Receipt documents required for car rental insurance claims typically include the original rental agreement, detailed receipts showing the payment for the rental, and any damage reports provided by the rental company. These documents serve as proof of the rental transaction and help validate the claim by specifying costs incurred and the condition of the vehicle. Insurance companies may also request additional documentation, such as police reports or correspondence related to the incident.

What Receipt Documents are Required for Car Rental Insurance Claims?

| Number | Name | Description |

|---|---|---|

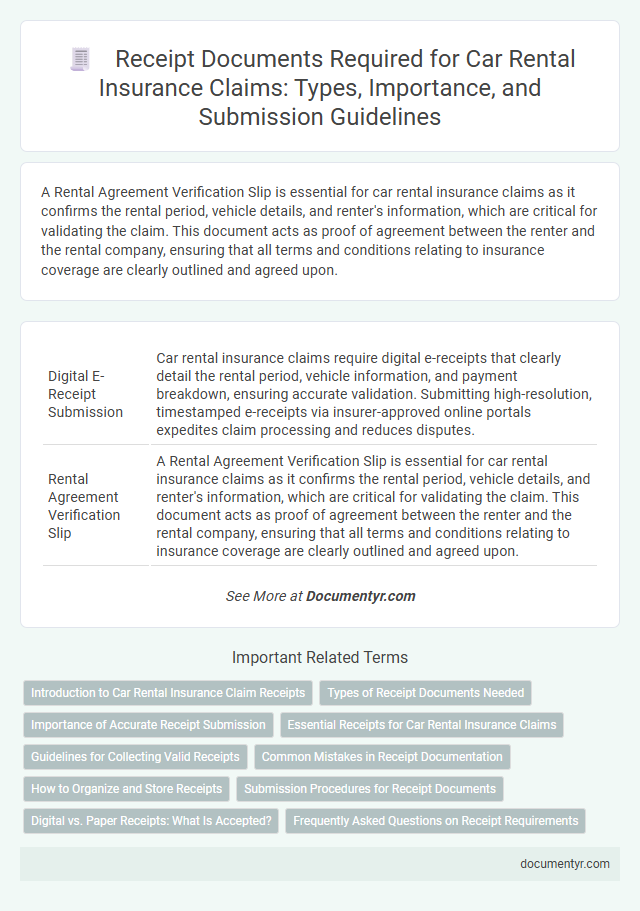

| 1 | Digital E-Receipt Submission | Car rental insurance claims require digital e-receipts that clearly detail the rental period, vehicle information, and payment breakdown, ensuring accurate validation. Submitting high-resolution, timestamped e-receipts via insurer-approved online portals expedites claim processing and reduces disputes. |

| 2 | Rental Agreement Verification Slip | A Rental Agreement Verification Slip is essential for car rental insurance claims as it confirms the rental period, vehicle details, and renter's information, which are critical for validating the claim. This document acts as proof of agreement between the renter and the rental company, ensuring that all terms and conditions relating to insurance coverage are clearly outlined and agreed upon. |

| 3 | Damage Assessment Report | A Damage Assessment Report is a crucial document required for car rental insurance claims as it provides a detailed evaluation of the vehicle's condition and the extent of damage. This report, often prepared by the rental company or an authorized assessor, serves as evidence to support the claim and ensure accurate reimbursement. |

| 4 | Electronic Incident Ledger | Electronic Incident Ledger serves as a crucial receipt document for car rental insurance claims by providing a detailed, timestamped record of incidents and transactions related to the rental period. This ledger captures essential information such as damage reports, payment confirmations, and rental extensions, ensuring accurate and verifiable documentation for claim processing. |

| 5 | GPS Mileage Tracker Logs | Receipt documents required for car rental insurance claims often include GPS mileage tracker logs that provide accurate and real-time evidence of the vehicle's usage and distance traveled during the rental period. These logs help verify authorized routes and usage, ensuring validity and preventing dispute over mileage or unauthorized trips. |

| 6 | Photo Timestamp Validation | Receipts required for car rental insurance claims must include a clear photo timestamp to validate the transaction date and time, ensuring the legitimacy of the rental period and associated expenses. This timestamp verification helps prevent fraudulent claims by confirming the receipt corresponds exactly to the rental duration covered by the insurance policy. |

| 7 | Maintenance History Statement | A detailed Maintenance History Statement documenting all repairs and service dates is essential for car rental insurance claims, as it verifies the vehicle's condition prior to rental. This receipt document helps insurers assess liability and coverage by providing proof of proper upkeep and addressing any pre-existing damages. |

| 8 | Contactless Return Confirmation | Contactless return confirmation receipt documenting the vehicle's condition and return time is essential for car rental insurance claims, providing proof that the car was returned without damage. This digital or emailed receipt reduces disputes and accelerates claim processing by verifying compliance with rental agreement terms. |

| 9 | Insurance Pre-Approval Notice | An Insurance Pre-Approval Notice is a critical receipt document required for car rental insurance claims, verifying that the insurer has authorized coverage before the rental period begins. This notice must include the claim number, insured party details, rental dates, and confirmation of approved coverage limits to ensure claim validity. |

| 10 | Third-Party Liability Endorsement Stub | The Third-Party Liability Endorsement Stub is a crucial receipt document required for car rental insurance claims as it verifies the additional coverage beyond the basic policy. Providing this stub ensures the rental company and insurer acknowledge the extended liability protection, facilitating smoother claim processing and reimbursement. |

Introduction to Car Rental Insurance Claim Receipts

Car rental insurance claims require specific receipt documents to validate the expenses and coverage. These receipts provide proof of payment and detail the services related to the rental vehicle.

The primary receipt documents needed include the rental agreement, payment invoice, and any repair or damage bills. Proper documentation ensures a smooth and efficient claims process with the insurance provider.

Types of Receipt Documents Needed

Receipt documents are essential for processing car rental insurance claims. These documents verify rental costs and any additional charges related to the insurance coverage.

The main types of receipt documents needed include the rental agreement, proof of payment, and any damage or incident reports. Your rental invoice should clearly itemize the daily rental rate, insurance fees, and any extra services purchased.

Importance of Accurate Receipt Submission

| Receipt Documents Required for Car Rental Insurance Claims |

|

|---|---|

| Importance of Accurate Receipt Submission |

|

Essential Receipts for Car Rental Insurance Claims

Essential receipts for car rental insurance claims include the rental agreement, the payment receipt, and any damage or repair invoices. These documents verify your rental period, payments made, and costs associated with any damages. Keeping these receipts organized ensures a smoother claims process with the insurance provider.

Guidelines for Collecting Valid Receipts

Receipts play a crucial role in car rental insurance claims as they serve as proof of expenses incurred. Collecting valid and detailed receipt documents ensures a smoother claims process and faster reimbursement.

- Keep Original Receipts - Maintain the unaltered, original copies of all rental and related expense receipts to validate your claim.

- Ensure Receipts Include Key Details - Receipts should clearly show the rental company's name, date, rental period, and detailed charges.

- Submit Timely and Legible Receipts - Provide receipts promptly with readable information to avoid delays or rejection in the insurance claim process.

Common Mistakes in Receipt Documentation

Accurate receipt documentation is essential for successful car rental insurance claims, but many renters make common errors that can delay or invalidate their claims. Understanding what specific receipt documents are required helps avoid these pitfalls and streamlines the reimbursement process.

- Incomplete Receipts - Receipts lacking detailed breakdowns of charges often fail to meet insurance company requirements.

- Non-itemized Charges - Receipts that do not specify individual costs such as insurance fees, fuel charges, or tolls can lead to claim denials.

- Missing Rental Agreement Reference - Receipts that do not reference the rental agreement or contract number complicate verification efforts during claim processing.

Submitting fully itemized, detailed, and clearly referenced receipts significantly increases the likelihood of a smooth car rental insurance claim experience.

How to Organize and Store Receipts

Organizing and storing receipts is crucial for successful car rental insurance claims. Proper documentation ensures all expenses are validated and claims are processed efficiently.

- Collect all relevant receipts - Keep receipts for rental fees, fuel purchases, damage repairs, and additional charges related to the car rental.

- Use digital storage solutions - Scan or photograph each receipt and store them in a dedicated folder on your computer or cloud service for easy access.

- Label and categorize receipts - Organize receipts by date and type of expense to streamline the claims process and avoid confusion during submission.

Submission Procedures for Receipt Documents

Car rental insurance claims require specific receipt documents to verify expenses and coverage. These documents include the original rental agreement, payment receipts, and any repair or damage invoices.

Submit all receipt documents promptly to the insurance provider, following their submission guidelines. Typically, receipts can be uploaded via the insurer's online portal or sent by mail. Ensure that all documents are clear, legible, and include dates, amounts, and the rental company's details.

Digital vs. Paper Receipts: What Is Accepted?

For car rental insurance claims, receipts serve as crucial proof of rental and expenses incurred. Digital receipts are widely accepted by most insurance providers, as long as they clearly display the rental company's details, dates, and costs. Paper receipts remain valid, but ensure they are legible and include all relevant information to support your claim effectively.

What Receipt Documents are Required for Car Rental Insurance Claims? Infographic