To ensure successful travel expense receipt reimbursement, submit detailed receipts showing the date, amount, and vendor for each expense. Include supporting documents such as travel itineraries, boarding passes, and hotel invoices to verify the purpose and duration of the trip. Accurate documentation helps streamline the approval process and minimizes delays in reimbursement.

What Documents Are Necessary for Travel Expense Receipt Reimbursement?

| Number | Name | Description |

|---|---|---|

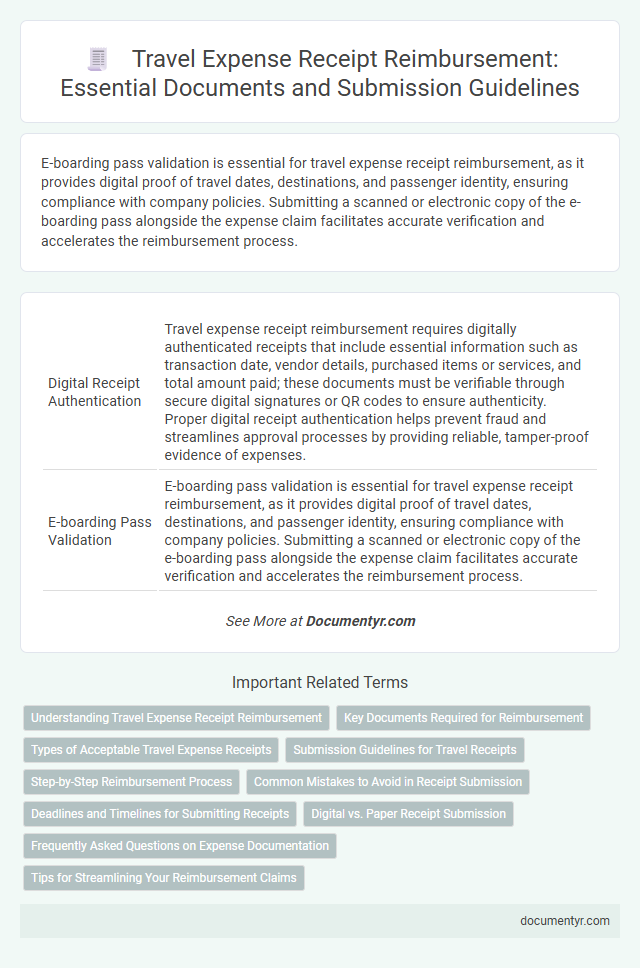

| 1 | Digital Receipt Authentication | Travel expense receipt reimbursement requires digitally authenticated receipts that include essential information such as transaction date, vendor details, purchased items or services, and total amount paid; these documents must be verifiable through secure digital signatures or QR codes to ensure authenticity. Proper digital receipt authentication helps prevent fraud and streamlines approval processes by providing reliable, tamper-proof evidence of expenses. |

| 2 | E-boarding Pass Validation | E-boarding pass validation is essential for travel expense receipt reimbursement, as it provides digital proof of travel dates, destinations, and passenger identity, ensuring compliance with company policies. Submitting a scanned or electronic copy of the e-boarding pass alongside the expense claim facilitates accurate verification and accelerates the reimbursement process. |

| 3 | Dynamic Itinerary Proof | Dynamic itinerary proof serves as essential documentation for travel expense receipt reimbursement, providing real-time, detailed confirmation of travel plans including flight times, accommodations, and transportation. This evidence validates actual travel dates and expenses, ensuring accurate reimbursement aligned with company policies and audit requirements. |

| 4 | Fiscalization Code (F-Code) | For travel expense receipt reimbursement, the Fiscalization Code (F-Code) serves as a critical verification element, ensuring compliance with local tax regulations and authenticity of the transaction. Receipts must prominently display the F-Code, along with detailed information such as date, vendor, and amount, to be eligible for processing by finance departments. |

| 5 | Real-time Expense Capture | Real-time expense capture requires submitting original, itemized receipts that clearly display vendor information, purchase date, and amount to ensure accurate travel expense receipt reimbursement. Digital copies must be timestamped and verifiable through expense management software to comply with corporate auditing standards. |

| 6 | Multi-currency Receipt Parsing | Travel expense receipt reimbursement requires submitting detailed receipts that include merchant information, date, and itemized expenses with clear currency indicators. Multi-currency receipt parsing demands accurate recognition of different currency symbols, exchange rates, and standardized formatting to ensure precise conversion and validation for reimbursement processes. |

| 7 | Carbon Offset Documentation | Travel expense receipt reimbursement requires submitting original receipts, itemized invoices, and proof of payment, with carbon offset documentation including verifiable certificates or purchase confirmations from recognized environmental organizations. These documents must detail the specific carbon offset projects funded, showing the amount of CO2 emissions compensated to ensure eligibility for reimbursement. |

| 8 | QR-coded Receipt Submission | Travel expense receipt reimbursement requires submitting original receipts featuring QR codes that verify transaction authenticity and enable quick digital processing. Essential documents include itemized receipts with QR codes, proof of payment, and a completed reimbursement form to ensure compliance with company policies and auditing standards. |

| 9 | AI-powered Document Aggregator | AI-powered document aggregators streamline travel expense receipt reimbursement by automatically extracting and organizing essential documents such as boarding passes, hotel invoices, and transportation receipts. These platforms enhance accuracy and efficiency by instantly verifying data against travel policies and generating compliant reimbursement reports. |

| 10 | Blockchain Travel Voucher | Travel expense receipt reimbursement requires detailed proof of purchase, including a valid blockchain travel voucher that ensures transaction authenticity and immutability. Essential documents typically include the blockchain voucher record, original receipts, and a clear expense report to verify compliance and facilitate accurate reimbursement processing. |

Understanding Travel Expense Receipt Reimbursement

Understanding travel expense receipt reimbursement requires submitting specific documents to verify expenses incurred during business travel. Essential documents include detailed receipts, proof of payment, and an approved travel authorization form. These records ensure accurate reimbursement and compliance with company policies.

Key Documents Required for Reimbursement

Key documents required for travel expense receipt reimbursement include original receipts that clearly show the date, vendor, and amount paid. A detailed travel itinerary or proof of the travel purpose is essential to validate the expenses. You must also provide an expense report summarizing all costs incurred during the trip for accurate reimbursement processing.

Types of Acceptable Travel Expense Receipts

What types of travel expense receipts are necessary for reimbursement? Acceptable travel expense receipts typically include original itemized receipts that clearly show the date, vendor, and amount paid. Examples include receipts for transportation, lodging, meals, and incidentals that directly relate to your travel.

Submission Guidelines for Travel Receipts

Submitting the correct documents is essential for travel expense receipt reimbursement. Proper adherence to submission guidelines ensures a smooth approval process.

- Original Receipts Required - Submit original receipts that clearly show the date, vendor, and amount paid.

- Itemized Receipts Preferred - Include detailed receipts specifying each service or product to validate the expense.

- Timely Submission - Provide all travel receipts within the organization's specified deadline to avoid delays or rejection.

Step-by-Step Reimbursement Process

To start the travel expense receipt reimbursement process, you must gather all original receipts and any related documents such as boarding passes or hotel invoices. These documents serve as proof of expenses incurred during your travel.

Submit the collected receipts through the designated reimbursement platform or to the finance department. Ensure each receipt is clearly labeled with the date, amount, and purpose to avoid delays in processing.

Complete a travel expense form detailing each expense and attach the corresponding receipts. This step verifies your claims and provides a clear record for the finance team.

After submission, the finance department reviews the documents for accuracy and compliance with company policies. Upon approval, the reimbursement amount is processed and credited back to your account or paycheck.

Common Mistakes to Avoid in Receipt Submission

Travel expense receipt reimbursement requires submitting specific documents such as original receipts, proof of payment, and a completed expense report. Accurate documentation ensures timely processing and avoids delays in reimbursement.

Common mistakes to avoid include submitting photocopies instead of original receipts, missing essential details like dates or vendor names, and failing to itemize expenses clearly. You should double-check all receipts for completeness before submission. Incomplete or unclear receipts often result in claim rejections or requests for additional information.

Deadlines and Timelines for Submitting Receipts

To ensure timely reimbursement of travel expenses, it is essential to submit all necessary receipts within the specified deadlines set by the organization or employer. Receipts must clearly document expenses such as transportation, lodging, meals, and incidental costs.

Most companies require submission of travel expense receipts within 30 to 60 days after the trip completion date. Missing these deadlines can result in delayed or denied reimbursement claims, making prompt submission critical for process efficiency.

Digital vs. Paper Receipt Submission

Submitting accurate receipts is essential for travel expense reimbursement to ensure valid proof of incurred costs. Understanding the differences between digital and paper receipt submission can streamline the reimbursement process and prevent delays.

- Paper Receipts - Physical copies must be clear and legible, often requiring signatures or stamps for validation.

- Digital Receipts - Electronic formats such as PDFs or photos are accepted by most organizations, facilitating quicker submission and processing.

- Submission Requirements - Both digital and paper receipts should include essential details like date, vendor, amount, and payment method to qualify for reimbursement.

Frequently Asked Questions on Expense Documentation

| Frequently Asked Questions | Details |

|---|---|

| What documents are required for travel expense receipt reimbursement? | Original, itemized receipts showing date, vendor, description, and amount of each expense. Boarding passes and itinerary may also be required. |

| Are digital receipts acceptable for reimbursement? | Yes, scanned or digital copies of receipts are generally accepted if they are clear and legible, and meet the organization's policy requirements. |

| Is a credit card statement sufficient proof of travel expenses? | No. Credit card statements alone usually do not provide enough detail. Itemized receipts are necessary to verify specific expenditures. |

| What supporting documents should accompany travel expense receipts? | Supporting documents may include travel authorizations, approvals, conference registrations, and proof of payment where applicable. |

| How should lost receipts be handled? | Submit a signed lost receipt affidavit or explanation form. Some organizations may require additional approval in the absence of a physical receipt. |

| What information must be included on a valid travel receipt? | Date of purchase, vendor name, detailed description of goods or services, and payment amount are essential for validation. |

| Are meal expenses reimbursable without receipts? | Generally not. Most policies require itemized receipts to confirm meal expenses, although per diem allowances may vary by organization. |

What Documents Are Necessary for Travel Expense Receipt Reimbursement? Infographic