A landlord needs a detailed receipt documenting any repairs or cleaning costs deducted from the security deposit to ensure transparency and legal compliance. This receipt should include itemized expenses with dates, descriptions, and amounts paid to contractors or service providers. Maintaining clear records protects both parties and helps resolve potential disputes efficiently.

What Receipt Documents Does a Landlord Need for Security Deposit Deductions?

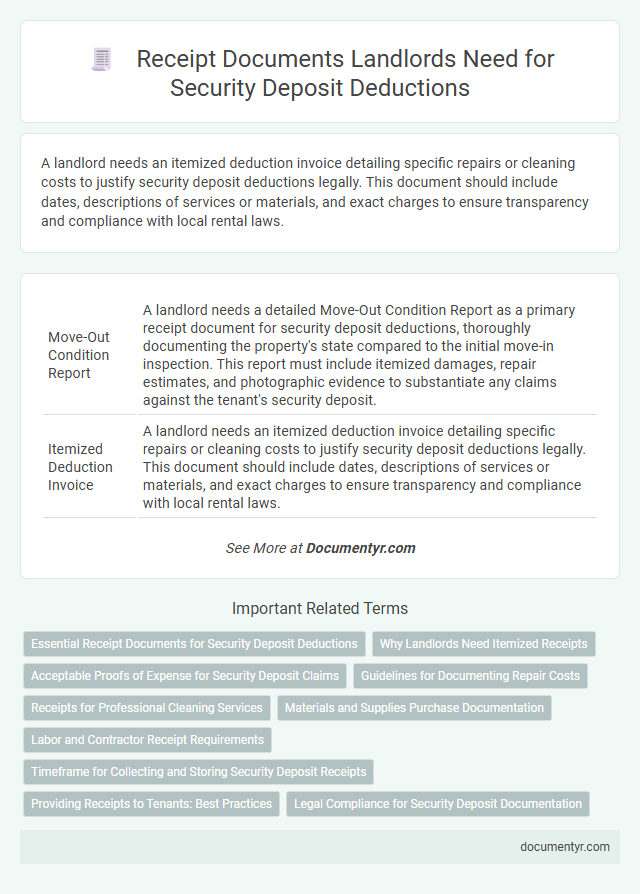

| Number | Name | Description |

|---|---|---|

| 1 | Move-Out Condition Report | A landlord needs a detailed Move-Out Condition Report as a primary receipt document for security deposit deductions, thoroughly documenting the property's state compared to the initial move-in inspection. This report must include itemized damages, repair estimates, and photographic evidence to substantiate any claims against the tenant's security deposit. |

| 2 | Itemized Deduction Invoice | A landlord needs an itemized deduction invoice detailing specific repairs or cleaning costs to justify security deposit deductions legally. This document should include dates, descriptions of services or materials, and exact charges to ensure transparency and compliance with local rental laws. |

| 3 | Third-Party Vendor Receipt | A landlord needs a detailed third-party vendor receipt that clearly itemizes the services or repairs performed, including dates, descriptions, and costs, to substantiate security deposit deductions. This receipt serves as verifiable proof of expenses incurred, ensuring transparency and compliance with legal requirements. |

| 4 | Digital Time-Stamped Estimate | Landlords must obtain a digital time-stamped estimate detailing repair costs to justify security deposit deductions, providing clear evidence of expenses incurred. This digitally verified document ensures transparency and legal compliance in itemizing damage-related charges. |

| 5 | Damage Assessment Statement | A Damage Assessment Statement is crucial for landlords to justify security deposit deductions by itemizing specific damages beyond normal wear and tear, supported by detailed descriptions and cost estimates for repairs. This document, alongside photos and repair invoices, provides clear evidence to avoid disputes and ensure compliance with local landlord-tenant laws. |

| 6 | Security Deposit Reconciliation Form | A Security Deposit Reconciliation Form is essential for landlords to document itemized deductions from a tenant's security deposit, detailing damages, repairs, and cleaning costs alongside corresponding receipts. This form ensures transparent communication and legal compliance by providing tenants with a clear breakdown of withheld amounts supported by verifiable evidence. |

| 7 | Pre-Move-In Photo Log | A landlord needs a detailed pre-move-in photo log documenting the property's condition before the tenant's occupancy to justify security deposit deductions. High-resolution images with timestamps serve as critical evidence against disputes over damage claims. |

| 8 | Materials Purchase Receipt | A landlord must retain materials purchase receipts that clearly itemize supplies used for repairs or maintenance related to security deposit deductions, ensuring transparency and compliance with local regulations. These receipts serve as essential proof of expenses directly incurred after a tenant's lease termination, validating the legitimacy of withheld deposit amounts. |

| 9 | Professional Cleaning Certification | A landlord needs a Professional Cleaning Certification as a key receipt document to justify security deposit deductions related to cleaning fees, proving that the property was professionally cleaned to a specified standard. This certificate typically includes details such as the cleaning service provider's name, date of service, scope of work, and cost, ensuring transparency and compliance with local rental laws. |

| 10 | Repair Contractor Authorization Doc | A landlord must obtain a Repair Contractor Authorization Document to justify security deposit deductions related to repair costs, ensuring transparency and legal compliance. This document verifies that repairs were authorized and performed by a licensed contractor, providing essential proof for itemized deductions from the tenant's security deposit. |

Essential Receipt Documents for Security Deposit Deductions

Landlords must maintain detailed receipt documents to justify any security deposit deductions. Essential records include itemized repair bills and cleaning service invoices directly linked to tenant damage.

Receipts for purchased materials used in repairs also serve as crucial evidence. These documents protect landlords from disputes and ensure transparent communication with tenants regarding deductions.

Why Landlords Need Itemized Receipts

Landlords must keep itemized receipts to document security deposit deductions clearly. These receipts detail each expense, providing transparency and accountability.

Itemized receipts protect landlords from disputes by offering concrete proof of repair or cleaning costs. They ensure compliance with legal requirements for security deposit deductions. Providing you with precise documentation fosters trust and prevents misunderstandings with tenants.

Acceptable Proofs of Expense for Security Deposit Claims

Landlords must provide clear receipts to justify security deposit deductions. Acceptable proofs of expense include repair invoices, cleaning service receipts, and receipts for replaced items or materials. These documents serve as evidence to support legitimate claims and protect tenants' rights.

Guidelines for Documenting Repair Costs

What receipt documents does a landlord need for security deposit deductions? Landlords must provide detailed receipts that clearly itemize repair costs to justify deductions. Accurate documentation should include the date, description of repairs, and the amount paid.

What guidelines should be followed when documenting repair costs for security deposit deductions? You should keep original invoices or receipts that specify labor and material expenses separately. Photographic evidence before and after repairs supports the legitimacy of the charges.

Receipts for Professional Cleaning Services

Receipts for professional cleaning services are essential documents a landlord needs when making security deposit deductions. These receipts provide clear proof of the costs incurred to restore the rental property to its original condition.

To validate deductions, your receipt should include the service provider's name, date of service, and detailed charges. Keeping organized and itemized receipts helps avoid disputes and ensures transparency in the refund process.

Materials and Supplies Purchase Documentation

Receipts for materials and supplies purchased for repairs or maintenance are essential documentation when a landlord makes security deposit deductions. These receipts should clearly show the date, items bought, quantities, and costs to validate the expenses. Keeping detailed purchase documentation helps protect your rights and ensures transparency in the deduction process.

Labor and Contractor Receipt Requirements

Landlords must provide detailed receipts when deducting security deposits for labor and contractor services. Proper documentation ensures transparency and legal compliance in handling tenant funds.

- Itemized Labor Receipts - Receipts must clearly list labor charges, hours worked, and the nature of the service provided.

- Contractor Invoices - Invoices from licensed contractors should include company details, service dates, and a breakdown of costs.

- Proof of Payment - Landlords need to supply proof that payments to contractors or laborers were completed to validate the deductions.

Timeframe for Collecting and Storing Security Deposit Receipts

Landlords must carefully document all security deposit deductions to protect both parties and comply with legal requirements. Understanding the proper timeframe for collecting and storing these receipts ensures transparency and accountability in the rental process.

- Receipt Collection Timeframe - Landlords should collect and provide receipts for all security deposit deductions within 30 days after the tenant vacates the property.

- Storage Duration - Receipts for security deposit deductions must be stored for at least three years to comply with recordkeeping laws and facilitate dispute resolution.

- Required Documentation - Detailed receipts must include the date, description of repairs or services, and costs to validate deductions against the security deposit.

Timely collection and secure storage of security deposit receipts are essential to uphold landlord-tenant agreements and legal standards.

Providing Receipts to Tenants: Best Practices

Providing detailed receipts is essential for landlords when deducting security deposits to maintain transparency and avoid disputes. Proper documentation supports clear communication and legal compliance in tenant transactions.

- Itemized Receipts - Landlords should provide itemized receipts listing each deduction to clearly explain charges to tenants.

- Include Date and Details - Receipts must include the date, description of work or damage, and cost for accurate record-keeping.

- Supply Copies Promptly - Delivering receipts to tenants promptly after deductions helps build trust and meets legal timeframes.

What Receipt Documents Does a Landlord Need for Security Deposit Deductions? Infographic