Receipt documents required for travel expense reimbursement typically include itemized receipts that detail the date, vendor, and amount paid for transportation, lodging, meals, and other allowable expenses. Credit card statements alone are often insufficient; clear proof of purchase showing the nature of the expense is essential. Ensuring all receipts comply with company policy and include necessary details helps streamline the reimbursement process and avoid delays.

What Receipt Documents Are Required for Travel Expense Reimbursement?

| Number | Name | Description |

|---|---|---|

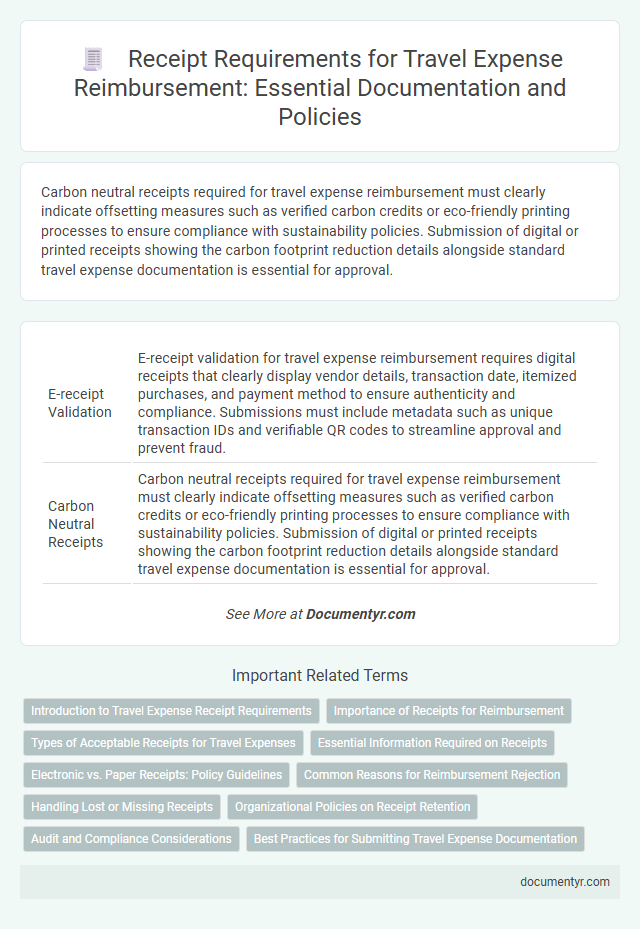

| 1 | E-receipt Validation | E-receipt validation for travel expense reimbursement requires digital receipts that clearly display vendor details, transaction date, itemized purchases, and payment method to ensure authenticity and compliance. Submissions must include metadata such as unique transaction IDs and verifiable QR codes to streamline approval and prevent fraud. |

| 2 | Carbon Neutral Receipts | Carbon neutral receipts required for travel expense reimbursement must clearly indicate offsetting measures such as verified carbon credits or eco-friendly printing processes to ensure compliance with sustainability policies. Submission of digital or printed receipts showing the carbon footprint reduction details alongside standard travel expense documentation is essential for approval. |

| 3 | Dynamic QR-coded Receipts | Dynamic QR-coded receipts streamline travel expense reimbursement by providing verifiable, real-time transaction details accessible through scanned codes. These receipts enhance accuracy and reduce fraud, ensuring quicker approval processes for submitted travel expenses. |

| 4 | Blockchain-authenticated Receipts | Blockchain-authenticated receipts provide a secure and tamper-proof record essential for travel expense reimbursement, ensuring that all transaction details are verifiable and immutable. These digital receipts streamline the approval process by offering transparent, time-stamped proof of expenses commonly required by corporate finance departments. |

| 5 | Itemized Digital Vouchers | Itemized digital vouchers provide detailed records of each purchased item, including descriptions, quantities, prices, and taxes, essential for validating travel expense reimbursement claims. These vouchers ensure compliance with company policies by offering clear, accurate proof of expenses, facilitating faster and more efficient reimbursement processing. |

| 6 | In-trip Expense Snapshots | In-trip expense snapshots must clearly display the date, vendor name, itemized purchases, and total amount to validate travel expense reimbursements. High-resolution images or digital copies of receipts are essential to ensure accuracy and compliance with company policies. |

| 7 | Automated OCR Invoice Extraction | Receipts required for travel expense reimbursement must include detailed information such as date, vendor name, total amount, and itemized charges, which automated OCR invoice extraction systems can accurately capture and validate. This technology improves processing efficiency by minimizing manual data entry errors and ensuring compliance with company policies through precise digital documentation. |

| 8 | Geo-tagged E-ticket Receipts | Geo-tagged e-ticket receipts provide essential location-specific data that verifies travel dates, destinations, and ticket purchases, ensuring accurate travel expense reimbursement. These digital documents streamline expense audits by linking exact travel routes to claimed costs, reducing the risk of fraud and simplifying compliance with corporate policies. |

| 9 | API-linked Expense Receipts | API-linked expense receipts must include detailed transaction data, such as date, time, vendor information, and payment method, to ensure accurate travel expense reimbursement. These digital receipts streamline verification processes by providing real-time, tamper-proof documentation directly integrated with expense management systems. |

| 10 | Multi-currency Smart Receipts | Multi-currency smart receipts are essential for travel expense reimbursement as they automatically convert foreign currency transactions into the home currency, ensuring accurate and compliant documentation. These receipts must include detailed transaction data, currency exchange rates, and vendor information to meet auditing standards and streamline the reimbursement process. |

Introduction to Travel Expense Receipt Requirements

What receipt documents are required for travel expense reimbursement? Travel expense reimbursements mandate specific receipt documents to verify and validate costs incurred during business travel. Proper documentation ensures compliance with company policies and facilitates accurate expense reporting.

Importance of Receipts for Reimbursement

Receipts are essential documents required to validate travel expense reimbursement claims. They serve as proof of payment and ensure transparency and accuracy in expense reporting.

- Proof of Payment - Receipts confirm the exact amount paid during travel, preventing disputes and inconsistencies.

- Expense Verification - Receipts provide detailed information about the date, vendor, and nature of the expense for auditing purposes.

- Compliance Assurance - Submitting receipts aligns with company policies and regulatory requirements, facilitating smooth reimbursement processing.

Types of Acceptable Receipts for Travel Expenses

Submitting proper receipt documents is essential for travel expense reimbursement to ensure compliance and accurate processing. Different types of receipts are recognized as valid proof of expenditure during travel.

- Itemized Receipts - Detailed receipts listing each purchased item or service are required to verify the specific expenses claimed.

- Credit Card Statements - These can support reimbursement requests when accompanied by matching itemized receipts or proof of payment.

- Hotel and Accommodation Bills - Official invoices showing the traveler's name, stay dates, and charges are necessary for lodging expense reimbursement.

Essential Information Required on Receipts

Receipts for travel expense reimbursement must include essential information to ensure proper processing. Key details typically involve the date of the transaction, the vendor's name, and a clear description of the purchased item or service.

Your receipt should also show the total amount paid and the method of payment if possible. Having these elements clearly stated helps validate the expense and speeds up reimbursement approval.

Electronic vs. Paper Receipts: Policy Guidelines

Travel expense reimbursement requires submission of valid receipt documents, either electronic or paper, to verify your expenses. Each organization sets specific policies on acceptable receipt formats to ensure compliance and accuracy.

Electronic receipts typically must be clear, legible, and include essential details such as date, merchant name, and amount. Paper receipts require original copies and often need to be scanned or photocopied if submitted digitally, adhering to company guidelines.

Common Reasons for Reimbursement Rejection

| Receipt Document | Purpose | Common Reasons for Reimbursement Rejection |

|---|---|---|

| Transportation Receipts | Proof of airfare, taxi, train, or rental car expenses incurred during travel | Missing itemized details, unclear dates, or unrelated charges |

| Lodging Receipts | Verification of hotel or accommodation expenses | Absent guest name, incomplete stay dates, or handwritten receipts without official formatting |

| Meal Receipts | Evidence of food expenses during business travel | Exceeding company limits, lack of itemization, or no indication of date and location |

| Conference or Registration Receipts | Proof of fees paid for attending business-related events or training | Missing payment confirmation, unrelated event details, or failure to specify attendee name |

| Miscellaneous Expense Receipts | Receipts for taxis, parking, tolls, or other incidental travel costs | Lack of business purpose explanation, illegible receipts, or missing dates |

| Credit Card Statements | Supplemental proof when receipts are unavailable | Unclear transaction details, absence of matching receipts, or unrelated purchases |

Handling Lost or Missing Receipts

Travel expense reimbursement requires original receipts documenting all incurred costs such as transportation, lodging, meals, and incidentals. Lost or missing receipts should be addressed promptly by submitting a detailed expense report including date, amount, vendor, and reason for the missing receipt. Some organizations also accept affidavits or manager approvals as proof for unrecoverable receipts to ensure reimbursement compliance.

Organizational Policies on Receipt Retention

Organizational policies on receipt retention for travel expense reimbursement typically require original, itemized receipts that detail the date, vendor, and amount spent. Receipts must be retained and submitted within a specified timeframe, often aligned with the fiscal reporting period. Your compliance with these policies ensures timely processing and prevents delays in reimbursement.

Audit and Compliance Considerations

Receipt documents are essential for travel expense reimbursement to ensure accuracy and compliance with company policies and regulatory standards. Proper documentation supports the validity of the claimed expenses and facilitates audit processes.

Receipts must clearly show the date, amount, and vendor details to meet audit requirements. Incomplete or missing receipts can result in reimbursement delays or denial due to non-compliance. Maintaining organized and legible receipts helps streamline internal reviews and external audits.

What Receipt Documents Are Required for Travel Expense Reimbursement? Infographic