Receipt documents necessary for employee travel reimbursement include detailed proof of expenses such as airline tickets, hotel invoices, meal receipts, and transportation bills. These documents must clearly show the date, amount, vendor details, and purpose of the expense to ensure accurate and compliant reimbursement processing. Properly organized receipts streamline approval workflows and prevent delays in employee reimbursements.

What Receipt Documents are Necessary for Employee Travel Reimbursement?

| Number | Name | Description |

|---|---|---|

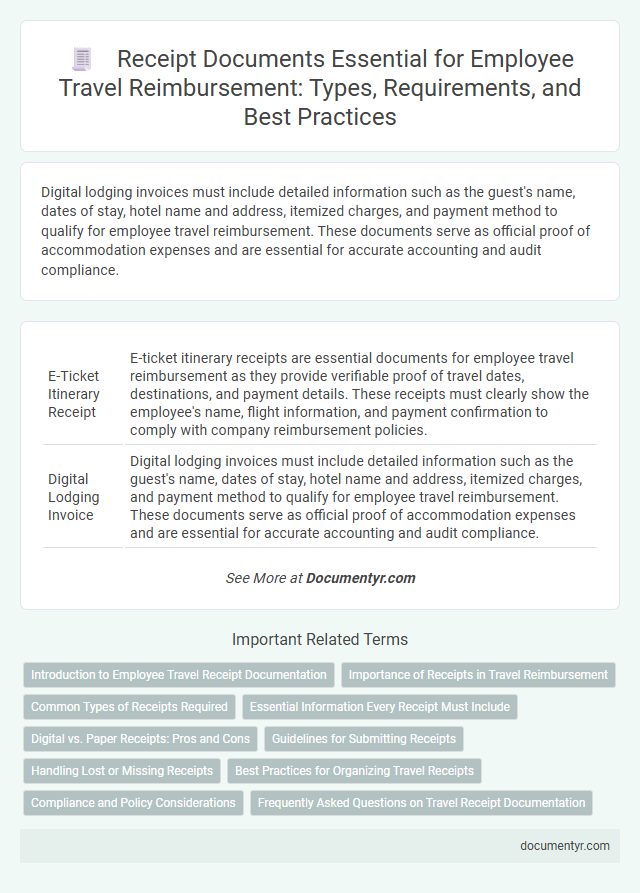

| 1 | E-Ticket Itinerary Receipt | E-ticket itinerary receipts are essential documents for employee travel reimbursement as they provide verifiable proof of travel dates, destinations, and payment details. These receipts must clearly show the employee's name, flight information, and payment confirmation to comply with company reimbursement policies. |

| 2 | Digital Lodging Invoice | Digital lodging invoices must include detailed information such as the guest's name, dates of stay, hotel name and address, itemized charges, and payment method to qualify for employee travel reimbursement. These documents serve as official proof of accommodation expenses and are essential for accurate accounting and audit compliance. |

| 3 | Electronic Meal Receipt | Electronic meal receipts required for employee travel reimbursement must clearly display the date, vendor name, itemized food purchases, and total amount paid to comply with corporate and IRS guidelines. These digital documents ensure accurate expense verification and prompt approval by providing a transparent record of meal costs during business travel. |

| 4 | Ride-Hailing Fare Receipt (e.g., Uber, Grab) | For employee travel reimbursement, ride-hailing fare receipts such as Uber or Grab must include the date, time, pick-up and drop-off locations, fare breakdown, and payment confirmation. These detailed receipts serve as proof of transportation expenses and are essential for accurate accounting and compliance with company travel policies. |

| 5 | E-Boarding Pass Proof | E-Boarding passes serve as essential receipt documents for employee travel reimbursement, providing verifiable proof of flight participation and travel dates. These digital records include passenger name, flight details, and timestamps, ensuring compliance with company travel policies and audit requirements. |

| 6 | Mobile Payment Proof (e.g., Apple Pay, Google Pay Receipt) | Mobile payment proofs such as Apple Pay and Google Pay receipts are essential for employee travel reimbursement as they provide a secure, timestamped digital record of transactions that align with company expense policies. These electronic receipts must clearly show the merchant name, transaction date, and amount to validate travel-related expenses efficiently. |

| 7 | Conference Registration E-Receipt | Conference registration e-receipts are essential documents for employee travel reimbursement as they provide official proof of payment and detail the specific event attended, including dates and fees. These digital receipts must include the employee's name, event name, payment amount, and transaction date to ensure compliance with company reimbursement policies. |

| 8 | Per Diem Allowance Confirmation | Receipts confirming per diem allowance eligibility must include itemized expenses such as meals and lodging, clearly matching the organizational travel policy requirements. These documents validate the amount claimed and ensure compliance with IRS guidelines for per diem reimbursement during employee travel. |

| 9 | Contactless Transit Pass Receipt | Contactless transit pass receipts serve as essential documentation for employee travel reimbursement, providing precise transaction dates, amounts, and pass details critical for verifying travel expenses. Employers often require digital or printed receipts from transit agencies or payment apps to ensure compliance with travel policies and facilitate accurate expense reporting. |

| 10 | Itemized Business Expense E-Receipt | An itemized business expense e-receipt is essential for employee travel reimbursement as it provides detailed proof of transactions, including descriptions, quantities, and prices of purchased items or services. Employers require these digital receipts to verify expenses, ensure compliance with company policies, and facilitate accurate accounting and auditing processes. |

Introduction to Employee Travel Receipt Documentation

Receipts play a crucial role in the employee travel reimbursement process, serving as proof of expenses incurred. Proper documentation ensures compliance with company policies and facilitates smooth reimbursement. Understanding which receipt documents are necessary helps you prepare accurate and complete reports for faster approvals.

Importance of Receipts in Travel Reimbursement

Receipts play a crucial role in employee travel reimbursement by providing proof of expenses incurred during business trips. Without proper documentation, your reimbursement claims may be delayed or denied.

- Proof of Expense - Receipts verify the actual costs of transportation, lodging, and meals that employees pay while traveling for work.

- Compliance with Company Policy - Receipts ensure that reimbursement claims align with the employer's travel and expense guidelines.

- Accurate Record-Keeping - Retaining receipts supports precise accounting and auditing processes within the organization.

Common Types of Receipts Required

Receipts are essential documents for processing employee travel reimbursements accurately. Understanding the common types of receipts required helps you avoid delays and ensures compliance with company policies.

- Transportation Receipts - These include airline tickets, train fares, taxi or ride-sharing invoices, and car rental agreements proving travel expenses.

- Accommodation Receipts - Hotel invoices or lodging bills showing dates of stay and payment details are necessary for reimbursement.

- Meal Receipts - Receipts from restaurants or food vendors during travel must detail the date and amount spent for meal expense claims.

Collecting these common receipts guarantees smoother processing of your employee travel reimbursements.

Essential Information Every Receipt Must Include

What receipt documents are necessary for employee travel reimbursement? Receipts must clearly show the date, vendor, and total amount paid to validate expenses. Including the purpose of the expense and employee name ensures compliance with company policies.

Digital vs. Paper Receipts: Pros and Cons

When submitting receipts for employee travel reimbursement, understanding the differences between digital and paper receipts is essential. Your choice impacts the ease of processing and record keeping.

- Digital Receipts Offer Convenience - They can be easily stored, searched, and submitted electronically, reducing physical storage needs.

- Paper Receipts Provide Tangibility - Physical copies serve as direct proof and are sometimes required for official audits.

- Digital Receipts May Face Compatibility Issues - Some systems may not accept certain formats or need manual conversion, causing delays.

Guidelines for Submitting Receipts

Receipt documents are essential for verifying expenses during employee travel reimbursement. They must clearly show the date, vendor, amount, and description of the service or product purchased.

Guidelines for submitting receipts require that you provide legible and original copies, often in digital format. Receipts should be submitted promptly, accompanied by appropriate forms or expense reports to ensure timely processing.

Handling Lost or Missing Receipts

Receipts for transportation, lodging, meals, and other travel-related expenses are necessary for employee travel reimbursement. Accurate records ensure compliance with company policies and streamline the reimbursement process.

If you lose or misplace a receipt, notify your finance or accounting department immediately. Provide alternative proof of the expense, such as credit card statements or bank transaction records. Many organizations require a signed affidavit explaining the missing receipt to process reimbursement.

Best Practices for Organizing Travel Receipts

Receipt documents play a crucial role in processing employee travel reimbursement accurately. Essential receipts include transportation tickets, hotel invoices, meal expenses, and any other travel-related costs incurred during the trip.

Best practices for organizing travel receipts involve categorizing them by type and date to streamline submission and review. Clear labeling and digital storage of receipts can significantly reduce errors and expedite reimbursement for your claims.

Compliance and Policy Considerations

Receipts for employee travel reimbursement must include detailed information such as the date, amount, merchant name, and description of the expense to meet compliance standards. Your organization's travel policy often requires original, itemized receipts to verify the legitimacy of expenses and ensure adherence to internal controls. Retaining and submitting these documents promptly helps avoid delays and supports accurate financial auditing.

What Receipt Documents are Necessary for Employee Travel Reimbursement? Infographic