Businesses must retain all tax receipts related to income, expenses, and deductions to ensure accurate record-keeping during audits. Important documents include sales receipts, purchase invoices, expense receipts, and bank statements. Proper organization of these records supports compliance with tax regulations and simplifies the audit process.

What Documents Does a Business Need to Keep for Tax Receipt Audits?

| Number | Name | Description |

|---|---|---|

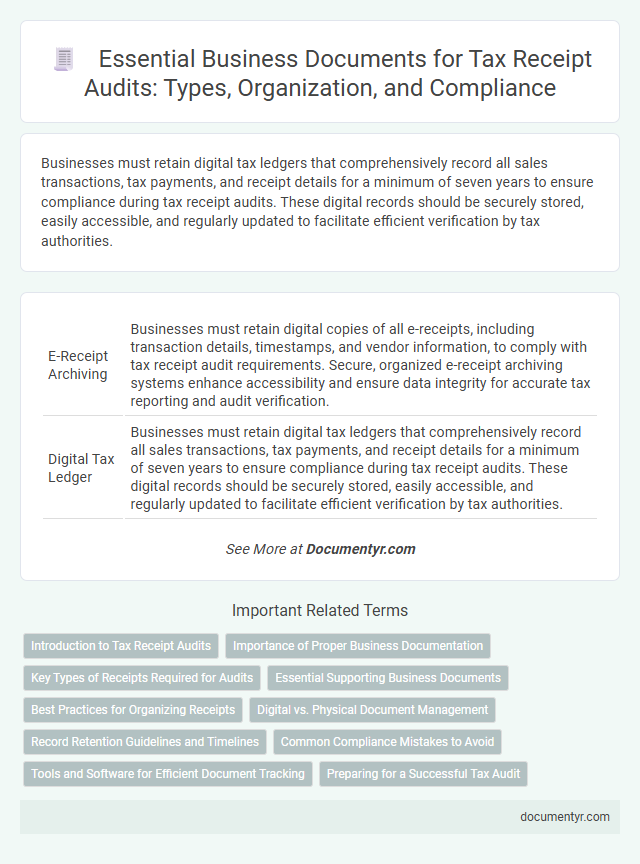

| 1 | E-Receipt Archiving | Businesses must retain digital copies of all e-receipts, including transaction details, timestamps, and vendor information, to comply with tax receipt audit requirements. Secure, organized e-receipt archiving systems enhance accessibility and ensure data integrity for accurate tax reporting and audit verification. |

| 2 | Digital Tax Ledger | Businesses must retain digital tax ledgers that comprehensively record all sales transactions, tax payments, and receipt details for a minimum of seven years to ensure compliance during tax receipt audits. These digital records should be securely stored, easily accessible, and regularly updated to facilitate efficient verification by tax authorities. |

| 3 | Real-Time Invoice Capture | Businesses must retain detailed transaction records, including real-time invoice capture data, to ensure accurate tax receipt audits and compliance with tax authorities. Utilizing automated invoice capture systems enhances the precision of records, enabling instant verification and reducing the risk of discrepancies during tax audits. |

| 4 | AI-Generated Expense Reports | Businesses must retain AI-generated expense reports alongside original receipts, invoices, and payment confirmations for tax receipt audits to ensure compliance with IRS record-keeping requirements. Digital copies of expense reports created using AI tools should be securely stored with metadata detailing the generation date and approval history to validate authenticity during audits. |

| 5 | Blockchain-Authenticated Receipts | Businesses must retain blockchain-authenticated receipts as verifiable proof of transactions, ensuring immutable records for tax receipt audits. These digital receipts provide enhanced security and traceability, simplifying compliance with tax authorities' requirements for accurate and tamper-proof documentation. |

| 6 | Automated Compliance Checklists | Automated compliance checklists streamline the management of essential tax receipt documents including sales receipts, purchase invoices, payroll records, and expense reports, ensuring businesses retain accurate records for audit purposes. Implementing digital solutions accelerates compliance verification, reduces human error, and guarantees adherence to tax regulations by systematically tracking document retention periods and format requirements. |

| 7 | Cloud-Based Receipt Management | Businesses must retain digital copies of tax receipts, invoice records, and expense reports for at least seven years to comply with IRS audit requirements. Cloud-based receipt management systems provide secure, organized storage with easy access, automated backup, and audit trail features essential for efficient tax receipt audits. |

| 8 | OCR Scanned Supporting Documents | Businesses must retain OCR-scanned supporting documents such as receipts, invoices, and payment confirmations for tax receipt audits to ensure accuracy and compliance with tax regulations. These digital records enable efficient data retrieval and verification, reducing errors during audit reviews and supporting transparent financial reporting. |

| 9 | Integrated Transaction Backups | Businesses must retain integrated transaction backups including digital receipts, point-of-sale records, and payment confirmation logs for accurate tax receipt audits. Maintaining these comprehensive backups ensures compliance with tax regulations and facilitates efficient auditing by providing detailed transactional evidence. |

| 10 | Crypto Transaction Statements | Businesses must retain detailed crypto transaction statements, including wallet addresses, transaction IDs, dates, and amounts, to ensure accurate tax receipt audits and compliance with IRS regulations. These records provide essential proof of purchase, sale, or exchange, helping to verify taxable events and prevent discrepancies during audits. |

Introduction to Tax Receipt Audits

Tax receipt audits are thorough examinations conducted by tax authorities to verify the accuracy of your reported income and expenses. Businesses must maintain organized records to support deductions and claims made on tax returns. Proper documentation ensures smooth audit processes and helps avoid penalties or disputes.

Importance of Proper Business Documentation

Maintaining accurate business documentation is essential for successful tax receipt audits. Proper records ensure compliance and simplify the verification process during audits.

- Receipts and Invoices - These documents provide proof of all business transactions and expenses.

- Bank Statements - Statements help validate income deposits and track financial activities.

- Tax Returns and Filing Records - They serve as official evidence of reported income and tax payments.

Keeping organized and detailed paperwork protects your business from discrepancies and potential penalties.

Key Types of Receipts Required for Audits

Businesses must retain various types of receipts to comply with tax receipt audits. Proper documentation supports expense claims and verifies income for accurate tax reporting.

Key receipts include sales receipts, purchase invoices, and expense receipts that detail business transactions. Payroll records and tax payment confirmations are also essential for audit verification.

Essential Supporting Business Documents

What essential supporting business documents must be retained for tax receipt audits? Keeping accurate sales receipts, invoices, and purchase orders is crucial for verifying financial transactions. These documents serve as primary evidence during tax audits to substantiate income and expenses.

Best Practices for Organizing Receipts

Businesses must retain receipts related to income, expenses, and tax payments to ensure compliance during tax receipt audits. Organizing receipts by date, category, and vendor facilitates quick retrieval and accurate record-keeping. Your best practice is to use digital tools or filing systems that secure and categorize receipts efficiently for hassle-free audit preparation.

Digital vs. Physical Document Management

Businesses must retain specific documents to comply with tax receipt audit requirements, focusing on both digital and physical records. Effective management of these documents ensures accuracy and regulatory compliance.

- Retention of Sales Receipts - Maintaining detailed sales receipts helps verify income and supports tax deductions during audits.

- Digital Document Storage - Utilizing digital storage solutions allows for efficient organization and quick retrieval of audit-related documents.

- Physical Document Preservation - Keeping hard copies of critical tax documents safeguards against data loss and meets legal retention policies.

Record Retention Guidelines and Timelines

Businesses must retain specific records to comply with tax receipt audits and avoid penalties. Proper record retention ensures all documents are available for verification by tax authorities.

- Keep receipts for at least seven years - The IRS generally requires businesses to retain tax-related documents, including receipts, for seven years to support income and expense claims.

- Maintain digital or physical copies - Records can be stored electronically or on paper, provided they are legible, accessible, and backed up appropriately for audit purposes.

- Include all supporting documents - Store invoices, bank statements, canceled checks, and contracts along with receipts to create a comprehensive audit trail for verification.

Common Compliance Mistakes to Avoid

| Document Type | Purpose | Common Compliance Mistakes | Best Practices |

|---|---|---|---|

| Sales Receipts | Proof of income for products or services sold | Failing to retain original copies or missing date stamps | Store all receipts systematically with clear date and amount details |

| Purchase Invoices | Verification of business expenses and tax deductions | Using incomplete or unorganized invoices that lack vendor information | Keep detailed invoices including vendor name, date, and itemized costs |

| Bank Statements | Supporting financial transactions and reconciliations | Ignoring discrepancies between statements and receipt records | Regularly reconcile bank statements with receipts and accounting records |

| Expense Reports | Summarizing employee expenses for reimbursement and audits | Submitting unverified expenses or lacking receipts for claims | Attach all original receipts and clearly document purpose for each expense |

| Tax Returns and Supporting Schedules | Evidence for claimed deductions and declared incomes | Not storing copies of filed returns or supporting documents | Maintain organized digital and physical copies of all tax filings and related proofs |

| Payroll Records | Proof of wage payments and tax withholdings | Incomplete records or failure to keep records for the required period | Retain detailed payroll documents including timesheets and tax forms |

| Contracts and Agreements | Justification for income and expense obligations | Mishandling or misplacing signed contracts | Organize contracts chronologically and ensure all parties' signatures are documented |

Tools and Software for Efficient Document Tracking

Businesses must maintain accurate records of tax receipts to comply with audit requirements. Tools and software designed for document tracking streamline this process, reducing the risk of errors and lost records.

Accounting software such as QuickBooks, Xero, and Expensify offer integrated receipt scanning and categorization features. These solutions improve efficiency by automatically organizing receipts and generating detailed reports for tax audits.

What Documents Does a Business Need to Keep for Tax Receipt Audits? Infographic