To claim receipt-based tax deductions, you need original receipts that clearly show the date, vendor, and amount paid for each expense. Proper documentation may also include credit card statements or bank records to support the expenditure details. Keeping organized, legible receipts is essential to ensure compliance and maximize deductible claims.

What Documents Are Needed to Claim Receipt-Based Tax Deductions?

| Number | Name | Description |

|---|---|---|

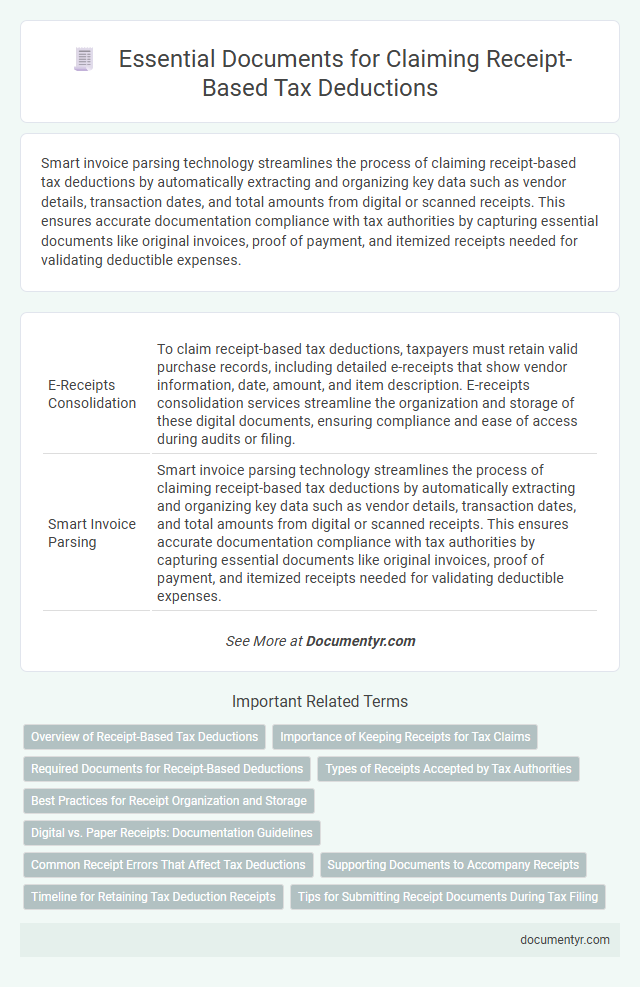

| 1 | E-Receipts Consolidation | To claim receipt-based tax deductions, taxpayers must retain valid purchase records, including detailed e-receipts that show vendor information, date, amount, and item description. E-receipts consolidation services streamline the organization and storage of these digital documents, ensuring compliance and ease of access during audits or filing. |

| 2 | Smart Invoice Parsing | Smart invoice parsing technology streamlines the process of claiming receipt-based tax deductions by automatically extracting and organizing key data such as vendor details, transaction dates, and total amounts from digital or scanned receipts. This ensures accurate documentation compliance with tax authorities by capturing essential documents like original invoices, proof of payment, and itemized receipts needed for validating deductible expenses. |

| 3 | Digital Proof of Purchase | Digital proof of purchase, such as electronic receipts, email confirmations, or scanned copies of physical receipts, is essential for claiming receipt-based tax deductions and must include key details like the vendor's name, transaction date, item description, and amount paid. Properly stored digital documents facilitate easier verification by tax authorities and support accurate record-keeping in compliance with tax regulations. |

| 4 | Blockchain-Verified Receipts | To claim receipt-based tax deductions, taxpayers must provide original receipts or digital copies verified through blockchain technology, ensuring authenticity and tamper-proof records. Blockchain-verified receipts enhance the credibility of transactions by securely timestamping and storing purchase details, streamlining the audit process for tax authorities. |

| 5 | Cloud Receipt Syncing | To claim receipt-based tax deductions using cloud receipt syncing, digital copies of receipts must be accurately uploaded and timestamped, ensuring they reflect purchase details such as date, amount, and vendor. Maintaining synchronized cloud records integrated with accounting software enhances audit readiness and complies with IRS requirements for verifiable electronic documentation. |

| 6 | Automated Expense Categorization | Receipts, invoices, and bank statements are essential documents required to claim receipt-based tax deductions, ensuring accurate proof of expenses. Automated expense categorization software leverages OCR technology to scan and classify these documents, streamlining the deduction process by reducing errors and improving compliance. |

| 7 | NFT Receipt Tokens | Claiming receipt-based tax deductions requires retaining NFT receipt tokens that serve as verifiable proof of transaction details, including date, amount, and vendor information. These digital tokens must be securely stored and accurately mapped to corresponding expenses to satisfy tax authority documentation standards. |

| 8 | OCR-Enabled Document Capture | OCR-enabled document capture streamlines the process of retrieving essential receipts and invoices required for claim receipt-based tax deductions by accurately extracting relevant data such as date, amount, and vendor details. This technology ensures compliance with tax regulations by providing digitized, searchable proof of expenses, minimizing errors and facilitating efficient record-keeping for audit purposes. |

| 9 | AI-Generated Expense Summaries | AI-generated expense summaries must include detailed transaction data, vendor information, and timestamps to qualify as valid documents for receipt-based tax deductions. These summaries should be accompanied by original digital or paper receipts to ensure compliance with tax authority requirements. |

| 10 | Real-Time Receipt Uploads | Real-time receipt uploads require digital copies of purchase receipts that clearly display the date, vendor name, transaction amount, and description of goods or services. These documents must be securely stored in a tax software or app that supports immediate submission to ensure timely and accurate receipt-based tax deductions. |

Overview of Receipt-Based Tax Deductions

What documents are needed to claim receipt-based tax deductions? Receipts serve as crucial proof of your eligible expenses, enabling accurate tax deduction claims. Maintaining organized, detailed receipts ensures compliance with tax regulations and maximizes potential deductions.

Importance of Keeping Receipts for Tax Claims

Keeping receipts is crucial for claiming receipt-based tax deductions as these documents provide proof of your expenses. Receipts validate the amounts spent and ensure compliance with tax authorities during audits. Properly organized receipts simplify the tax filing process and maximize your potential deductions.

Required Documents for Receipt-Based Deductions

To claim receipt-based tax deductions, you must retain original receipts that clearly detail the date, amount, and description of each expense. Supporting documents such as invoices, credit card statements, or payment confirmations that match the receipt details are also essential. Maintaining organized records with these documents ensures proper validation during tax audits and compliance with tax regulations.

Types of Receipts Accepted by Tax Authorities

Tax authorities accept specific types of receipts to validate your receipt-based tax deductions. These receipts must clearly show the transaction details and proof of payment.

Accepted receipts include sales receipts, invoices, and official payment confirmations issued by registered businesses or service providers. The receipts should include the date, amount paid, vendor details, and a clear description of goods or services purchased. Digital receipts with verifiable information are increasingly recognized as valid for tax purposes.

Best Practices for Receipt Organization and Storage

Proper documentation is essential to successfully claim receipt-based tax deductions. Organizing and storing receipts efficiently helps ensure compliance and simplifies the deduction process.

- Gather Original Receipts - Collect all original purchase receipts that clearly show the date, vendor, and amount paid to validate your deductions.

- Use Categorized Folders - Separate receipts by expense categories such as travel, meals, or supplies to streamline tracking and retrieval.

- Digitize and Backup - Scan or photograph receipts and store them securely in digital formats with backups to prevent loss or damage.

Digital vs. Paper Receipts: Documentation Guidelines

Claiming receipt-based tax deductions requires proper documentation to validate your expenses. Understanding the differences between digital and paper receipts helps ensure compliance with tax authorities.

- Digital Receipts Must Be Legible - Digital copies should clearly show the date, vendor, amount, and description of the purchase.

- Paper Receipts Should Be Stored Safely - Physical receipts need to be kept organized and protected from damage for future reference.

- Both Formats Require Consistent Record-Keeping - Maintaining accurate records for all receipts, whether digital or paper, simplifies the deduction claim process.

Common Receipt Errors That Affect Tax Deductions

Receipts serve as crucial evidence when claiming receipt-based tax deductions, but common errors can jeopardize your claims. Missing or incomplete information on receipts often leads to disallowed deductions by tax authorities.

Receipts must clearly show the date, vendor name, amount paid, and description of the purchase to be valid. Illegible receipts, altered documents, or handwritten notes lacking official details often result in rejection during tax audits.

Supporting Documents to Accompany Receipts

Supporting documents are essential to validate receipts when claiming receipt-based tax deductions. These documents ensure accuracy and compliance with tax regulations.

- Invoices - Provide detailed information verifying the transaction and purchase specifics.

- Bank or Credit Card Statements - Demonstrate proof of payment corresponding to the receipt.

- Contracts or Agreements - Confirm the terms and legitimacy of the expense being claimed.

Organizing these documents together with receipts strengthens Your tax deduction claims and simplifies audits.

Timeline for Retaining Tax Deduction Receipts

To claim receipt-based tax deductions, you must retain original receipts or digital copies showing the date, amount, and nature of the expense. These documents serve as proof for deductions related to business, medical, charitable, and other eligible expenses.

The timeline for retaining tax deduction receipts typically spans at least three to seven years, depending on the local tax authority's regulations. Keeping receipts for this period ensures you can substantiate your claims in case of audits or tax inquiries.

What Documents Are Needed to Claim Receipt-Based Tax Deductions? Infographic