Retain original medical receipts, detailed invoices, and proof of payment for pet insurance claims to ensure accurate processing. Include veterinarian reports, diagnosis summaries, and prescription records to support the legitimacy of treatments. Keep copies of all correspondence with the insurance company to track claim progress and resolve discrepancies.

What Documents Should Be Retained for Medical Receipt Insurance Claims?

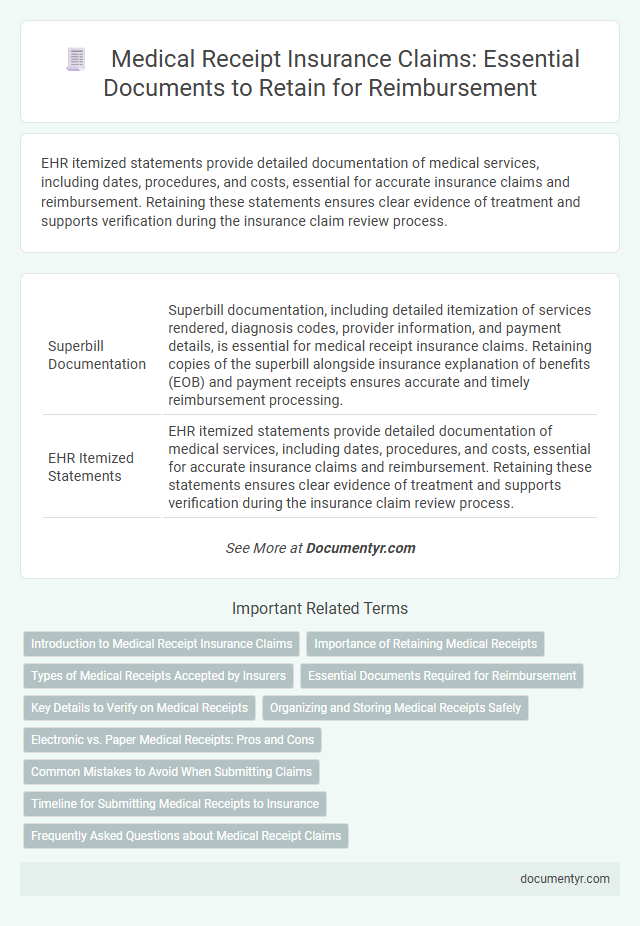

| Number | Name | Description |

|---|---|---|

| 1 | Superbill Documentation | Superbill documentation, including detailed itemization of services rendered, diagnosis codes, provider information, and payment details, is essential for medical receipt insurance claims. Retaining copies of the superbill alongside insurance explanation of benefits (EOB) and payment receipts ensures accurate and timely reimbursement processing. |

| 2 | EHR Itemized Statements | EHR itemized statements provide detailed documentation of medical services, including dates, procedures, and costs, essential for accurate insurance claims and reimbursement. Retaining these statements ensures clear evidence of treatment and supports verification during the insurance claim review process. |

| 3 | Preauthorization Letters | Preauthorization letters are essential documents to retain for medical receipt insurance claims as they validate prior approval from insurance providers for specific treatments or procedures. Keeping these letters ensures smoother claim processing and reduces the risk of claim denials due to lack of documented insurer consent. |

| 4 | Explanation of Benefits (EOBs) | Explanation of Benefits (EOBs) are crucial documents that detail the healthcare services billed, the amount covered by insurance, and the patient's financial responsibility, making them essential for medical receipt insurance claims. Retaining EOBs ensures accurate record-keeping, facilitates claim verification, and aids in resolving billing discrepancies with insurers. |

| 5 | Digital Copay Receipts | Digital copay receipts, including itemized payment details and provider information, should be retained as essential documentation for medical receipt insurance claims. These digital receipts ensure accurate verification and streamline the claims process by providing clear evidence of payment transactions. |

| 6 | Non-Covered Services Denial Notice | Non-covered services denial notices must be retained as critical documentation for medical receipt insurance claims to substantiate claim denials and support appeals. These notices provide detailed explanations from insurers about services not covered under a policy and are essential for resolving disputes and ensuring accurate reimbursement. |

| 7 | Telehealth Session Transcripts | Retain detailed telehealth session transcripts along with billing statements and provider notes to ensure accurate documentation for medical receipt insurance claims. These records support claim verification by capturing service specifics, dates, and provider credentials essential for reimbursement. |

| 8 | AI-Generated Billing Codes Verification | Retain all original medical receipts, AI-generated billing codes, and related documentation such as diagnosis reports and treatment summaries to ensure accurate insurance claims processing. Verifying AI-generated billing codes against standardized medical coding systems like ICD-10 and CPT is crucial for preventing claim denials and facilitating efficient reimbursement. |

| 9 | Direct-Pay Claims Attachments | For direct-pay insurance claims, it is crucial to retain original medical receipts, detailed invoices reflecting services rendered, and any itemized statements indicating payment adjustments or denials. Supporting documentation such as medical reports, proof of payment, and pre-authorization letters ensure accurate and efficient processing of claims. |

| 10 | Smart Prescription Receipts | Smart prescription receipts containing detailed information such as patient identification, medication details, prescriber information, and transaction dates must be retained for medical receipt insurance claims to ensure accurate validation and reimbursement. These digital records improve claim efficiency by providing verifiable proof of prescribed treatments and pharmacy transactions aligned with insurer requirements. |

Introduction to Medical Receipt Insurance Claims

Medical receipt insurance claims require accurate documentation to ensure proper reimbursement. You must retain detailed records of all medical services received, including itemized receipts and proof of payment. Keeping these documents organized simplifies the claim process and supports verification by insurance providers.

Importance of Retaining Medical Receipts

Retaining medical receipts is essential for accurate insurance claims and reimbursement processes. These documents serve as proof of medical expenses and support claim validity.

- Proof of Payment - Medical receipts verify that payments were made for treatments or services.

- Claim Verification - Insurers require receipts to authenticate the legitimacy of medical expenses claimed.

- Financial Record Keeping - Keeping receipts helps track healthcare spending and manage budgets effectively.

Proper retention of medical receipts ensures smooth processing and faster approval of insurance claims.

Types of Medical Receipts Accepted by Insurers

| Type of Medical Receipt | Description | Purpose for Insurance Claims |

|---|---|---|

| Prescription Receipts | Proof of purchase for prescribed medications from a licensed pharmacy. | Verify costs for medication reimbursement under medical insurance policies. |

| Hospital Bills | Detailed statements itemizing services rendered during hospital visits or stays. | Support claims related to inpatient or outpatient treatments covered by insurance. |

| Consultation Receipts | Receipts from consultations with doctors, specialists, or medical practitioners. | Document professional fees paid for medical advice or diagnosis. |

| Laboratory Test Receipts | Proof of payment for diagnostic tests such as blood work, imaging, or pathology. | Validate expenses incurred for diagnostic procedures under insurance coverage. |

| Medical Equipment Receipts | Receipts for purchasing or renting medical devices like wheelchairs, crutches, or monitoring equipment. | Claim expenses related to necessary medical aids reimbursable by insurance providers. |

| Pharmacy Receipts | Detailed bills showing purchases of over-the-counter or prescribed medical supplies. | Used to confirm purchases eligible for insurance claims involving medications or supplies. |

| Surgical Bills | Invoices specifying charges for surgical procedures, anesthesia, and associated hospital services. | Document costs covered under medical insurance for surgical treatments. |

Essential Documents Required for Reimbursement

Medical receipt insurance claims require specific documents to ensure smooth reimbursement. Keeping essential records organized supports accurate and timely processing.

- Original Medical Receipts - These provide proof of payment and details of the billed services or treatments.

- Doctor's Prescription or Referral - Documentation validating the medical necessity of the service or medication.

- Insurance Claim Form - A completed claim form submitted to your insurance provider for reimbursement.

Key Details to Verify on Medical Receipts

Retain original medical receipts showing the provider's name, date of service, and detailed description of treatments or procedures. Verify that receipts include the patient's name, itemized costs, and payment method to ensure claim accuracy. Confirm that receipts are legible and contain official stamps or signatures from the healthcare provider for validity.

Organizing and Storing Medical Receipts Safely

Keeping medical receipts organized and stored safely is crucial for successful insurance claims. Proper management ensures quick access and prevents loss or damage to important documents.

- Retain original receipts - Store all original medical receipts as proof of treatment and expenses for insurance verification.

- Organize by date and provider - Arrange receipts chronologically and by healthcare provider to streamline claim processing and tracking.

- Use secure storage - Keep receipts in a fireproof and waterproof container or digitally scan and backup files securely to prevent loss.

Electronic vs. Paper Medical Receipts: Pros and Cons

Medical receipt insurance claims require retaining specific documents such as itemized receipts, proof of payment, and detailed medical reports. These documents validate your expenses and facilitate claim processing.

Electronic medical receipts offer easy storage, quick access, and reduced risk of loss or damage. Paper receipts, while tangible, are susceptible to physical deterioration and misplacement over time.

Common Mistakes to Avoid When Submitting Claims

Keeping proper documents is essential for medical receipt insurance claims. Important papers include itemized receipts, insurance forms, and medical reports.

Common mistakes include submitting incomplete receipts or missing signatures. Errors in patient information or dates can lead to claim denial.

Timeline for Submitting Medical Receipts to Insurance

What is the timeline for submitting medical receipts to insurance for claims?

Medical receipts should be submitted within the timeframe specified by the insurance provider, typically between 30 to 90 days from the date of service. Prompt submission ensures faster claim processing and reduces the risk of claim denial.

What Documents Should Be Retained for Medical Receipt Insurance Claims? Infographic