Employees need to submit original receipts or clear digital copies as proof of expenses incurred. Supporting documents such as itemized invoices, credit card statements, or payment confirmations are often required to verify the transaction details. Accurate expense reports including dates, amounts, and purpose of the expense help ensure compliance with company policies.

What Documents Does an Employee Need for Submitting Expense Receipts?

| Number | Name | Description |

|---|---|---|

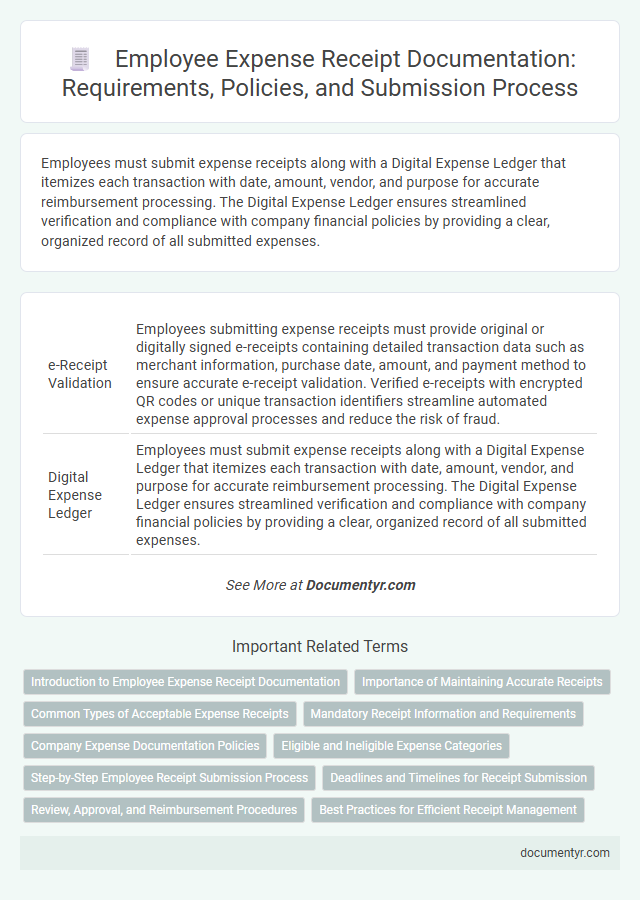

| 1 | e-Receipt Validation | Employees submitting expense receipts must provide original or digitally signed e-receipts containing detailed transaction data such as merchant information, purchase date, amount, and payment method to ensure accurate e-receipt validation. Verified e-receipts with encrypted QR codes or unique transaction identifiers streamline automated expense approval processes and reduce the risk of fraud. |

| 2 | Digital Expense Ledger | Employees must submit expense receipts along with a Digital Expense Ledger that itemizes each transaction with date, amount, vendor, and purpose for accurate reimbursement processing. The Digital Expense Ledger ensures streamlined verification and compliance with company financial policies by providing a clear, organized record of all submitted expenses. |

| 3 | Smart Scan Reconciliation | Employees submitting expense receipts for Smart Scan Reconciliation must provide original receipts or digital copies that clearly display vendor details, transaction date, amount, and payment method to ensure accurate automated processing. Supporting documents such as itemized bills, travel itineraries, and credit card statements may be required to validate expenses and facilitate seamless integration with expense management software. |

| 4 | Zero-Paper Audit Trail | Employees submitting expense receipts must provide digital copies of original invoices, detailed transaction records, and proof of payment to establish a zero-paper audit trail, ensuring compliance and streamlined verification. Electronic expense management systems automatically capture and store these documents in encrypted formats, enhancing accuracy and facilitating seamless audits. |

| 5 | AI-Audited Proof of Purchase | Employees must submit original receipts or AI-audited proof of purchase that includes detailed transaction data, vendor information, and timestamps to ensure accuracy and compliance during expense reimbursement. These AI-verified documents streamline auditing by automatically flagging inconsistencies and validating expense legitimacy. |

| 6 | Open Banking Transaction Attachments | Employees submitting expense receipts should provide Open Banking transaction attachments, including detailed transaction statements that verify payment dates, amounts, and merchant information. These documents ensure transparent and accurate expense reporting by linking directly to authenticated bank transactions. |

| 7 | Blockchain-Verified Invoice | Employees must provide blockchain-verified invoices as proof of authenticity and tamper-proof validation when submitting expense receipts. These digital documents ensure enhanced transparency and streamline the reimbursement process by securely recording transaction details on a decentralized ledger. |

| 8 | Geo-Tagged Expense Submission | Employees must submit geo-tagged expense receipts that include location metadata to verify the place of transaction accurately. Essential documents include original expense receipts with embedded GPS coordinates, corporate credit card statements, and timestamped photos of the expense to ensure compliance with audit requirements. |

| 9 | Automated VAT Capture | Employees submitting expense receipts for Automated VAT Capture must provide original receipts containing detailed supplier information, VAT identification numbers, and clear itemized expenses to ensure accurate tax deduction processing. Digital copies must be legible and compliant with tax authority standards to facilitate seamless automated verification and reimbursement. |

| 10 | Receipt Splitting Protocol | Employees submitting expense receipts must provide detailed original receipts itemizing each purchase to comply with the receipt splitting protocol, preventing combined or altered documents. Digital copies should clearly display vendor information, transaction date, and individual costs to ensure accurate reimbursement processing and audit trails. |

Introduction to Employee Expense Receipt Documentation

Submitting expense receipts is a crucial part of the employee reimbursement process. Proper documentation ensures accuracy and compliance with company policies and tax regulations.

Employees must provide specific documents to validate their expenses. These documents serve as evidence and facilitate smooth approval of reimbursements.

Importance of Maintaining Accurate Receipts

Accurate receipts are essential for verifying expense claims and ensuring reimbursement. Your expense receipts provide proof of purchase and support compliance with company policies and tax regulations. Maintaining clear and organized documentation simplifies the submission process and protects against discrepancies during audits.

Common Types of Acceptable Expense Receipts

Employees must submit clear and detailed expense receipts to ensure reimbursement approval. Common types of acceptable expense receipts include itemized receipts, credit card statements, and official invoices.

Itemized receipts provide an overview of each purchased item, including prices and taxes. Official invoices from vendors confirm the transaction and are often required for larger expenses.

Mandatory Receipt Information and Requirements

Employees must submit expense receipts that contain specific mandatory information to ensure proper reimbursement. Receipts lacking essential details may be rejected or delayed in processing.

- Date of Expense - The receipt must clearly show the exact date the expense was incurred to verify the period of the claim.

- Vendor Details - The receipt should include the name and contact information of the merchant or service provider for validation purposes.

- Itemized Description - Detailed listing of purchased items or services with corresponding prices must be present to support the expense amount.

Company Expense Documentation Policies

What documents does an employee need for submitting expense receipts? Employees must provide original, itemized receipts that clearly show the date, vendor, and amount of each expense. Company expense documentation policies often require submission of approval forms and detailed expense reports for verification and reimbursement processing.

Eligible and Ineligible Expense Categories

| Document Required | Eligible Expense Categories | Ineligible Expense Categories |

|---|---|---|

| Original Receipt | Travel expenses such as airfare, taxi fares, and hotel accommodations. | Personal expenses, fines, and penalties. |

| Itemized Invoice | Meals during business trips with detailed breakdown. | Entertainment not related to business purposes. |

| Proof of Payment | Office supplies purchased for business use. | Alcoholic beverages and gifts not aligned with company policy. |

| Expense Report Form | Conference fees and registration costs. | Expenses lacking proper documentation or receipts. |

| Approval Email or Document | Pre-approved expenses within company guidelines. | Unauthorized or unapproved miscellaneous expenses. |

Ensure your submitted documents align with these criteria to facilitate smooth expense reimbursement.

Step-by-Step Employee Receipt Submission Process

Employees must submit specific documents to ensure their expense receipts are processed accurately and efficiently. Understanding the step-by-step submission process helps avoid delays in reimbursement.

- Expense Receipt - Original or digital copies of receipts detailing the date, vendor, and amount spent are mandatory.

- Expense Report Form - A completed form summarizing the expenses and purpose must accompany receipts for verification.

- Approval Documentation - Manager or supervisor approval, either signed or electronic, is required before submission.

Following these steps guarantees a smooth and compliant expense reimbursement process.

Deadlines and Timelines for Receipt Submission

Employees must submit expense receipts promptly to ensure timely reimbursement and compliance with company policies. Missing deadlines can lead to delayed processing or rejection of claims.

Companies typically require receipts to be submitted within 30 to 60 days from the date of the expense. Some organizations enforce monthly cut-off dates, making it essential to keep track of submission timelines. Employees should verify specific deadlines in their expense policy to avoid complications.

Review, Approval, and Reimbursement Procedures

To submit expense receipts, you need to provide original receipts, a completed expense report form, and any relevant approval emails or authorization documents. The review process involves verifying the receipts against company policy and ensuring all submitted documents are accurate and legible. Once approved, reimbursement is processed according to the company's financial schedule, typically through payroll or direct deposit.

What Documents Does an Employee Need for Submitting Expense Receipts? Infographic