A landlord needs several key documents for rent receipt compliance, including a valid lease agreement outlining payment terms, tenant identification to verify residency, and proof of payment such as bank statements or transaction records. Maintaining organized records of rent receipts is essential for accurate bookkeeping and resolving potential disputes. These documents ensure transparency and legal protection for both landlords and tenants.

What Documents Does a Landlord Need for Rent Receipt Compliance?

| Number | Name | Description |

|---|---|---|

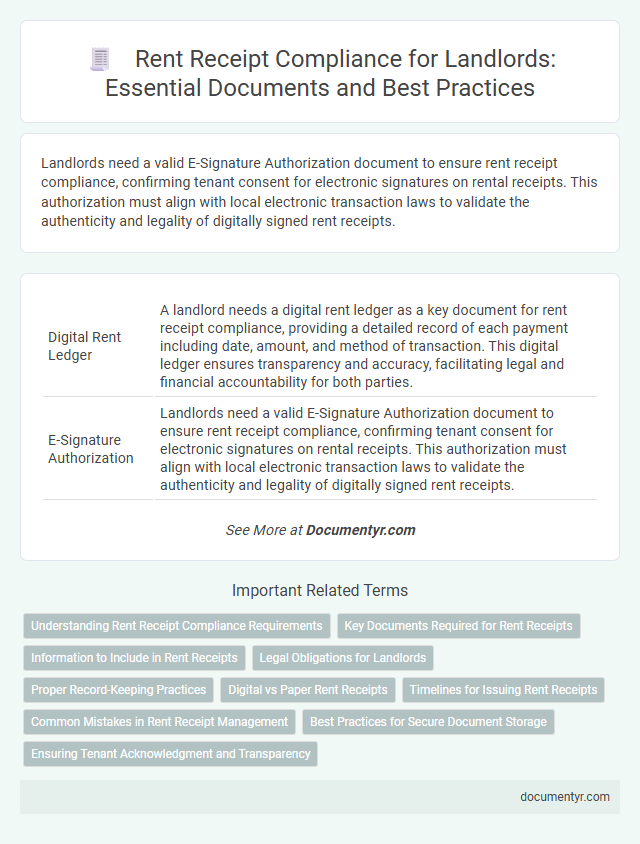

| 1 | Digital Rent Ledger | A landlord needs a digital rent ledger as a key document for rent receipt compliance, providing a detailed record of each payment including date, amount, and method of transaction. This digital ledger ensures transparency and accuracy, facilitating legal and financial accountability for both parties. |

| 2 | E-Signature Authorization | Landlords need a valid E-Signature Authorization document to ensure rent receipt compliance, confirming tenant consent for electronic signatures on rental receipts. This authorization must align with local electronic transaction laws to validate the authenticity and legality of digitally signed rent receipts. |

| 3 | Automated Payment Timestamp | A landlord needs automated payment timestamps generated by reliable property management software to ensure rent receipt compliance, providing accurate records of transaction dates and times. These timestamps serve as legally valid proof of payment and streamline audit processes by minimizing human error and enhancing data integrity. |

| 4 | Blockchain-Verified Receipt | A landlord needs a blockchain-verified rent receipt that includes tenant and property details, payment amount, date, and a digital signature to ensure immutability and authenticity for rent receipt compliance. This decentralized ledger documentation enhances transparency, prevents fraud, and provides an unalterable proof of payment for audit and legal purposes. |

| 5 | Tenant KYC Documentation | Landlords need tenant KYC documentation such as valid government-issued identification, proof of address, and rental agreement copies to ensure rent receipt compliance. These documents verify tenant identity and support accurate record-keeping for legal and tax purposes. |

| 6 | GST-Compliant Invoice (if applicable) | A GST-compliant invoice for rent receipt must include the landlord's GSTIN, invoice number, date, description of the rental property, rental amount, GST rate, and the total amount including GST to ensure adherence to tax regulations. Providing this document allows tenants to claim Input Tax Credit and ensures transparent financial transactions between landlords and tenants. |

| 7 | E-Stamp Endorsement Proof | Landlords must provide an E-Stamp Endorsement Proof as part of rent receipt compliance to legally validate the rent transaction and prevent disputes. This e-stamped document serves as evidence of stamp duty payment, ensuring authenticity and adherence to local government regulations. |

| 8 | Two-Factor Authentication Log | To ensure rent receipt compliance, landlords must maintain a Two-Factor Authentication log that verifies tenant identity during digital transactions, enhancing security and preventing fraud. This log serves as a critical document demonstrating adherence to data protection standards and verifying the authenticity of rent payments. |

| 9 | QR Code Verifiable Receipt | Landlords must provide rent receipts that include tenant details, payment amounts, dates, and a QR code for verifiable receipt compliance, ensuring authenticity and easy digital verification. Incorporating a QR code links the receipt to a secured database, enhancing transparency and preventing disputes. |

| 10 | Rent Transaction API Record | A landlord needs a Rent Transaction API Record to ensure accurate and compliant rent receipt documentation, capturing payment dates, amounts, and tenant details digitally. This electronic record streamlines verification and maintains a transparent audit trail for rent collection compliance. |

Understanding Rent Receipt Compliance Requirements

| Document Type | Description | Purpose for Compliance |

|---|---|---|

| Rent Receipt Template | Standardized form including tenant name, rental property address, payment date, amount paid, and payment method. | Ensures clear and consistent documentation of rent transactions for legal and accounting purposes. |

| Tenant Payment Records | Detailed logs or spreadsheets tracking all rent payments made by tenants over time. | Facilitates audit trails and supports verification in case of disputes related to rent collection. |

| Lease Agreement | Legal contract specifying rent amount, due dates, payment terms, and tenant-landlord obligations. | Provides the foundational terms that receipts corroborate, supporting rent receipt validity. |

| Tax Documentation | Records such as IRS forms or local tax filings that report rental income. | Complies with tax authorities' requirements by substantiating rental income through receipts. |

| Payment Method Evidence | Proof of payment like bank statements, online payment confirmations, or cash receipt copies. | Validates the authenticity of rent receipts and confirms payment completion. |

| Local Compliance Guidelines | Documentation outlining specific municipal or state rent receipt regulations. | Ensures adherence to jurisdiction-specific rent receipt standards and legal mandates. |

Key Documents Required for Rent Receipts

Landlords must maintain accurate rent receipts to comply with legal and tax regulations. Key documents ensure transparency and protect both parties in rental agreements.

Essential documents include a detailed rent receipt template showing tenant name, payment amount, date, and rental period. Proof of payment, such as bank statements or online transaction records, supports receipt validity.

Information to Include in Rent Receipts

Rent receipts are essential documents that prove payment and protect both landlords and tenants. They need to include specific information to ensure compliance with rental agreements and legal requirements.

- Tenant's Full Name - Clearly state the tenant's name to specify who made the payment.

- Payment Amount and Date - Record the exact rent amount paid and the date the payment was received.

- Property Address - Include the rental property's full address to identify the location related to the payment.

Legal Obligations for Landlords

Landlords must maintain proper documentation to comply with rent receipt regulations and avoid legal issues. Ensuring accurate records protects your rights and supports transparent rental transactions.

- Lease Agreement - Serves as the foundational contract outlining rental terms and tenant obligations.

- Payment Receipts - Provides proof of rent payments and helps resolve disputes.

- Tenant Identification - Verifies the tenant's identity and supports legal accountability.

Maintaining these documents is essential for meeting your legal obligations as a landlord and ensuring compliance with rental laws.

Proper Record-Keeping Practices

Landlords must maintain accurate and detailed rent receipts to ensure compliance with legal and tax requirements. Essential documents include signed rental agreements, payment records, and official rent receipt templates that clearly outline the transaction details.

Proper record-keeping practices involve organizing receipts chronologically and securely storing both physical and digital copies. Consistent documentation helps prevent disputes, facilitates audits, and supports transparent financial management for rental properties.

Digital vs Paper Rent Receipts

Landlords must retain documentation that verifies rent payments for compliance purposes. Digital rent receipts offer secure, easily accessible records with timestamp features, while paper receipts provide a traditional, tangible proof of payment. Your choice between digital and paper receipts depends on organizational preferences and legal requirements in your jurisdiction.

Timelines for Issuing Rent Receipts

Landlords must adhere to specific timelines when issuing rent receipts to ensure compliance with local regulations. Timely documentation supports transparent rental transactions and protects both parties involved.

- Receipt Issuance Deadline - Landlords are generally required to provide rent receipts within 24 to 72 hours of payment to meet legal standards.

- Monthly Rent Documentation - Receipts should be issued for every rent payment received each month to maintain accurate financial records.

- Digital and Physical Formats - Both electronic and printed receipts must be dated promptly to comply with jurisdictional requirements and facilitate tenant verification.

Common Mistakes in Rent Receipt Management

Landlords must maintain proper documentation to ensure rent receipt compliance, including tenant information, payment details, and transaction dates. Accurate rent receipts serve as proof of payment and protect both parties from disputes.

Common mistakes in rent receipt management include failing to issue receipts promptly, omitting important details like payment method or date, and not keeping organized records. Mismanagement can lead to legal complications and loss of trust between landlords and tenants. Proper documentation safeguards your rental business and ensures transparency in transactions.

Best Practices for Secure Document Storage

What documents does a landlord need for rent receipt compliance? Landlords must keep copies of rent receipts, tenant lease agreements, and payment records to ensure accurate tracking. Secure storage of these documents protects sensitive information and supports legal compliance.

How can landlords best store rent receipt documents securely? Using encrypted digital storage solutions and password-protected files minimizes unauthorized access risks. Physical documents should be kept in locked, fireproof cabinets to safeguard against damage and theft.

Why is maintaining organized rent receipt records important for landlords? Proper organization aids quick retrieval during disputes, audits, or tax reporting. Clear documentation provides evidence of payment history and reinforces landlord-tenant trust.

What are key digital security measures for rent receipt compliance? Implementing regular data backups and multi-factor authentication enhances document security. Cloud-based services with compliance certifications offer reliable protection and accessibility.

How often should landlords review and update their document storage practices? Regular reviews--at least annually--ensure compliance with current laws and technology standards. Updating storage methods helps prevent data loss and adapts to evolving security threats.

What Documents Does a Landlord Need for Rent Receipt Compliance? Infographic