Organizing receipts in freelance invoicing requires key documents such as detailed invoices, proof of payment, and expense receipts to ensure accurate financial tracking and tax compliance. Including purchase orders and contracts can further validate transactions and support bookkeeping efforts. Maintaining digital or physical copies of these documents streamlines audit processes and enhances record-keeping efficiency.

What Documents Are Necessary for Receipt Organization in Freelance Invoicing?

| Number | Name | Description |

|---|---|---|

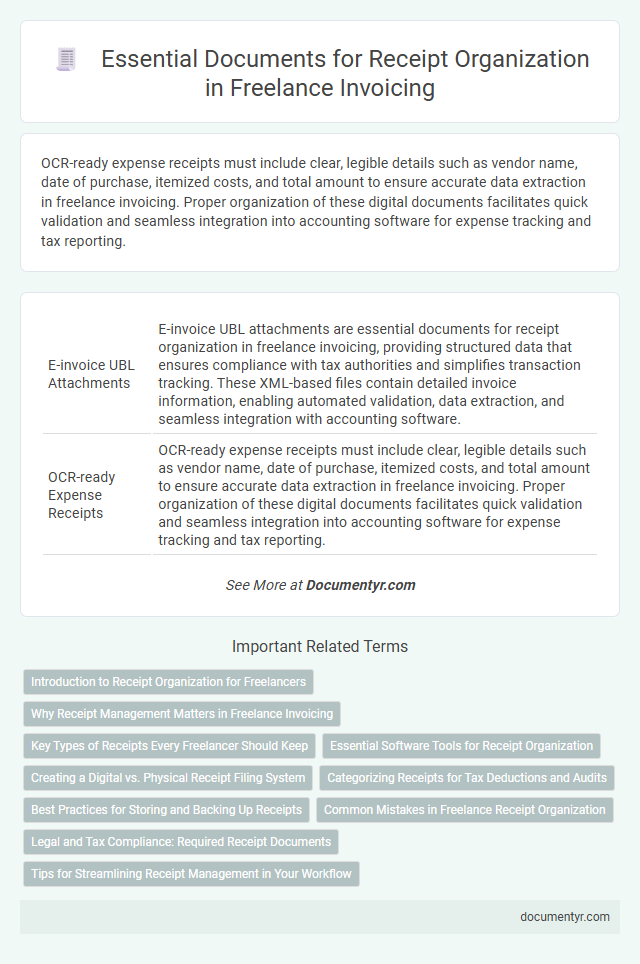

| 1 | E-invoice UBL Attachments | E-invoice UBL attachments are essential documents for receipt organization in freelance invoicing, providing structured data that ensures compliance with tax authorities and simplifies transaction tracking. These XML-based files contain detailed invoice information, enabling automated validation, data extraction, and seamless integration with accounting software. |

| 2 | OCR-ready Expense Receipts | OCR-ready expense receipts must include clear, legible details such as vendor name, date of purchase, itemized costs, and total amount to ensure accurate data extraction in freelance invoicing. Proper organization of these digital documents facilitates quick validation and seamless integration into accounting software for expense tracking and tax reporting. |

| 3 | Payment Reconciliation Statements | Payment reconciliation statements are essential for accurate receipt organization in freelance invoicing as they provide detailed records of payments received, invoices cleared, and outstanding amounts. Maintaining these statements ensures transparency, simplifies tax reporting, and aids in resolving payment discrepancies efficiently. |

| 4 | Digital KYC Verifications | Digital KYC verifications require freelancers to provide government-issued identification, proof of address, and a selfie for identity confirmation, ensuring compliance with regulatory standards. These documents facilitate secure receipt organization by authenticating client details and streamlining invoice validation processes. |

| 5 | VAT-compliant Invoice Copies | VAT-compliant invoice copies must include the freelancer's VAT identification number, client details, an itemized list of services or products provided, the invoice date, and the total amount including VAT. Retaining these documents in organized digital or physical formats ensures accurate tax reporting and facilitates efficient receipt management in freelance invoicing. |

| 6 | Tax Residency Certificates | Tax residency certificates are essential documents for receipt organization in freelance invoicing as they verify the freelancer's tax status and prevent double taxation. Maintaining accurate tax residency certificates ensures compliance with international tax regulations and facilitates proper reporting for invoicing and tax declaration. |

| 7 | Remittance Advices | Remittance advices serve as crucial documents in freelance invoicing by providing detailed payment information that ensures accurate receipt organization and reconciliation. Including remittance advices helps freelancers track incoming payments, verify amounts received, and maintain clear financial records for tax and accounting purposes. |

| 8 | Client PO Confirmation PDFs | Client PO confirmation PDFs serve as critical documents for receipt organization in freelance invoicing, verifying authorized purchase orders and ensuring accurate payment tracking. Maintaining a structured archive of these PDFs enables seamless audit trails and supports efficient financial reconciliation. |

| 9 | eSignature Audit Trails | eSignature audit trails are essential documents for receipt organization in freelance invoicing as they provide verifiable records of signing events, including timestamps, IP addresses, and signer authentication details. Maintaining these digital audit trails ensures the integrity and legal enforceability of receipts, facilitating accurate record-keeping and compliance with tax regulations. |

| 10 | Cloud-based Billable Line-items | Cloud-based billable line-items require detailed documentation such as itemized service descriptions, time-stamped entries, and corresponding digital receipts to ensure accuracy in freelance invoicing. Maintaining organized records through cloud platforms enhances transparency and simplifies expense tracking for tax and client reconciliation purposes. |

Introduction to Receipt Organization for Freelancers

Effective receipt organization is essential for freelancers to manage their financial records and streamline invoicing. Proper documentation supports accurate tax reporting and expense tracking in freelance business operations.

- Invoices - Detailed records of services rendered and payment terms ensuring transparency in freelance transactions.

- Receipts - Proof of payment for business expenses that validate deductible costs during tax filing.

- Contracts - Agreements outlining project scope and payment conditions to clarify client-freelancer obligations.

Why Receipt Management Matters in Freelance Invoicing

Receipt management is essential for accurate freelance invoicing, ensuring that every expense and payment is properly documented. Proper organization helps maintain clear records for tax purposes and financial tracking.

Having necessary documents like receipts, invoices, and payment confirmations simplifies dispute resolution and client communication. Your well-organized receipts support professionalism and efficient business operations in freelancing.

Key Types of Receipts Every Freelancer Should Keep

Organizing receipts is crucial for accurate record-keeping and tax compliance in freelance invoicing. Key documents include payment receipts, expense receipts, and service invoices that validate your income and costs.

Keep receipts for business-related purchases, client payments, and any subcontractor expenses. Proper management of these receipts ensures smoother financial tracking and easier audit preparation for your freelance work.

Essential Software Tools for Receipt Organization

| Document Type | Description | Purpose in Receipt Organization |

|---|---|---|

| Invoices | Detailed billing records sent to clients | Track payments and services rendered for accurate record-keeping |

| Receipts | Proof of payment received from clients or for expenses | Verify transactions and support financial audits |

| Bank Statements | Monthly summaries of account transactions | Reconcile income and expenses with invoicing records |

| Expense Reports | Records of business-related expenses with supporting receipts | Manage deductions and track spendings accurately |

| Essential Software Tools for Receipt Organization | ||

| Accounting Software (e.g., QuickBooks, Xero) | Automates invoicing, receipt tracking, and financial reporting | Centralizes all financial documents to simplify management and tax preparation |

| Receipt Scanning Apps (e.g., Expensify, Shoeboxed) | Digitizes and organizes physical receipts with OCR technology | Reduces manual data entry and ensures accurate expense tracking |

| Cloud Storage Services (e.g., Google Drive, Dropbox) | Securely stores electronic copies of all invoices and receipts | Enables easy access and sharing of documents for your freelance invoicing needs |

| Spreadsheet Software (e.g., Microsoft Excel, Google Sheets) | Customizable templates for manual tracking and analysis | Useful for tracking receipt details when integrated with invoicing workflows |

Creating a Digital vs. Physical Receipt Filing System

Efficient receipt organization is crucial for accurate freelance invoicing and tax compliance. Choosing between digital and physical receipt filing systems impacts accessibility, security, and space management.

- Digital Receipt Filing System - Store scanned invoices and receipts in organized folders on cloud platforms for easy retrieval and backup.

- Physical Receipt Filing System - Use labeled binders or folders to categorize paper receipts by date or client for straightforward reference and audit trails.

- Necessary Documents - Maintain copies of invoices, payment confirmations, expense receipts, and tax-related documents for comprehensive freelance accounting.

Categorizing Receipts for Tax Deductions and Audits

What documents are necessary for receipt organization in freelance invoicing? Receipts must be categorized by expense type, such as office supplies, travel, and meals, to streamline tax deduction claims. Proper categorization ensures easy retrieval during audits and accurate financial reporting.

Best Practices for Storing and Backing Up Receipts

Proper organization of receipts is essential for accurate freelance invoicing and tax compliance. Essential documents include detailed invoices, payment confirmations, and expense receipts that verify your transactions.

Best practices for storing receipts involve categorizing them by date and project for easy retrieval. Use digital tools like cloud storage or dedicated accounting software to back up your receipts securely. Regularly updating and verifying your records minimizes errors and ensures all necessary documentation is available when needed.

Common Mistakes in Freelance Receipt Organization

Organizing receipts in freelance invoicing requires maintaining clear records such as invoices, payment confirmations, and expense receipts. Common mistakes include mixing personal and business receipts, failing to date receipts properly, and neglecting to categorize expenses accurately. Proper documentation ensures accurate tax reporting and smooth financial management for freelancers.

Legal and Tax Compliance: Required Receipt Documents

Organizing receipts in freelance invoicing requires maintaining legal and tax compliance by keeping key documents such as detailed receipts, invoices, and proof of payment records. These documents must clearly reflect transaction dates, services rendered, payment amounts, and client information to satisfy tax authority requirements. Proper documentation ensures accurate income reporting, supports tax deductions, and facilitates audits or financial reviews.

What Documents Are Necessary for Receipt Organization in Freelance Invoicing? Infographic