Corporate credit card receipt reconciliation requires documents such as detailed receipts, transaction statements, and expense reports to ensure accurate record-keeping. Supporting documents like approval notes and purchase orders help verify the legitimacy of each transaction. Maintaining organized and complete documentation streamlines auditing and financial reporting processes.

What Documents Are Needed for Corporate Credit Card Receipt Reconciliation?

| Number | Name | Description |

|---|---|---|

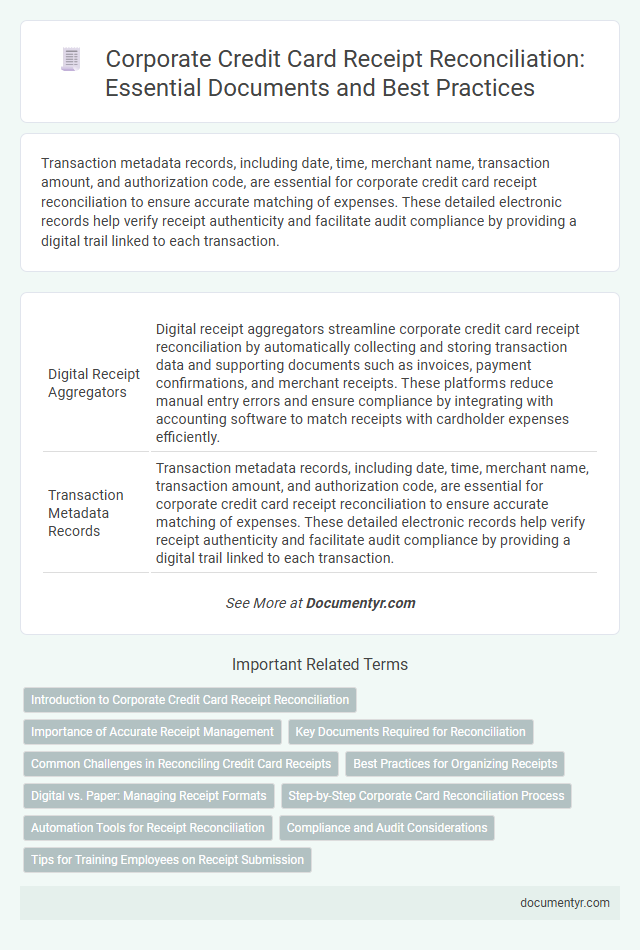

| 1 | Digital Receipt Aggregators | Digital receipt aggregators streamline corporate credit card receipt reconciliation by automatically collecting and storing transaction data and supporting documents such as invoices, payment confirmations, and merchant receipts. These platforms reduce manual entry errors and ensure compliance by integrating with accounting software to match receipts with cardholder expenses efficiently. |

| 2 | Transaction Metadata Records | Transaction metadata records, including date, time, merchant name, transaction amount, and authorization code, are essential for corporate credit card receipt reconciliation to ensure accurate matching of expenses. These detailed electronic records help verify receipt authenticity and facilitate audit compliance by providing a digital trail linked to each transaction. |

| 3 | Corporate Card Feed Integrations | Corporate credit card receipt reconciliation requires integrating corporate card feeds with expense management software to automatically import transaction data, reducing manual entry errors. Essential documents include detailed receipts, transaction reports, and vendor invoices synced directly through secure API connections between the corporate card issuer and the accounting system. |

| 4 | E-Invoice Attachments | E-invoice attachments are essential for corporate credit card receipt reconciliation, providing digital proof of transactions that streamline expense verification and auditing processes. These documents include detailed transaction records, vendor information, and itemized charges, ensuring accuracy and compliance with financial regulations. |

| 5 | Real-Time Expense Submission Logs | Corporate credit card receipt reconciliation requires real-time expense submission logs that capture transaction details, timestamps, and merchant information to ensure accuracy and prevent fraud. These logs must be paired with original receipts and approval records to maintain compliance with internal audit standards and financial policies. |

| 6 | Automated OCR Extracted Receipts | Automated OCR technology extracts key data such as merchant name, transaction date, amount, and tax details from corporate credit card receipts, streamlining receipt reconciliation by eliminating manual entry errors. Essential documents include original receipts, credit card statements, and expense reports alongside OCR-processed data for accurate verification and audit compliance. |

| 7 | AI-Powered Mismatch Alerts | Corporate credit card receipt reconciliation requires accurate submission of transaction receipts, detailed invoices, and vendor proofs to verify spending. AI-powered mismatch alerts enhance this process by automatically detecting discrepancies between submitted receipts and recorded transactions, increasing accuracy and reducing manual review time. |

| 8 | ERP System Receipt Imports | Corporate credit card receipt reconciliation in ERP systems requires importing digital copies of receipts, typically in formats such as PDF or JPEG, along with transaction details like date, amount, vendor name, and cardholder information. Accurate mapping of these imported receipts to corresponding credit card statements within the ERP ensures efficient expense tracking and audit compliance. |

| 9 | Audit Trail Snapshots | Audit trail snapshots are essential for corporate credit card receipt reconciliation as they provide detailed, time-stamped records of transactions, enabling verification of purchase authenticity and compliance with company policies. These digital records must include transaction dates, amounts, vendor details, and user approvals to ensure accurate expense tracking and streamline audit processes. |

| 10 | Virtual Card Transaction Statements | Virtual card transaction statements serve as essential documentation for corporate credit card receipt reconciliation, providing detailed records of individual purchases, dates, vendors, and transaction amounts. These statements streamline expense verification by matching each virtual card transaction with corresponding receipts, ensuring accuracy and compliance with corporate financial policies. |

Introduction to Corporate Credit Card Receipt Reconciliation

Corporate credit card receipt reconciliation is essential for maintaining accurate financial records and ensuring compliance with company policies. It involves matching receipts with corporate card transactions to verify expenses and prevent discrepancies.

This process requires gathering specific documents to support each transaction and simplify auditing.

- Corporate credit card statement - Detailed list of transactions from the credit card issuer that serves as the primary reference for reconciliation.

- Original receipts - Proof of purchase that includes date, vendor, amount, and description validating each expense.

- Expense reports - Reports filled by employees summarizing business expenses, providing context for each transaction.

Importance of Accurate Receipt Management

Accurate receipt management is essential for corporate credit card receipt reconciliation to ensure compliance with financial policies and facilitate precise expense tracking. Proper documentation prevents discrepancies and aids in auditing processes by providing verifiable proof of transactions.

Required documents typically include itemized receipts, credit card statements, and approval forms that validate the expenditure. Maintaining organized and accurate records improves financial transparency and streamlines the reconciliation workflow for corporate finance teams.

Key Documents Required for Reconciliation

What documents are needed for corporate credit card receipt reconciliation? Receipts detailing each transaction are essential to verify expenses and match them with credit card statements. You must also provide the credit card statement and any relevant approval forms for accurate reconciliation.

Common Challenges in Reconciling Credit Card Receipts

| Documents Needed for Corporate Credit Card Receipt Reconciliation |

|---|

| Detailed receipts showing itemized purchases |

| Credit card statements with transaction dates and amounts |

| Expense reports linked to each transaction |

| Approval forms or authorization for specific purchases |

| Supporting documents such as invoices or travel itineraries |

| Common Challenges in Reconciling Credit Card Receipts |

| Missing or incomplete receipts causing discrepancies |

| Unclear or illegible receipts making verification difficult |

| Timing differences between transaction dates and statement dates |

| Multiple transactions combined into a single receipt complicating allocation |

| Unauthorized or personal expenses mixed with corporate charges |

| You may face difficulties ensuring all purchases are properly documented and reconciled |

| Manual reconciliation processes prone to human error and delays |

Best Practices for Organizing Receipts

Proper receipt reconciliation is essential for accurate corporate credit card expense tracking and compliance. Efficient organization of receipts facilitates smoother audits and financial reporting.

- Original Receipts - Collect all physical or digital receipts that match each credit card transaction to verify expenditures accurately.

- Detailed Expense Reports - Include itemized expense reports that link receipts to business purposes, dates, and approval statuses.

- Consistent Filing System - Implement a standardized filing method, such as categorized folders or digital management tools, to keep receipts easily accessible and well-organized.

Maintaining these best practices ensures transparent, accountable reconciliation of corporate credit card expenses.

Digital vs. Paper: Managing Receipt Formats

Receipts for corporate credit card reconciliation come in two primary formats: digital and paper. Understanding the differences in managing these formats is crucial for accurate record-keeping and auditing.

Digital receipts can be easily stored, searched, and shared, often integrating seamlessly with expense management software. Paper receipts require physical filing and are prone to loss or damage, making them harder to track. You should establish a consistent process to capture and organize both formats to ensure compliance and simplify reconciliation.

Step-by-Step Corporate Card Reconciliation Process

Receipt reconciliation for corporate credit cards requires specific documents to ensure accuracy and compliance. Proper documentation helps streamline the review and approval process efficiently.

- Credit Card Statement - Provides a detailed list of all transactions made during the billing period.

- Receipts and Invoices - Serve as proof of purchase and verify the purpose of each transaction.

- Expense Report - Summarizes and categorizes expenses, linking each transaction to business activities.

Automation Tools for Receipt Reconciliation

Corporate credit card receipt reconciliation requires essential documents such as itemized receipts, credit card statements, and expense reports. Automation tools streamline this process by using AI-powered OCR to extract and match data accurately, reducing manual errors. These tools also integrate with accounting software, enhancing efficiency and ensuring compliance with company policies.

Compliance and Audit Considerations

Corporate credit card receipt reconciliation requires specific documentation to ensure compliance with internal policies and external regulations. Essential documents include original receipts, detailed expense reports, and transaction statements from the credit card provider.

Maintaining accurate records supports audit trails and reduces the risk of financial discrepancies or penalties. Your organization must retain these documents for the required period to meet regulatory audit standards effectively.

What Documents Are Needed for Corporate Credit Card Receipt Reconciliation? Infographic