Nonprofits must maintain accurate receipt documents to ensure fundraising compliance, including donation acknowledgment letters that specify the donor's name, donation amount, and date. These receipts should clarify whether any goods or services were provided in exchange for the contribution to comply with IRS regulations. Proper documentation supports transparency, tax deduction claims, and adherence to state and federal fundraising laws.

What Receipt Documents Does a Nonprofit Need for Fundraising Compliance?

| Number | Name | Description |

|---|---|---|

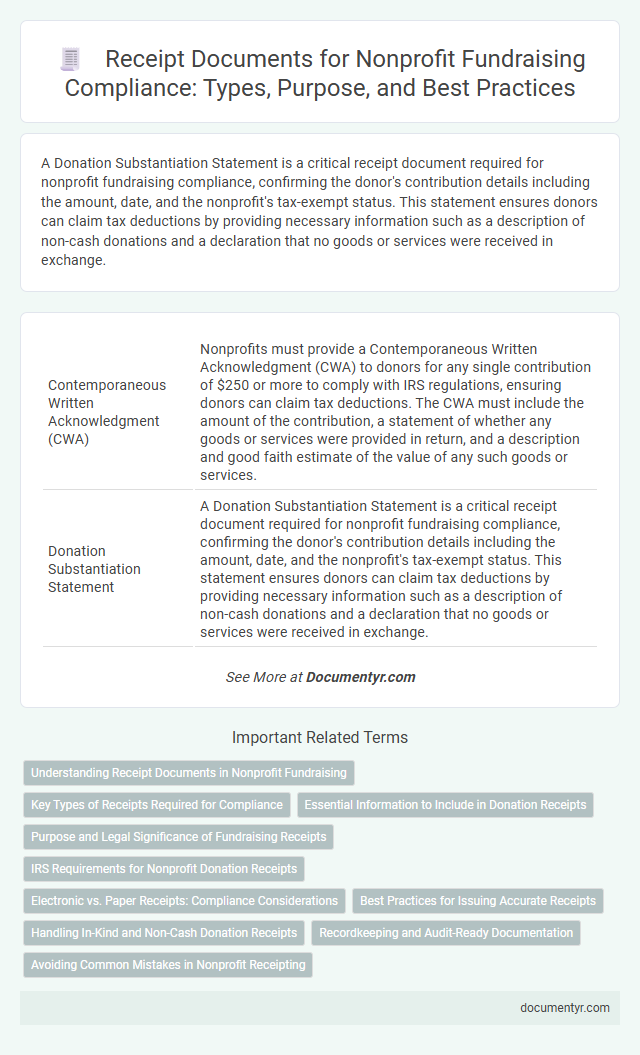

| 1 | Contemporaneous Written Acknowledgment (CWA) | Nonprofits must provide a Contemporaneous Written Acknowledgment (CWA) to donors for any single contribution of $250 or more to comply with IRS regulations, ensuring donors can claim tax deductions. The CWA must include the amount of the contribution, a statement of whether any goods or services were provided in return, and a description and good faith estimate of the value of any such goods or services. |

| 2 | Donation Substantiation Statement | A Donation Substantiation Statement is a critical receipt document required for nonprofit fundraising compliance, confirming the donor's contribution details including the amount, date, and the nonprofit's tax-exempt status. This statement ensures donors can claim tax deductions by providing necessary information such as a description of non-cash donations and a declaration that no goods or services were received in exchange. |

| 3 | Quid Pro Quo Disclosure Notice | A nonprofit must provide a Quid Pro Quo Disclosure Notice for any fundraising contribution exceeding $75, clearly stating the value of goods or services received in exchange. This notice ensures compliance with IRS regulations by informing donors of the deductible amount of their donation. |

| 4 | Electronic Tax Receipt | Nonprofits must issue electronic tax receipts that include donor identification, donation amount, date of contribution, and the organization's official registration number to ensure fundraising compliance. These digital receipts must comply with IRS guidelines and local regulations to validate tax-deductible donations and maintain transparent financial records. |

| 5 | In-Kind Gift Acknowledgment | Nonprofits must issue detailed In-Kind Gift Acknowledgments that specify the donor's name, description of the donated goods or services, and the date of the contribution to comply with fundraising regulations. These receipts serve as official documentation for tax purposes and help maintain transparency and accountability in nonprofit fundraising activities. |

| 6 | Donor-Advised Fund Grant Receipt | A nonprofit must provide a Donor-Advised Fund Grant Receipt that includes the donor-advised fund sponsor's name, the donation amount, and the date of the grant to ensure IRS compliance. This receipt serves as official documentation for the donor's tax deduction and confirms the nonprofit's receipt of funds from the donor-advised fund. |

| 7 | Cryptocurrency Donation Receipt | Nonprofits must issue cryptocurrency donation receipts that include the donor's name, date of donation, fair market value at the time of the transaction, and a clear statement confirming no goods or services were provided in exchange for the contribution. These receipts ensure compliance with IRS regulations and provide transparent documentation for donors claiming tax deductions. |

| 8 | Non-Cash Contribution Receipt | Nonprofit organizations must provide Non-Cash Contribution Receipts that include a detailed description of the donated items, the date of contribution, and the donor's information to ensure compliance with IRS regulations. These receipts are essential for donors claiming tax deductions and must reflect the fair market value of the non-cash gifts in accordance with IRS guidelines. |

| 9 | Event Ticket Value Statement | Nonprofit organizations must provide an event ticket value statement that clearly separates the deductible portion of the ticket price from the fair market value of any goods or services received. This statement ensures compliance with IRS guidelines by informing donors of the exact amount eligible for a tax deduction. |

| 10 | Disaster Relief Gift Certification | Disaster relief gift certification requires nonprofits to provide detailed receipts documenting donor information, donation amount, and designation specifically for disaster relief efforts to comply with IRS regulations. These receipts must include the nonprofit's tax-exempt status, a statement that no goods or services were provided in exchange, and clear acknowledgment of the gift's purpose to ensure transparency and donor trust. |

Understanding Receipt Documents in Nonprofit Fundraising

Understanding receipt documents is essential for nonprofit organizations to maintain fundraising compliance and transparency. Proper documentation supports legal requirements and donor trust.

- Donation Receipt - A formal acknowledgment issued to donors, detailing the donation amount and confirming tax-deductible eligibility.

- In-Kind Contribution Receipt - Records non-monetary donations such as goods or services, specifying fair market value and donor information.

- Event Ticket or Sales Receipt - Documents funds raised through events, highlighting the portion that is tax-deductible versus the value received.

Maintaining accurate and comprehensive receipt documents ensures compliance with fundraising regulations and fosters accountability in nonprofit operations.

Key Types of Receipts Required for Compliance

Nonprofits must issue specific types of receipts to ensure fundraising compliance and maintain donor trust. Proper documentation supports tax deductions and meets regulatory requirements.

Donation receipts confirming cash or in-kind contributions detail the donor's name, amount, and date of donation. Event ticket receipts and sponsorship acknowledgments serve as proof of fundraising activities and comply with legal standards.

Essential Information to Include in Donation Receipts

Nonprofit organizations must include essential information in donation receipts to maintain fundraising compliance. Receipts should clearly state the donor's name, the date of the donation, and the exact amount contributed. Including a statement confirming that no goods or services were provided in exchange for the donation is vital for tax deduction purposes.

Purpose and Legal Significance of Fundraising Receipts

What receipt documents does a nonprofit need for fundraising compliance? Nonprofit organizations must issue receipts that clearly state the donor's name, donation amount, date, and purpose of the contribution. These receipts serve as legal proof for tax deductions and ensure transparency in fundraising activities.

IRS Requirements for Nonprofit Donation Receipts

Nonprofit organizations must provide donation receipts that comply with IRS requirements to maintain fundraising transparency and legal compliance. These receipts serve as official documentation for donors to claim tax deductions.

The IRS mandates that nonprofit donation receipts include the organization's name, the donation date, and the exact amount contributed. For contributions over $250, a written acknowledgment must state whether any goods or services were provided in exchange for the donation. Failure to issue compliant receipts can jeopardize a nonprofit's tax-exempt status and reduce donor trust.

Electronic vs. Paper Receipts: Compliance Considerations

Nonprofits must provide accurate receipt documents to maintain fundraising compliance and donor trust. Understanding the compliance considerations for electronic versus paper receipts is critical in managing donor records effectively.

- Record Retention Requirements - Both electronic and paper receipts must be retained for a minimum of three to seven years, depending on state and IRS regulations.

- Legality of Electronic Receipts - Electronic receipts are legally acceptable if they include all required elements like donor name, donation amount, and nonprofit tax ID, ensuring compliance with IRS standards.

- Security and Accessibility - Electronic receipts require robust data security measures and easy donor access, while paper receipts demand physical storage and protection from damage or loss.

Best Practices for Issuing Accurate Receipts

Nonprofits must ensure fundraising receipts comply with legal and tax requirements to maintain transparency and donor trust. Accurate receipts are essential for documenting donations and supporting tax deductions.

- Include Key Information - Receipts should list the donor's name, donation amount, date, and a clear description of the contribution.

- Provide Tax-Exempt Status Details - Clearly display your nonprofit's tax-exempt identification number and statement verifying the donation's eligibility for tax deduction.

- Issue Receipts Promptly - Send receipts quickly after receiving donations to facilitate timely donor record-keeping and compliance with IRS guidelines.

Handling In-Kind and Non-Cash Donation Receipts

Nonprofits must provide accurate receipts to comply with fundraising regulations, especially when handling in-kind and non-cash donations. Proper documentation ensures transparency and supports donor tax deductions.

Receipts for in-kind donations should include a detailed description of the items, their estimated fair market value, and the date of donation. You must also specify if any goods or services were exchanged to comply with IRS guidelines.

Recordkeeping and Audit-Ready Documentation

| Receipt Document | Purpose | Key Details to Include |

|---|---|---|

| Donation Acknowledgment Receipts | Provide proof of contributions for donor tax purposes and organizational records | Donor name, donation date, amount or description of non-cash gifts, statement of goods/services provided or a declaration if none |

| Fundraising Event Receipts | Document payments related to fundraising events for transparency and audit trails | Buyer information, event date, amount paid, description of event or goods/services received |

| Grant and Sponsorship Receipts | Record grant funds or sponsorship contributions received | Funder name, grant/sponsorship amount, date received, purpose or restrictions on use |

| In-Kind Donation Receipts | Track non-monetary gifts to ensure proper valuation and reporting | Donor name, detailed description of item(s), estimated fair market value, date received |

| Expense Receipts for Fundraising Activities | Verify organizational spending related to fundraising for compliance and audits | Date, vendor name, description of expense, amount paid, relevance to fundraising |

| Internal Recordkeeping Logs | Maintain comprehensive logs to support receipts and reconcile donations | Date of transaction, donor or funder details, payment method, corresponding receipt numbers |

Maintaining these receipt documents ensures your nonprofit remains compliant with fundraising regulations and audit-ready, facilitating transparency and trust with donors and regulatory bodies.

What Receipt Documents Does a Nonprofit Need for Fundraising Compliance? Infographic