Contractors need several key documents for invoice receipts, including a detailed purchase order, a signed contract specifying terms and payment conditions, and proof of completed work such as delivery notes or completion certificates. These documents ensure accuracy, confirm service delivery, and provide a legal basis for payment processing. Proper documentation helps avoid disputes and facilitates timely, efficient invoice approval.

What Documents Does a Contractor Need for Invoice Receipts?

| Number | Name | Description |

|---|---|---|

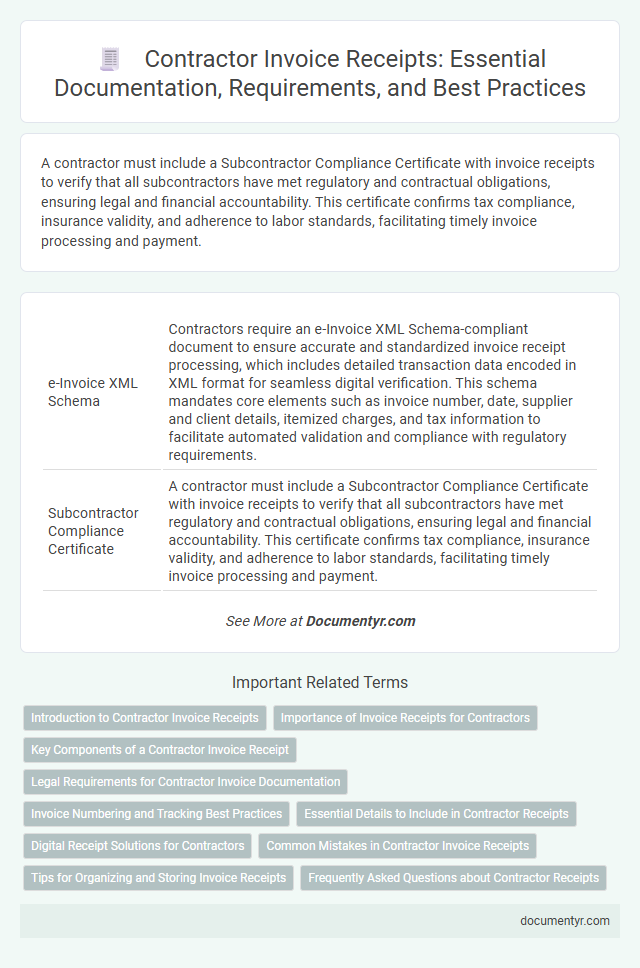

| 1 | e-Invoice XML Schema | Contractors require an e-Invoice XML Schema-compliant document to ensure accurate and standardized invoice receipt processing, which includes detailed transaction data encoded in XML format for seamless digital verification. This schema mandates core elements such as invoice number, date, supplier and client details, itemized charges, and tax information to facilitate automated validation and compliance with regulatory requirements. |

| 2 | Subcontractor Compliance Certificate | A contractor must include a Subcontractor Compliance Certificate with invoice receipts to verify that all subcontractors have met regulatory and contractual obligations, ensuring legal and financial accountability. This certificate confirms tax compliance, insurance validity, and adherence to labor standards, facilitating timely invoice processing and payment. |

| 3 | Digital Payment Acknowledgment | Contractors need digital payment acknowledgments such as electronic receipts, transaction confirmation emails, and digital payment gateway records to verify invoice payments accurately. These documents ensure transparent audit trails and facilitate seamless financial reconciliation in project management. |

| 4 | Retention Release Document | Contractors require a Retention Release Document to ensure the formal release of withheld funds after project milestones or final completion, confirming all contractual obligations have been met. This document serves as critical evidence for invoice receipts and financial audits, safeguarding both parties' interests in construction and service agreements. |

| 5 | Blockchain-Stamped Work Order | Contractors require blockchain-stamped work orders as key documents for invoice receipts, ensuring immutability and verifiable proof of service delivery. These blockchain-validated documents provide enhanced transparency and security, facilitating faster payment processing and reducing disputes. |

| 6 | Proof of Materials Delivery Docket | A contractor requires a Proof of Materials Delivery Docket as a critical document for invoice receipts, ensuring verification of the delivered materials' quantity and condition. This receipt acts as evidence that materials were received on-site, facilitating accurate payment processing and dispute resolution. |

| 7 | Automated Timesheet Integration Report | Contractors need an Automated Timesheet Integration Report to accurately link work hours with invoice receipts, ensuring precise billing and minimizing disputes. This document provides detailed time-tracking data synchronized with project management systems, enhancing transparency and payment verification. |

| 8 | Smart Contract Completion Statement | A contractor must provide a Smart Contract Completion Statement as a critical document for invoice receipts, detailing the fulfillment of contractual obligations and validating work completion. This statement facilitates transparent verification, ensuring timely payment and compliance with project terms in smart contract environments. |

| 9 | Mobile App Sign-Off Receipt | A contractor needs a Mobile App Sign-Off Receipt to digitally confirm job completion and client approval, ensuring accurate and timely invoicing through secure, timestamped records. This document integrates with invoicing software to streamline payment processing and maintain audit trails for compliance and dispute resolution. |

| 10 | e-Tax Deduction Certificate | Contractors require an e-Tax Deduction Certificate to validate tax withheld on invoice receipts, ensuring compliance with government tax regulations. This electronic document serves as proof of tax deductions made by the client, streamlining the contractor's accounting and tax filing processes. |

Introduction to Contractor Invoice Receipts

Contractor invoice receipts are essential documents that verify completed work and authorize payment. They serve as proof of services rendered and detail the agreed-upon charges.

You need specific documents to ensure accuracy and compliance when managing invoice receipts. These documents support the contractor's claims and facilitate smooth financial transactions.

Importance of Invoice Receipts for Contractors

Invoice receipts are essential documents for contractors to verify payment and maintain accurate financial records. These receipts serve as proof of transactions and support tax compliance and auditing processes.

- Proof of Payment - Invoice receipts confirm that contractors have received payment for services rendered or goods supplied.

- Financial Record-Keeping - Proper invoice receipts enable contractors to track income and manage budgets effectively.

- Tax Compliance - Invoice receipts provide necessary documentation for tax reporting and claiming deductions.

Contractors must collect and organize invoice receipts to ensure transparent and efficient business operations.

Key Components of a Contractor Invoice Receipt

| Document | Description | Purpose |

|---|---|---|

| Invoice | A detailed statement listing the services provided, including descriptions, quantities, and rates. | Serves as the primary billing document requesting payment for completed work. |

| Purchase Order (PO) | Official document issued by the client authorizing the contractor to perform the work and specifying terms. | Validates the invoiced services and confirms agreed pricing and scope. |

| Work Completion Report | Documentation confirming the completion of contracted tasks or milestones. | Supports the invoice by proving that the services billed have been rendered. |

| Timesheets | Records of hours worked by the contractor or subcontractors on the project. | Justifies labor charges listed on the invoice, ensuring accuracy. |

| Tax Identification Number (TIN) or VAT Certificate | Official identification for tax purposes assigned to the contractor. | Required for legal compliance and tax reporting in the invoice. |

| Payment Terms and Conditions | Defines payment schedules, methods, and penalties for late payments. | Ensures clear expectations and facilitates timely processing of invoice receipts. |

| Bank Details | Information required for electronic payment transfers including account number and bank name. | Enables smooth transaction of payments related to the invoice. |

Legal Requirements for Contractor Invoice Documentation

Contractors must provide precise and legally compliant invoice documentation to ensure payment processing and regulatory adherence. Essential documents include a detailed invoice, proof of work completion, and tax identification information.

Legal requirements for contractor invoice documentation often mandate inclusion of the contractor's business license, contract or purchase order references, and itemized charges linked to project milestones. Accurate time logs or delivery receipts support the validation of services rendered. These documents safeguard both the contractor and client by establishing clear proof of transaction and service fulfillment.

Invoice Numbering and Tracking Best Practices

Contractors need invoice receipts that include clear invoice numbering to ensure proper tracking and organization of payments. Implementing a systematic invoice numbering method, such as sequential or date-based codes, helps prevent duplication and simplifies record-keeping. Using digital tools or software for invoice tracking enhances accuracy and enables efficient retrieval of payment details when needed.

Essential Details to Include in Contractor Receipts

Contractors must provide specific documents for invoice receipts to ensure clear and accurate payment processing. Including essential details in contractor receipts supports verification and compliance with contractual agreements.

- Invoice Document - This includes the contractor's name, contact information, and a unique invoice number for identification.

- Detailed Service Description - Specifies the work performed, hours logged, and materials used to justify the charges listed.

- Payment Terms and Dates - Clarifies due dates, accepted payment methods, and any late fee policies to avoid disputes.

Digital Receipt Solutions for Contractors

Contractors need essential documents such as purchase orders, signed contracts, and delivery confirmation to support accurate invoice receipts. Digital receipt solutions streamline the collection and storage of these documents, enhancing organization and reducing errors. Your use of cloud-based platforms ensures quick access and efficient management of all necessary invoice records.

Common Mistakes in Contractor Invoice Receipts

Contractors must provide accurate and complete documents to ensure smooth processing of invoice receipts. Common errors in these documents can delay payment and cause disputes.

- Missing Purchase Order Number - Omitting the purchase order number causes confusion and slows approval processes.

- Incomplete Work Descriptions - Vague or insufficient details about the services rendered complicate verification and validation.

- Incorrect Tax Information - Errors in tax identification numbers or tax rates lead to billing inaccuracies and compliance issues.

Tips for Organizing and Storing Invoice Receipts

Contractors need to collect essential documents such as detailed invoices, purchase orders, and delivery receipts for accurate invoice receipt management. Maintaining clear and complete records ensures smooth financial tracking and compliance during audits.

Organize invoice receipts by categorizing them based on date, project, or vendor to facilitate quick retrieval. Store all documents digitally using cloud-based storage with secure backups to prevent data loss and enhance accessibility.

What Documents Does a Contractor Need for Invoice Receipts? Infographic