To ensure your receipt submissions are tax deductible, you must provide original receipts showing detailed purchase information such as vendor name, date, itemized description, and total amount paid. Supporting documents like credit card statements or bank slips may be required to verify the transaction. Properly organized and complete documentation strengthens the legitimacy of your tax deductions during audits.

What Documents Do You Need for Tax Deductible Receipt Submissions?

| Number | Name | Description |

|---|---|---|

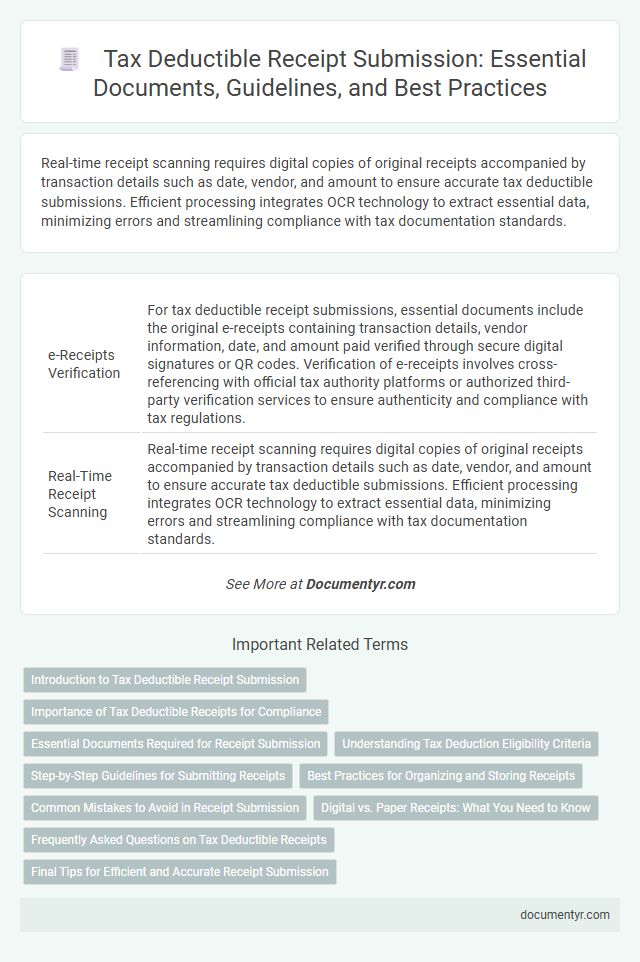

| 1 | e-Receipts Verification | For tax deductible receipt submissions, essential documents include the original e-receipts containing transaction details, vendor information, date, and amount paid verified through secure digital signatures or QR codes. Verification of e-receipts involves cross-referencing with official tax authority platforms or authorized third-party verification services to ensure authenticity and compliance with tax regulations. |

| 2 | Real-Time Receipt Scanning | Real-time receipt scanning requires digital copies of original receipts accompanied by transaction details such as date, vendor, and amount to ensure accurate tax deductible submissions. Efficient processing integrates OCR technology to extract essential data, minimizing errors and streamlining compliance with tax documentation standards. |

| 3 | Blockchain-Authenticated Receipts | Blockchain-authenticated receipts require submission of the original digital receipt linked to a blockchain transaction ID to ensure verifiable authenticity. Supporting documents such as proof of purchase, transaction date, and vendor details enhance the credibility and eligibility of tax-deductible claims. |

| 4 | Machine-Readable Invoice Format (MRIF) | Tax deductible receipt submissions require a Machine-Readable Invoice Format (MRIF), which includes detailed transaction data encoded in a standardized digital format to ensure accuracy and compliance with tax authority regulations. MRIF documents must contain essential elements such as supplier identification, invoice number, date, itemized charges, and tax information to qualify for tax deductions and facilitate automated processing. |

| 5 | Digital Expense Tags | For tax deductible receipt submissions, digital expense tags such as transaction IDs, vendor details, and payment dates are essential for accurate record-keeping and audit compliance. These digital tags enhance the organization and verification of expenses, ensuring claims meet tax authority requirements. |

| 6 | Automated Deduction Categorization | Tax deductible receipt submissions require documents such as official receipts, invoices, and proof of payment, which automated deduction categorization systems analyze using OCR and AI to classify expenses accurately. These systems enhance tax compliance by cross-referencing receipt data with tax codes, reducing manual errors and submission delays. |

| 7 | Zero-Paper Audit Trail | For tax-deductible receipt submissions, maintain digital copies of receipts with clear timestamps, vendor details, and transaction amounts to ensure a zero-paper audit trail. Utilize cloud-based expense management systems that automatically capture and store receipts, enhancing accuracy and compliance while eliminating the need for physical documents. |

| 8 | Optical Character Recognition (OCR) Receipts | For tax-deductible receipt submissions, you need scanned or photographed receipts that are compatible with Optical Character Recognition (OCR) technology to ensure accurate data extraction of merchant details, dates, and amounts. Verified OCR receipts streamline the validation process by converting printed text into editable, searchable data, facilitating efficient record-keeping and compliance with tax regulations. |

| 9 | Taxonomy-Linked Document Submission | Tax deductible receipt submissions require documents such as official donation receipts, proof of payment, and organizational tax identification numbers, all linked through a standardized taxonomy to ensure compliance and verification. Proper categorization using taxonomy-linked document submission streamlines validation processes and enhances the accuracy of financial records for tax deductions. |

| 10 | Cloud-Based Receipt Repository | For tax-deductible receipt submissions, a cloud-based receipt repository consolidates digital copies of purchase receipts, invoices, and payment proofs, ensuring easy access and organized storage for IRS verification. Secure platforms with metadata tagging and OCR capabilities streamline the categorization and retrieval of tax-relevant documents, enhancing accuracy and compliance during audits. |

Introduction to Tax Deductible Receipt Submission

Submitting a tax deductible receipt is essential for claiming eligible expenses on your tax return. Accurate documentation helps ensure compliance with tax regulations and maximizes your eligible deductions. Proper understanding of required documents streamlines the submission process and supports valid claims.

Importance of Tax Deductible Receipts for Compliance

Tax deductible receipts are essential for verifying eligible expenses when filing tax returns. Proper documentation ensures compliance with tax regulations and simplifies audit processes.

- Accurate Proof of Donation - Tax deductible receipts serve as official proof required by the tax authorities to validate charitable contributions.

- Record Keeping - Maintaining organized receipts helps individuals and businesses track deductible expenses accurately year-round.

- Audit Protection - Presenting valid tax deductible receipts during audits prevents disputes and supports legitimate claims for deductions.

Essential Documents Required for Receipt Submission

Essential documents for tax deductible receipt submissions include original receipts that clearly show the vendor's name, date of purchase, and amount paid. Bank statements or credit card slips may supplement these receipts to verify the transaction.

Invoices or bills that detail the goods or services acquired are often required for proper tax documentation. Proof of payment such as canceled checks can also serve as supporting evidence for your submission.

Understanding Tax Deduction Eligibility Criteria

What documents do you need to submit for a tax-deductible receipt? Receipts must include the donor's name, date of donation, and amount contributed. Proof of payment such as bank statements or credit card slips also supports eligibility.

How can you verify if a receipt qualifies for tax deduction? The receipt should come from a registered charitable organization recognized by tax authorities. It must clearly state the organization's tax identification number and donation purpose.

Why is it important to keep original receipts for tax deduction claims? Original receipts serve as legal proof during tax audits and submission reviews. Digital copies may be accepted, but originals provide stronger validation of transactions.

Step-by-Step Guidelines for Submitting Receipts

To ensure successful tax deductible receipt submissions, understanding the required documents is essential. Follow these step-by-step guidelines to streamline the process efficiently.

- Gather Original Receipts - Collect all original purchase or expense receipts relevant to your tax deductions.

- Include Proof of Payment - Attach bank statements or credit card slips confirming the transaction.

- Prepare Supporting Documents - Provide invoices, contracts, or letters that substantiate the expense claim.

Submitting a complete set of properly organized documents enhances the likelihood of tax deduction approval.

Best Practices for Organizing and Storing Receipts

Organizing and storing receipts efficiently ensures smoother tax deductible receipt submissions. Maintain categorized folders or digital files based on expense types and dates to quickly locate documents when needed. Secure your receipts in both physical and digital formats to prevent loss and facilitate easy access during tax preparation.

Common Mistakes to Avoid in Receipt Submission

Proper documentation is essential for tax-deductible receipt submissions to ensure compliance with tax regulations. Missing or incomplete receipts can lead to rejected claims or audits.

Common mistakes include submitting handwritten receipts or failing to include the vendor's details and transaction date. Ensure receipts are legible, clearly show the amount paid, and are submitted within the required timeframe.

Digital vs. Paper Receipts: What You Need to Know

When submitting tax deductible receipts, understanding the differences between digital and paper receipts is crucial for proper documentation. Both formats have specific requirements to ensure compliance with tax regulations.

- Digital Receipts Must Be Clear and Legible - High-quality images or PDFs that show all necessary details such as date, vendor, and amount are essential for validation.

- Paper Receipts Should Be Original and Intact - Physical copies must be preserved without damage to maintain authenticity for tax authorities.

- Both Formats Require Accurate Itemization - Receipts must clearly itemize purchases to qualify for tax deductions and to support audit processes.

Frequently Asked Questions on Tax Deductible Receipts

Understanding the necessary documents for tax deductible receipt submissions is essential for accurate reporting. Proper documentation ensures compliance with tax regulations and maximizes eligible deductions.

Receipts must include the donor's name, donation amount, date of contribution, and the registered charity's details. Official tax receipts often require the charity's registration number to validate tax exemption status. Proof of payment, such as bank statements or credit card slips, supports the authenticity of the receipt.

What Documents Do You Need for Tax Deductible Receipt Submissions? Infographic