Receipt documents required for charitable donation proof must include the donor's name, date of the donation, and the nonprofit organization's details. The receipt should specify the donation amount or a description of any donated items, along with a statement confirming no goods or services were provided in exchange. Proper documentation ensures compliance with tax regulations and facilitates accurate record-keeping for both donors and charitable organizations.

What Receipt Documents Are Required for Charitable Donation Proof?

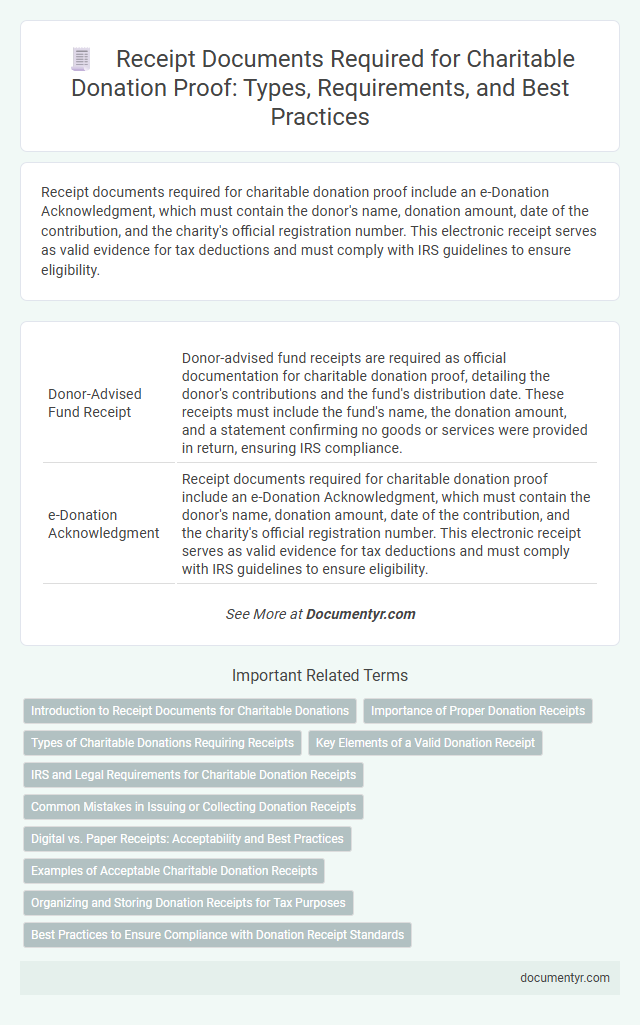

| Number | Name | Description |

|---|---|---|

| 1 | Donor-Advised Fund Receipt | Donor-advised fund receipts are required as official documentation for charitable donation proof, detailing the donor's contributions and the fund's distribution date. These receipts must include the fund's name, the donation amount, and a statement confirming no goods or services were provided in return, ensuring IRS compliance. |

| 2 | e-Donation Acknowledgment | Receipt documents required for charitable donation proof include an e-Donation Acknowledgment, which must contain the donor's name, donation amount, date of the contribution, and the charity's official registration number. This electronic receipt serves as valid evidence for tax deductions and must comply with IRS guidelines to ensure eligibility. |

| 3 | Blockchain Donation Certificate | Blockchain donation certificates serve as immutable receipt documents required for charitable donation proof, ensuring transparency and verifiable authenticity through decentralized ledger technology. These certificates record transaction details, donor identity, and donation amount, streamlining tax deduction claims and regulatory compliance. |

| 4 | In-Kind Gift Valuation Statement | An In-Kind Gift Valuation Statement is required to substantiate charitable donations of non-cash items, detailing the fair market value of the donated goods at the time of contribution. This document ensures compliance with IRS regulations by providing accurate valuation, allowing donors to claim appropriate tax deductions. |

| 5 | Qualified Appraisal Report | A Qualified Appraisal Report is required for charitable donations of property valued over $5,000 and must be completed by a qualified appraiser to substantiate the donation's fair market value. This report serves as essential documentation to comply with IRS regulations and claim a tax deduction accurately. |

| 6 | Digital NFT Receipt | Digital NFT receipts serve as verifiable proof of charitable donations by securely linking the donor's identity and transaction details on a blockchain ledger. These receipts include essential information such as the charity's name, donation amount, date, and a unique token ID, ensuring transparency and compliance with tax regulations. |

| 7 | Peer-to-Peer Fundraising Confirmation | Peer-to-peer fundraising confirmation requires a detailed receipt documenting donor information, donation amount, date, and confirmation of funds transfer to the charitable organization for tax deduction purposes. Official receipts must comply with IRS guidelines, including the charity's name, tax ID, and a statement that no goods or services were provided in exchange. |

| 8 | Crowdfunding Platform Receipt | A crowdfunding platform receipt for charitable donations must include the donor's name, the transaction date, the donation amount, the platform's name, and a statement verifying the donation's tax-deductible status. This receipt serves as essential documentation for tax deduction claims and compliance with IRS regulations on charitable contributions. |

| 9 | Gift Acceptance Policy Disclosure | Receipts for charitable donations must comply with IRS guidelines by including the charity's name, donation date, amount, and a statement of any goods or services received, ensuring transparency under the Gift Acceptance Policy Disclosure. This documentation is essential to validate the donation for tax deductions and aligns with nonprofit regulations to prevent conflicts of interest and promote donor trust. |

| 10 | Donor Privacy Compliance Notice | Receipts for charitable donations must include a Donor Privacy Compliance Notice to ensure adherence to data protection laws, detailing how donor information is collected, used, and safeguarded. This notice protects donor privacy by informing individuals of their rights and the charity's commitment to confidentiality and secure handling of personal data. |

Introduction to Receipt Documents for Charitable Donations

Receipts serve as essential documentation when claiming tax deductions for charitable donations. Proper receipt documents provide proof of the contribution and its value for legal and financial purposes.

- Official Donation Receipt - Issued by the charity, this receipt confirms the donation amount and details the organization's tax-exempt status.

- Itemized Contribution Statement - Lists donated goods or services with estimated values, required for non-cash contributions.

- Bank or Credit Card Statement - Shows transaction records supporting electronic donations to qualified charitable organizations.

Importance of Proper Donation Receipts

Receipt documents serve as essential proof for charitable donations and play a crucial role in tax deduction claims. Proper donation receipts ensure your contributions are accurately recorded and legally recognized.

- Detailed Donation Receipt - Includes donor name, donation amount, date, and charity details to validate the transaction.

- Official Charity Documentation - Verifies the nonprofit status of the organization receiving the donation.

- Itemized Receipts for Non-Cash Donations - Lists donated goods with estimated fair market value for IRS compliance.

Types of Charitable Donations Requiring Receipts

What types of charitable donations require receipts for proof? Most monetary contributions to qualified organizations need receipts to validate the donation. Non-cash donations exceeding a certain value also require detailed receipts for tax deduction purposes.

Key Elements of a Valid Donation Receipt

A valid charitable donation receipt must include the donor's name, the charity's name, and the date of the donation. It should clearly state the amount of cash or a detailed description of non-cash contributions. The receipt must also contain a statement confirming whether any goods or services were provided in exchange for the donation.

IRS and Legal Requirements for Charitable Donation Receipts

The IRS requires specific documentation to prove charitable donations for tax deduction purposes. Your receipt must include the organization's name, the date of the donation, and a description of the donated items or cash amount.

Legal requirements state that donations over $250 need a written acknowledgment from the charity to claim a tax deduction. This receipt should also confirm whether any goods or services were provided in exchange for the donation.

Common Mistakes in Issuing or Collecting Donation Receipts

Receipt documents for charitable donation proof typically include official donation receipts issued by registered charities, containing the donor's name, donation amount, date, and the charity's registration number. These documents are essential for tax deductions and verifying contributions.

Common mistakes in issuing or collecting donation receipts include missing donor information, inaccurate donation amounts, and lack of proper authorization or signatures from the charity. You should ensure that all receipts clearly state the charity's registration details and the purpose of the donation. Failure to obtain accurate receipts may result in denied tax benefits or complications during audits.

Digital vs. Paper Receipts: Acceptability and Best Practices

Receipt documents required for charitable donation proof include official acknowledgment from the charity, detailing the donation amount and date. Both digital and paper receipts are generally acceptable, provided they contain the necessary information to verify your contribution. For best practices, ensure your receipt is legible, includes the charity's name, and keeps digital backups to safeguard your records.

Examples of Acceptable Charitable Donation Receipts

| Receipt Type | Details | Examples |

|---|---|---|

| Written Acknowledgment | Required for donations valued over $250. Must include donee's name, donation date, and amount or description of non-cash donation. | Official charity letterhead acknowledgment, printed receipt from the organization, or email confirmation with detailed donation info. |

| Bank or Credit Card Statement | Used for cash donations under $250. Should show donor's name, charity's name, and transaction amount. | Credit card bill, bank statement, or a canceled check in your name reflecting the charitable donation. |

| Payroll Deduction Statement | Employer-provided statement verifying donations deducted from paycheck. Includes charity name and total contributions. | Annual payroll summary, pay stub notation, or employer's official statement confirming charitable contributions. |

| Receipt for Donated Property | For non-cash donations under $500, requires a receipt showing description and condition of property accepted by charity. | Signed donation form from the organization detailing items donated, like clothing, furniture, or vehicles. |

| Qualified Appraisal | Necessary for non-cash donations over $5,000. Must be prepared by a qualified appraiser and include the appraiser's information. | Formal appraisal report attached to the receipt or acknowledgement from the charity documenting the item's fair market value. |

Organizing and Storing Donation Receipts for Tax Purposes

Organizing donation receipts is essential for proving charitable contributions during tax filing. Proper documentation ensures you can claim eligible deductions accurately and avoid potential audits.

Store receipts in a dedicated folder, either physical or digital, categorized by donor organization and date. Maintaining clear records supports compliance with IRS requirements for charitable donation proof.

What Receipt Documents Are Required for Charitable Donation Proof? Infographic