Travel expense receipt audits require essential documents such as original receipts detailing dates, amounts, and vendor information to verify the authenticity of expenses. Supporting documents like travel itineraries, credit card statements, and approval forms are needed to validate the purpose and authorization of each expenditure. Properly organized records ensure compliance with company policies and facilitate accurate reimbursement processing.

What Documents Are Necessary for Travel Expense Receipt Audits?

| Number | Name | Description |

|---|---|---|

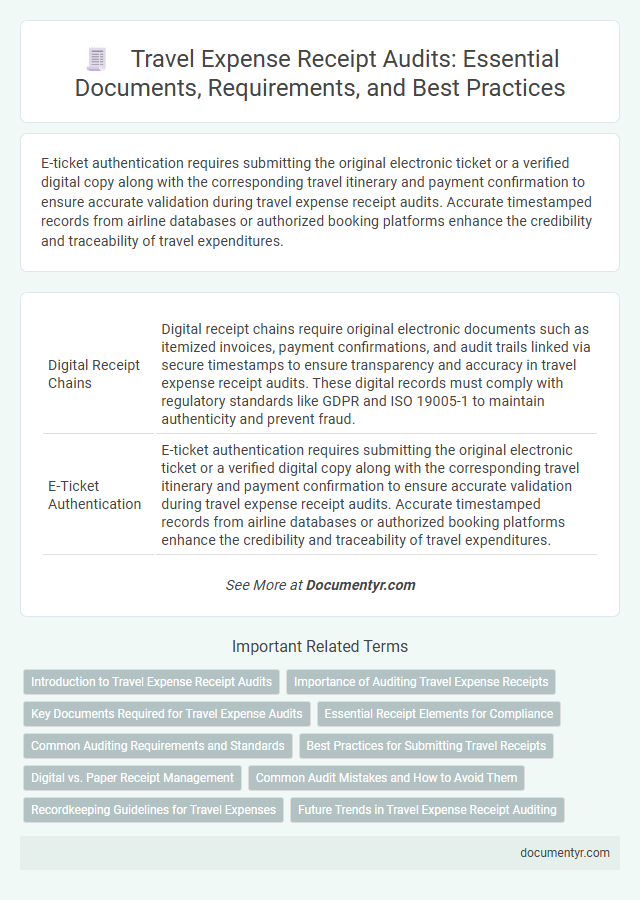

| 1 | Digital Receipt Chains | Digital receipt chains require original electronic documents such as itemized invoices, payment confirmations, and audit trails linked via secure timestamps to ensure transparency and accuracy in travel expense receipt audits. These digital records must comply with regulatory standards like GDPR and ISO 19005-1 to maintain authenticity and prevent fraud. |

| 2 | E-Ticket Authentication | E-ticket authentication requires submitting the original electronic ticket or a verified digital copy along with the corresponding travel itinerary and payment confirmation to ensure accurate validation during travel expense receipt audits. Accurate timestamped records from airline databases or authorized booking platforms enhance the credibility and traceability of travel expenditures. |

| 3 | Geo-Tagged Expense Logs | Geo-tagged expense logs provide precise location data that enhances the accuracy and authenticity of travel expense receipts during audits. Including timestamps and GPS coordinates in these logs helps auditors verify the legitimacy of expenses by cross-referencing travel routes and locations with claimed costs. |

| 4 | Blockchain-Stamped Invoices | Blockchain-stamped invoices provide an immutable and verifiable record essential for travel expense receipt audits, ensuring authenticity and preventing tampering. Auditors require these invoices alongside travel itineraries, payment confirmations, and identification documents to validate the legitimacy and accuracy of claimed expenses. |

| 5 | Per Diem Breakdown Sheets | Per diem breakdown sheets are essential for travel expense receipt audits as they provide detailed documentation of daily allowances for meals, lodging, and incidental expenses. These sheets help verify compliance with government or company travel policies by itemizing costs and ensuring accurate reimbursement. |

| 6 | Automated Policy Compliance Reports | Automated policy compliance reports streamline travel expense receipt audits by verifying submitted documents against corporate travel policies, ensuring that receipts include essential data such as date, vendor information, amount, and payment method. These reports enhance accuracy and efficiency by automatically flagging missing or non-compliant receipts, supporting thorough documentation review during expense reimbursement processes. |

| 7 | Mobile Receipt Capture Metadata | Mobile receipt capture metadata is essential for travel expense receipt audits, including timestamps, geolocation data, and device information that verify the authenticity and timing of the expense. Supporting documents such as itemized receipts, credit card statements, and travel itineraries complement metadata to ensure compliance with company policies and regulatory requirements. |

| 8 | Split-Fare Ride Receipts | Split-fare ride receipts must include detailed transaction information such as the date, fare amount for each passenger, payment method, and the names or identifiers of all riders involved. Proper documentation ensures compliance with travel expense audit requirements and facilitates accurate reimbursement processing. |

| 9 | OCR-Verified Transaction Summaries | OCR-verified transaction summaries are essential for travel expense receipt audits as they provide accurate, automated extraction of key data points such as merchant names, dates, amounts, and payment methods, reducing manual errors and speeding up verification. These summaries must be accompanied by original receipts, credit card statements, and travel itineraries to ensure comprehensive validation of expenses in compliance with audit requirements. |

| 10 | Cross-Border Tax Reclaim Forms | Cross-border tax reclaim forms are essential documents for travel expense receipt audits, ensuring compliance with international tax regulations and enabling the recovery of value-added tax (VAT) paid during business travel. Proper documentation must include original receipts, proof of travel dates, and relevant customs declarations to validate the expense and facilitate accurate tax reclaim processing. |

Introduction to Travel Expense Receipt Audits

Travel expense receipt audits involve reviewing submitted receipts to verify that expenses comply with company policies and regulatory requirements. Accurate documentation ensures transparency and prevents fraudulent claims during the audit process. Understanding the essential documents needed streamlines the audit and facilitates efficient expense management.

Importance of Auditing Travel Expense Receipts

Auditing travel expense receipts ensures accuracy and compliance with company policies and tax regulations. This process helps prevent fraud and supports financial transparency in business travel.

- Receipts for transportation - Essential for verifying costs related to flights, taxis, trains, or car rentals incurred during travel.

- Lodging invoices - Required to confirm accommodation expenses and ensure they align with approved budgets.

- Meal and entertainment receipts - Necessary to validate daily allowances and business-related hospitality expenses.

Key Documents Required for Travel Expense Audits

Travel expense receipt audits require a set of key documents to verify the legitimacy and accuracy of claimed expenses. Proper documentation ensures compliance with company policies and regulatory standards.

- Original Receipts - Provide proof of payment for transportation, lodging, and meals during business travel.

- Itinerary Details - Show the dates, locations, and purpose of the trip to validate the expense timeline.

- Expense Reports - Summarize all incurred costs with clear itemization for auditor review.

You must keep these documents organized and accessible to facilitate a smooth travel expense audit process.

Essential Receipt Elements for Compliance

Travel expense receipt audits require specific documents to verify compliance and accuracy. Essential receipt elements include the date of purchase, vendor details, itemized expenses, and the total amount paid. You must ensure receipts clearly display these details to avoid discrepancies during the audit process.

Common Auditing Requirements and Standards

What documents are necessary for travel expense receipt audits? Travel expense audits require detailed documentation to verify the authenticity and accuracy of claims. Common auditing requirements include original receipts, proof of payment, and travel itineraries to ensure compliance with accounting standards and company policies.

Best Practices for Submitting Travel Receipts

Submitting accurate travel expense receipts is essential for a smooth audit process. Ensuring all necessary documents are organized and complete helps avoid reimbursement delays.

- Itemized Receipts - Provide detailed receipts showing date, vendor, and expenses to verify each transaction.

- Travel Itinerary - Include a copy of the itinerary outlining travel dates, destinations, and purpose for context.

- Expense Reports - Submit a comprehensive report summarizing all expenses with explanations matching each receipt.

Digital vs. Paper Receipt Management

Travel expense receipt audits require specific documents to verify your expenditures accurately. Essential items include original receipts, credit card statements, and detailed itineraries that match reported expenses.

Digital receipt management offers advantages such as easy organization, quick retrieval, and reduced risk of loss compared to paper receipts. However, paper receipts remain necessary for some audits where original signatures or stamps are required for validation.

Common Audit Mistakes and How to Avoid Them

Accurate documentation is essential for travel expense receipt audits to ensure compliance and avoid disallowances. Necessary documents typically include itemized receipts, proof of payment, and travel itineraries supporting each expense.

Common audit mistakes involve submitting incomplete receipts, missing dates, or failing to clearly link expenses to business travel purposes. You should verify that all receipts are itemized and dated, and maintain detailed travel logs. Organizing documents systematically reduces errors and expedites the audit process.

Recordkeeping Guidelines for Travel Expenses

Travel expense receipt audits require thorough documentation to verify the legitimacy of your claims. Essential documents include original receipts, credit card statements, and detailed itineraries.

Recordkeeping guidelines emphasize maintaining organized and accurate records for all travel-related expenditures. Proper documentation ensures compliance with company policies and tax regulations.

What Documents Are Necessary for Travel Expense Receipt Audits? Infographic