To claim a business expense receipt, you need the original invoice or receipt detailing the purchase, including the date, vendor, and amount spent. Proof of payment such as a bank statement or credit card slip may also be required to verify the transaction. Retaining these documents ensures compliance with tax regulations and supports accurate expense reporting.

What Documents Are Needed to Claim a Business Expense Receipt?

| Number | Name | Description |

|---|---|---|

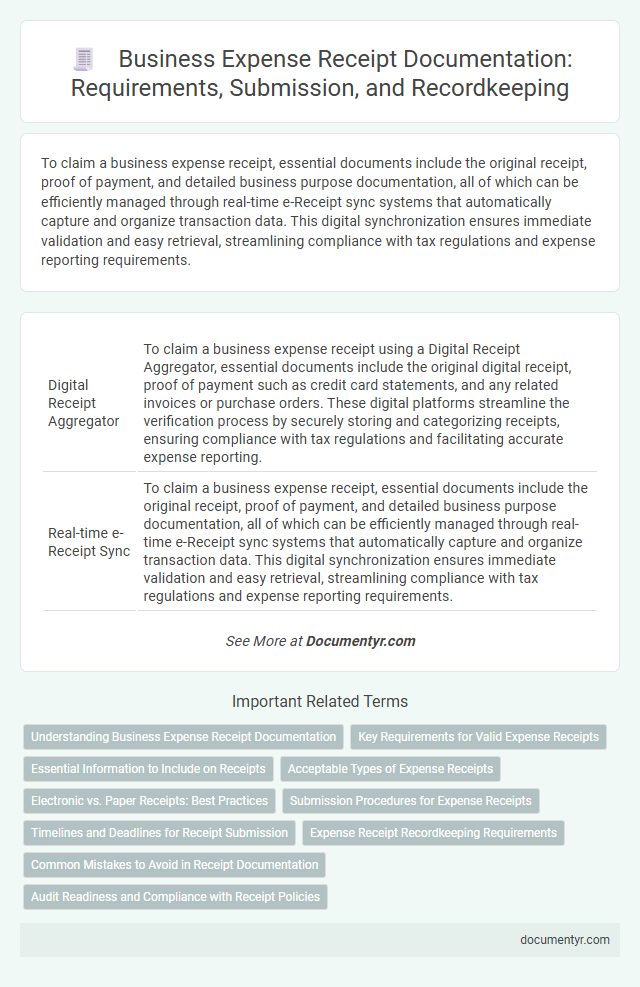

| 1 | Digital Receipt Aggregator | To claim a business expense receipt using a Digital Receipt Aggregator, essential documents include the original digital receipt, proof of payment such as credit card statements, and any related invoices or purchase orders. These digital platforms streamline the verification process by securely storing and categorizing receipts, ensuring compliance with tax regulations and facilitating accurate expense reporting. |

| 2 | Real-time e-Receipt Sync | To claim a business expense receipt, essential documents include the original receipt, proof of payment, and detailed business purpose documentation, all of which can be efficiently managed through real-time e-Receipt sync systems that automatically capture and organize transaction data. This digital synchronization ensures immediate validation and easy retrieval, streamlining compliance with tax regulations and expense reporting requirements. |

| 3 | Expense Verification Blockchain | To claim a business expense receipt, essential documents include the original receipt, proof of payment, and detailed expense reports to ensure accurate expense verification. Expense verification blockchain technology secures and authenticates these documents by providing an immutable ledger that tracks each transaction's validity and prevents fraud. |

| 4 | Automated VAT Reclaim File | To claim a business expense receipt for Automated VAT Reclaim, you need a valid VAT invoice containing supplier details, VAT registration number, purchase date, and a clear breakdown of VAT amounts. Accurate digital records or electronic receipts compatible with automated VAT reclaim software streamline the submission process and ensure compliance with tax authorities. |

| 5 | Interactive Proof of Purchase | Claiming a business expense receipt requires an interactive proof of purchase, such as a detailed digital receipt or e-invoice that includes vendor information, transaction date, itemized list of purchased goods or services, and payment method. These interactive documents enhance verification accuracy and streamline expense tracking for accounting and tax compliance. |

| 6 | AI-driven Expense Categorization | To claim a business expense receipt, essential documents include the original receipt, proof of payment, and a detailed description of the expense purpose, which AI-driven expense categorization systems analyze to classify and validate expenses accurately. These AI tools enhance compliance by automatically extracting relevant data, ensuring receipts meet tax regulations and company policies for seamless reimbursement processing. |

| 7 | E-invoice Attachment Protocol | To claim a business expense receipt, it is essential to attach the e-invoice in compliance with the E-invoice Attachment Protocol, which requires the digital invoice to be verified and linked directly to the expense claim. This protocol ensures authenticity and facilitates seamless integration with accounting software, improving audit readiness and financial accuracy. |

| 8 | OCR-Generated Receipt Audit Trail | To claim a business expense receipt, essential documents include the original receipt, proof of payment, and an audit trail generated through OCR technology that verifies the receipt's authenticity and details such as date, vendor, and amount. Implementing OCR-generated receipt audit trails enhances expense validation by accurately extracting and matching data against financial records, ensuring compliance and reducing errors in reimbursement processes. |

| 9 | Smart Expense Policy Tagging | To claim a business expense receipt, you must submit the original receipt or a clear digital copy along with detailed information such as date, vendor, amount, and purpose of the expense, ensuring compliance with company policies. Smart Expense Policy Tagging automates categorization by extracting key data points from receipts, streamlining approval workflows and enhancing accuracy in expense reporting. |

| 10 | API-Based Merchant Validation | To claim a business expense receipt through API-based merchant validation, essential documents include the original receipt containing the merchant's name, date of purchase, itemized list of goods or services, and total amount paid, all verified via the merchant's API for authenticity. Supporting documents like purchase orders or payment confirmations linked through API integration enhance validation accuracy and streamline expense reporting. |

Understanding Business Expense Receipt Documentation

What documents are needed to claim a business expense receipt? Business expense receipts must include proof of the transaction, such as the original receipt or invoice. These documents should clearly show the date, amount, vendor details, and nature of the expense to ensure accurate claim processing.

How can one ensure the business expense receipt documentation is complete? Complete documentation typically involves supporting records like payment confirmations, credit card statements, or bank statements. These additional documents verify the authenticity of the expense and help maintain compliance with tax regulations.

Key Requirements for Valid Expense Receipts

To claim a business expense receipt, the document must include specific details such as the date of the transaction, the vendor's name, and a clear description of the items or services purchased. The receipt should also display the total amount paid and the method of payment to ensure accurate record-keeping. Your expense receipt must be legible and original or a digital copy that meets these key requirements for validation during tax or accounting reviews.

Essential Information to Include on Receipts

To claim a business expense receipt, you must ensure it contains specific essential information for proper documentation. Accurate receipts help validate your expenses during audits or tax filings.

- Date of purchase - The receipt must clearly show the exact date when the business expense occurred.

- Vendor or supplier details - Include the name and contact information of the seller to verify the transaction.

- Itemized list of goods or services - A detailed description and cost breakdown of each item or service purchased must be present.

Receipts lacking these details may be rejected when claiming business expenses for tax or accounting purposes.

Acceptable Types of Expense Receipts

| Acceptable Types of Expense Receipts | Description |

|---|---|

| Itemized Receipts | Detailed receipts that list each purchased item or service with individual prices, necessary for verifying specific business-related expenses. |

| Credit Card Statements | Statements showing transaction details for business expenses, accepted when accompanied by itemized receipts or invoices. |

| Invoices | Official bills from suppliers or vendors documenting services or goods provided, including company name, date, amount, and description. |

| Payment Confirmations | Digital or printed confirmations from payment platforms providing proof of purchase relevant to business expenses. |

| Travel and Accommodation Receipts | Receipts from hotels, airlines, taxis, and transport services used for business travel, required for travel expense claims. |

| Meals and Entertainment Receipts | Receipts for meals or entertainment expenses related to business activities, must include date, attendees, and business purpose. |

| Official Tax Receipts | Receipts containing tax identification details and tax amounts, essential for claiming tax deductions on business expenses. |

Electronic vs. Paper Receipts: Best Practices

Claiming a business expense receipt requires maintaining accurate documentation to satisfy tax regulations. Electronic and paper receipts each have distinct advantages and best practices for record keeping.

- Electronic Receipts Are Easily Stored and Organized - Digital formats allow quick searching, backup, and sharing, reducing the risk of loss compared to paper copies.

- Paper Receipts Must Be Legible and Intact - Physical receipts should be kept in a safe place and scanned promptly to preserve details that may fade over time.

- Consistent Documentation Ensures Compliance - Properly dated, itemized receipts with the business purpose clearly noted support valid claims for both electronic and paper formats.

Submission Procedures for Expense Receipts

To claim a business expense receipt, you need the original receipt clearly showing the date, vendor details, and amount spent. Supporting documents such as invoices, credit card statements, or payment proofs may also be required for verification.

Submission of expense receipts usually requires attaching them to an expense report or reimbursement form. Ensure all documents are accurately filled out with expense categories and purpose of the expense. Follow your company's submission deadlines and keep copies for your personal records.

Timelines and Deadlines for Receipt Submission

To claim a business expense receipt, it is essential to submit the document within the specified timelines set by tax authorities or company policies. Typically, receipts should be submitted within 30 to 60 days from the date of the expense to ensure eligibility for reimbursement or tax deduction.

Meeting deadlines for receipt submission helps avoid delays in processing claims and potential rejection of expenses. Keeping track of submission timelines and maintaining organized records supports smooth financial audit and compliance.

Expense Receipt Recordkeeping Requirements

To claim a business expense receipt, it is essential to retain original receipts that clearly show the date, amount, and description of the purchase. Expense receipt recordkeeping requirements demand that these documents must link directly to the business activity and include vendor information. Maintaining organized records supports accurate tax reporting and ensures compliance with IRS regulations.

Common Mistakes to Avoid in Receipt Documentation

To claim a business expense receipt, you need original, itemized receipts that clearly show the date, vendor, amount, and description of the purchase. Supporting documents such as invoices, credit card statements, and proof of payment are also essential for accurate record-keeping.

Common mistakes in receipt documentation include missing or illegible details, which can lead to disallowed expenses during audits. Ensure your receipts are properly organized and preserved to avoid delays or rejection of your business expense claims.

What Documents Are Needed to Claim a Business Expense Receipt? Infographic