Receipts required for FSA or HSA reimbursements must clearly show the date of service, the provider's name, a description of the medical expense, and the amount paid. These documents often include itemized bills, Explanation of Benefits (EOBs), or pharmacy receipts that verify the eligible expense. Ensuring receipts meet these criteria helps prevent claim denials and speeds up the reimbursement process.

What Receipts Are Required for FSA or HSA Reimbursements?

| Number | Name | Description |

|---|---|---|

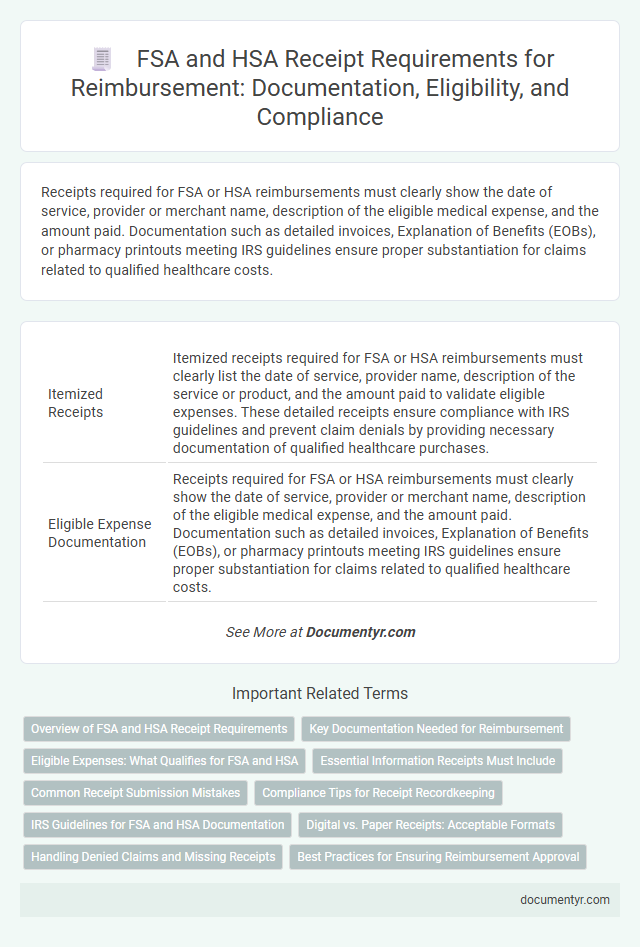

| 1 | Itemized Receipts | Itemized receipts required for FSA or HSA reimbursements must clearly list the date of service, provider name, description of the service or product, and the amount paid to validate eligible expenses. These detailed receipts ensure compliance with IRS guidelines and prevent claim denials by providing necessary documentation of qualified healthcare purchases. |

| 2 | Eligible Expense Documentation | Receipts required for FSA or HSA reimbursements must clearly show the date of service, provider or merchant name, description of the eligible medical expense, and the amount paid. Documentation such as detailed invoices, Explanation of Benefits (EOBs), or pharmacy printouts meeting IRS guidelines ensure proper substantiation for claims related to qualified healthcare costs. |

| 3 | EOB (Explanation of Benefits) | Explanation of Benefits (EOB) statements are essential receipts for FSA or HSA reimbursements, detailing medical services provided, amounts billed, the insurer's payment, and the patient's responsibility. These documents validate eligible expenses and must be submitted alongside itemized receipts or bills to ensure accurate and compliant reimbursement claims. |

| 4 | Prescription Pay Receipts | Prescription pay receipts must include detailed information such as the patient's name, date of service, medication name, amount paid, and provider details to qualify for FSA or HSA reimbursements. Clear itemization on these receipts ensures compliance with IRS requirements and facilitates accurate claims processing. |

| 5 | Provider Information Verification | Receipts required for FSA or HSA reimbursements must include detailed provider information such as the name, address, and contact number of the healthcare provider or pharmacy to verify the legitimacy of the expense. Accurate provider details ensure compliance with IRS regulations and facilitate smooth claim processing for eligible medical expenses. |

| 6 | Dual-purpose Expense Notation | Receipts required for FSA or HSA reimbursements must clearly indicate the date of service, provider name, and the amount paid, with a specific notation for dual-purpose expenses showing the eligible portion separately. This detailed documentation ensures accurate validation and compliance with IRS rules for medical expense reimbursements. |

| 7 | Over-the-Counter Receipt Requirement | Receipts for FSA or HSA reimbursements must include the date of purchase, item description, and amount paid to verify eligible expenses, especially for over-the-counter items. Over-the-counter receipt requirements mandate clear documentation proving the product qualifies for reimbursement under IRS guidelines, as many items need detailed proof to be accepted. |

| 8 | IRS Compliance Proof | Receipts required for FSA or HSA reimbursements must include the date of service, provider's name, description of the medical expense, and the amount paid to meet IRS compliance proof standards. These detailed receipts ensure eligibility verification and substantiation of qualified healthcare expenses under tax regulations. |

| 9 | Letter of Medical Necessity | Receipts required for FSA or HSA reimbursements must detail the date, description, provider, and amount of the medical expense, and a Letter of Medical Necessity (LMN) is essential when the expense involves non-standard treatments or supplies to confirm their medical purpose. An LMN must be written by a qualified healthcare provider, specifying the medical condition, prescribed treatment, and demonstrating that the expense is essential for the diagnosis or treatment to satisfy IRS documentation standards. |

| 10 | Digital Receipt Submission | Receipts required for FSA or HSA reimbursements must clearly show the date of service, provider or merchant name, itemized description of the expense, and payment amount to meet IRS standards. Digital receipt submission is supported by most FSA/HSA administrators, allowing participants to upload scanned or photographed receipts via secure mobile apps or online portals for faster and paperless expense verification. |

Overview of FSA and HSA Receipt Requirements

| Account Type | Receipt Requirements | Key Details |

|---|---|---|

| Flexible Spending Account (FSA) | Itemized receipts showing date of service, provider name, and expense description | Receipts must clearly indicate eligible medical expenses. Credit card statements alone are insufficient without detailed proof of the purchase. |

| Health Savings Account (HSA) | Receipts or invoices detailing the service, date, and provider, as well as the expense amount | Receipts are required for reimbursement and tax documentation purposes. Digital or paper copies are accepted but must include all relevant details. |

| General Notes | Receipts should be submitted promptly to avoid reimbursement delays | Keeping copies of all receipts is essential for audit and verification by the account administrator or IRS. |

Key Documentation Needed for Reimbursement

Receipts required for FSA or HSA reimbursements must clearly detail the date of service, provider name, and description of the medical expense. You need proof that the expense was eligible and incurred within the plan year.

Key documentation includes itemized receipts showing the type of service or product and the amount paid. Credit card statements or canceled checks alone are insufficient without supporting details.

Eligible Expenses: What Qualifies for FSA and HSA

Receipts for FSA and HSA reimbursements must clearly document eligible medical expenses to ensure compliance with IRS guidelines. Accurate receipts demonstrate that purchased items or services qualify for these tax-advantaged accounts.

- Itemized Details - Receipts must include the date, provider name, and description of the eligible medical service or product.

- Proof of Payment - Receipts should show the amount paid and confirm the transaction was completed by the FSA or HSA account holder.

- Eligible Expenses - Common eligible costs include prescriptions, doctor visits, medical devices, and certain over-the-counter medications with a prescription.

Receipts missing required information risk denial of reimbursement from FSA or HSA accounts.

Essential Information Receipts Must Include

```htmlWhat essential information must receipts include for FSA or HSA reimbursements? Receipts must clearly show the date of the service, the provider's name, and a detailed description of the medical expense. They should also include the amount paid and proof of payment to ensure eligibility for reimbursement.

```Common Receipt Submission Mistakes

Receipts required for FSA or HSA reimbursements must clearly show the date of service, provider's name, and the specific medical expense details. Common receipt submission mistakes include missing itemized information, illegible text, or receipts without proof of payment. Ensuring your receipts meet these criteria helps prevent delays or denials in reimbursement processing.

Compliance Tips for Receipt Recordkeeping

Receipts required for FSA or HSA reimbursements must clearly show the date of service, provider's name, and a detailed description of the eligible expense. Compliance tips for receipt recordkeeping include organizing documents promptly and ensuring all receipts are legible and retained for the required period by the IRS. You should maintain both physical and digital copies to avoid delays in claim processing and to meet audit requirements.

IRS Guidelines for FSA and HSA Documentation

Receipts required for FSA or HSA reimbursements must comply with IRS guidelines to ensure eligibility. Proper documentation verifies that expenses are qualified medical costs under tax regulations.

The IRS mandates that receipts include the date of service, provider's name, description of the expense, and the amount paid. These details help substantiate claims and prevent reimbursement denials. You should keep all receipts in case of an IRS audit or review by your plan administrator.

Digital vs. Paper Receipts: Acceptable Formats

Receipts are essential for verifying eligible expenses for FSA and HSA reimbursements. Both digital and paper receipts are accepted as long as they meet specific documentation criteria.

- Digital Receipts Accepted - Electronic copies such as PDFs, emails, or app-generated receipts are valid for reimbursement claims.

- Paper Receipts Required - Original printed receipts must include detailed information on the provider, date, and amount of the expense.

- Information Standards - All receipts must clearly show the service or product purchased, date of service, and payment amount to qualify for reimbursement.

Handling Denied Claims and Missing Receipts

For FSA or HSA reimbursements, receipts must clearly show the date of service, provider name, and the type of medical expense incurred. Receipts should match the expense claimed to avoid reimbursement delays or denials.

Handling denied claims requires promptly reviewing the reason for denial and submitting corrected or additional documentation. Missing receipts can often be replaced by requesting duplicate statements from the healthcare provider or pharmacy.

What Receipts Are Required for FSA or HSA Reimbursements? Infographic