Receipt documents required for health insurance reimbursements include detailed medical bills, payment receipts, and prescription slips that clearly outline the services rendered and amounts paid. These documents must be legible, contain the provider's contact information, and date of service to ensure proper processing. Maintaining organized and accurate receipts helps streamline reimbursement claims and avoid delays.

What Receipt Documents are Required for Health Insurance Reimbursements?

| Number | Name | Description |

|---|---|---|

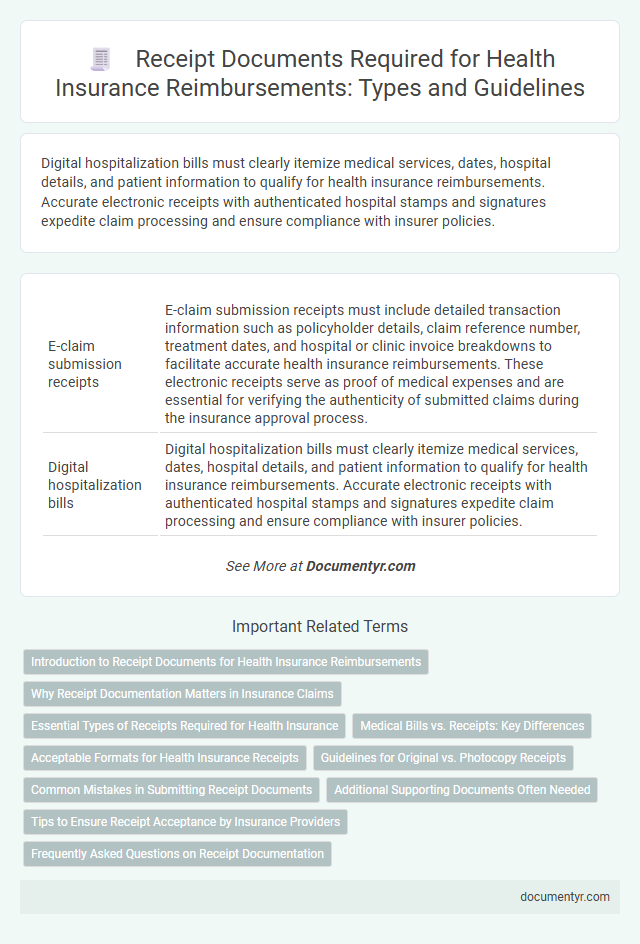

| 1 | E-claim submission receipts | E-claim submission receipts must include detailed transaction information such as policyholder details, claim reference number, treatment dates, and hospital or clinic invoice breakdowns to facilitate accurate health insurance reimbursements. These electronic receipts serve as proof of medical expenses and are essential for verifying the authenticity of submitted claims during the insurance approval process. |

| 2 | Digital hospitalization bills | Digital hospitalization bills must clearly itemize medical services, dates, hospital details, and patient information to qualify for health insurance reimbursements. Accurate electronic receipts with authenticated hospital stamps and signatures expedite claim processing and ensure compliance with insurer policies. |

| 3 | Pharmacy e-invoice copies | Pharmacy e-invoice copies are essential receipt documents required for health insurance reimbursements as they provide detailed proof of medication purchases, including drug names, quantities, prices, and transaction dates. Submitting these digital invoices ensures accurate claim processing and compliance with insurer policies, facilitating faster reimbursement approvals. |

| 4 | QR-coded diagnostic reports | QR-coded diagnostic reports are essential receipt documents required for health insurance reimbursements as they provide verified, tamper-proof medical data ensuring authenticity and quick processing. These reports facilitate seamless claim settlements by linking detailed diagnostic information directly to insurance providers. |

| 5 | Telehealth consultation receipts | Telehealth consultation receipts must include the provider's name, date of service, type of consultation, and payment amount to qualify for health insurance reimbursements. Insurance companies often require itemized receipts detailing the virtual service delivered and the technology platform used. |

| 6 | Cashless claim settlement vouchers | Cashless claim settlement vouchers are essential receipt documents for health insurance reimbursements, providing proof of direct payment to the hospital by the insurer. These vouchers must include detailed information such as patient details, treatment costs, and approval signatures to ensure smooth processing and reimbursement. |

| 7 | Itemized treatment cost breakups | Health insurance reimbursements require detailed receipt documents that include itemized treatment cost breakups specifying charges for consultations, diagnostic tests, medications, and procedures. These detailed receipts enable accurate claim processing and verification of eligible expenses according to policy terms. |

| 8 | Pre-authorization approval slips | Pre-authorization approval slips are essential receipt documents required for health insurance reimbursements, as they validate prior consent from the insurance provider for specific medical procedures or treatments. Submitting these slips along with detailed bills and medical reports ensures smoother claim processing and reduces the risk of claim denial. |

| 9 | Electronic proof of payment (UPI, wallet) | Electronic proofs of payment such as UPI transaction IDs and digital wallet receipts serve as essential documents for health insurance reimbursements, verifying the payment and enabling seamless claim processing. Insurers typically require these electronic payment confirmations to authenticate the expenditure and prevent fraud, ensuring compliance with claim submission guidelines. |

| 10 | Wearable device health monitoring logs | Wearable device health monitoring logs serve as critical receipt documents for health insurance reimbursements by providing detailed records of vital signs and physical activity, which validate claims related to preventive care and chronic disease management. Insurers typically require these digital logs to be time-stamped, authenticated, and aligned with prescribed monitoring periods to ensure accuracy and compliance with reimbursement policies. |

Introduction to Receipt Documents for Health Insurance Reimbursements

Receipt documents play a crucial role in health insurance reimbursements by verifying the medical expenses you have incurred. These documents provide proof of payment and detailed information about the services rendered.

Health insurance providers require specific receipt documents to process claims accurately and efficiently. Properly organized receipts help ensure timely reimbursement and reduce the risk of claim denials.

Why Receipt Documentation Matters in Insurance Claims

Receipt documentation is essential in health insurance reimbursements to verify the authenticity of medical expenses. Proper receipts ensure accurate claim processing and prevent fraudulent claims.

- Proof of Payment - Receipts validate that the medical service or product was paid for by the insured individual.

- Detailed Service Information - Receipts include specifics such as date, provider details, and type of treatment, which are crucial for claim verification.

- Compliance with Insurance Policy - Proper receipt documentation aligns submitted claims with insurer requirements, avoiding delays or denials.

Accurate and complete receipt documentation streamlines health insurance claims and supports timely reimbursement.

Essential Types of Receipts Required for Health Insurance

| Receipt Type | Description | Importance for Health Insurance Reimbursement |

|---|---|---|

| Medical Bills Receipt | Official invoices issued by hospitals, clinics, or diagnostic centers listing treatment details, services provided, and charges. | Serves as proof of healthcare services availed and the cost incurred; mandatory for claim processing. |

| Pharmacy Receipts | Receipts issued when purchasing prescribed medicines and medical supplies from licensed pharmacies. | Validates expenses on prescribed drugs; critical for medicine reimbursement under health insurance. |

| Doctor's Prescriptions | Written prescriptions by licensed medical practitioners specifying medication or treatment required. | Confirms medical necessity of treatments and medications claimed for reimbursement. |

| Diagnostic Test Reports with Receipts | Receipts combined with diagnostic reports from authorized labs for tests like blood work, X-rays, MRIs, etc. | Demonstrates the nature and cost of diagnostic procedures for insurance claim validation. |

| Payment Receipts | Proof of payment made towards hospital bills, medicines, and other related healthcare expenses. | Validates actual expenditure and supports the authenticity of reimbursement claims. |

| Discharge Summary | Document issued upon patient discharge detailing hospital stay, treatment, and procedures performed. | Acts as evidence of hospitalization duration and treatment specifics necessary for cashless claims or reimbursements. |

Medical Bills vs. Receipts: Key Differences

Receipts and medical bills serve different purposes in health insurance reimbursements. Understanding these distinctions ensures your claims are processed smoothly.

Medical bills outline detailed charges from healthcare providers. Receipts confirm payment for medical services received.

- Purpose - Medical bills itemize services and costs, while receipts verify proof of payment.

- Content - Medical bills include provider details, treatment dates, and codes; receipts include payment date and amount paid.

- Usage in Claims - Insurance companies require medical bills to assess coverage and receipts to confirm payment for reimbursements.

Acceptable Formats for Health Insurance Receipts

Health insurance reimbursements require specific receipt documents that prove eligible medical expenses. These receipts must clearly show details such as the provider's name, date of service, description of treatment, and payment amount.

Acceptable formats for health insurance receipts include printed invoices, digital receipts, and official pharmacy bills. Scanned copies or clear photographs of original receipts are also accepted, provided they contain all necessary information and are legible.

Guidelines for Original vs. Photocopy Receipts

Health insurance reimbursements require proper receipt documents to validate your medical expenses. Guidelines distinguish between original receipts and photocopies to ensure authenticity and compliance.

- Original Receipts Are Mandatory - Health insurance providers typically require original receipts as proof of genuine medical transactions.

- Photocopy Receipts May Be Rejected - Photocopies often lack verifiable authenticity and may not be accepted during claims processing.

- Authorized Originals Include Stamps and Signatures - Valid receipts must contain official stamps, signatures, and itemized details to qualify for reimbursement.

Common Mistakes in Submitting Receipt Documents

Receipt documents play a crucial role in health insurance reimbursements by providing proof of medical expenses. Proper submission of these documents ensures timely and accurate claim processing.

Common mistakes in submitting receipt documents include incomplete or unclear receipts, missing essential details such as the provider's information, and lack of itemized bills. Sometimes, receipts submitted are not original or do not match the claimed treatment dates. Ensuring your receipts are legible, detailed, and authentic can significantly reduce claim rejections and delays.

Additional Supporting Documents Often Needed

What receipt documents are required for health insurance reimbursements? Health insurance companies typically require original payment receipts detailing the medical services or medicines purchased. These receipts must clearly show the patient's name, date of service, and amount paid.

What additional supporting documents are often needed for health insurance reimbursements? Besides original receipts, insurers frequently request prescriptions, diagnosis reports, and discharge summaries to verify the treatment. These documents help ensure the claim's validity and facilitate faster processing.

Tips to Ensure Receipt Acceptance by Insurance Providers

Health insurance reimbursements require detailed receipts that clearly show the provider's name, date of service, description of treatment, and the amount paid. Receipts must be original or digitally certified to avoid rejection by insurance companies. Keep receipts legible, itemized, and match them with your insurance claim forms to ensure timely reimbursement processing.

What Receipt Documents are Required for Health Insurance Reimbursements? Infographic