Freelancers must present key documents such as a valid tax identification number, a completed invoice detailing the services rendered, and proof of identity to ensure payments comply with legal and financial regulations. Accurate records including contracts or work agreements may be requested to verify the legitimacy of the transaction. Keeping these documents organized and readily available facilitates smooth processing and timely receipt of invoice payments.

What Documents Does a Freelancer Need to Show for Invoice Payments Received?

| Number | Name | Description |

|---|---|---|

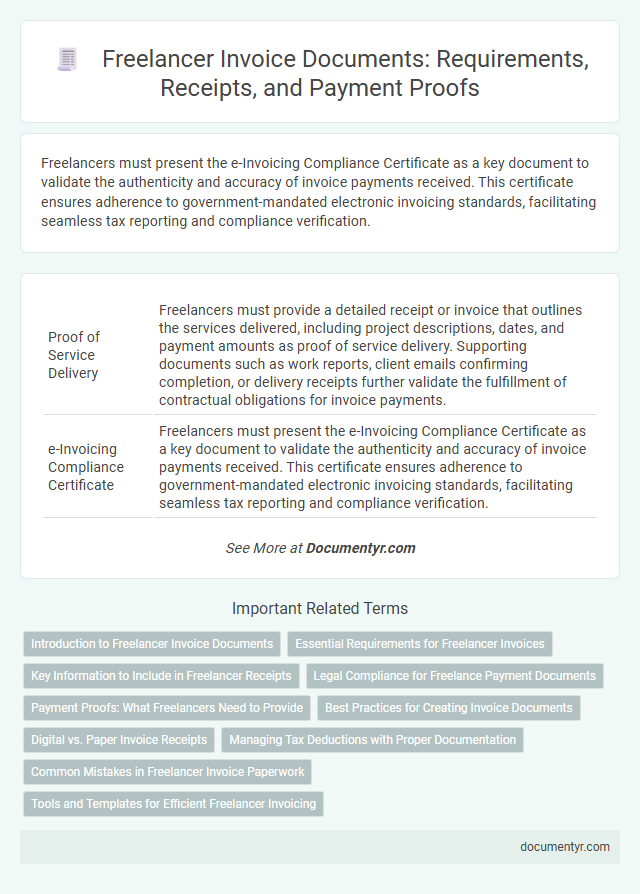

| 1 | Proof of Service Delivery | Freelancers must provide a detailed receipt or invoice that outlines the services delivered, including project descriptions, dates, and payment amounts as proof of service delivery. Supporting documents such as work reports, client emails confirming completion, or delivery receipts further validate the fulfillment of contractual obligations for invoice payments. |

| 2 | e-Invoicing Compliance Certificate | Freelancers must present the e-Invoicing Compliance Certificate as a key document to validate the authenticity and accuracy of invoice payments received. This certificate ensures adherence to government-mandated electronic invoicing standards, facilitating seamless tax reporting and compliance verification. |

| 3 | Digital Payment Receipt | Freelancers must present a digital payment receipt that includes transaction details such as the payment date, amount, payer information, and transaction ID to verify invoice payments received. This receipt serves as proof of payment and is essential for accurate financial record-keeping and tax compliance. |

| 4 | Statement of Work (SoW) Confirmation | Freelancers must provide a Statement of Work (SoW) Confirmation to validate invoice payments received, as it clearly outlines the agreed deliverables, timelines, and payment terms, ensuring transparency and contractual compliance. This document serves as critical evidence for payment disputes and tax auditing by linking invoiced amounts directly to approved project milestones. |

| 5 | eKYC Verification Document | Freelancers must provide eKYC verification documents such as a government-issued ID, PAN card, and proof of address to validate their identity for invoice payments received. These documents ensure compliance with tax regulations and enable secure transaction processing by confirming the freelancer's authenticity. |

| 6 | Tax Residency Certificate | Freelancers must provide a Tax Residency Certificate to validate their tax status and avoid double taxation when submitting invoice payments. This certificate ensures compliance with international tax treaties and confirms the freelancer's eligibility for reduced withholding tax rates on received payments. |

| 7 | UTR (Unique Transaction Reference) Number | Freelancers must provide a UTR (Unique Transaction Reference) number when submitting documents for invoice payments to ensure accurate transaction tracing and compliance with tax authorities. This unique code allows both freelancers and clients to verify payment details efficiently, facilitating transparent financial records and streamlined auditing processes. |

| 8 | Freelancer Agreement Acknowledgment | Freelancers need to present a Freelancer Agreement Acknowledgment as part of their documentation to validate invoice payments received, ensuring terms of service and payment conditions are formally accepted. This document, combined with detailed invoices, supports compliance with tax regulations and maintains transparent financial records for both parties. |

| 9 | Self-Billing Authorization | Freelancers must provide a Self-Billing Authorization document when invoices are generated and paid by clients on their behalf, ensuring compliance with tax regulations and transparent payment processes. This authorization allows clients to issue invoices directly, simplifying bookkeeping and validating the legitimacy of invoice payments received. |

| 10 | Remittance Advice Attachment | Freelancers should provide a remittance advice attachment as proof of invoice payments received, which details the payment amount, date, and corresponding invoice numbers. This document ensures accurate reconciliation of accounts and serves as official confirmation for both parties in the transaction. |

Introduction to Freelancer Invoice Documents

Invoices serve as essential documents for freelancers to receive payments and maintain accurate financial records. Proper documentation ensures clear communication between you and your clients regarding services rendered and payment terms. Understanding which documents to present when handling invoice payments streamlines the payment process and aids in compliance with tax requirements.

Essential Requirements for Freelancer Invoices

Freelancers must provide specific documents to validate invoice payments received. These documents ensure transparency and compliance with tax and accounting regulations.

- Invoice Copy - A detailed invoice specifying services rendered, payment amount, and date.

- Proof of Payment - Bank statements or payment receipts confirming funds received for the invoice.

- Tax Identification - Freelancer's tax ID or registration details verifying legal status for invoicing.

Key Information to Include in Freelancer Receipts

Freelancers need to provide a clear invoice detailing services rendered, payment amount, and payment due date to ensure smooth transactions. Include your name, contact information, client details, and an accurate description of the work completed. Ensure the receipt also lists the invoice number, payment method, and date of payment to maintain proper records.

Legal Compliance for Freelance Payment Documents

Freelancers must provide legally compliant documents to validate invoice payments received. Key documents include the original invoice, proof of payment, and a signed contract outlining service terms.

Compliance with tax regulations requires maintaining receipts and payment records for audit purposes. Proper documentation ensures transparent transactions and protects freelancers from legal disputes.

Payment Proofs: What Freelancers Need to Provide

| Document Type | Description | Purpose |

|---|---|---|

| Invoice Copy | Detailed invoice listing services rendered, payment terms, and due amount. | Serves as the primary billing document to request payment. |

| Bank Statement | Official statement from your bank showing the credited payment. | Acts as proof that the payment was received into your account. |

| Payment Receipts | Receipts issued by the client or payment gateways confirming the transaction. | Verifies the exact payment date and amount received. |

| Payment Confirmation Emails | Emails or messages from the client confirming payment completion. | Supports the record of payment authorization. |

| Contract or Agreement | Written contract stating payment schedules and services agreed upon. | Validates the legitimacy of the payment and invoice terms. |

| Tax Certificates (If applicable) | Documents related to tax deductions or withholdings on payments. | Required for accurate tax reporting and compliance. |

Best Practices for Creating Invoice Documents

What documents does a freelancer need to show for invoice payments received? Freelancers should provide a clear and detailed invoice that includes their contact information, payment terms, and a breakdown of services rendered. Including a copy of the contract or agreement further validates the payment request and ensures transparency.

What are the best practices for creating invoice documents? Freelancers must use professional templates that highlight essential elements like the invoice number, date, and payment due date. Accurate descriptions, itemized costs, and clear payment instructions improve the chances of timely payments and reduce disputes.

Digital vs. Paper Invoice Receipts

Freelancers must provide accurate documentation to verify invoice payments received. Digital invoice receipts have become increasingly popular due to their convenience and ease of storage.

Paper invoice receipts remain relevant for formal record-keeping and situations where digital access is limited. Digital receipts often include detailed metadata such as timestamps and transaction IDs, enhancing validation. Both types serve as proof of payment but differ in format and accessibility.

Managing Tax Deductions with Proper Documentation

Freelancers must maintain accurate records of all invoice payments to ensure proper tax deduction management. Organizing essential documents facilitates compliance with tax regulations and simplifies financial tracking.

- Invoices with Payment Receipts - These confirm the services provided and the exact amounts received, forming the basis for tax reporting.

- Tax Identification Number (TIN) Documentation - Necessary to validate tax status and ensure correct withholding tax application.

- Expense Receipts Related to Service Delivery - Supporting documents to claim legitimate deductions and reduce taxable income.

Proper documentation enables freelancers to accurately report income and optimize tax deductions while avoiding potential audits or penalties.

Common Mistakes in Freelancer Invoice Paperwork

Freelancers must provide accurate and complete documentation when submitting invoices for payment, including a detailed invoice, proof of work completion, and relevant tax identification numbers. Missing or incorrect paperwork can delay payment processing and complicate tax reporting.

Common mistakes in freelancer invoice paperwork include omitting essential details such as invoice number, date, or payment terms. Inadequate proof of work or failure to include business registration or tax information often results in rejected or delayed payments.

What Documents Does a Freelancer Need to Show for Invoice Payments Received? Infographic