Receipt documents necessary for tax deduction claims include official purchase invoices, payment confirmations, and detailed bills specifying the transaction amount and date. These receipts must clearly identify the vendor, description of goods or services, and the payer's information to ensure compliance with tax authorities. Maintaining organized and legitimate receipts helps substantiate deductions during audits and improves the accuracy of tax filings.

What Receipt Documents are Necessary for Tax Deduction Claims?

| Number | Name | Description |

|---|---|---|

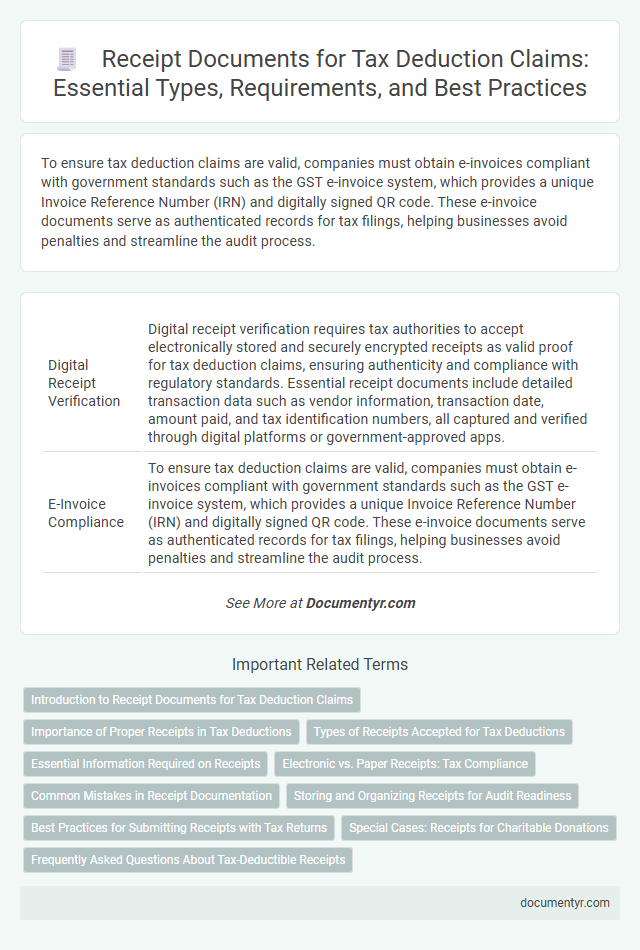

| 1 | Digital Receipt Verification | Digital receipt verification requires tax authorities to accept electronically stored and securely encrypted receipts as valid proof for tax deduction claims, ensuring authenticity and compliance with regulatory standards. Essential receipt documents include detailed transaction data such as vendor information, transaction date, amount paid, and tax identification numbers, all captured and verified through digital platforms or government-approved apps. |

| 2 | E-Invoice Compliance | To ensure tax deduction claims are valid, companies must obtain e-invoices compliant with government standards such as the GST e-invoice system, which provides a unique Invoice Reference Number (IRN) and digitally signed QR code. These e-invoice documents serve as authenticated records for tax filings, helping businesses avoid penalties and streamline the audit process. |

| 3 | Crypto Transaction Receipts | Crypto transaction receipts are essential for tax deduction claims as they provide proof of purchase, sale, or exchange, including details such as transaction date, amount, cryptocurrency type, and wallet addresses. Accurate records of these receipts ensure compliance with tax regulations and help substantiate cost basis, capital gains, and losses during tax filing. |

| 4 | Eco-Friendly Purchase Proofs | Receipts for eco-friendly purchases such as energy-efficient appliances, solar panel installations, and electric vehicle acquisitions must include detailed information like purchase date, item description, vendor details, and payment proof to qualify for tax deduction claims. Documentation verifying the environmental benefits or certifications of the products enhances the validity of these receipts for government or tax authority requirements. |

| 5 | Automated Expense Matching | Automated expense matching requires receipt documents with clear vendor details, transaction dates, itemized purchases, and payment amounts to ensure accuracy in tax deduction claims. Digital formats compatible with accounting software enhance verification efficiency and compliance with tax regulations. |

| 6 | Blockchain-Auth Receipts | Blockchain-authenticated receipts provide an immutable and verifiable record essential for tax deduction claims, ensuring compliance with tax authorities by securely documenting transaction details. These digital receipts reduce the risk of fraud and simplify audit processes, streamlining the validation of expenses for accurate tax reporting. |

| 7 | Vendor-Issued QR Receipts | Vendor-issued QR receipts are essential documents for tax deduction claims as they provide digitally verified transaction details, including vendor identification, transaction date, amount, and QR code verification. These receipts comply with tax authorities' requirements by ensuring authenticity, minimizing fraud risks, and facilitating streamlined expense tracking for claimants. |

| 8 | Split Payment Documentation | Split payment documentation for tax deduction claims must include detailed receipts showing the division of payment between buyer and supplier, clearly indicating the amounts withheld and remitted to tax authorities. Essential documents also comprise official invoices and confirmation of tax remittance to ensure compliance with tax regulations. |

| 9 | Subscription Service Receipts | Subscription service receipts must clearly itemize the service provider's name, subscription period, payment amount, and payment date to qualify for tax deduction claims. Receipts should also include proof of payment methods such as credit card statements or bank transfers to ensure compliance with tax authority requirements. |

| 10 | Cross-Border E-Receipts | Cross-border e-receipts for tax deduction claims must include detailed information such as vendor identification, transaction date, itemized purchase details, and currency conversion rates compliant with local tax regulations. Properly structured e-receipts stored in secure digital formats support audit trails and fulfill tax authority requirements for cross-border transactions. |

Introduction to Receipt Documents for Tax Deduction Claims

Receipt documents serve as proof of your expenses and are essential for claiming tax deductions. These documents typically include itemized bills, payment proofs, and official invoices. Properly organized receipts ensure accurate tax reporting and help validate your deduction claims.

Importance of Proper Receipts in Tax Deductions

Proper receipts serve as critical evidence when claiming tax deductions, ensuring all expenses are accurately documented. Receipts must include essential details such as the vendor's name, date of purchase, amount paid, and description of goods or services. You should retain these receipts to support your deduction claims and avoid potential issues during tax audits.

Types of Receipts Accepted for Tax Deductions

Receipts are essential documents that serve as proof of your expenses when claiming tax deductions. Understanding the types of receipts accepted by tax authorities helps ensure your claims are valid and processed smoothly.

- Official Receipts - Issued by registered businesses, these receipts include detailed information such as vendor details, date, amount, and description of goods or services purchased.

- Electronic Receipts - Digital copies or emailed receipts are accepted if they contain the necessary details and are verifiable by tax authorities.

- Bank or Credit Card Statements - Used as supplementary evidence, these documents support receipt claims when original receipts are lost but must clearly indicate the transaction related to the deduction.

Essential Information Required on Receipts

Receipts for tax deduction claims must include specific details to be considered valid by tax authorities. Essential information such as the date of the transaction and the seller's name ensures authenticity and traceability.

The receipt should clearly state the amount paid and the description of goods or services purchased. Including the buyer's details and the payment method strengthens the claim and supports accurate record-keeping.

Electronic vs. Paper Receipts: Tax Compliance

Receipt documents play a crucial role in substantiating tax deduction claims. Proper record-keeping ensures compliance with tax regulations and facilitates audit processes.

Electronic receipts offer a convenient and secure way to store transaction records, reducing the risk of loss or damage compared to paper receipts. Tax authorities increasingly accept electronic formats, provided they meet authenticity and integrity requirements. You must ensure that both electronic and paper receipts contain essential details such as vendor information, transaction date, amount, and description of goods or services purchased for eligibility in tax deduction claims.

Common Mistakes in Receipt Documentation

Proper receipt documentation is crucial when claiming tax deductions to ensure compliance and avoid audits. Common mistakes can lead to denied claims or delays in processing your tax returns.

- Missing Details - Receipts lacking essential information like date, vendor name, or amount can invalidate your claim.

- Illegible Documentation - Faded or unclear receipts reduce the credibility of your expense proof for tax authorities.

- Incorrect Categorization - Misclassifying expenses on your receipts can result in disallowed deductions or penalties.

Storing and Organizing Receipts for Audit Readiness

Receipts play a crucial role in substantiating expenses claimed for tax deductions. Properly storing and organizing these documents ensures easy access during audits and supports compliance with tax regulations.

Maintain receipts in categorized folders or digital formats sorted by date and expense type. Utilizing scanning apps and cloud storage enhances security and facilitates quick retrieval when needed for tax verification.

Best Practices for Submitting Receipts with Tax Returns

Receipts serve as vital documentation when claiming tax deductions, providing proof of eligible expenses. Proper submission of these receipts ensures compliance and maximizes the chances of successful deduction approval.

- Accurate and Detailed Receipts - Include the date, vendor name, purchase description, and total amount to validate the expense.

- Organized Submission - Arrange receipts by category and attach them in the order they appear on tax forms for easy reference.

- Retain Copies - Keep physical or digital copies of all submitted receipts for future audits and verification purposes.

Following these best practices enhances the accuracy and credibility of tax deduction claims.

Special Cases: Receipts for Charitable Donations

| Receipt Documents Necessary for Tax Deduction Claims | Tax deduction claims require valid receipts as proof of expenses. These documents must include details such as date, amount paid, payer and payee information, and the purpose of the transaction. |

|---|---|

| Special Cases: Receipts for Charitable Donations | Receipts for charitable donations must be issued by registered nonprofit organizations. They should specify the donor's name, donation amount, date, and the charity's registration number. Such receipts are crucial to validate your eligibility for tax deductions on donations. |

What Receipt Documents are Necessary for Tax Deduction Claims? Infographic