To ensure reimbursement of business travel expenses, essential documents include original receipts that clearly display the date, vendor, itemized purchases, and total amount paid. A detailed expense report outlining the purpose of the trip and the business nature of each expense must accompany these receipts. Submission of company-specific forms or approval signatures may also be required to validate and process the reimbursement request efficiently.

What Documents Are Needed for Reimbursement of Business Travel Receipts?

| Number | Name | Description |

|---|---|---|

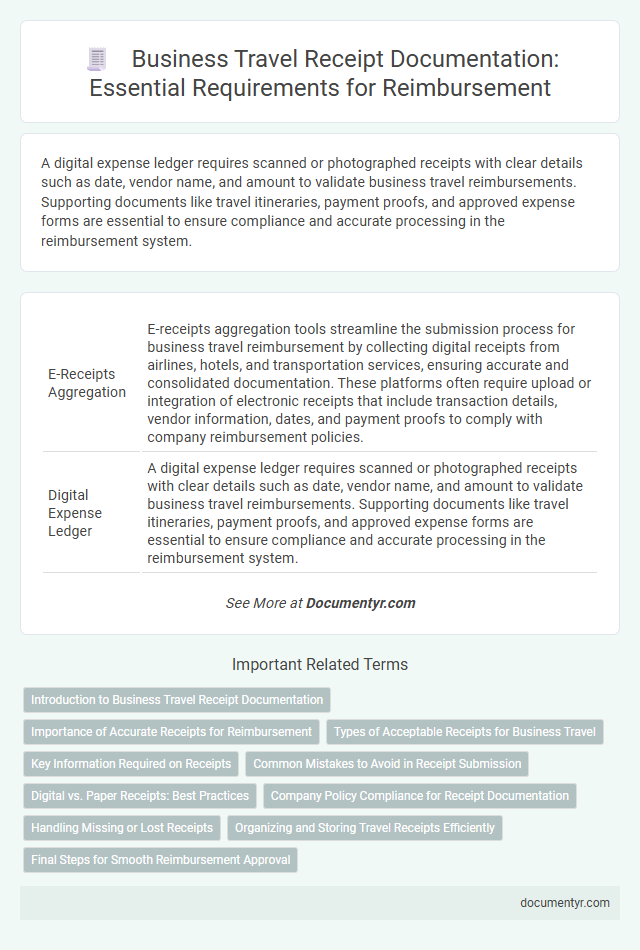

| 1 | E-Receipts Aggregation | E-receipts aggregation tools streamline the submission process for business travel reimbursement by collecting digital receipts from airlines, hotels, and transportation services, ensuring accurate and consolidated documentation. These platforms often require upload or integration of electronic receipts that include transaction details, vendor information, dates, and payment proofs to comply with company reimbursement policies. |

| 2 | Digital Expense Ledger | A digital expense ledger requires scanned or photographed receipts with clear details such as date, vendor name, and amount to validate business travel reimbursements. Supporting documents like travel itineraries, payment proofs, and approved expense forms are essential to ensure compliance and accurate processing in the reimbursement system. |

| 3 | OCR-Verified Invoices | OCR-verified invoices are essential documents for reimbursement of business travel expenses, ensuring accurate extraction of data such as date, vendor name, and total amount from scanned receipts. These digitally verified invoices streamline the approval process by providing standardized proof of expenditure that meets compliance and auditing requirements. |

| 4 | Automated Per Diem Calculators | Automated per diem calculators require detailed business travel receipts including transportation, lodging, and meal expenses to accurately verify reimbursement claims. These systems rely on itemized receipts and official travel itineraries to ensure compliance with company policies and government regulations. |

| 5 | Blockchain-Stamped Receipts | For reimbursement of business travel expenses, essential documents include original receipts, proof of payment, and detailed travel itineraries, with blockchain-stamped receipts providing an immutable and verifiable record that ensures authenticity and prevents fraud. Blockchain technology enhances the integrity of business travel receipts by securely timestamping and storing transaction data, streamlining the approval process for reimbursements. |

| 6 | VAT Compliance Certificates | For reimbursement of business travel expenses, VAT compliance certificates must be submitted alongside official receipts to verify the legitimacy of VAT charges. These certificates ensure adherence to tax regulations and facilitate accurate VAT reclaim processes within corporate accounting systems. |

| 7 | Geo-Tagged Travel Proofs | Reimbursement of business travel expenses requires submission of geo-tagged travel proofs, including GPS-enabled receipts and timestamped location data to validate travel routes and expenses. These digital documents enhance transparency and comply with corporate policies by accurately linking costs to business travel locations. |

| 8 | API-Linked Transportation Stubs | For reimbursement of business travel receipts, API-linked transportation stubs such as e-tickets, boarding passes, and payment confirmations serve as essential proof of transaction and travel details. These documents must clearly display traveler information, date, origin, destination, and fare paid to ensure compliance with company and tax regulations. |

| 9 | Carbon Offset Documentation | For reimbursement of business travel receipts, carbon offset documentation must include official receipts or certificates showing the purchase of verified carbon credits from recognized environmental organizations. These documents should clearly state the offset project details, the amount of CO2 offset, and correspond with the travel dates and destinations to ensure compliance with company sustainability policies. |

| 10 | Multi-Currency Reimbursement Forms | Multi-currency reimbursement forms require original business travel receipts that clearly display the date, vendor details, transaction amount in the foreign currency, and payment method to ensure accurate currency conversion and compliance. Supporting documents such as credit card statements or bank proofs may also be necessary to verify exchange rates and cross-check expenses during multi-currency reimbursement processing. |

Introduction to Business Travel Receipt Documentation

Business travel receipt documentation is essential for accurate reimbursement and financial record-keeping. Proper documentation ensures compliance with company policies and tax regulations.

You need to collect detailed receipts that capture expenses such as transportation, lodging, meals, and incidentals. Maintaining organized records streamlines the reimbursement process and minimizes errors.

Importance of Accurate Receipts for Reimbursement

Accurate receipts are essential for the reimbursement of business travel expenses to ensure proper documentation and compliance with company policies. Without precise receipts, reimbursement claims may be delayed or denied, affecting your financial recovery.

- Detailed Receipt Information - Receipts must clearly show the date, vendor, amount, and purpose of the expense for verification.

- Original Copies - Submitting original or scanned copies of receipts is crucial to prevent fraud and maintain expense records.

- Compliance with Company Policies - Receipts must align with the organization's reimbursement guidelines to guarantee approval and processing.

Types of Acceptable Receipts for Business Travel

| Type of Receipt | Description | Key Details Required | Common Use Cases |

|---|---|---|---|

| Airfare Receipt | Proof of payment for airline tickets purchased for business travel. | Passenger name, flight details, date, amount paid, payment method. | Reimbursement of flights to business meetings, conferences, or client visits. |

| Hotel Invoice | Document showing expenses related to lodging during business trips. | Guest name, reservation dates, room rate, taxes, total amount. | Claims for overnight stays during business travel. |

| Car Rental Receipt | Evidence of rental charges for vehicles used during business travel. | Rental period, vehicle type, rental company, amount charged. | Reimbursement for transport needs at business destinations. |

| Taxi or Ride-Sharing Receipts | Proof of transportation costs incurred using cabs or services like Uber or Lyft. | Date of service, pickup and drop-off locations, fare amount. | Local travel expenses between airports, hotels, and meetings. |

| Meal Receipts | Receipts showing cost of meals during business travel. | Restaurant name, date, items ordered, total cost. | Reimbursement for business-related dining expenses. |

| Public Transportation Tickets | Tickets or receipts for buses, trains, subways used during business trips. | Date, route, fare amount. | Claims for economical transportation options during travel. |

| Conference or Event Registration Receipts | Documentation of registration fees paid for business events or seminars. | Event name, registrant information, fee amount, date. | Reimbursement of professional development or networking event costs. |

Key Information Required on Receipts

Reimbursement of business travel expenses requires specific documentation to ensure compliance and accuracy. Receipts must contain essential information to validate the expenses for your company's accounting records.

- Date of Purchase - The receipt must clearly display the transaction date to confirm the expense occurred during the business trip.

- Vendor Details - The name and contact information of the service provider or merchant should be shown to verify the source of the expense.

- Itemized Description - A detailed list of purchased goods or services is necessary to distinguish business-related costs from personal expenses.

Receipts missing any of these key elements may lead to reimbursement delays or denials.

Common Mistakes to Avoid in Receipt Submission

Submitting business travel receipts requires precise documentation to ensure timely reimbursement. Essential documents include original receipts, proof of payment, and a detailed travel itinerary.

Common mistakes to avoid include submitting blurry or incomplete receipts, missing signatures on expense reports, and failing to provide itemized details. Ensure all receipts are dated correctly and correspond to approved travel dates. Keep your documents organized to prevent delays in the reimbursement process.

Digital vs. Paper Receipts: Best Practices

For reimbursement of business travel expenses, both digital and paper receipts are commonly accepted, but digital receipts offer enhanced accessibility and easier submission. Businesses should ensure digital receipts are clear, itemized, and include all necessary details such as date, vendor, and amount. Retaining original paper receipts as a backup is recommended for compliance and audit purposes, especially if digital copies are lost or corrupted.

Company Policy Compliance for Receipt Documentation

Company policy compliance for receipt documentation requires submitting original receipts that clearly show the date, vendor, and amount spent. You must ensure all receipts correspond to approved business travel expenses and are itemized to avoid reimbursement delays. Retaining receipts that align with your organization's guidelines is essential for smooth processing and audit purposes.

Handling Missing or Lost Receipts

Reimbursement of business travel receipts requires original receipts, including transportation, lodging, and meal expenses. Proper documentation ensures accurate and timely processing of your reimbursement claims.

Handling missing or lost receipts involves submitting a detailed lost receipt affidavit or expense report explaining the circumstances. Providing alternative proof like credit card statements can support your claim and expedite approval.

Organizing and Storing Travel Receipts Efficiently

Efficient organization and storage of business travel receipts simplify the reimbursement process and prevent delays. Proper documentation ensures accuracy and accountability for all expenses incurred.

- Keep physical and digital copies - Store hard copies in a dedicated folder and scan receipts to create electronic backups for secure access.

- Label receipts by date and category - Sorting receipts chronologically and by expense type streamlines verification and expense reporting.

- Use expense management apps - Leverage specialized software to capture, organize, and submit travel receipts directly from your mobile device.

What Documents Are Needed for Reimbursement of Business Travel Receipts? Infographic