Health insurance reimbursement receipts require detailed documentation including the original receipt with the service provider's name, date of service, and itemized charges. A prescription or referral from a licensed healthcare professional may be necessary to validate the treatment or medication claimed. Proof of payment and the insured person's policy information must also be included to ensure smooth processing.

What Documents Are Necessary for Health Insurance Reimbursement Receipts?

| Number | Name | Description |

|---|---|---|

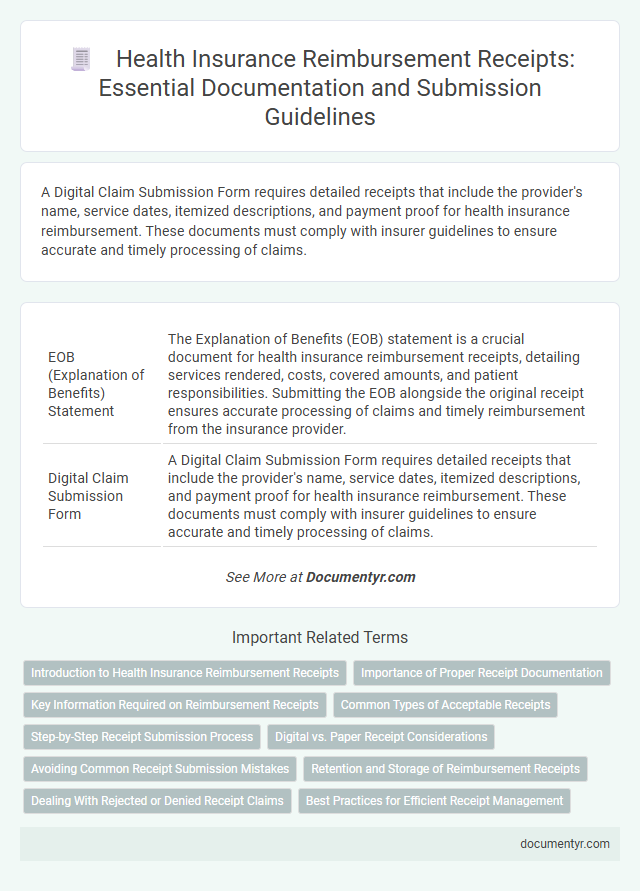

| 1 | EOB (Explanation of Benefits) Statement | The Explanation of Benefits (EOB) statement is a crucial document for health insurance reimbursement receipts, detailing services rendered, costs, covered amounts, and patient responsibilities. Submitting the EOB alongside the original receipt ensures accurate processing of claims and timely reimbursement from the insurance provider. |

| 2 | Digital Claim Submission Form | A Digital Claim Submission Form requires detailed receipts that include the provider's name, service dates, itemized descriptions, and payment proof for health insurance reimbursement. These documents must comply with insurer guidelines to ensure accurate and timely processing of claims. |

| 3 | Pre-authorization Approval Letter | A Pre-authorization Approval Letter is essential for health insurance reimbursement receipts as it confirms that the insurer has approved the medical service or procedure in advance, ensuring eligibility for coverage. Submitting this letter along with the receipt validates the claim and expedites the reimbursement process by demonstrating compliance with insurer requirements. |

| 4 | Cashless Settlement Voucher | A Cashless Settlement Voucher is essential for health insurance reimbursement as it details the expenses directly settled by the insurer with the hospital, eliminating the need for upfront payment. This voucher must include the patient's information, hospital details, treatment summaries, and the insurer's approval to validate the claim swiftly. |

| 5 | Electronic Remittance Advice (ERA) | Electronic Remittance Advice (ERA) is a critical document for health insurance reimbursement receipts, providing detailed explanations of the payments made by insurers, including service codes, amounts paid, and patient information. Submitting the ERA along with itemized receipts ensures accurate processing and faster reimbursement claims by clearly verifying the services billed and payments received. |

| 6 | Diagnostic Code Report (ICD-10/ICD-11) | Health insurance reimbursement receipts require the inclusion of a Diagnostic Code Report, specifically using ICD-10 or ICD-11 codes, to accurately identify medical conditions and justify the claims. This documentation ensures compliance with insurer policies and facilitates precise processing of healthcare expense reimbursements. |

| 7 | Superbill Document | A Superbill document is essential for health insurance reimbursement receipts as it contains detailed information about the medical services provided, including diagnosis codes and procedure codes required by insurers to process claims. This itemized receipt serves as a comprehensive proof of treatment and payment, ensuring accurate and timely reimbursement from health insurance companies. |

| 8 | Telemedicine Consultation Receipt | Telemedicine consultation receipts must include patient identification, date and time of consultation, healthcare provider details, service description, and total amount charged to qualify for health insurance reimbursement. Accurate documentation of these elements ensures compliance with insurer requirements and facilitates smooth claim processing. |

| 9 | AI-generated Claim Validation Slip | Health insurance reimbursement receipts require an AI-generated claim validation slip that verifies the authenticity of medical expenses through machine learning algorithms analyzing treatment details and payment information. This digital document ensures faster, more accurate claim processing by securely linking receipt data with insurance policy terms and healthcare provider credentials. |

| 10 | Blockchain-stamped Treatment Invoice | Blockchain-stamped treatment invoices serve as immutable, verifiable documents essential for health insurance reimbursement receipts, ensuring authenticity and preventing fraud. These digital invoices must include patient details, treatment dates, medical codes, service descriptions, and payment information to comply with insurer requirements. |

Introduction to Health Insurance Reimbursement Receipts

Health insurance reimbursement receipts are essential documents for claiming expenses incurred on medical treatments and services. These receipts serve as proof of payment, detailing the services provided, dates, and costs. Understanding the requirements for such receipts ensures your claims process is smooth and efficient.

Importance of Proper Receipt Documentation

Proper receipt documentation is crucial for health insurance reimbursement as it provides verifiable proof of medical expenses incurred. Accurate and detailed receipts help ensure smooth claim processing and prevent delays or rejections.

Receipts must include essential information such as the date of service, provider's name, description of treatment or medication, and the amount paid. Clear documentation supports the authenticity of the claim and helps insurance companies validate coverage. Maintaining organized and complete receipts safeguards your eligibility for timely reimbursement.

Key Information Required on Reimbursement Receipts

Health insurance reimbursement receipts must include specific key information to ensure smooth claim processing. Proper documentation helps verify the legitimacy of the medical expenses incurred.

- Patient Details - The receipt must clearly state the patient's full name and identification number to confirm the beneficiary of the treatment.

- Provider Information - The name, address, and registration number of the healthcare provider must be included to validate the source of the medical service.

- Treatment and Payment Details - The date of service, description of the treatment or medicine, amount paid, and mode of payment are essential for reimbursement verification.

Common Types of Acceptable Receipts

Health insurance reimbursement often requires specific documents to validate your claims. Common types of acceptable receipts include detailed pharmacy bills, hospital payment slips, and consultation invoices. Ensure these receipts clearly show the date of service, provider details, and itemized charges for smooth processing.

Step-by-Step Receipt Submission Process

What documents are necessary for health insurance reimbursement receipts? A clear and detailed receipt outlining medical services and costs is essential. Proof of payment and a valid insurance claim form must also be included.

How do you begin the receipt submission process? Start by gathering all relevant receipts and medical reports related to your treatment. Ensure each document is legible and corresponds to the specific dates of service.

What is the next step after collecting the required documents? Complete the insurance provider's claim form accurately, verifying all personal and policy details. Attach the original receipts and any supporting medical certificates.

How should you submit your documents to the insurer? Submit the entire packet either through the insurer's online portal or by mailing a physical copy. Keep copies of all documents for your records and follow any specific instructions provided.

Digital vs. Paper Receipt Considerations

Health insurance reimbursement requires specific documentation to verify medical expenses accurately. Choosing between digital and paper receipts impacts the ease and speed of the reimbursement process.

- Legibility and Clarity - Digital receipts are often clearer and easier to read, reducing errors during submission.

- Authentication and Verification - Paper receipts may require additional validation, whereas digital receipts can include embedded metadata for authentication.

- Submission Flexibility - Digital receipts enable faster electronic submission, while paper receipts might necessitate physical mailing or scanning.

Selecting the appropriate receipt format ensures compliance with insurer requirements and expedites health insurance claims.

Avoiding Common Receipt Submission Mistakes

| Document Type | Importance for Health Insurance Reimbursement | Common Submission Mistakes to Avoid |

|---|---|---|

| Original Receipt | Serves as proof of payment and verifies the amount spent on medical services or products. | Submitting photocopies or incomplete receipts without itemized details reduces claim approval chances. |

| Prescription or Doctor's Note | Validates the medical necessity of the treatment or medication claimed for reimbursement. | Missing or illegible prescriptions often cause claim denials or delays in processing. |

| Invoice or Billing Statement | Breaks down the services provided and the associated costs, ensuring transparency. | Invoices lacking provider contact details or authorization codes may be rejected. |

| Proof of Payment | Confirms that the medical service or product was paid by the insured. | Failing to include bank statements, credit card slips, or transaction confirmation reduces claim credibility. |

| Insurance Claim Form | Formalizes the request for reimbursement with necessary personal and policy details. | Incomplete or incorrectly filled forms delay processing or cause rejection. |

| Patient Identification Document | Ensures the claim belongs to the insured individual for accurate processing. | Submitting expired or unclear identification can result in claim refusal. |

Retention and Storage of Reimbursement Receipts

Health insurance reimbursement receipts must be carefully retained to ensure smooth claim processing and future reference. These documents serve as proof of medical expenses and are essential when requesting reimbursement from insurance providers.

It is advisable to store receipts in a secure, organized manner, either digitally or physically, keeping them accessible for at least five years. Proper storage protects against loss or damage and facilitates efficient claim verification and audits.

Dealing With Rejected or Denied Receipt Claims

Health insurance reimbursement receipts must include specific documents such as detailed medical bills, proof of payment, and a valid prescription if applicable. These documents ensure that claims meet the insurer's requirements for processing.

When dealing with rejected or denied receipt claims, it is crucial to review the insurer's rejection reason carefully and gather any missing or additional documentation. Promptly resubmitting corrected receipts with complete supporting evidence increases the likelihood of successful reimbursement.

What Documents Are Necessary for Health Insurance Reimbursement Receipts? Infographic