validating deductions during tax filing and audits. |

| 9 | Split Interest Trust Gift Receipt | Split Interest Trust Gift Receipts must include detailed information such as the donor's name, trust identification, date of the gift, description and value of the donated property, and the percentage of trust income interest retained by the donor or beneficiaries. These receipts are essential for substantiating charitable donation deductions and ensuring compliance with IRS rules for split interest trusts. |

| 10 | Digital Verification Code for E-Filed Deductions | Receipt documents for charitable donation deductions must include a Digital Verification Code (DVC) when the donation is e-filed, ensuring the IRS can authenticate the transaction efficiently. The DVC, typically provided by the charity, links the electronic record to the official receipt, facilitating seamless tax deduction claims. |

Understanding Charitable Donation Receipts

| Receipt Document | Description | Importance for Tax Deductions |

|---|---|---|

| Official Donation Receipt | Issued by the charity, includes donor name, organization details, date, and amount donated. | Essential for substantiating deductions on tax returns and verifying donation authenticity. |

| Itemized Contribution Receipt | Lists donated goods or property with descriptions and estimated fair market value. | Required when claiming deductions for non-cash contributions, ensuring accurate valuation. |

| Bank or Credit Card Statement | Proof of payment showing transaction to a qualified charitable organization. | Supports receipt documentation, especially for donations under specific thresholds. |

| Acknowledgment Letter from Charity | Confirms receipt of your donation and indicates any goods or services received in return. | Needed to establish the deductible amount when benefits are involved, as deductions reduce by fair market value of benefits. |

| Online Donation Confirmation | Email or digital receipt confirming amount, date, and charity name for electronic donations. | Valid proof for electronic donations and necessary for electronic filing deductions. |

Key IRS Requirements for Donation Receipts

Receipt documents are essential for claiming charitable donation deductions on your tax return. The IRS requires specific information on donation receipts to verify eligibility.

- Receipt must include the organization's name - The official name of the qualified charity must be clearly stated on the receipt.

- Donation amount and date - The receipt should specify the exact cash contribution and the date of the donation.

- Statement of goods or services provided - If any goods or services were received in exchange for the donation, the receipt must describe them or state that none were given.

Essential Elements of a Valid Donation Receipt

What receipt documents are needed for charitable donation deductions? A valid donation receipt must include specific essential elements to qualify for tax deductions. Your receipt should clearly specify the donor's name, the charity's name, the donation date, and the amount contributed.

Types of Charitable Donations and Corresponding Receipts

Charitable donation deductions require specific receipt documents to validate the contributions made. Different types of donations call for different forms of receipts to ensure compliance with tax regulations.

Monetary donations generally need a written acknowledgment from the charity, including the donor's name, donation amount, and date. Non-cash contributions such as clothing, household items, or vehicles often require a detailed receipt describing the items donated and their condition.

Cash vs. Non-Cash Donation Documentation

Receipts for charitable donation deductions vary depending on whether the donation is cash or non-cash. Proper documentation is essential to ensure compliance with IRS regulations and to claim accurate tax deductions.

For cash donations, a written acknowledgment from the charity is required for contributions of $250 or more. This receipt must include the amount donated, the date of the contribution, and a statement confirming whether any goods or services were provided in exchange. Non-cash donations need a detailed receipt describing the items, their condition, and the estimated fair market value.

Electronic vs. Paper Receipts: Best Practices

Receipts for charitable donation deductions must include the donor's name, the donation amount, the date of the contribution, and the charity's name. Electronic receipts are legally acceptable when they contain the same information as paper receipts and are stored securely to prevent alteration. You should keep electronic receipts organized in a digital folder or use donation tracking apps to ensure easy access during tax filing.

Recordkeeping Guidelines for Donors

Proper documentation is essential for claiming charitable donation deductions on tax returns. Donors must maintain specific receipt documents to comply with IRS recordkeeping guidelines.

- Written Acknowledgment from Charity - Required for donations over $250, this receipt must detail the contribution amount and affirm whether any goods or services were provided in exchange.

- Bank Records or Credit Card Statements - These serve as supplementary proof for cash donations less than $250, showing the payment date and amount.

- Receipts for Non-Cash Donations - Donors must keep detailed receipts or appraisals for property donations to substantiate the fair market value claimed.

Deadlines and Timing for Receiving Donation Receipts

Receipt documents for charitable donation deductions must include the organization's name, the donation date, and the amount given. These details are essential to verify your contribution for tax purposes.

Receipts should be obtained promptly, ideally at the time of donation, to meet IRS deadlines. For contributions over $250, the receipt must be received by the tax filing date to qualify for deductions.

Common Mistakes in Donation Receipt Documentation

Receipt documents are essential for claiming charitable donation deductions accurately on your tax returns. Understanding common mistakes in donation receipt documentation helps ensure your contributions are properly recognized by tax authorities.

- Missing Donor Information - Receipts lacking the donor's name and address may lead to deduction disallowance.

- Unclear Donation Description - Incomplete or vague descriptions of donated items or amounts can cause issues during audits.

- No Acknowledgement of Received Gifts - Receipts must confirm the charity received the donation; failure to provide this reduces claim validity.

Properly documented receipts protect your deduction claims and simplify tax filing.

What Receipt Documents Are Needed for Charitable Donation Deductions? Infographic