Receipts needed for FSA/HSA reimbursement must clearly show the date of purchase, the vendor's name, and a detailed description of the item or service provided, confirming it qualifies as an eligible medical expense. Proof of payment is also essential to validate the transaction, ensuring the expense is reimbursable under IRS guidelines. Submitting receipts with precise, complete information prevents delays and facilitates smooth processing of health-related account claims.

What Receipt Documents Are Necessary for FSA/HSA Reimbursement?

| Number | Name | Description |

|---|---|---|

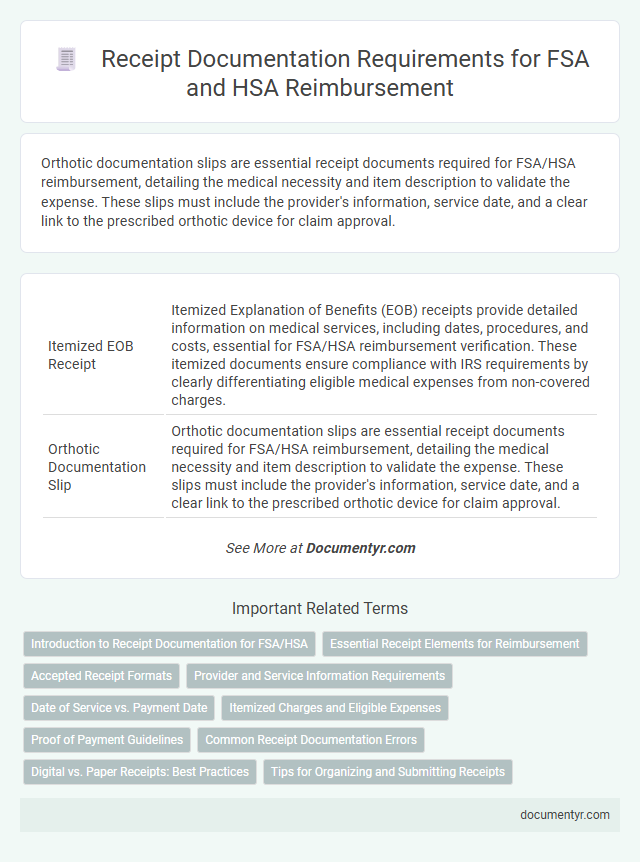

| 1 | Itemized EOB Receipt | Itemized Explanation of Benefits (EOB) receipts provide detailed information on medical services, including dates, procedures, and costs, essential for FSA/HSA reimbursement verification. These itemized documents ensure compliance with IRS requirements by clearly differentiating eligible medical expenses from non-covered charges. |

| 2 | Orthotic Documentation Slip | Orthotic documentation slips are essential receipt documents required for FSA/HSA reimbursement, detailing the medical necessity and item description to validate the expense. These slips must include the provider's information, service date, and a clear link to the prescribed orthotic device for claim approval. |

| 3 | Telehealth Session Invoice | Telehealth session invoices required for FSA/HSA reimbursement must include the date of service, provider's name, detailed description of the medical service, and the amount charged. Clear documentation ensures compliance with IRS guidelines and facilitates prompt reimbursement for eligible telehealth expenses. |

| 4 | Mobile Pharmacy e-Receipt | Mobile pharmacy e-receipts must include essential details such as the date of purchase, pharmacy name, patient's name, itemized list of eligible medications or supplies, and total amount paid to qualify for FSA/HSA reimbursement. These digital receipts ensure compliance with IRS requirements by providing clear evidence of qualified medical expenses for seamless reimbursement processing. |

| 5 | Digital OTC Medicine Receipt | Digital OTC medicine receipts must clearly show the date of purchase, product description, price, and the name of the retailer to qualify for FSA/HSA reimbursement. Receipts submitted electronically should be itemized and contain sufficient detail to verify eligible expenses under IRS guidelines. |

| 6 | Out-of-Network Provider Receipt | Receipts for FSA/HSA reimbursement must include the provider's name, date of service, description of medical care or items purchased, and the total amount paid, with out-of-network provider receipts requiring clear indication of service dates and itemized charges. Proper documentation ensures compliance with IRS regulations and facilitates the approval of eligible medical expenses. |

| 7 | Flexible Orthodontic Payment Statement | A Flexible Orthodontic Payment Statement is essential for FSA/HSA reimbursement as it details the patient's name, service dates, provider information, and amounts paid for orthodontic care. This documentation verifies eligible medical expenses and supports claims by clearly outlining the orthodontic treatment costs covered under the plan. |

| 8 | Insulin Pump Supplies Proof-of-Purchase | Receipt documents necessary for FSA/HSA reimbursement of insulin pump supplies must include detailed proof-of-purchase showing the itemized cost, vendor name, purchase date, and description matching the prescribed medical device. This documentation ensures compliance with IRS requirements by verifying the supplies are eligible medical expenses under FSA/HSA guidelines. |

| 9 | Specialist Superbill Receipt | Specialist superbill receipts are essential for FSA/HSA reimbursement as they provide detailed information including provider details, date of service, diagnosis codes, procedure codes, and the amount paid, ensuring compliance with IRS requirements. These receipts validate eligible medical expenses and facilitate accurate claims processing for flexible and health savings accounts. |

| 10 | HSA-Qualified OTC COVID-19 Test Receipt | HSA-qualified OTC COVID-19 test receipts must clearly show the date of purchase, product description, and proof of payment to comply with IRS reimbursement requirements. Receipts lacking specific details or proof of purchase may lead to denial of FSA/HSA claims for eligible medical expenses. |

Introduction to Receipt Documentation for FSA/HSA

Receipt documentation is essential for verifying expenses when seeking reimbursement from Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA). Proper receipts ensure that eligible medical costs qualify under IRS guidelines for tax-advantaged spending accounts.

- Detailed Receipt Requirements - Receipts must include the date of service, provider information, and an itemized list of services or products.

- Proof of Payment - Documentation should show the method and amount of payment to confirm the transaction was completed.

- Eligible Expense Verification - Receipts must clearly indicate that the expense is medically necessary and meets FSA/HSA eligibility criteria.

Essential Receipt Elements for Reimbursement

Receipt documents for FSA/HSA reimbursement must include specific essential elements to be considered valid. These elements ensure the expense qualifies and the reimbursement process is smooth.

Key receipt details include the date of service, provider or merchant name, and a clear description of the item or service purchased. The total amount paid and proof of payment are also necessary for submission.

Accepted Receipt Formats

Receipts for FSA/HSA reimbursement must clearly detail the date of service, provider name, and description of the eligible expense. Accepted receipt formats include printed receipts, digital copies, and itemized invoices showing the out-of-pocket amount paid. Keep your receipts organized and ensure they meet these criteria to avoid claim denials.

Provider and Service Information Requirements

To qualify for FSA/HSA reimbursement, receipts must clearly display specific provider and service information. Accurate documentation ensures compliance with IRS requirements and facilitates smooth claims processing.

- Provider Name and Address - The receipt must include the full name and physical address of the healthcare provider or service facility.

- Date of Service - Clearly state the exact date(s) when the medical service or treatment was rendered.

- Description of Service - A detailed explanation of the medical service or product provided must appear on the receipt to verify eligibility for reimbursement.

Date of Service vs. Payment Date

Receipts for FSA/HSA reimbursements must clearly show the date of service rather than just the payment date to ensure eligibility. The date of service indicates when the medical service or product was provided, which is crucial for validating claims within the plan year.

- Date of Service is Mandatory - FSA/HSA administrators require receipts that include the date the healthcare service was actually rendered, not the date you paid for it.

- Payment Date Alone is Insufficient - A receipt showing only the payment date cannot confirm if the expense occurred within the eligible reimbursement period.

- Accurate Documentation Prevents Denials - Proper receipts with the service date help avoid claim rejections and speed up reimbursement processing.

Always verify your receipt includes the date of service to guarantee your expense qualifies for FSA/HSA reimbursement.

Itemized Charges and Eligible Expenses

Receipt documents are crucial for FSA and HSA reimbursements. They must clearly show itemized charges and eligible expenses to be valid.

Itemized receipts detail each service or product separately, including date, description, and cost. Eligible expenses typically include medical services, prescription drugs, and certain medical supplies. Receipts lacking this information may be rejected during the reimbursement process.

Proof of Payment Guidelines

| Receipt Document | Proof of Payment Guidelines |

|---|---|

| Itemized Receipt | Must include date of purchase, name and address of the provider or merchant, detailed description of each item or service, and individual prices to verify eligibility. |

| Proof of Payment | Requires a clear method of payment such as a credit card statement, bank statement, canceled check, or receipt showing payment was made in full. |

| Provider Statement | Should specify services provided, dates, and amount paid. Acceptable when an itemized receipt is unavailable but proof of payment is clear. |

| Credit Card or Bank Statement | Should clearly show the transaction date, merchant name, and payment amount matching the receipt or provider statement to confirm payment. |

| Cash Receipt | Must be detailed with merchant information and date. Proof of payment can be supplemented by a canceled check or credit card statement if necessary. |

| Digital Receipts | Accepted if they contain all necessary details: merchant info, date, itemized charges, and proof of payment via electronic transaction records. |

Common Receipt Documentation Errors

Receipt documents necessary for FSA/HSA reimbursement must clearly show the date of service, provider name, and itemized description of the product or service. Common receipt documentation errors include missing provider information, incomplete service descriptions, and illegible or altered receipts. Ensuring your receipt contains all required details helps avoid claim denials and speeds up reimbursement processing.

Digital vs. Paper Receipts: Best Practices

Receipts are essential documents for FSA/HSA reimbursement, serving as proof of eligible medical expenses. Both digital and paper receipts must include the date, provider's name, services rendered, and amount paid to be valid for claims.

Digital receipts offer easy storage and quick submission, often accepted by FSA/HSA administrators when clear and legible. Paper receipts remain important for backup and situations where digital copies cannot be obtained or submitted.

What Receipt Documents Are Necessary for FSA/HSA Reimbursement? Infographic