Expense receipt submission in nonprofit organizations requires specific documents including the original receipt showing detailed transaction information, proof of payment such as a bank statement or credit card slip, and a completed expense report form with appropriate authorization signatures. Supporting documentation like vendor invoices or contracts may also be required to validate the expense. Properly organized and accurate paperwork ensures compliance with organizational policies and audit requirements.

What Documents are Needed for Expense Receipt Submission in Nonprofit Organizations?

| Number | Name | Description |

|---|---|---|

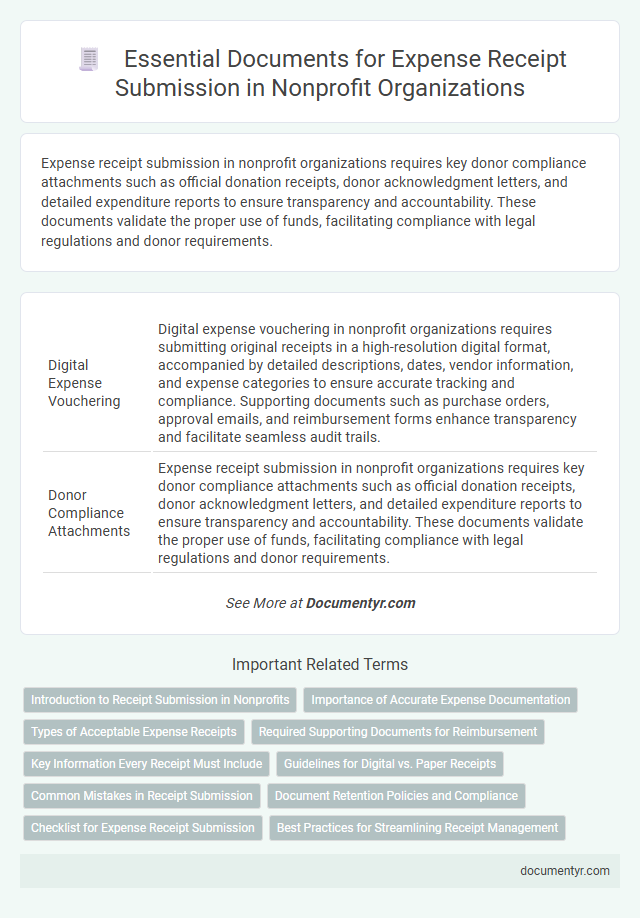

| 1 | Digital Expense Vouchering | Digital expense vouchering in nonprofit organizations requires submitting original receipts in a high-resolution digital format, accompanied by detailed descriptions, dates, vendor information, and expense categories to ensure accurate tracking and compliance. Supporting documents such as purchase orders, approval emails, and reimbursement forms enhance transparency and facilitate seamless audit trails. |

| 2 | Donor Compliance Attachments | Expense receipt submission in nonprofit organizations requires key donor compliance attachments such as official donation receipts, donor acknowledgment letters, and detailed expenditure reports to ensure transparency and accountability. These documents validate the proper use of funds, facilitating compliance with legal regulations and donor requirements. |

| 3 | Grant-Specific Invoice Certification | Expense receipt submission in nonprofit organizations requires grant-specific invoice certification to ensure compliance with funding agency requirements, including detailed invoices, proof of payment, and supporting documentation that aligns expenses with the approved grant budget. Accurate certification helps verify that all expenditures are allowable, allocable, and reasonable under the terms of the grant agreement. |

| 4 | Real-Time Spend Analytics Report | Expense receipt submission in nonprofit organizations requires accurate documentation such as invoices, payment proofs, and detailed expense descriptions to ensure compliance and transparency. Integrating these documents with real-time spend analytics reports enables organizations to monitor budget adherence, track expenditure patterns, and optimize financial decision-making effectively. |

| 5 | E-Receipt Blockchain Validation | Nonprofit organizations require detailed expense receipts including vendor invoices, payment proofs, and authorization signatures, with E-Receipt Blockchain Validation ensuring authenticity, tamper-proof records, and enhanced transparency. This digital validation method efficiently streamlines audit processes by securely linking transaction data to an immutable blockchain ledger, reducing fraud and administrative overhead. |

| 6 | Source-of-Funds Declaration | Nonprofit organizations require a Source-of-Funds Declaration alongside standard receipts and invoices to verify the legitimacy of expense submissions and ensure compliance with financial regulations. This declaration is essential for tracing funding origins, preventing misuse, and supporting transparent accounting practices. |

| 7 | Restricted Fund Disbursement Proof | Expense receipt submission in nonprofit organizations requires detailed documentation including original invoices, payment proofs, and signed disbursement vouchers to validate restricted fund usage. Restricted fund disbursement proof must specifically demonstrate compliance with donor-imposed limitations, often necessitating grant agreements and detailed budget reports. |

| 8 | Expense Pre-Approval Memo | Expense receipt submission in nonprofit organizations requires an Expense Pre-Approval Memo detailing the purpose, amount, and authorization of the expenditure to ensure compliance and transparency. This memo must be accompanied by original receipts or invoices to validate the expenses for accurate record-keeping and audit readiness. |

| 9 | Nonprofit Funder Acknowledgement Form | Nonprofit organizations typically require an Expense Receipt Submission to include a Nonprofit Funder Acknowledgement Form, which verifies funder support and compliance with grant terms. This form, alongside detailed receipts and invoices, ensures accurate documentation for financial audits and funding accountability. |

| 10 | Automated Receipt Parsing XML | Expense receipt submission in nonprofit organizations requires documents including itemized receipts, invoices, and proof of payment, all formatted for compatibility with automated receipt parsing XML systems to ensure accurate data extraction. Utilizing standardized XML schemas enables efficient validation, categorization, and integration of expense data into financial management software, enhancing transparency and compliance with regulatory standards. |

Introduction to Receipt Submission in Nonprofits

Submitting expense receipts is a crucial part of maintaining transparency and accountability in nonprofit organizations. Proper documentation ensures that all expenditures align with the organization's mission and comply with regulatory standards.

Receipts serve as proof of transactions and help in accurate financial reporting and auditing processes. Understanding the required documents for expense receipt submission simplifies the reimbursement and record-keeping efforts within nonprofits.

Importance of Accurate Expense Documentation

Accurate expense documentation in nonprofit organizations is essential for maintaining financial transparency and ensuring compliance with regulatory requirements. Proper receipts and supporting documents validate the authenticity of each expense, supporting effective budget management and audit readiness.

For expense receipt submission, you need original receipts, invoices, and any relevant proof of payment such as bank statements or credit card slips. Detailed descriptions and approval records further enhance the reliability of expense claims, preventing discrepancies and potential funding issues.

Types of Acceptable Expense Receipts

Nonprofit organizations require specific types of expense receipts for accurate submission and reimbursement. Acceptable expense receipts typically include detailed invoices, credit card statements, and original merchant-issued receipts that clearly show the date, amount, and nature of the expense. Receipts must also align with the nonprofit's financial policies and demonstrate legitimate business-related expenditures.

Required Supporting Documents for Reimbursement

Nonprofit organizations require specific documents to process expense receipt submissions accurately. Proper supporting documents ensure transparency and compliance with financial policies.

- Original Receipt - The original, itemized receipt provides proof of purchase and details necessary for verification.

- Expense Report - A completed expense report summarizes the reimbursable expenses and links them to organizational activities.

- Approval Authorization - A signed approval from the relevant authority confirms the expense is legitimate and permitted.

Submitting all required supporting documents helps nonprofits maintain accurate accounting records and facilitates timely reimbursement.

Key Information Every Receipt Must Include

What key information must every receipt include for expense submission in nonprofit organizations? Receipts should clearly display the vendor's name, date of purchase, and detailed description of items or services acquired. Accurate totals and proof of payment are essential for proper financial documentation and auditing purposes.

Guidelines for Digital vs. Paper Receipts

Expense receipt submission in nonprofit organizations requires adherence to specific documentation guidelines to ensure transparency and compliance. Understanding the differences between digital and paper receipts is essential for accurate record-keeping.

- Digital Receipts Must Be Clear and Legible - Ensure all digital images or PDFs of receipts show the vendor, date, amount, and purpose clearly to meet auditing standards.

- Paper Receipts Require Original Copies - Submit original paper receipts without alterations or damage to validate the transaction.

- Retention Policy Applies to Both Formats - Keep your submitted receipts, whether digital or paper, for the duration specified by your nonprofit's financial policies, typically 3 to 7 years.

Common Mistakes in Receipt Submission

Expense receipt submission in nonprofit organizations requires specific documents to ensure proper accounting and compliance. Common mistakes during submission can delay reimbursement and complicate financial audits.

- Missing Supporting Documents - Failing to include original receipts, invoices, or proof of payment often results in rejected expense claims.

- Incorrect or Incomplete Information - Submitting receipts without necessary details like date, vendor name, or amount leads to confusion and delays.

- Unclear Expense Purpose - Not providing a clear description or justification for the expense causes difficulties in verifying its relevance to the nonprofit's mission.

Document Retention Policies and Compliance

Nonprofit organizations require specific documents for expense receipt submission to ensure compliance with regulatory standards. Proper document retention policies are essential to maintain transparency and accountability in financial reporting.

Receipts must clearly show the date, amount, vendor details, and purpose of the expense to validate transactions. Organizations should retain these documents for a minimum of seven years, adhering to IRS guidelines and state regulations. Compliance with these policies helps prevent audit issues and supports effective financial management within the nonprofit sector.

Checklist for Expense Receipt Submission

| Checklist for Expense Receipt Submission | Details |

|---|---|

| Original Expense Receipt | Must be a clear, itemized receipt showing date, vendor name, items or services purchased, and total amount spent. |

| Expense Report Form | Completed and signed form detailing the purpose of the expense, project or event it relates to, and the requester's information. |

| Approval Documentation | Written approval from authorized personnel, such as a supervisor or finance manager, confirming the legitimacy of the expense. |

| Proof of Payment | Copy of bank statement, credit card slip, or canceled check validating payment against the receipt. |

| Supporting Documents | Additional documents like mileage logs, conference agendas, or contracts relevant to the expense. |

| Vendor Information | Complete vendor contact details including name, address, and phone number for verification purposes. |

| Compliance Statement | Declaration that the expense complies with the nonprofit's policies and funding source restrictions. |

What Documents are Needed for Expense Receipt Submission in Nonprofit Organizations? Infographic