To ensure health insurance reimbursement for pet-related expenses, you need detailed receipts showing the date of service, the type of treatment or medication provided, and the cost incurred. These receipts must include the veterinarian's name and contact information alongside itemized charges to validate the claim. Submitting clear, organized documents helps expedite the reimbursement process and avoid claim denials.

What Receipt Documents Do You Need for Health Insurance Reimbursement?

| Number | Name | Description |

|---|---|---|

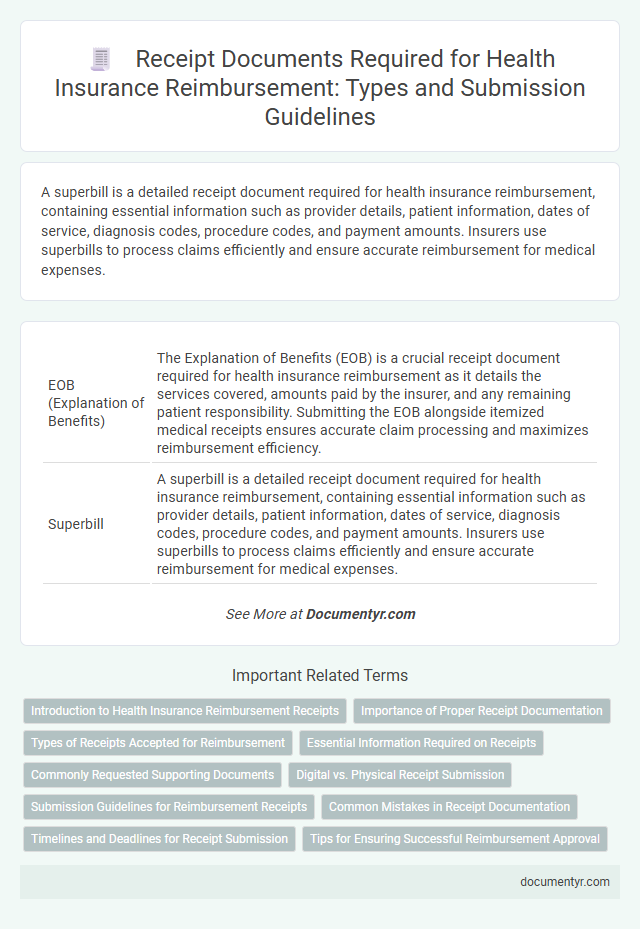

| 1 | EOB (Explanation of Benefits) | The Explanation of Benefits (EOB) is a crucial receipt document required for health insurance reimbursement as it details the services covered, amounts paid by the insurer, and any remaining patient responsibility. Submitting the EOB alongside itemized medical receipts ensures accurate claim processing and maximizes reimbursement efficiency. |

| 2 | Superbill | A superbill is a detailed receipt document required for health insurance reimbursement, containing essential information such as provider details, patient information, dates of service, diagnosis codes, procedure codes, and payment amounts. Insurers use superbills to process claims efficiently and ensure accurate reimbursement for medical expenses. |

| 3 | Itemized Medical Receipt | An itemized medical receipt is essential for health insurance reimbursement as it provides detailed information about each medical service, including dates, procedures, and costs. Insurance companies require this breakdown to verify the treatment and ensure accurate claim processing. |

| 4 | National Provider Identifier (NPI) Reference | Receipts for health insurance reimbursement must include the provider's National Provider Identifier (NPI) to verify the healthcare professional's credentials and ensure proper claim processing. Accurate documentation featuring the NPI helps expedite approval by linking services to authorized providers within the health plan's network. |

| 5 | Digital Health Claim Submission | For digital health claim submission, essential receipt documents include detailed invoices specifying medical services, dates of treatment, provider information, and itemized costs. Submitting electronic receipts with verified digital signatures or QR codes ensures faster processing and higher approval rates for health insurance reimbursement. |

| 6 | Procedural Terminology (CPT) Codes | Receipts for health insurance reimbursement must include detailed Procedural Terminology (CPT) codes corresponding to each medical service or treatment provided, ensuring accurate identification and processing of claims. These CPT codes must be clearly itemized alongside dates of service, provider information, and payment amounts to satisfy insurer requirements and expedite reimbursement. |

| 7 | Telehealth Service Receipt | A telehealth service receipt required for health insurance reimbursement must include the provider's name, date of service, description of the telehealth procedure or consultation, the service duration, and the total amount paid. Detailed billing codes such as CPT or telehealth-specific codes ensure proper processing and verification by insurers. |

| 8 | QR Code Embedded Invoice | To ensure smooth health insurance reimbursement, you need receipt documents that include a QR code embedded invoice, which allows for quick verification of transaction details and authenticity. This QR code enhances data accuracy by linking directly to the original billing information, reducing processing time and potential errors in claims. |

| 9 | E-Receipts with ICD-10 Codes | E-receipts for health insurance reimbursement must include detailed information such as patient identification, date of service, provider details, and itemized charges linked to specific ICD-10 codes for accurate diagnosis documentation. Ensuring the e-receipt contains ICD-10 codes facilitates claim processing by verifying the medical necessity of treatments and services for reimbursement approval. |

| 10 | Real-Time Adjudication Forms | Real-time adjudication forms are essential receipt documents for health insurance reimbursement, providing immediate verification of medical services and eligibility during the claims process. These forms streamline claim approvals by ensuring accurate data capture and reducing processing time, supporting faster reimbursement. |

Introduction to Health Insurance Reimbursement Receipts

| Introduction to Health Insurance Reimbursement Receipts | |

|---|---|

| Definition of Health Insurance Reimbursement Receipts | Official documents issued by healthcare providers that serve as proof of medical expenses eligible for reimbursement under health insurance policies. |

| Purpose | Enable policyholders to claim compensation for covered medical costs from their insurance companies efficiently and accurately. |

| Key Elements Required on Receipts |

|

| Types of Receipts Accepted |

|

| Importance in Health Insurance Claims | Receipts provide transparent and verifiable evidence of expenses, facilitating prompt approval and accurate reimbursement of claims. |

Importance of Proper Receipt Documentation

Proper receipt documentation is essential for health insurance reimbursement to verify medical expenses accurately. Ensuring receipts contain detailed information prevents claim rejections and facilitates timely refunds.

Receipts must include the date of service, provider's details, itemized list of treatments or medications, and the amount paid. Clear and organized documentation supports the validity of your claim and accelerates the approval process. Maintaining well-documented receipts safeguards your financial interests when dealing with health insurance providers.

Types of Receipts Accepted for Reimbursement

What types of receipts are accepted for health insurance reimbursement? Receipts must clearly show the date of service, provider's name, and detailed description of the medical service or product. Proof of payment with the amount paid is essential for successful reimbursement claims.

Essential Information Required on Receipts

Receipts required for health insurance reimbursement must include detailed information to ensure smooth processing. Essential details include the date of service, the provider's name, and a clear description of the medical services or products purchased. Accurate payment amounts and proof of payment are also necessary to validate your claim effectively.

Commonly Requested Supporting Documents

Commonly requested supporting documents for health insurance reimbursement include itemized receipts, medical bills, and proof of payment. These receipts must clearly display the provider's name, service dates, and detailed descriptions of treatments or medications. Submitting accurate and complete receipt documents ensures a smooth reimbursement process.

Digital vs. Physical Receipt Submission

Health insurance reimbursement often requires submitting valid receipt documents that clearly show the date, service details, and amount paid. Both digital and physical receipts are accepted, but insurers may have specific preferences or guidelines for submission formats.

Digital receipts offer quicker submission and easy storage, typically presented as email confirmations or PDF files from healthcare providers. Physical receipts must be kept intact with legible print to avoid delays, often scanned or mailed as proof of payment for reimbursement claims.

Submission Guidelines for Reimbursement Receipts

Receipts for health insurance reimbursement must meet specific submission guidelines to ensure successful claims processing. Proper documentation helps verify eligible medical expenses and accelerates reimbursement timelines.

- Detailed Receipt Required - Receipts must include the provider's name, date of service, description of services, and total amount paid.

- Proof of Payment - Payment confirmation such as credit card statements or bank receipts must accompany the original receipt.

- Original or Clear Copies - Submit original receipts or clear scanned copies to avoid delays or claim denial.

Common Mistakes in Receipt Documentation

Receipts are essential for health insurance reimbursement as they validate your medical expenses. Proper documentation prevents claim denials or delays in processing.

- Missing Important Details - Receipts often lack provider information, dates, or detailed service descriptions, which are critical for insurance verification.

- Illegible or Incomplete Receipts - Faded text, unclear handwriting, or partial receipts reduce the chances of successful reimbursement.

- Using Generic Payment Receipts - Receipts not specifying medical services or itemized charges can lead to claim rejection by insurers.

Timelines and Deadlines for Receipt Submission

Receipts for health insurance reimbursement must be submitted within the specified timeline set by your insurance provider. Typically, this deadline ranges from 30 to 90 days after the date of service.

Submitting receipts after the deadline may result in claim denial or delayed reimbursement. Understanding and adhering to these submission deadlines ensures timely processing of your health insurance claims.

What Receipt Documents Do You Need for Health Insurance Reimbursement? Infographic