Receipt documents essential for small business loan applications include proof of income, business expenses, and tax filings. Detailed receipts showing purchases, payments, and operational costs help validate financial stability and cash flow. Lenders rely on these documents to assess creditworthiness and ensure accurate evaluation of loan eligibility.

What Receipt Documents Are Necessary for Small Business Loan Applications?

| Number | Name | Description |

|---|---|---|

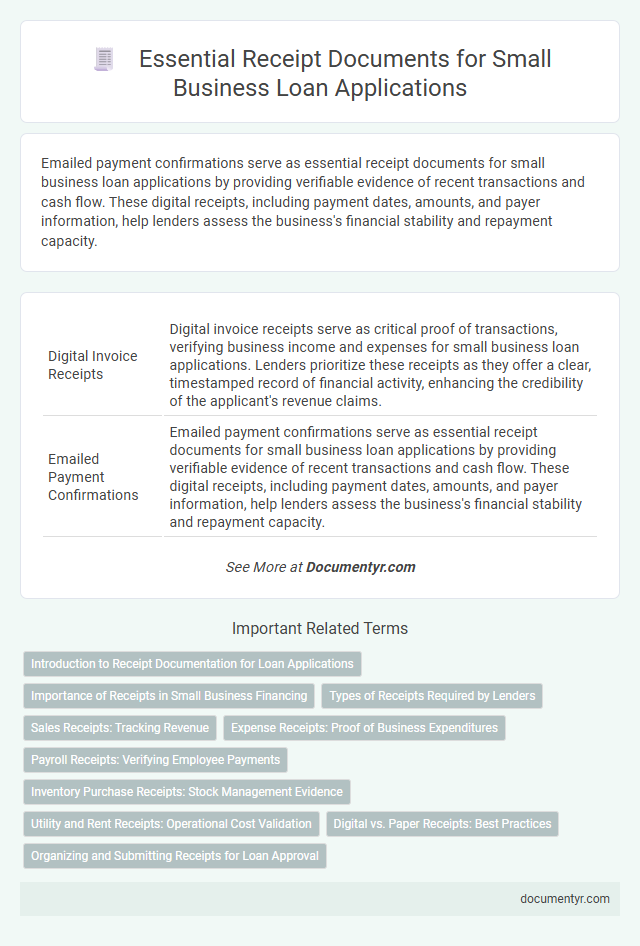

| 1 | Digital Invoice Receipts | Digital invoice receipts serve as critical proof of transactions, verifying business income and expenses for small business loan applications. Lenders prioritize these receipts as they offer a clear, timestamped record of financial activity, enhancing the credibility of the applicant's revenue claims. |

| 2 | Emailed Payment Confirmations | Emailed payment confirmations serve as essential receipt documents for small business loan applications by providing verifiable evidence of recent transactions and cash flow. These digital receipts, including payment dates, amounts, and payer information, help lenders assess the business's financial stability and repayment capacity. |

| 3 | Cloud-based Sales Receipts | Cloud-based sales receipts provide essential transaction records and real-time financial data necessary for small business loan applications, demonstrating consistent revenue streams and accurate bookkeeping. These digital receipts help lenders verify sales history, cash flow, and business legitimacy efficiently, enhancing approval chances. |

| 4 | Contactless Transaction Records | Contactless transaction records serve as essential receipt documents for small business loan applications by providing clear, verifiable proof of sales and cash flow without physical paperwork. These digital records, including NFC payment confirmations and mobile wallet receipts, support accurate financial reporting and streamline lender verification processes. |

| 5 | Mobile Point-of-Sale Receipts | Mobile point-of-sale receipts are essential documents for small business loan applications as they provide verifiable proof of sales transactions, demonstrating consistent revenue streams. Lenders rely on these digital receipts to assess cash flow stability, validate business activity, and evaluate repayment capacity accurately. |

| 6 | Third-party Payment Processor Receipts (e.g., Stripe, Square) | Third-party payment processor receipts from platforms like Stripe and Square provide verified transaction details essential for small business loan applications, demonstrating consistent revenue streams. These digital receipts include timestamps, payment amounts, and customer information, which lenders use to assess financial stability and cash flow reliability. |

| 7 | Blockchain-verified Receipts | Blockchain-verified receipts provide immutable proof of transactions, enhancing the credibility of expense records necessary for small business loan applications. These receipts reduce the risk of fraud and expedite lender verification by ensuring transparent and tamper-proof documentation. |

| 8 | e-Receipt Aggregator Statements | Small business loan applications require receipt documents such as e-Receipt aggregator statements that consolidate all digital transaction records, providing clear evidence of income and expenses. These statements enhance financial transparency and support accurate cash flow analysis for lenders. |

| 9 | Automated Expense Report Receipts | Automated expense report receipts streamline small business loan applications by providing accurate, itemized documentation of business expenses, enhancing transparency and verification processes. These digital receipts ensure compliance with lender requirements by capturing transaction details such as date, vendor, amount, and purpose, facilitating faster approval workflows. |

| 10 | AI-generated Categorized Receipts | AI-generated categorized receipts provide small business loan applicants with detailed, organized documentation of expenses and income, essential for accurate financial reporting and verification. These digitally optimized receipts streamline the loan approval process by offering clear categorization of transactions, reducing errors and enhancing lender confidence. |

Introduction to Receipt Documentation for Loan Applications

Receipt documents provide verifiable proof of business expenses and transactions essential for small business loan applications. Lenders require detailed receipts to assess the financial health and spending patterns of the business. Proper receipt documentation increases the chances of loan approval by demonstrating transparency and accurate record-keeping.

Importance of Receipts in Small Business Financing

Receipts serve as critical proof of business expenses and income, essential for accurate financial reporting in small business loan applications. Lenders rely on these documents to verify the legitimacy and stability of a small business's financial transactions.

Proper receipt documentation demonstrates responsible financial management and strengthens the credibility of a loan applicant. This transparency helps lenders assess risk and determine appropriate loan terms tailored to the business's needs.

Types of Receipts Required by Lenders

Receipts play a critical role in small business loan applications by proving expenditure and income authenticity. Lenders require specific types of receipts to verify financial stability and operational credibility.

- Sales Receipts - Document the revenue generated from customers, demonstrating consistent cash flow.

- Purchase Receipts - Detail expenses incurred for inventory or supplies, illustrating cost management.

- Expense Receipts - Include utilities, rent, and other operational costs to provide a clear picture of business overhead.

Submitting accurate and categorized receipts helps lenders assess the financial health of a small business effectively.

Sales Receipts: Tracking Revenue

Sales receipts play a critical role in demonstrating your business's revenue streams during small business loan applications. These documents validate income and support financial transparency necessary for lenders to assess your creditworthiness.

- Proof of Revenue - Sales receipts provide concrete evidence of income generated from goods or services sold.

- Transaction Details - Each receipt includes dates, amounts, and customer information, ensuring accurate revenue tracking.

- Financial Record Keeping - Organized sales receipts help maintain comprehensive financial records essential for loan documentation.

Expense Receipts: Proof of Business Expenditures

Expense receipts serve as vital proof of business expenditures when applying for a small business loan. These documents validate the costs incurred during business operations, ensuring transparency and accuracy in financial reporting.

Lenders require detailed expense receipts to assess your company's spending habits and financial health. Submitting organized and authentic receipts strengthens your loan application by providing concrete evidence of legitimate business expenses.

Payroll Receipts: Verifying Employee Payments

Payroll receipts play a crucial role in verifying employee payments during small business loan applications. These documents provide transparent evidence of wages paid, ensuring compliance with loan requirements.

Accurate payroll receipts demonstrate your commitment to financial responsibility and employee compensation. Lenders review these receipts to confirm consistent payroll processing and validate business expenses. Maintaining organized payroll documentation supports a smoother loan approval process.

Inventory Purchase Receipts: Stock Management Evidence

Inventory purchase receipts serve as crucial evidence of stock management for small business loan applications. These documents verify the acquisition of goods, reflecting accurate inventory levels and cost tracking. Lenders rely on inventory purchase receipts to assess the business's operational stability and financial reliability.

Utility and Rent Receipts: Operational Cost Validation

What receipt documents are necessary for small business loan applications to validate operational costs? Utility and rent receipts play a crucial role in demonstrating consistent business expenses. These documents help lenders assess financial stability and cash flow management.

Digital vs. Paper Receipts: Best Practices

| Receipt Document | Description | Digital vs. Paper | Best Practices |

|---|---|---|---|

| Sales Receipts | Proof of business income from customer transactions. | Digital receipts are easier to organize and store securely compared to paper receipts. | Scan paper receipts immediately and save digital copies in dedicated cloud folders for quick access during loan applications. |

| Expense Receipts | Documentation of business expenses including supplies, rent, and utilities. | Paper receipts may fade or get lost; digital receipts reduce risks of damage and misplacement. | Use receipt scanning apps or accounting software to digitize and categorize expenses consistently. |

| Bank and Credit Card Statements | Provide verification of payments and cash flow related to business activities. | Digital statements provide searchable, downloadable formats preferred by lenders. | Maintain organized digital records aligned with receipt data for transparent loan application support. |

| Invoice Receipts | Confirm billed amounts and payments received from clients or customers. | Digital invoices streamline tracking payment history and simplify sharing with lenders. | Automate invoicing systems to generate and store receipts electronically to enhance accuracy. |

| Tax Receipts | Evidence of tax payments and deductions relevant to loan eligibility and credit. | Digital copies protect data integrity and facilitate easy submission during application. | Keep backed-up digital versions and organize tax documents by fiscal year for immediate retrieval. |

What Receipt Documents Are Necessary for Small Business Loan Applications? Infographic