Essential documents for electronic receipt record keeping include digital copies of purchase receipts, invoices, and payment confirmations. These files must be clear, legible, and stored in common formats such as PDF or JPEG to ensure easy access and verification. Maintaining organized electronic folders with accurate naming conventions supports efficient retrieval and audit compliance.

What Documents Are Needed for Electronic Receipt Record Keeping?

| Number | Name | Description |

|---|---|---|

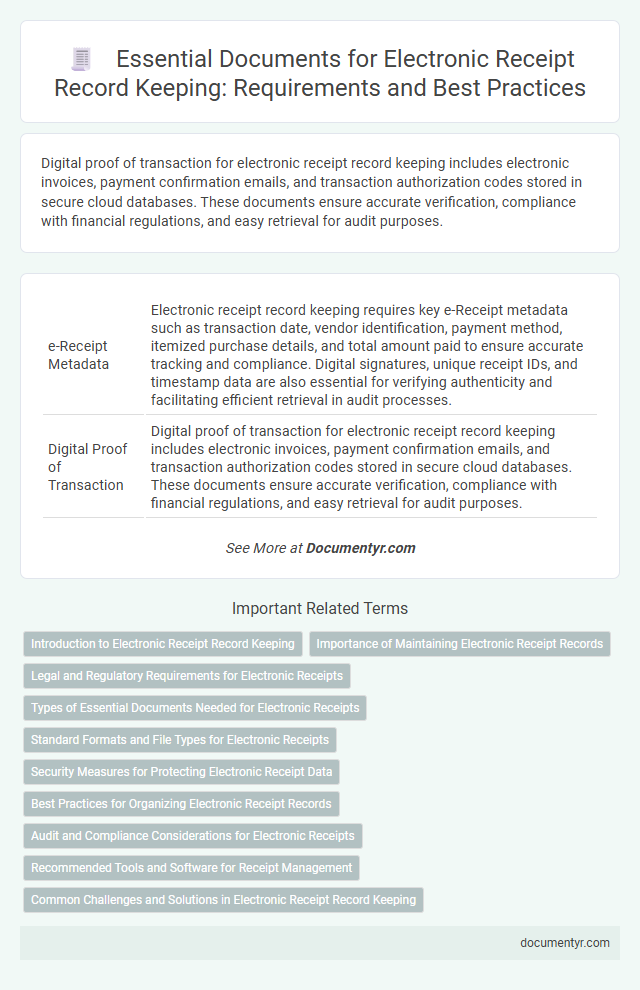

| 1 | e-Receipt Metadata | Electronic receipt record keeping requires key e-Receipt metadata such as transaction date, vendor identification, payment method, itemized purchase details, and total amount paid to ensure accurate tracking and compliance. Digital signatures, unique receipt IDs, and timestamp data are also essential for verifying authenticity and facilitating efficient retrieval in audit processes. |

| 2 | Digital Proof of Transaction | Digital proof of transaction for electronic receipt record keeping includes electronic invoices, payment confirmation emails, and transaction authorization codes stored in secure cloud databases. These documents ensure accurate verification, compliance with financial regulations, and easy retrieval for audit purposes. |

| 3 | XML Invoice Attachments | XML invoice attachments are essential for electronic receipt record keeping as they provide standardized, machine-readable data that ensures accurate transaction details and compliance with tax regulations. These XML files must include key elements such as supplier information, invoice number, date, itemized charges, and digital signatures to validate authenticity and facilitate automated processing. |

| 4 | Blockchain-stamped Receipts | Blockchain-stamped receipts require digital signatures, timestamp data, and cryptographic hashes to ensure authenticity and immutability for electronic receipt record keeping. Supporting documents include original transaction records, merchant receipts, and detailed metadata integrated within the blockchain ledger for secure audit trails. |

| 5 | QR Code Validated Receipts | QR code validated receipts require digital copies of the original receipt, including the embedded QR code data and transaction details, to ensure authenticity and compliance with electronic record-keeping regulations. Storing these receipts in secure, searchable formats such as PDF or encrypted databases facilitates efficient auditing and verification processes. |

| 6 | PDF/A Archival Receipts | PDF/A archival receipts require original transaction data, including invoice and payment confirmation, to ensure long-term preservation and compliance with legal standards in electronic receipt record keeping. These documents must be digitally signed and include metadata for authenticity, enabling secure retrieval and verification in accounting audits. |

| 7 | Smart Contract Receipts | Smart contract receipts require digital signatures, blockchain transaction hashes, and timestamp proof to ensure authenticity and traceability in electronic receipt record keeping. These documents integrate with decentralized ledger technology to provide immutable records facilitating compliance and audit processes. |

| 8 | eIDAS-compliant Documents | eIDAS-compliant documents required for electronic receipt record keeping include qualified electronic signatures, electronic seals, and time stamps that ensure authenticity, integrity, and legal validity across the EU. These documents must align with the standards set by the eIDAS Regulation to guarantee secure and standardized electronic transactions. |

| 9 | OCR-Extracted Receipt Data | Electronic receipt record keeping requires documents containing OCR-extracted receipt data such as vendor name, transaction date, total amount, and itemized purchase details to ensure accurate digital archiving. High-quality scans or digital images with clear text enable OCR software to reliably extract and index essential receipt information for efficient retrieval and compliance with tax regulations. |

| 10 | API-Generated Acknowledgments | API-generated acknowledgments for electronic receipt record keeping must include transaction ID, timestamp, payer and payee details, payment method, and amount to ensure compliance with audit and tax regulations. These digital receipts serve as verifiable proof of payment and streamline integration with financial management systems for accurate record maintenance. |

Introduction to Electronic Receipt Record Keeping

Electronic receipt record keeping streamlines the management of your purchase records by digitizing transaction data. This method enhances organization and ensures easy access to important documents.

To maintain accurate electronic receipts, you need digital copies of transaction confirmations, such as emails or PDF invoices. Payment method records, including credit card or bank statements, support verification. Proper storage of these documents helps with tax preparation, expense tracking, and auditing processes.

Importance of Maintaining Electronic Receipt Records

Maintaining electronic receipt records is essential for accurate financial management and tax compliance. Proper documentation ensures easy retrieval and verification of all transactions.

- Receipts and Invoices - Digital copies of sales receipts and supplier invoices confirm purchase details and payment amounts.

- Bank Statements - Electronic bank statements verify transaction dates and amounts against recorded receipts.

- Payment Confirmation - Records such as electronic payment confirmations or transaction IDs provide proof of completed payments.

Legal and Regulatory Requirements for Electronic Receipts

| Document Type | Legal and Regulatory Requirement | Purpose |

|---|---|---|

| Electronic Receipt Copies | Must be retained in an unalterable digital format according to tax authority regulations (such as IRS or VAT rules) | Ensure authenticity and integrity for audit purposes |

| Audit Trail Records | Required by financial regulatory bodies to track changes and access history | Support compliance verification and dispute resolution |

| Customer Consent Documentation | Compliance with data privacy laws like GDPR or CCPA is mandatory when storing personal information | Protect customer data and validate legal receipt storage |

| Encryption and Security Protocol Logs | Must adhere to cybersecurity standards specified by industry regulations (e.g., PCI DSS for payment data) | Safeguard electronic receipts against unauthorized access or data breaches |

| Retention Period Records | Legal requirements usually specify retention periods, commonly 5 to 7 years depending on jurisdiction | Ensure availability of records during mandated audit periods |

| System Compliance Certifications | Verification of adherence to electronic record keeping standards such as ISO 27001 or SSAE 18 | Provide assurance that electronic receipt systems meet regulatory criteria |

Types of Essential Documents Needed for Electronic Receipts

Electronic receipt record keeping requires certain essential documents to ensure accuracy and compliance. These include digital invoice copies, payment confirmation records, and transaction details with timestamps. Your organized storage of these documents helps streamline audits and financial management.

Standard Formats and File Types for Electronic Receipts

What standard formats and file types are required for electronic receipt record keeping? Electronic receipts should be saved in widely accepted formats such as PDF, JPEG, or PNG to ensure compatibility and long-term accessibility. These formats preserve the original details and allow for easy searching and retrieval when needed.

Security Measures for Protecting Electronic Receipt Data

Electronic receipt record keeping requires specific documents such as scanned copies of original receipts, digital invoices, and transaction confirmation emails. These documents must be stored in secure, searchable digital formats to ensure easy retrieval and compliance with regulatory standards.

Implementing strong security measures is essential to protect electronic receipt data from unauthorized access and cyber threats. Encryption protocols, multi-factor authentication, and regular data backups help maintain the confidentiality and integrity of stored receipt information.

Best Practices for Organizing Electronic Receipt Records

Electronic receipt record keeping requires specific documents to ensure accurate financial tracking and compliance. Proper organization of these records enhances accessibility and audit readiness.

- Digital Copies of Receipts - Store clear, legible images or PDFs of all transaction receipts for easy reference and verification.

- Transaction Details - Maintain records including date, vendor, amount, and payment method to support receipt authenticity and context.

- Organized File Structure - Implement a consistent folder system categorized by date, vendor, or expense type to streamline retrieval and management.

Adopting structured electronic organization standards improves efficiency and secures financial documentation integrity.

Audit and Compliance Considerations for Electronic Receipts

Electronic receipt record keeping requires documents that verify transaction authenticity, such as the original e-receipt, payment confirmation, and vendor details. Audit and compliance considerations mandate retaining these records in secure, tamper-proof formats that meet regulatory standards like GDPR or IRS requirements. Ensuring the availability of these documents supports accurate financial reporting and facilitates smooth auditing processes for your business.

Recommended Tools and Software for Receipt Management

Efficient electronic receipt record keeping requires specific documents for accurate tracking and tax purposes. Recommended tools and software help organize, store, and retrieve receipts effectively.

- Receipt Scanning Software - Converts paper receipts into digital formats for easy storage and access.

- Cloud Storage Services - Provides secure and accessible backup of electronic receipts from any device.

- Expense Management Applications - Automates receipt categorization and integrates with accounting systems for streamlined financial management.

What Documents Are Needed for Electronic Receipt Record Keeping? Infographic