Freelance contractors need to provide specific documentation for tax receipt submissions, including a completed W-9 form, invoices detailing services rendered with corresponding dates and payment amounts, and proof of payment such as bank statements or canceled checks. Maintaining accurate records of contracts or agreements can further support the legitimacy of claimed expenses. Ensuring these documents are organized and readily accessible simplifies the tax filing process and helps avoid potential audits or discrepancies.

What Documents Does a Freelance Contractor Need for Tax Receipt Submissions?

| Number | Name | Description |

|---|---|---|

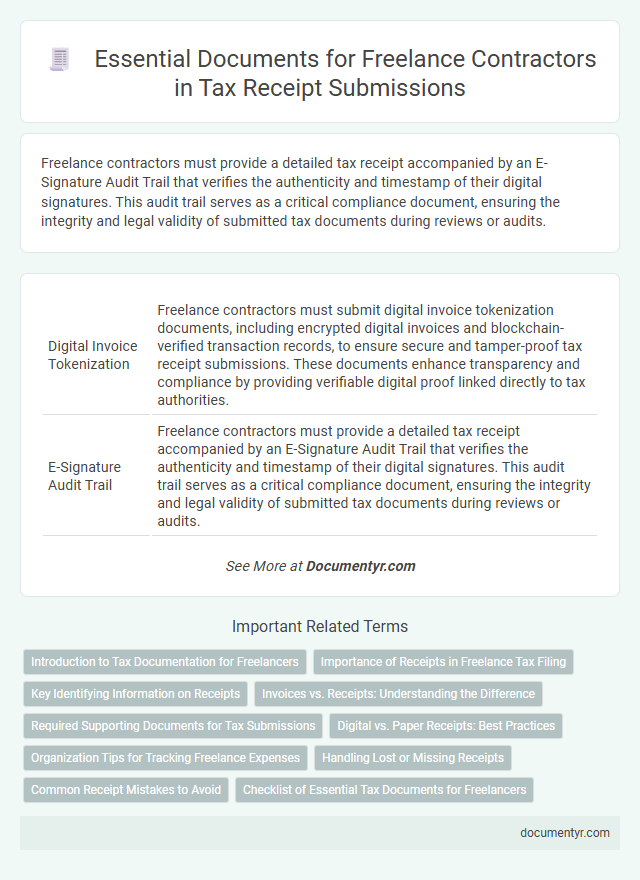

| 1 | Digital Invoice Tokenization | Freelance contractors must submit digital invoice tokenization documents, including encrypted digital invoices and blockchain-verified transaction records, to ensure secure and tamper-proof tax receipt submissions. These documents enhance transparency and compliance by providing verifiable digital proof linked directly to tax authorities. |

| 2 | E-Signature Audit Trail | Freelance contractors must provide a detailed tax receipt accompanied by an E-Signature Audit Trail that verifies the authenticity and timestamp of their digital signatures. This audit trail serves as a critical compliance document, ensuring the integrity and legal validity of submitted tax documents during reviews or audits. |

| 3 | Blockchain-Notarized Paystub | Freelance contractors need blockchain-notarized paystubs as essential documents for tax receipt submissions, providing tamper-proof verification of income and payment dates. These blockchain-secured paystubs enhance transparency and streamline validation processes with tax authorities by offering immutable proof of earnings. |

| 4 | Smart Contract Payment Ledger | Freelance contractors must maintain a Smart Contract Payment Ledger that securely records all transaction details, including payment dates, amounts, and client information, ensuring transparent and verifiable tax receipt submissions. This digital ledger acts as a critical document for IRS audits, providing immutable proof of income and compliance with tax regulations. |

| 5 | Real-Time VAT Calculation Sheet | A freelance contractor must provide a Real-Time VAT Calculation Sheet along with invoices to ensure accurate tax receipt submissions, reflecting up-to-date VAT amounts based on current rates. This document helps streamline tax compliance by offering precise, itemized VAT calculations critical for both contractors and tax authorities. |

| 6 | Automated Expense Category Tagging | Freelance contractors need to provide receipts, invoices, and completed W-9 forms when submitting tax documents to ensure accurate expense reporting. Automated expense category tagging software enhances organization by accurately classifying expenses like travel, supplies, and professional services, simplifying tax preparation and compliance. |

| 7 | QR-Coded Service Acknowledgment | A freelance contractor must provide a QR-coded service acknowledgment document, which verifies service completion and facilitates accurate tax receipt submissions by linking to official payment records. This document ensures compliance with tax authorities and streamlines the validation process through secure, scannable proof of transaction. |

| 8 | Gig Economy Deduction Statement | Freelance contractors in the gig economy must provide a detailed Gig Economy Deduction Statement along with their usual tax documentation, including invoices, 1099 forms, and expense receipts. This statement itemizes business-related costs such as platform fees, equipment purchases, and mileage, ensuring accurate deductions and compliance with IRS requirements. |

| 9 | Freelancer Crypto Payment Record | Freelance contractors receiving crypto payments must maintain detailed records of each transaction, including the date, amount in cryptocurrency, USD value at the time of payment, and wallet addresses involved, to ensure accurate tax receipt submissions. These crypto payment records serve as essential proof of income and help reconcile tax liabilities with traditional financial statements. |

| 10 | E-Receipts Reconciliation Log | Freelance contractors must maintain an E-Receipts Reconciliation Log to accurately track all digital payment confirmations and ensure compliance during tax receipt submissions. This log serves as a comprehensive record of each transaction, including date, amount, client details, and payment method, facilitating efficient auditing and accurate tax reporting. |

Introduction to Tax Documentation for Freelancers

Freelance contractors must maintain accurate tax documentation to ensure smooth submission of tax receipts. Proper record-keeping simplifies tax filing and supports compliance with government regulations.

Essential documents include invoices, payment records, and expense receipts directly related to freelance projects. Organizing these documents helps verify income and deductible expenses during tax reporting periods.

Importance of Receipts in Freelance Tax Filing

What documents does a freelance contractor need for tax receipt submissions? Receipts play a crucial role in accurately reporting income and expenses in freelance tax filings. You must keep thorough records of all receipts to ensure compliance with tax regulations and maximize deductible expenses.

Key Identifying Information on Receipts

| Document Type | Key Identifying Information Required | Purpose |

|---|---|---|

| Invoice |

|

Serves as the primary document detailing services rendered and payment requested, essential for tax record-keeping. |

| Receipt |

|

Proves payment has been made, supports declared income on tax returns. |

| 1099-NEC Form (U.S.) |

|

Reports income paid to freelancers to the IRS, critical for annual tax filing. |

| Bank Statements |

|

Supports income claims by providing evidence of electronic payments received. |

Invoices vs. Receipts: Understanding the Difference

Freelance contractors must clearly understand the difference between invoices and receipts when submitting documents for tax purposes. Knowing which document to use ensures accurate record-keeping and compliance with tax regulations.

- Invoice - A detailed request for payment outlining the services provided and amount due, typically issued before payment.

- Receipt - Proof of payment issued after the payment has been received, confirming the transaction is complete.

- Tax Documentation - Invoices support income reporting while receipts serve as proof of expenses, both critical for accurate tax filings.

Required Supporting Documents for Tax Submissions

Freelance contractors must submit invoices and detailed receipts as primary proof of income for tax purposes. Maintaining copies of contracts or work agreements ensures clarity on service terms and payment conditions. Additionally, keeping records of expense receipts related to business activities supports valid tax deductions and accurate reporting.

Digital vs. Paper Receipts: Best Practices

Freelance contractors must maintain accurate records of their expenses and income for tax receipt submissions. Both digital and paper receipts serve as valid proof of transactions, but each format requires specific handling to ensure compliance.

Digital receipts offer easy storage and quick access through cloud services, reducing the risk of physical damage or loss. Paper receipts should be organized chronologically and kept in a safe place to prevent deterioration and to facilitate audits.

Organization Tips for Tracking Freelance Expenses

Freelance contractors must keep accurate documentation, including invoices, receipts, and bank statements, to support tax receipt submissions. Organizing these documents by date and category streamlines expense tracking and ensures no deductible costs are overlooked. Utilizing digital tools or dedicated folders helps maintain an efficient record-keeping system for your freelance expenses.

Handling Lost or Missing Receipts

Freelance contractors must submit accurate tax receipts to ensure proper deduction claims and compliance with tax authorities. Managing lost or missing receipts is crucial for maintaining organized financial records and avoiding penalties.

- Invoice Copies - Keep digital or physical copies of all service invoices as proof of income and expenses.

- Bank Statements - Use bank statements to verify transactions when receipts are unavailable.

- Written Affidavits - Prepare sworn affidavits describing lost receipts and the associated expenses for tax authority validation.

Maintaining meticulous records and alternative documentation supports accurate tax reporting despite missing receipts.

Common Receipt Mistakes to Avoid

Freelance contractors must provide specific documents to ensure accurate tax receipt submissions. Understanding common receipt mistakes can help avoid delays and audits.

- Incomplete Receipts - Missing details like date, amount, or payer's information can invalidate a receipt for tax purposes.

- Unclear or Illegible Information - Poorly written or printed receipts make verification difficult and may be rejected by tax authorities.

- Absence of Proof of Payment - Failing to include bank statements or transaction records alongside receipts can lead to disputes over the claimed expenses.

What Documents Does a Freelance Contractor Need for Tax Receipt Submissions? Infographic