Nonprofits must include key documents in donation receipt records, such as the donor's name, date of the donation, and the amount contributed. Receipts should also detail the description of any non-cash donations and state whether any goods or services were provided in exchange. Maintaining these records ensures compliance with IRS regulations and supports accurate tax reporting for both the organization and the donor.

What Documents Does a Nonprofit Need to Include in Donation Receipt Records?

| Number | Name | Description |

|---|---|---|

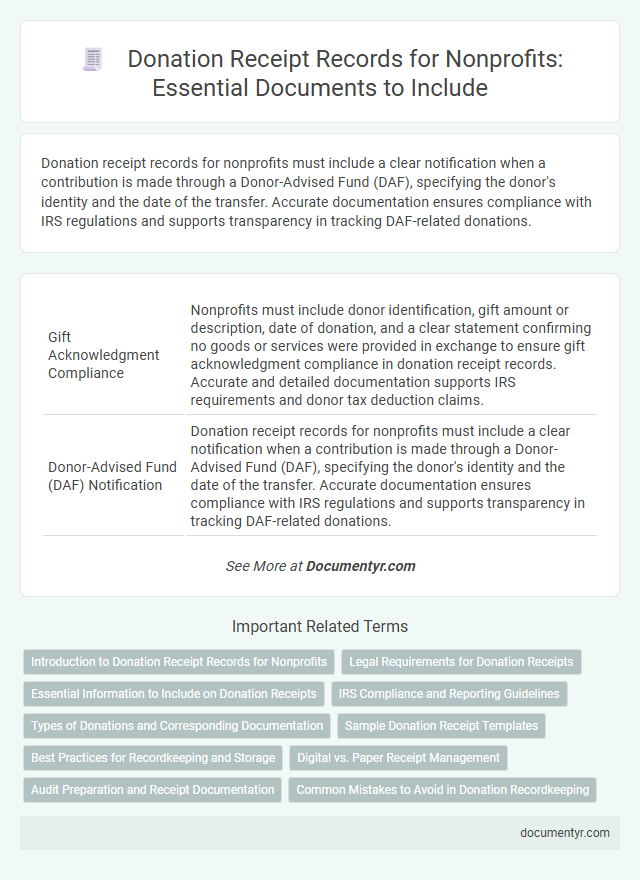

| 1 | Gift Acknowledgment Compliance | Nonprofits must include donor identification, gift amount or description, date of donation, and a clear statement confirming no goods or services were provided in exchange to ensure gift acknowledgment compliance in donation receipt records. Accurate and detailed documentation supports IRS requirements and donor tax deduction claims. |

| 2 | Donor-Advised Fund (DAF) Notification | Donation receipt records for nonprofits must include a clear notification when a contribution is made through a Donor-Advised Fund (DAF), specifying the donor's identity and the date of the transfer. Accurate documentation ensures compliance with IRS regulations and supports transparency in tracking DAF-related donations. |

| 3 | In-Kind Donation Itemization | Nonprofits must include a detailed itemization of in-kind donations in donation receipt records, specifying the type, condition, and estimated fair market value of each donated item. Accurate and thorough documentation ensures compliance with IRS regulations and facilitates proper acknowledgment for donors claiming tax deductions. |

| 4 | Quid Pro Quo Disclosure Statement | Nonprofits must include a Quid Pro Quo Disclosure Statement in donation receipt records when donors receive goods or services valued over $75, clearly stating the amount of the donation deductible for tax purposes. This statement ensures compliance with IRS regulations, helping donors accurately report their charitable contributions. |

| 5 | Restricted Gift Purpose Statement | A nonprofit must include a clear Restricted Gift Purpose Statement in donation receipt records to specify the donor-imposed limitations on the use of funds, ensuring compliance with legal and accounting standards. This documentation helps maintain transparency, enforces proper fund allocation, and supports accurate financial reporting and audits. |

| 6 | Digital Signature Authentication | Nonprofit organizations must include digital signature authentication on donation receipts to verify the authenticity and integrity of the document, ensuring compliance with IRS regulations and enhancing donor trust. Key documents incorporated in donation receipt records include the digitally signed acknowledgment letter, transaction details, donor information, and proof of receipt, all securely maintained for audit purposes. |

| 7 | Bifurcated Contribution Record | Nonprofits must include a bifurcated contribution record in donation receipt records, detailing both the donor's identity and the specific value of non-cash contributions to ensure compliance with IRS regulations. This bifurcated record supports accurate reporting and substantiates tax deduction claims, enhancing transparency and accountability in donation management. |

| 8 | Non-Cash Contribution Appraisal | Nonprofits must include a qualified appraisal summary and the donor's signed acknowledgment when documenting non-cash contribution appraisals in donation receipt records. IRS Form 8283 and appraiser's details are essential to validate the fair market value for audit compliance and tax deduction purposes. |

| 9 | Volunteer Service Valuation | Nonprofits must include detailed descriptions of volunteer services provided, along with documented methods used to determine the fair market value of those services, in their donation receipt records. Accurate valuation ensures compliance with IRS guidelines and enhances transparency for donors claiming charitable deductions. |

| 10 | Blockchain-Verified Receipt Ledger | Nonprofits must include donor information, donation amount, date, and purpose in blockchain-verified receipt ledgers to ensure transparency and immutability. This decentralized record enhances security and auditability by providing a timestamped and tamper-proof donation history. |

Introduction to Donation Receipt Records for Nonprofits

Nonprofits must maintain accurate donation receipt records to ensure transparency and compliance with tax regulations. Proper documentation helps donors claim tax deductions and supports the organization's financial accountability.

- Donation Receipt - A written acknowledgment provided to the donor detailing the contribution amount and date.

- Donor Information - Essential details including the donor's name, address, and contact information for record-keeping.

- Purpose of Donation - Documentation specifying whether the donation is restricted, unrestricted, or in-kind, clarifying its intended use.

Maintaining comprehensive donation receipt records is crucial for nonprofit organizations to validate contributions and uphold legal standards.

Legal Requirements for Donation Receipts

Your nonprofit must maintain specific documents to comply with legal requirements for donation receipts. Proper record-keeping protects your organization and ensures donor trust.

- Written Acknowledgment - Include the donor's name, donation amount, date, and a clear statement if any goods or services were provided in exchange.

- IRS Compliance - Keep receipts that follow IRS guidelines specifying the fair market value of non-cash donations for tax deduction purposes.

- Donation Logs - Maintain detailed logs of all donations received, linking each receipt to individual donations for audit and verification.

Essential Information to Include on Donation Receipts

Nonprofits must include the donor's name, the donation date, and the donation amount on their donation receipts. Clear description of any donated goods or services and a statement indicating whether any goods or services were provided in return is essential. This information ensures compliance with IRS regulations and provides transparency for both the nonprofit and the donor.

IRS Compliance and Reporting Guidelines

| Document | Description | IRS Compliance and Reporting Guidelines |

|---|---|---|

| Donation Receipt | Official document provided to donors detailing the gift amount and description. | Must include donor's name, donation date, amount or description of non-cash gifts, and statement of goods or services provided, if any. Required for donations over $250 to ensure donor's tax deduction eligibility. |

| Thank You Letter | Formal acknowledgment of receipt of donation. | Used to satisfy IRS substantiation requirements when combined with detailed donation receipts. Should not replace the official receipt. |

| Donor Information Records | Database or file containing donor contact details and donation history. | Essential for verifying donor identity and donation amounts during IRS audits. Must be retained for at least three years from the date of the contribution. |

| Non-Cash Contribution Documentation | Appraisals, receipts, or forms related to non-monetary donations such as goods or services. | Required for donations over $500. IRS Form 8283 must be filled out by donor and organization to validate fair market value for tax deduction purposes. |

| Disclosure Statements | Information on quid pro quo contributions when donor receives goods or services in exchange for donations. | Mandatory disclosure if the value of goods or services exceeds $75. Must include a good faith estimate of the value and written statement as per IRS regulations. |

| IRS Form 8282 | Form filed by nonprofit when donated property is sold within three years. | Ensures compliance with IRS reporting for disposition of donated property and prevents misuse of tax deductions by donors. |

Types of Donations and Corresponding Documentation

What documents should a nonprofit include in donation receipt records to ensure proper acknowledgment? Nonprofits must keep detailed records for each type of donation to comply with IRS regulations and facilitate donor deductions. These records typically include written acknowledgments for cash gifts and specific documentation for non-cash donations.

How are cash donations documented in nonprofit donation receipts? For cash contributions, nonprofits should provide a receipt containing the donor's name, the date of the donation, and the amount given. This receipt serves as proof for the donor's tax records and is essential for amounts over $250.

What documentation is required for non-cash donations like clothing or household items? Nonprofits need to issue a receipt describing the donated items in detail, including their condition, quantity, and estimated fair market value. Donors must keep this receipt along with a qualified appraisal for items valued over $5,000 to meet IRS requirements.

Which documents support donations of vehicles or real estate to a nonprofit? Donation receipts for vehicles must include the vehicle identification number and a statement about how the nonprofit plans to use or dispose of the vehicle. Real estate donations require a deed, a qualified appraisal, and a written acknowledgment reflecting the property's fair market value and date of transfer.

Sample Donation Receipt Templates

Maintaining accurate donation receipt records is essential for nonprofit organizations to ensure transparency and compliance with tax regulations. Sample donation receipt templates help standardize the information required for each contribution.

- Donor Information - Include the donor's full name and contact details to verify the source of the donation.

- Donation Details - Record the date, amount, and description of the donated items or funds clearly.

- Nonprofit Verification - Provide the organization's name, tax-exempt status, and an authorized signature to authenticate the receipt.

Best Practices for Recordkeeping and Storage

Nonprofits must include the donor's name, the donation date, and the amount contributed in donation receipt records. These details are essential for accurate tax reporting and compliance with IRS regulations.

Best practices for recordkeeping involve organizing receipts in a secure, easily accessible system, such as digital databases with backup copies. Proper storage ensures data integrity, aids in audit preparedness, and enhances donor trust.

Digital vs. Paper Receipt Management

Nonprofits must include key details such as the donor's name, donation amount, date of the contribution, and a description of any donated goods or services in their donation receipt records. Accurate and complete documentation ensures compliance with IRS regulations and facilitates donor tax deductions.

Digital receipt management offers efficient storage, quick retrieval, and easy sharing compared to traditional paper methods. Nonprofits can use software solutions to automate record-keeping, reduce physical storage space, and enhance data security. However, maintaining backups and ensuring digital receipts meet legal standards remains crucial for audit readiness.

Audit Preparation and Receipt Documentation

Nonprofits must include detailed donation receipts in their records to ensure transparency and accuracy during audit preparation. Essential documents include the donor's name, donation amount, date of contribution, and a clear description of any non-cash items received. Proper receipt documentation supports compliance with IRS regulations and strengthens the organization's financial accountability.

What Documents Does a Nonprofit Need to Include in Donation Receipt Records? Infographic