To claim medical expense receipts for tax deductions, you need to provide official documents including detailed invoices or receipts that specify the medical services or treatments received, dates, and amounts paid. Proof of payment such as credit card statements or bank slips may also be required to validate the transaction. Keeping organized records of prescriptions, medical reports, and insurance claims further strengthens the legitimacy of your tax deduction claims.

What Documents Are Required for Medical Expense Receipts for Tax Deductions?

| Number | Name | Description |

|---|---|---|

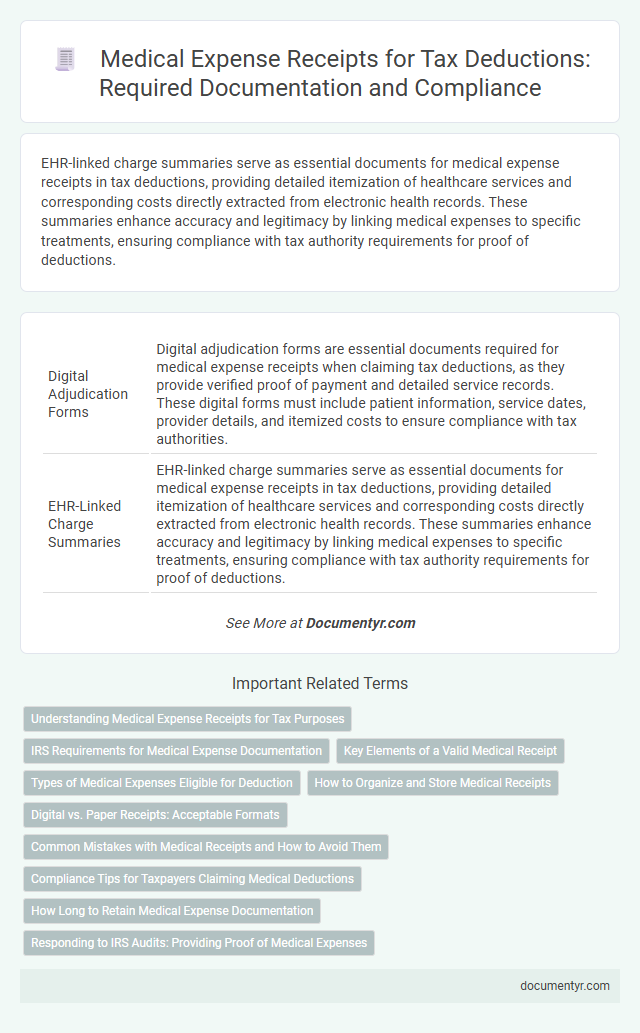

| 1 | Digital Adjudication Forms | Digital adjudication forms are essential documents required for medical expense receipts when claiming tax deductions, as they provide verified proof of payment and detailed service records. These digital forms must include patient information, service dates, provider details, and itemized costs to ensure compliance with tax authorities. |

| 2 | EHR-Linked Charge Summaries | EHR-linked charge summaries serve as essential documents for medical expense receipts in tax deductions, providing detailed itemization of healthcare services and corresponding costs directly extracted from electronic health records. These summaries enhance accuracy and legitimacy by linking medical expenses to specific treatments, ensuring compliance with tax authority requirements for proof of deductions. |

| 3 | Blockchain-Verified Medical Invoices | Blockchain-verified medical invoices provide immutable and tamper-proof records essential for tax deductions, ensuring authenticity and reducing fraud in medical expense claims. These digital receipts must include patient details, treatment information, healthcare provider credentials, and transaction timestamps verified on the blockchain to qualify for tax deductions. |

| 4 | QR-Embedded Prescription Receipts | Medical expense receipts for tax deductions require QR-embedded prescription receipts, which must include detailed information such as the patient's name, date of service, prescribed medications, and the healthcare provider's credentials encoded within the QR code for authenticity verification. These digital receipts enhance accuracy, prevent fraud, and streamline the submission process by allowing tax authorities to quickly verify the legitimacy of medical expenses. |

| 5 | AI-Generated Diagnosis Statements | AI-generated diagnosis statements must include the patient's name, diagnosis details, date of service, and the healthcare provider's credentials to qualify as valid medical expense receipts for tax deductions. Properly formatted digital signatures or authentication codes ensure the receipt's compliance with tax authority requirements. |

| 6 | FHIR-Compliant Treatment Records | FHIR-compliant treatment records must include detailed patient information, dates of service, and itemized medical procedures to qualify as valid documents for medical expense receipts in tax deductions. Accurate documentation of healthcare provider credentials and treatment codes ensures compliance with tax authority regulations and facilitates seamless expense verification. |

| 7 | E-signed Practitioner Affidavits | Medical expense receipts eligible for tax deductions must include proof of payment and a detailed description of the medical services or products received, with E-signed practitioner affidavits serving as a valid electronic signature confirming the authenticity and accuracy of the information provided. The inclusion of E-signed affidavits ensures compliance with tax authority guidelines while streamlining the submission process for electronic records. |

| 8 | Encrypted Telehealth Billing Receipts | Encrypted telehealth billing receipts must include the patient's name, date of service, provider's details, and a clear description of the medical service rendered to qualify for tax deductions on medical expenses. Ensuring the receipt is securely encrypted protects sensitive health information while meeting IRS documentation requirements for medical expense claims. |

| 9 | Smart OCR Medical Claim Summaries | Medical expense receipts for tax deductions require detailed documentation including itemized bills, prescription copies, and official payment proofs, all of which can be efficiently extracted using Smart OCR Medical Claim Summaries technology. This advanced system enhances accuracy by automatically recognizing and categorizing key medical expense data, streamlining the submission process for tax benefits. |

| 10 | Patient-Portal Downloaded Billing History | Patient-portal downloaded billing history must include detailed service dates, provider information, and itemized charges to qualify as valid medical expense receipts for tax deductions. Accurate documentation ensures compliance with IRS requirements and facilitates claim verification during audits. |

Understanding Medical Expense Receipts for Tax Purposes

Medical expense receipts are essential documents required to claim tax deductions on healthcare costs. These receipts serve as proof of payments made for medical treatments, prescription medications, and related healthcare services.

To qualify for tax deductions, receipts must clearly show the patient's name, the date of service, the type of medical service or product, and the amount paid. Receipts from licensed medical practitioners, pharmacies, hospitals, and medical equipment suppliers are typically accepted by tax authorities.

IRS Requirements for Medical Expense Documentation

| Document Type | Description | IRS Requirements |

|---|---|---|

| Receipts from Medical Providers | Official receipts or invoices showing payment for medical services, including doctor's fees, hospital charges, and prescriptions. | Must include the provider's name, date of service, description of service, and amount paid. Receipts should be detailed and valid for IRS audits. |

| Cancelled Checks or Bank Statements | Proof of payment for medical expenses when receipts are unavailable or to supplement receipts. | Must clearly show the payee's name, payment date, and amount. Necessary when receipts lack detail or for services paid by check or electronic transfer. |

| Prescription Labels and Pharmacy Bills | Documentation of prescription medications purchased, including labels from the pharmacy and detailed bills. | Include the patient's name, prescription details, date filled, and amount paid. Required to verify the expense qualifies as a medical deduction. |

| Insurance Statements | Explanation of Benefits (EOB) or payment summaries from health insurance providers showing amounts paid by insurance and co-pays. | Essential to document the actual out-of-pocket medical expenses, excluding any amounts reimbursed by insurance. |

| Medical Mileage Logs | Records of mileage driven for medical purposes, if claiming mileage deductions. | Logs must include dates, mileage, purpose of trip, and destination. IRS requires detailed and contemporaneous records. |

| Statements from Medical Suppliers | Bills or receipts for medical equipment, supplies, and devices necessary for medical care. | Documents must state the supplier's name, description of goods, date, and price. Important for validating deductible durable medical expenses. |

Key Elements of a Valid Medical Receipt

Medical expense receipts must include specific details to qualify for tax deductions. Key elements of a valid medical receipt are the patient's name, the date of service, and a clear description of the medical service or product provided. You should also ensure the receipt shows the amount paid and the healthcare provider's name or official stamp.

Types of Medical Expenses Eligible for Deduction

Medical expense receipts must include detailed documentation to qualify for tax deductions. Types of eligible expenses typically cover payments for hospital visits, prescription medications, and dental care.

You should retain receipts that clearly show the date, amount paid, and the provider's information. Eligible medical expenses also include costs for medical devices, therapy sessions, and certain transportation related to medical treatment. Proper documentation ensures you can accurately claim deductions on your tax return.

How to Organize and Store Medical Receipts

Organizing and storing medical expense receipts properly is essential for maximizing tax deductions. Efficient management ensures all necessary documents are readily available during tax filing or audits.

- Sort Receipts by Date - Arrange medical receipts chronologically to easily track expenses over the tax year.

- Use Dedicated Folders or Envelopes - Keep all medical expense documents in labeled folders or envelopes to prevent loss or damage.

- Digitize Your Receipts - Scan or photograph receipts and store them securely in digital files for backup and convenience.

Maintaining organized and accessible medical receipts supports accurate tax deduction claims and simplifies financial record-keeping.

Digital vs. Paper Receipts: Acceptable Formats

What documents are required for medical expense receipts for tax deductions? You must keep receipts that clearly show the date, provider, and amount paid. Both digital and paper receipts are acceptable if they contain all necessary information.

Are digital receipts valid for medical expense tax deductions? Digital receipts, such as PDFs or emailed confirmations, are widely accepted by tax authorities. Ensure these electronic documents are legible and stored securely for easy access during audits.

Can paper receipts be used for claiming medical expenses on taxes? Paper receipts remain a valid form of proof when they detail the service provider, payment date, and amount. Keep them organized to simplify the deduction claim process.

How should digital medical receipts be stored for tax purposes? Store digital copies in secure folders or cloud storage with backup options to prevent data loss. These methods help maintain receipt integrity and facilitate quick retrieval if needed.

Is it necessary to convert paper receipts to digital format for tax deductions? Converting paper receipts to digital copies is optional but recommended for convenience and preservation. Ensure scanned copies are clear and complete to meet documentation standards.

Common Mistakes with Medical Receipts and How to Avoid Them

Medical expense receipts are essential for claiming tax deductions accurately. Ensuring proper documentation helps prevent errors during tax filing.

- Missing Essential Details - Receipts must include the provider's name, date of service, and amount paid to qualify for deductions.

- Illegible or Incomplete Receipts - Clear, readable receipts avoid rejection; always keep original copies or high-quality scans.

- Mixing Personal and Medical Expenses - Separate and itemize receipts to ensure only eligible medical expenses are claimed.

Compliance Tips for Taxpayers Claiming Medical Deductions

Medical expense receipts are essential documents for taxpayers claiming deductions on their tax returns. These receipts must include detailed information such as the date of service, provider's name, and the amount paid to ensure compliance with tax authorities.

Taxpayers should keep original receipts or vendor-issued statements to substantiate their medical expense claims. Organizing receipts by date and type of medical service helps streamline the deduction process and minimizes the risk of audit discrepancies.

How Long to Retain Medical Expense Documentation

Medical expense receipts must be retained to support tax deduction claims and ensure compliance with tax regulations. The IRS generally recommends keeping medical expense documentation for at least three years from the date you file your tax return. Retaining receipts and related documents for this period helps verify expenses in case of an audit or request for further information.

What Documents Are Required for Medical Expense Receipts for Tax Deductions? Infographic